Bitcoin Faces Continued Pressure as Mt Gox Liquidations and Miner Weigh on Prices

BTC Drops 2.7%, Heading for Fifth Consecutive Weekly Loss Amid Heavy Selling Pressure | That's TradingNEWS

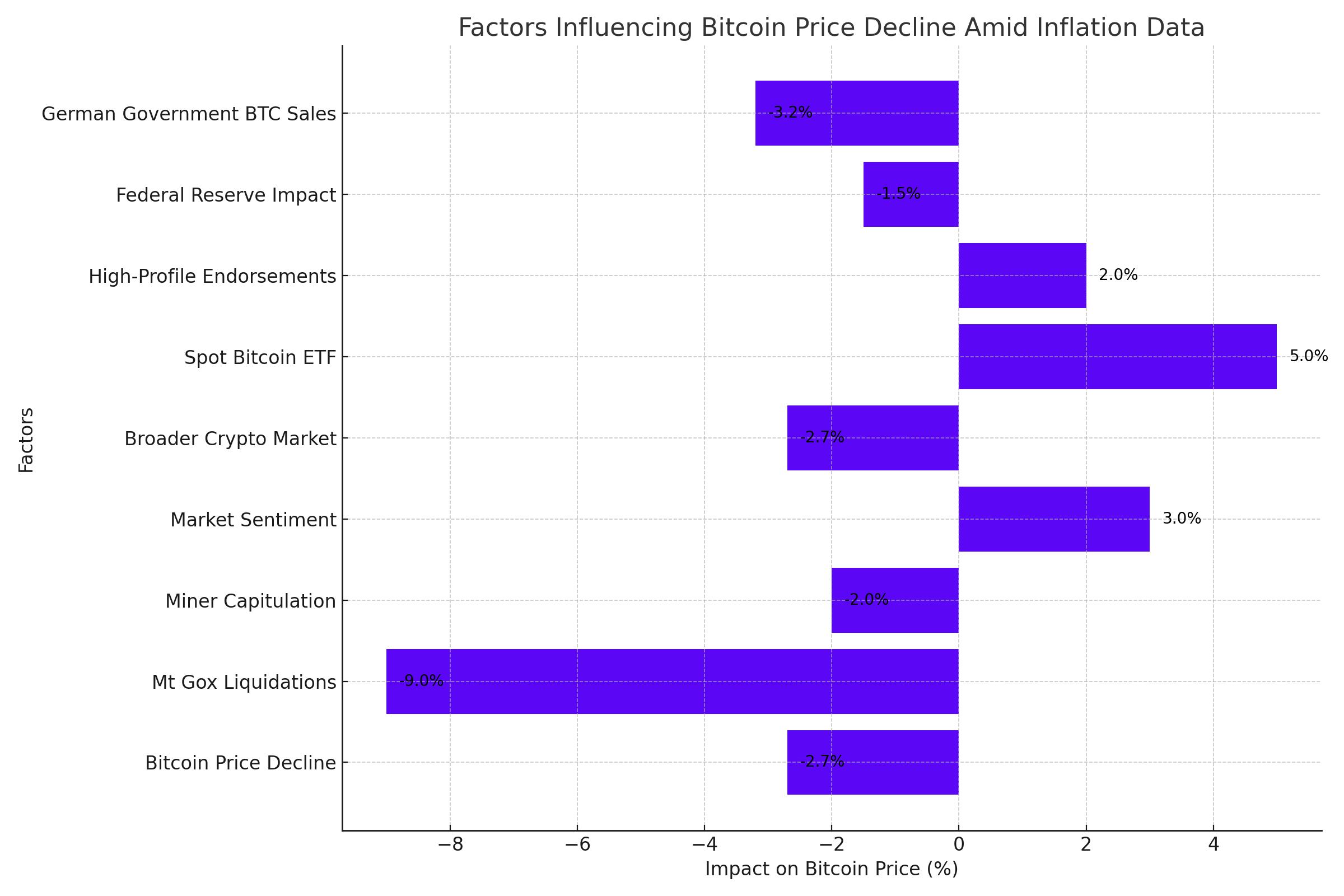

Bitcoin Price Decline Amid Inflation Data

Bitcoin (BTC) experienced a significant slide on Friday, reversing a recent rebound as traders remained cautious over selling pressure from the distribution of tokens by the defunct exchange Mt Gox, along with capitulation pressures on major miners. The broader crypto market found little support from a drop in the US dollar, even as softer-than-expected US inflation data increased bets that the Federal Reserve might begin cutting interest rates as soon as September.

As of 08:50 ET (12:50 GMT), Bitcoin fell 2.7% in the past 24 hours to $57,227.2, sinking as low as $56,551.

Mt Gox Liquidations and Market Impact

Bitcoin's persistent losses were largely driven by concerns over the token distributions by Mt Gox. The defunct exchange has begun returning Bitcoin to creditors from its 2014 hack. Traders speculate that recipients of these tokens may sell, given Bitcoin’s substantial price increase over the past decade. While Mt Gox liquidators did not specify the exact size of its planned distribution, wallets linked to the exchange were seen moving about $9 billion worth of Bitcoin earlier this year.

Miner Capitulation Fears

The ongoing decline in Bitcoin prices has also raised concerns that major Bitcoin miners might be forced to sell their holdings to break even, especially after the recent halving event reduced mining rewards. Additionally, sales by the German state of Saxony of tokens confiscated from a piracy website have kept sentiment toward Bitcoin dim. Reports suggest the government holds at least $2 billion worth of Bitcoin.

Price Recovery Efforts and Market Sentiment

Despite the overall negative trend, Bitcoin remains above the four-month lows hit last week, with price declines attracting bargain buying. Optimism over potential interest rate cuts by the Federal Reserve also offers some relief to the risk-driven crypto markets. Analysts at JPMorgan have expressed a bullish outlook for August, predicting that selling pressure from Mt Gox and other liquidations will subside by the end of July. They also noted that Bitcoin reserves on major exchanges are reducing, which could lead to higher prices if supply cannot meet demand.

Broader Crypto Market Trends

The broader crypto market mirrored Bitcoin’s struggles, with major altcoins nursing losses. Ether (ETH) dropped 2.7% to $3,064.50, despite speculation over a spot Ether exchange-traded fund. XRP and ADA saw modest gains, rising 3.7% and 0.1%, respectively, while SOL dropped 5.6%. Among meme tokens, SHIB sank 5.7% and DOGE lost 5.4%.

Spot Bitcoin ETF Inflows

U.S. spot Bitcoin exchange-traded funds (ETFs) continued to see inflows, with a daily net inflow of $78.93 million on Thursday, marking the fifth consecutive day of positive inflows. BlackRock’s IBIT, the largest spot Bitcoin ETF by net asset value, led the day with $72.09 million in net inflows. Fidelity’s FBTC attracted $32.69 million, and Bitwise’s spot Bitcoin fund brought in $7.53 million.

High-Profile Endorsements and Political Influence

Former U.S. President Donald Trump will be speaking at Bitcoin 2024 in Nashville, Tennessee, on July 27. This marks a significant milestone for the conference and reflects growing political interest in the cryptocurrency sector. Trump has recently expressed strong support for the Bitcoin industry, pledging to back Bitcoin mining and ensure that the future of Bitcoin and crypto is "Made in the USA." This stance contrasts sharply with the current administration’s more cautious approach to cryptocurrency regulation.

Federal Reserve's Impact on Bitcoin

Bitcoin’s price movements remain sensitive to macroeconomic factors, particularly decisions by the Federal Reserve. The recent decline to $57,227 followed the Fed’s decision to pause rate cuts, disappointing investors who were hoping for a reduction in H1 2024. Despite slowing CPI inflation hinting at a potential economic soft-landing, the Fed’s choice to maintain high interest rates has pressured the market.

German Government BTC Sales

Adding to the selling pressure, the German government has resumed selling its Bitcoin holdings, which includes a total of 3,200 BTC distributed across various platforms. This follows the transfer of Bitcoin seized from a film pirating website earlier in the year. The significant sales by government entities often lead to increased market volatility, although the distribution across different platforms may help prevent extreme price swings.