Bitcoin Halving: Impact on Price and Market Dynamics

Analyzing Bitcoin's Price Trajectory Post-Halving and Market Sentiments | That's TradingNEWS

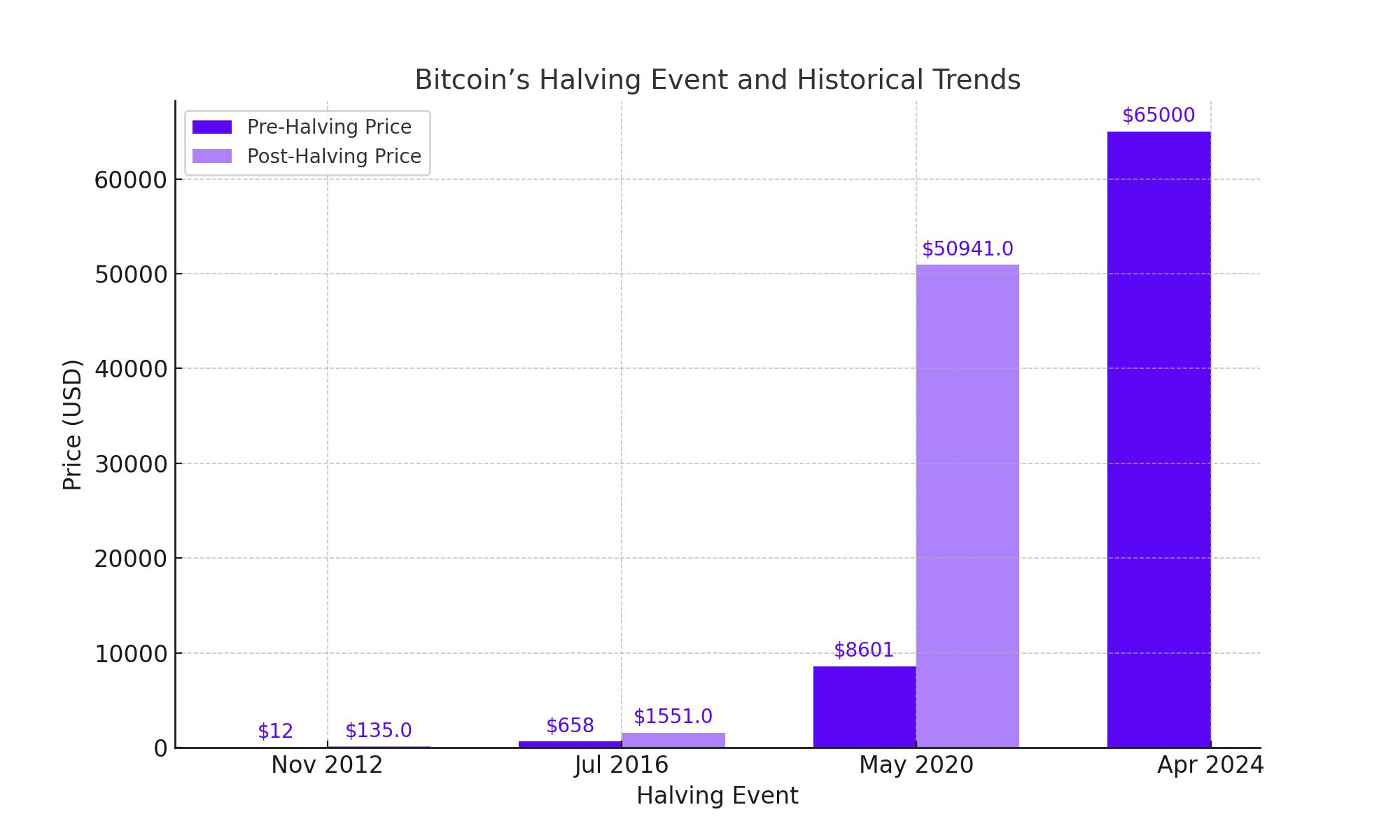

Bitcoin’s Halving Event and Historical Trends

Bitcoin’s most recent halving event occurred on April 19-20, reducing the mining reward from 6.25 BTC to 3.125 BTC. Historically, Bitcoin’s price experiences significant upward movement post-halving. For instance, after the first halving in November 2012, Bitcoin’s price surged from $12 to $135 within 300 days. Similarly, post the second halving in July 2016, the price escalated from $658 to $1,551. The third halving in May 2020 saw Bitcoin climb from $8,601 to $50,941 within 300 days. Currently, Bitcoin is trading around $65,000, up approximately 140% over the past year, though it remains 12% below its March high of $73,803.

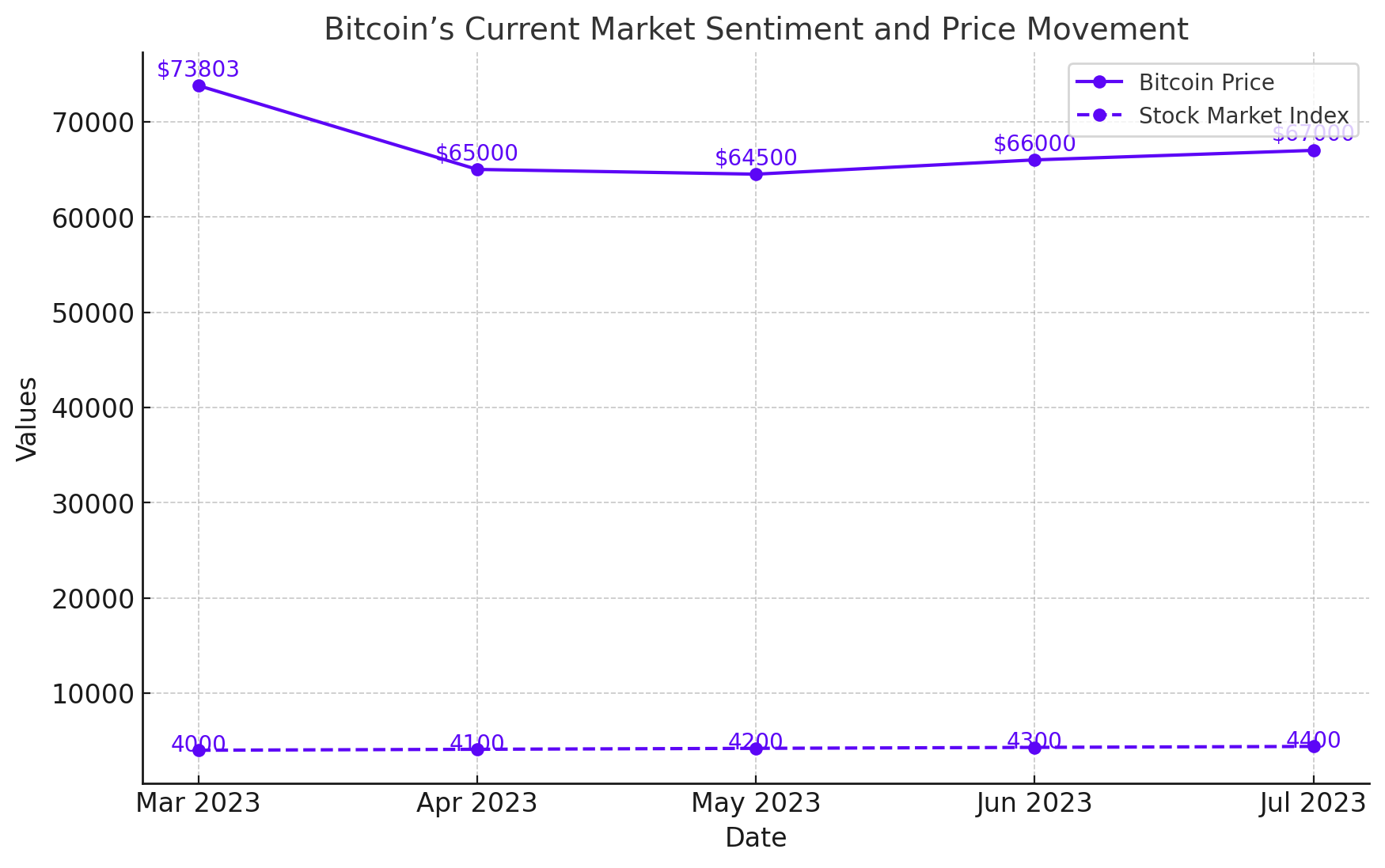

Current Market Sentiment and Price Movement

Bitcoin’s price hovers around $65,000, buoyed by eased inflation and a bullish stock market. Despite not experiencing a sharp post-halving jump, Bitcoin maintains a strong upward trend. Analysts like Steven Lubka from Swan Bitcoin emphasize that Bitcoin’s significant price gains generally unfold over months rather than immediate post-halving spikes. Similarly, Rennick Palley from Stratos anticipates continued upward movement over the next 12 months, driven by global liquidity dynamics and increasing adoption as a store of value.

Factors Influencing Bitcoin's Price

The broader adoption of Bitcoin and the introduction of spot Bitcoin ETFs have shifted the factors influencing its price. With the ongoing printing of fiat money and growing global recognition of Bitcoin’s value, experts like Palley predict a continued rise in Bitcoin's price in dollar terms. Moreover, the halving event enhances Bitcoin’s scarcity, reinforcing its inflation-resistant properties and driving up its value.

Predictions and Market Potential

Many analysts predict Bitcoin could surpass the $100,000 mark this year. Cathie Wood of ARK Invest posits that the combination of halving cycles and spot Bitcoin ETFs could push Bitcoin's price to $1.5 million by 2030. This bullish outlook is shared by several market experts, citing Bitcoin’s historical performance and the evolving financial landscape.

Impact of Institutional Interest

Institutional interest has significantly bolstered Bitcoin’s market dynamics. U.S. spot Bitcoin ETF inflows hit a two-week high of $303 million recently, with major inflows from Fidelity's FBTC and Grayscale's GBTC. Hedge funds like Millennium Management and Apollo Management Holdings have substantial holdings in these ETFs, indicating robust institutional confidence in Bitcoin's future.

Technical Analysis and Price Projections

Technically, Bitcoin’s price holds above the crucial pivot point at $66,680. Immediate resistance is noted at $69,296, followed by $71,090 and $72,809. The RSI level at 64 suggests room for further gains. A sustained position above the pivot point could drive prices higher, while a breach below could trigger a decline towards support levels at $64,662 and $63,299.

Conclusion

Bitcoin's recent halving event has set the stage for potential long-term price increases. Historical trends, coupled with increased institutional interest and broader adoption, suggest a bullish outlook for Bitcoin. Investors should monitor key technical levels and market sentiments to navigate the dynamic landscape of Bitcoin trading. For real-time updates and detailed financial metrics, visit the trading chart.