Bitcoin Faces Increased Market Volatility and Investor Skepticism

Bitcoin Faces FUD, Options Expiry, and Economic Data Impact While Institutional Interest Grows | That's TradingNEWS

Bitcoin Faces Market Volatility Amid Speculation and Major Economic Indicators

Extended FUD on Social Media

Bitcoin (BTC) has been navigating a turbulent market landscape, with prices swinging wildly amid an extended level of Fear, Uncertainty, and Doubt (FUD) on social media platform X. As of the latest data, Bitcoin's price hovers around $64,000, a decline from its previous high of over $70,000 earlier this month. According to cryptocurrency intelligence platform Santiment, this persistent negative sentiment is rare and indicative of increasing trader capitulation.

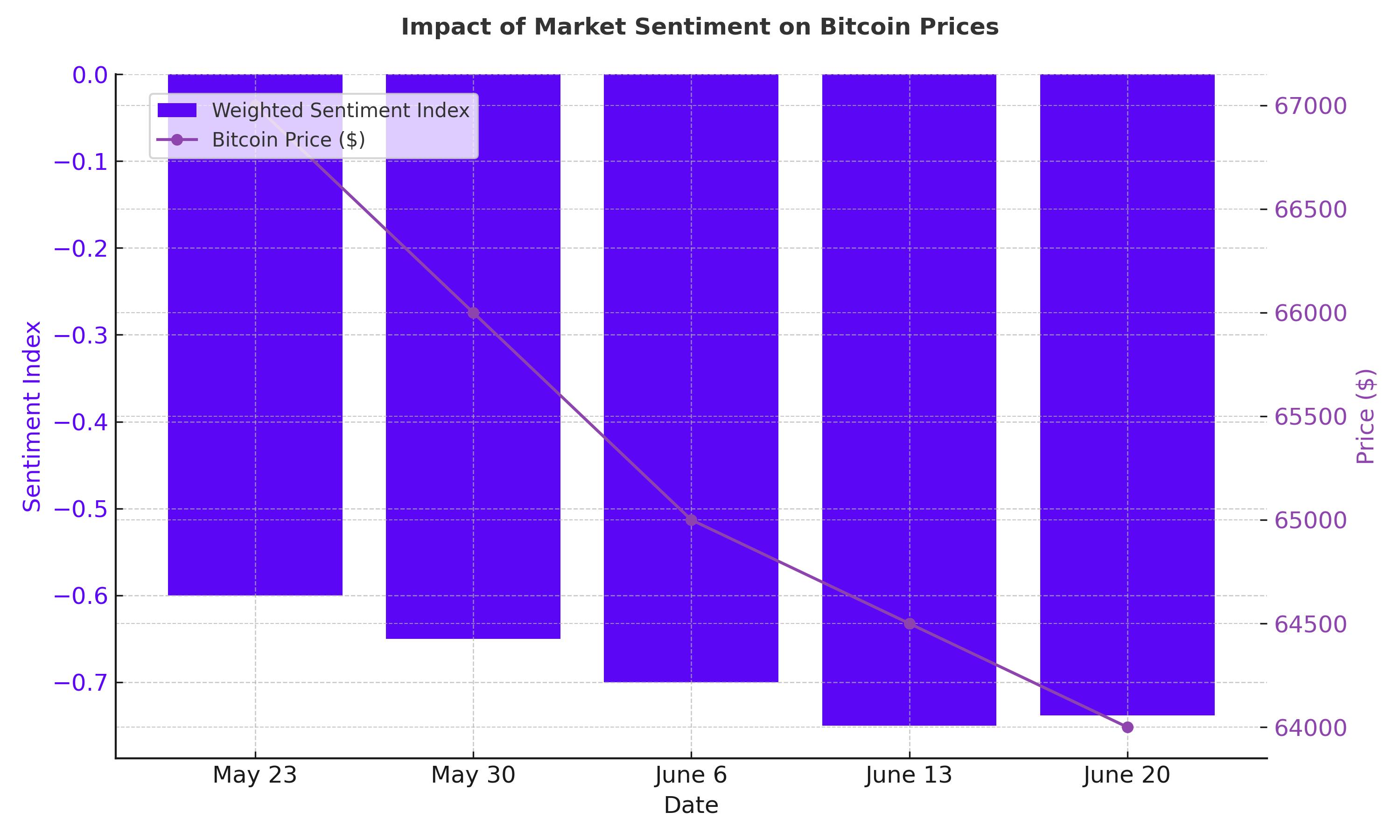

Impact of Market Sentiment

Santiment's Weighted Sentiment Index, which tracks Bitcoin mentions on X and compares the ratio of positive to negative comments, has remained negative since May 23, with a current score of -0.738. This index reflects a general disinterest or fear towards Bitcoin, as its price fluctuates between $64,180 and $67,294 over the past week. Despite this, significant events such as the approval of 11 Bitcoin exchange-traded funds (ETFs) and the Bitcoin halving have historically led to positive sentiment spikes.

Options Expiry and Market Volatility

The impending expiration of $1.96 billion worth of Bitcoin and Ethereum options is contributing to heightened market volatility. This substantial expiry, with a max pain point of $67,000 for Bitcoin options and $3,500 for Ethereum options, typically results in increased volatility. However, such periods often stabilize in the long term.

Economic Indicators and Their Impact

Traders are closely monitoring the upcoming U.S. GDP growth rate data and the Federal Reserve’s preferred inflation metric, the Personal Consumption Expenditures (PCE) inflation data. These reports, due Thursday and Friday, respectively, coincide with the significant BTC options expiry, potentially leading to increased volatility and a possible dip below $60,000.

ETF Outflows and Market Sentiment

Bitcoin is also facing substantial ETF outflows, with over $500 million leaving U.S.-listed spot Bitcoin ETFs in the past week. This trend adds to the selling pressure, compounded by significant Bitcoin movements from dormant wallets and large holdings by the German government being sent to exchanges. Despite these pressures, more than 87% of Bitcoin holders remain in profit, suggesting room for further profit-taking which could drive prices down further.

Technical Analysis and Key Support Levels

From a technical standpoint, Bitcoin is testing critical support levels. The Money Flow Index (MFI) indicates increased selling pressure, and two death cross patterns on the four-hour chart highlight a bearish outlook. Bitcoin needs to defend the support level at $62,451, the 61.8% Fibonacci retracement level, to prevent further declines.

Contrarian Bullish Indicators

Despite the negative sentiment, some analysts remain optimistic. Historically, extended periods of negative sentiment have often preceded market bounces. Additionally, whale accumulation during periods of trader fatigue generally leads to price rebounds. The reduction in Bitcoin exchange balances, with over 107,000 BTC exiting crypto exchanges in the last 30 days, could lead to a supply crunch, supporting a potential price increase.

Institutional Interest and Market Outlook

Institutional interest in Bitcoin continues to rise, bringing stability to the market and facilitating large-scale adoption. The latest data shows significant involvement from institutional investors, which is crucial for market stability. Analysts predict that Bitcoin’s consolidation may continue until the end of summer 2024, with a new bull run potentially starting around September, coinciding with major activity around the U.S. elections.

Prolonged Stagnation and Future Prospects

Bitcoin's prolonged price stagnation, oscillating between $63,000 and $67,000, reflects the market's current uncertainty. Despite this, some analysts remain bullish, forecasting potential surges. Notably, CrediBULL Crypto suggests Bitcoin could reach $100,000 within 30 days, while Bernstein Research predicts a target of $200,000 by the end of 2025.

Bitcoin's Correlation with Traditional Markets

Barry Bannister, chief equity strategist at Stifel, emphasizes Bitcoin’s strong correlation with the Nasdaq 100 since 2020, viewing BTC as a speculative asset rather than "digital gold." This relationship suggests potential declines in the S&P 500, with large-cap tech stocks, such as Nvidia (NASDAQ:NVDA), appearing particularly vulnerable.

Long-Term Profitability and Market Dynamics

Despite short-term volatility, Bitcoin remains a profitable asset for long-term holders, with a 120% profit margin realized by Bitcoin holders. This reflects the confidence of crypto investors and the bullish market underpinnings. The involvement of institutional investors and the reduction in Bitcoin supply due to recent halving events also support a positive long-term outlook.

In conclusion, Bitcoin's current market dynamics involve a complex interplay of negative sentiment, significant economic indicators, and technical analysis. Despite recent bearish trends, the long-term outlook remains cautiously optimistic. Investors should remain vigilant, leveraging technical indicators and market sentiment to navigate this volatile environment effectively.