Bitcoin Hits $100K: Why Analysts Predict $160K by 2025

Institutional Demand, ETF Inflows, and Global Adoption Fuel Bitcoin's Bullish Outlook | That's TradingNEWS

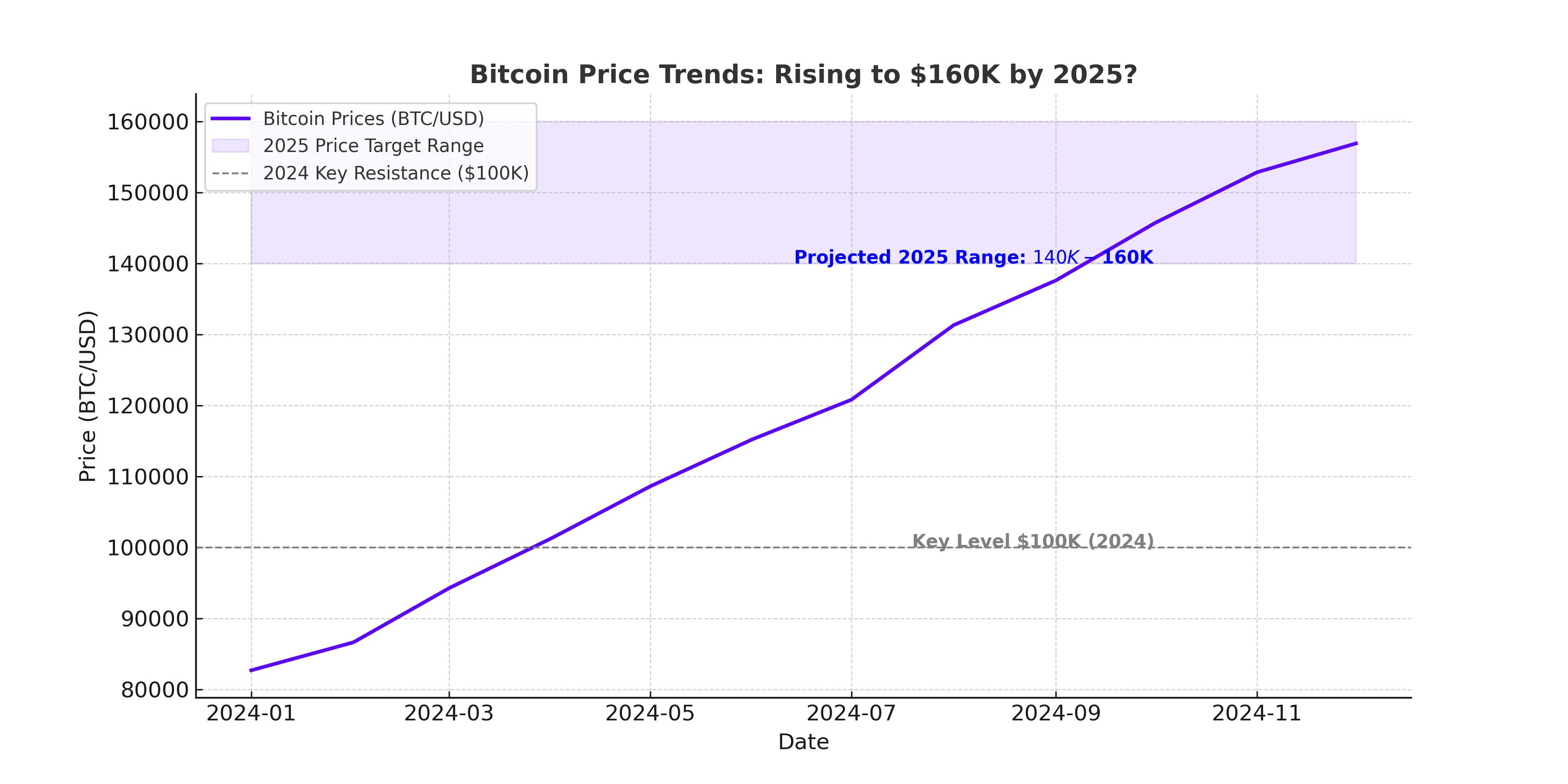

Bitcoin (BTC-USD): Rising to $160K by 2025?

Bitcoin (BTC-USD), the most dominant cryptocurrency, recently crossed the psychologically significant $100,000 mark, signaling robust market momentum fueled by institutional adoption, ETF inflows, and macroeconomic shifts. Trading at $99,985 as of the latest data, Bitcoin has showcased both resilience and volatility, with analysts forecasting an ambitious $160,000 target for 2025.

The Path to $160,000: Institutional Backing and Macroeconomic Shifts

The key driver behind Bitcoin’s sustained rally has been the growing inflows into spot Bitcoin ETFs. BlackRock’s iShares Bitcoin Trust alone has amassed over $500,000 BTC, with $431.6 million in inflows recorded on December 12. The cumulative inflows for U.S.-listed Bitcoin ETFs have surged past $4.4 billion in a streak of 11 consecutive days. This wave of institutional interest signals a paradigm shift, as traditional investors increasingly view Bitcoin as a hedge against inflation and a portfolio diversifier.

Macroeconomic factors also play a crucial role in Bitcoin’s trajectory. The European Central Bank’s recent rate cut of 25 basis points, alongside anticipated easing from the Federal Reserve, has created a favorable environment for risk assets like Bitcoin. These policy changes are expected to boost liquidity and investment appetite, potentially setting the stage for Bitcoin to achieve its lofty 2025 target.

ETF Inflows and the Ripple Effect on Market Dynamics

Spot Bitcoin ETFs are reshaping the market landscape by providing a regulated and accessible investment vehicle for institutional players. As of December 12, the combined net inflows for Bitcoin and Ethereum ETFs reached $870 million in a single day, reflecting heightened investor confidence. Bitcoin ETFs captured $597.5 million of this, with Fidelity, Grayscale, and Bitwise also seeing significant contributions.

These inflows not only bolster Bitcoin’s price but also reduce the asset’s availability on centralized exchanges. The supply on exchanges has dipped below 2.23 million BTC, highlighting a scarcity effect that could further drive prices upward.

Technical Analysis: Resistance and Breakout Potential

Bitcoin’s price has faced notable resistance around the $101,642 level. Technical indicators, such as the Relative Strength Index (RSI), suggest a mixed outlook. While the RSI on the daily chart remains above 50, signaling bullish momentum, it recently rejected the overbought level of 70, indicating potential price consolidation or a pullback.

A successful breakout above $104,088 would confirm a bullish inverted head-and-shoulder pattern, potentially pushing Bitcoin to a new all-time high near $119,510. However, failure to breach this resistance could result in a retest of the $98,369 support level.

BlackRock’s Strategic Allocation and Risk Management

BlackRock, a significant player in Bitcoin’s rise, recommends allocating 1–2% of multi-asset portfolios to Bitcoin, citing its potential for portfolio diversification without introducing excessive risk. This conservative approach aligns with Bitcoin’s role as a “unique diversifier,” given its low correlation with traditional assets.

The asset manager emphasizes the need for vigilance due to Bitcoin’s inherent volatility. Despite this caution, BlackRock’s massive inflows into Bitcoin ETFs underscore a strong conviction in the cryptocurrency’s long-term value proposition.

Adoption Milestone: Crossing the 8% Threshold

Bitcoin’s adoption is projected to surpass 8% of the global population by 2025, a critical threshold that historically signifies exponential growth for emerging technologies. Matrixport highlights that this adoption milestone, combined with increasing institutional interest and macroeconomic support, positions Bitcoin for transformative growth in the financial ecosystem.

Implications for Altcoins and Market Sentiment

Bitcoin’s dominance, accounting for over 53% of the crypto market cap, exerts significant influence on altcoins. Ethereum (ETH), the second-largest cryptocurrency, has also benefited from ETF inflows, with $273.6 million recorded on December 12. Ethereum is nearing its $4,000 resistance level, and a breakout could propel it toward $5,000.

Altcoins like Chainlink (LINK) and Avalanche (AVAX) have posted double-digit gains, reflecting broader market optimism. However, these assets remain susceptible to Bitcoin’s price movements, underscoring the interdependence within the crypto ecosystem.

A Speculative Yet Promising Investment

Bitcoin’s journey to $160,000 hinges on several factors: sustained ETF inflows, favorable macroeconomic conditions, and increasing adoption. While the current price of $99,985 presents an attractive entry point for long-term investors, the path forward is not without risks. Regulatory uncertainties and potential sell-offs could introduce volatility, making Bitcoin a speculative but compelling asset for those with a high risk tolerance.

Is Bitcoin (BTC-USD) a Buy at $100K?

With institutional inflows surging and macroeconomic policies favoring risk assets, Bitcoin at $100,000 offers significant upside potential. Analysts remain bullish, but investors should approach with caution, given the asset’s volatility. For those willing to embrace the risks, Bitcoin represents a unique opportunity to participate in the evolution of global finance.