Bitcoin Forecast 2024: Economic Indicators for Maximum Returns

Assessing the Influence of U.S. PCE Inflation Data and ETF Trends on Bitcoin's Market Dynamics | That's TradingNEWS

Economic Indicators and Their Impact on Cryptocurrency Markets

Exploring the Connection Between U.S. Economic Data and Bitcoin's Market Behavior

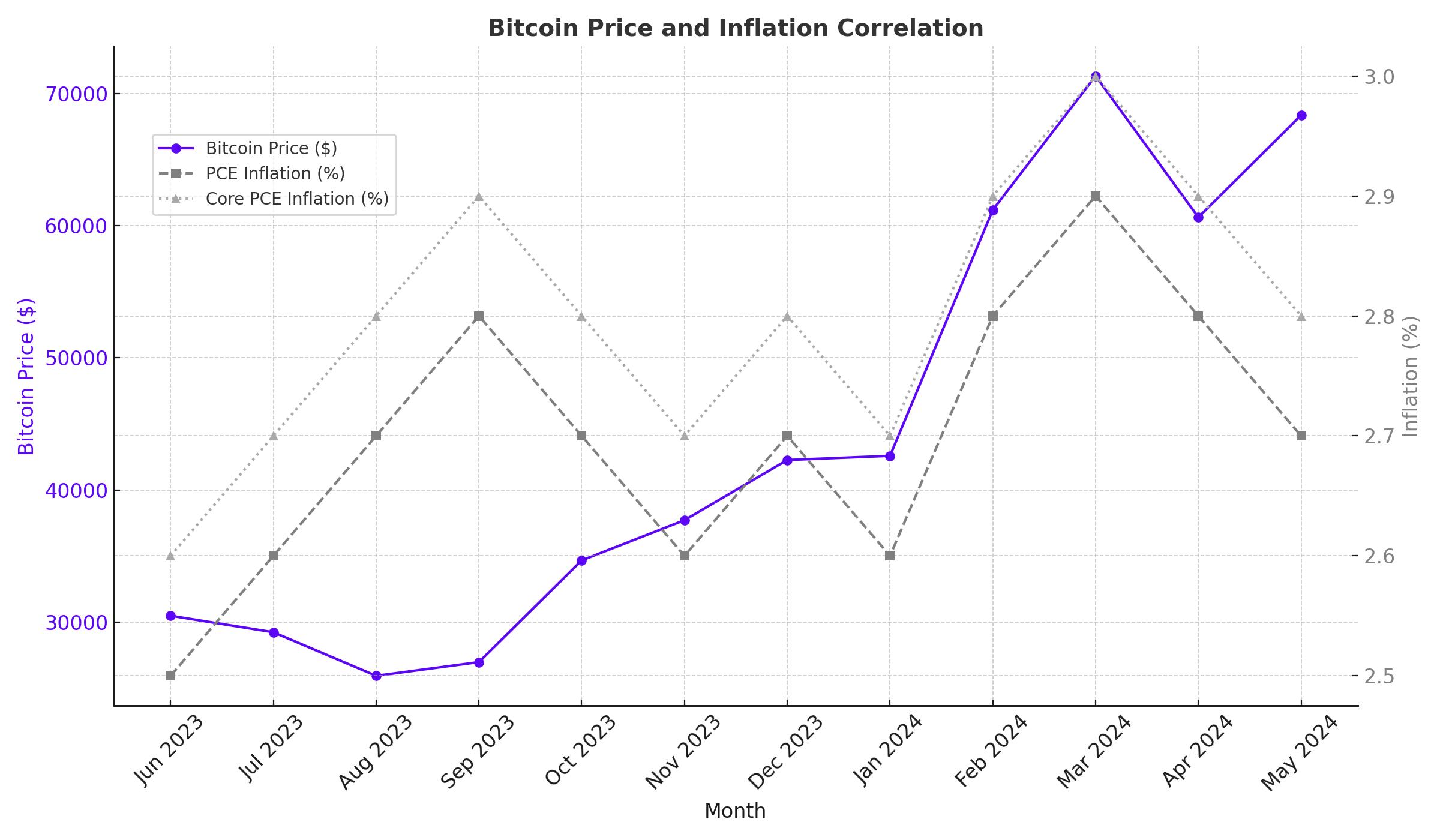

Recent U.S. economic indicators have shown a performance that surpassed market expectations, particularly in the first quarter. The Personal Consumption Expenditure (PCE) and Core PCE inflation data are crucial metrics that the U.S. Federal Reserve evaluates to guide their interest rate decisions. This analysis dives into the implications of these economic indicators on cryptocurrency markets, particularly Bitcoin.

Analyzing U.S. PCE Inflation Trends

In April, the U.S. PCE inflation matched the anticipated increase of 0.3%, maintaining the pace observed in March. Year-over-year, the PCE inflation escalated to 2.7%, aligning with Wall Street forecasts. Conversely, the Core PCE inflation, which excludes volatile food and energy prices, decelerated slightly to 0.2% from 0.3% the previous month, yet annually, it recorded a 2.8% rise.

This persistently high inflation above the Fed's 2% target suggests ongoing economic pressure, which tends to influence investor sentiment negatively. The anticipation of how these figures might influence Fed's rate decisions is a significant concern for market participants.

Bitcoin’s Market Response to Economic Data

Despite the broader economic uncertainties, Bitcoin showed resilience. Post the PCE data release, Bitcoin’s price experienced a modest increase of 0.95%, indicating a market that reacts not only to traditional economic indicators but also to speculative investor behavior and market sentiment.

Interest Rates and Crypto Valuations

With the Federal Reserve's potential rate adjustments on the horizon, as indicated by the CME FedWatch Tool forecasting a 99% probability of rate stability in June, investors are recalibrating their risk appetite. Lower interest rates generally make riskier assets like cryptocurrencies more attractive by reducing the opportunity cost of investing in them.

Short Term Technical Analysis and Future Projections for Bitcoin

Bitcoin is currently at a critical juncture, showing patterns that suggest a bullish continuation. It's forming a symmetrical triangle pattern, which is typically a continuation pattern in technical analysis. Should Bitcoin break above the upper trendline, technical indicators suggest a potential rise towards $74,000 to $75,000.

Bitcoin and Ethereum ETFs: Catalysts for Growth

The introduction of Bitcoin ETFs in the U.S. has introduced new dynamics to the market. These funds have facilitated substantial capital inflows, which bolstered Bitcoin's price. Similarly, the potential approval of Ethereum ETFs could further influence the cryptocurrency markets by providing traditional investors easier access to crypto assets.

Conclusion

In conclusion, while traditional economic indicators like the U.S. PCE inflation data provide valuable insights into general market trends, the unique factors affecting cryptocurrencies, such as regulatory developments and technological advancements, also play a crucial role. Investors should remain vigilant, considering both macroeconomic indicators and industry-specific developments when making investment decisions.