Bitcoin (BTC-USD): A Powerful Surge to $98,000 with Eyes on $100K and Beyond

Bitcoin, the world’s largest cryptocurrency, is steadily approaching a critical psychological milestone of $100,000, trading around $98,000 as of today. This remarkable rally reflects a convergence of market dynamics, including institutional inflows, ETF-driven momentum, and macroeconomic factors. Investors and analysts alike are watching closely, with many forecasting a bullish year for Bitcoin, driven by regulatory advancements and its increasing adoption as a global financial asset.

The Institutional Push: ETF Inflows and Market Liquidity

A significant driver of Bitcoin’s recent surge has been the record-breaking inflows into U.S.-based Bitcoin ETFs, totaling an impressive $900 million in a single day. Leading the charge was Fidelity’s Bitcoin ETF (FBTC), which attracted $357 million, followed by BlackRock’s iShares Bitcoin Trust (IBIT) with $252 million and ARK Invest’s ARKB at $222 million. These ETFs collectively added 9,360 BTC to their portfolios, signaling renewed institutional confidence in Bitcoin’s long-term potential.

The approval of spot Bitcoin ETFs has been a game-changer, providing traditional investors with easier access to the cryptocurrency market. This shift has not only expanded Bitcoin’s investor base but also injected significant liquidity, helping BTC recover from December’s dip to $92,000 and push toward $98,000.

On-Chain Metrics: Signs of Strength Amid Reduced Selling Pressure

Bitcoin’s on-chain data reveals a strengthening market. Over 48,000 BTC, valued at approximately $4.5 billion, have been withdrawn from exchanges in the past week. Such withdrawals typically indicate a long-term holding sentiment, reducing immediate selling pressure. Additionally, miner outflows have dropped significantly, with only 5,489 BTC sent to exchanges on January 1, down from November’s peak of 25,367 BTC during the post-election rally.

The Coinbase Premium Index, which tracks institutional demand, has also rebounded, reflecting a resurgence in U.S.-based institutional interest. Combined with strong ETF inflows, these metrics paint a bullish picture for Bitcoin’s near-term trajectory.

Macroeconomic and Political Catalysts: Trump, China, and Global Adoption

The macroeconomic environment and geopolitical developments are shaping Bitcoin’s narrative for 2025. President-elect Donald Trump’s pro-crypto stance has reignited speculation about the U.S. establishing a national Bitcoin reserve. Currently, the U.S. government holds approximately 213,297 BTC, valued at over $20 billion. Trump’s administration has hinted at increasing these holdings to strengthen the nation’s financial strategy and compete with China’s growing crypto dominance.

China, on the other hand, is also playing a pivotal role. The People’s Bank of China’s anticipated fiscal stimulus measures, including interest rate cuts, could fuel another leg of Bitcoin’s rally. With China and other nations like Japan and Germany exploring Bitcoin as a reserve asset, the global adoption of BTC is set to expand, providing further support to its price.

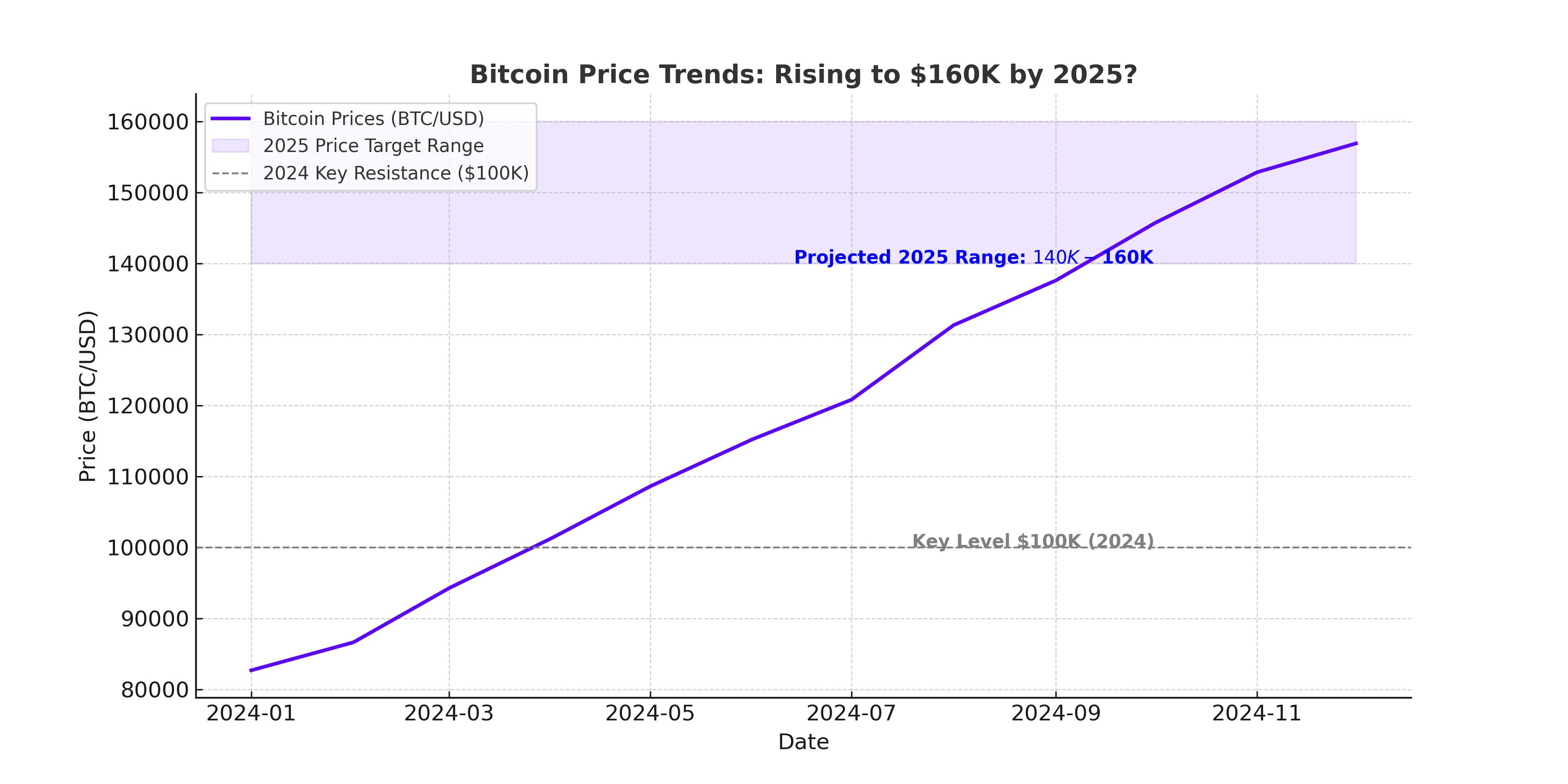

Bitcoin’s Price Predictions for 2025: Bullish Momentum Ahead?

Analysts remain optimistic about Bitcoin’s price trajectory in 2025, with several projecting significant gains. Standard Chartered predicts BTC could reach $200,000, driven by U.S. retirement funds and sovereign wealth fund adoption. Nexo has set an even higher target of $250,000, citing increasing institutional and social acceptance of Bitcoin as a financial asset. Robert Kiyosaki, the famed author of Rich Dad Poor Dad, forecasts a range of $175,000 to $350,000, highlighting the ongoing shift toward Bitcoin as a hedge against inflation and fiscal instability.

While the short-term resistance around $99,000 could lead to temporary pullbacks, key support levels at $85,000 and $81,000 are expected to hold, sustaining Bitcoin’s bullish momentum. The halving of Bitcoin mining rewards in April 2024 is another critical factor, historically leading to price surges 9–12 months post-event.

Risks and Challenges: Navigating Volatility and Regulatory Uncertainty

Despite its bullish outlook, Bitcoin faces challenges. Regulatory clarity remains a pressing issue, with the SEC’s stance on cryptocurrencies influencing market sentiment. Trump’s political decisions and potential delays in crypto-friendly policies could create short-term volatility. Additionally, Bitcoin’s volatile nature means that sharp price corrections are always a possibility, particularly if profit-taking intensifies around major resistance levels.

Global economic conditions, including inflation and interest rate movements, could also impact Bitcoin’s adoption and price. However, its position as a digital store of value and growing institutional adoption provide a strong foundation to weather these challenges.

The Road Ahead: Bitcoin’s Role in the Future of Finance

Bitcoin’s ascent to $98,000 and its potential breakthrough to $100,000 symbolize more than just market speculation; it marks the cryptocurrency’s growing integration into global financial systems. With institutional inflows reaching record highs, supportive on-chain metrics, and favorable macroeconomic trends, Bitcoin is positioned for continued growth in 2025 and beyond.

As analysts forecast price targets as high as $250,000, the next few years could redefine Bitcoin’s role in portfolios worldwide. For investors, the question is no longer whether to invest in Bitcoin but how much exposure to allocate to this transformative asset class.