Bitcoin Hits $109,350: Can It Surge to $250K in Trump’s Crypto Revolution?

Bitcoin skyrockets to new all-time highs as Trump’s pro-crypto policies ignite investor optimism. With BTC-USD eyeing $250K, is this the start of a historic bull run? | That's TradingNEWS

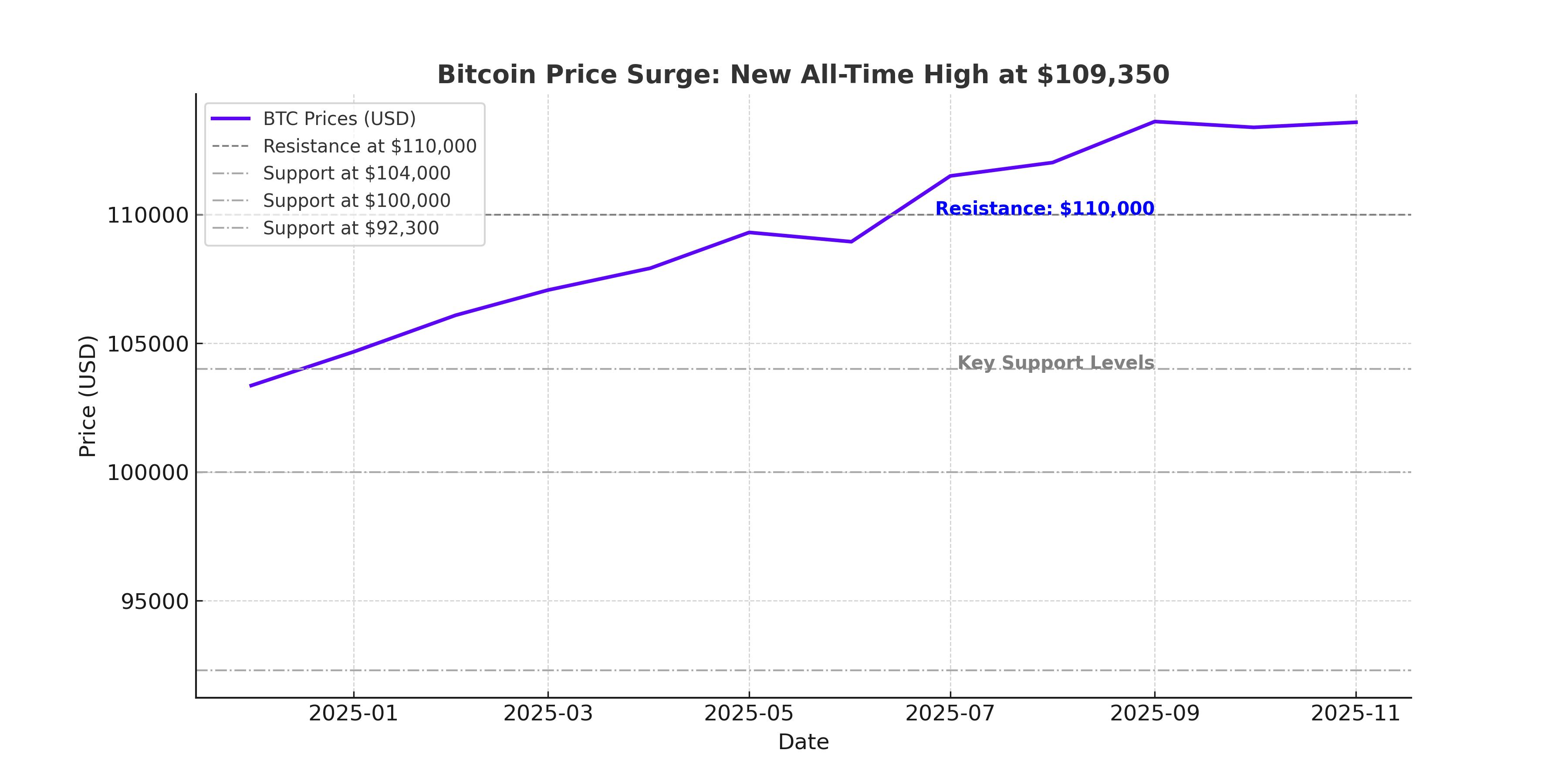

Bitcoin Surges to New All-Time High: $109,350 and Rising

The cryptocurrency market is witnessing an electrifying surge, with Bitcoin (BTC-USD) hitting a historic all-time high of $109,350 as of January 20, 2025. This meteoric rise coincides with market optimism fueled by Donald Trump’s return to the White House and his pro-crypto rhetoric. The cryptocurrency leader has gained over 70% since November 2024, benefiting from renewed institutional interest, robust ETF inflows, and speculative trading activity around new developments in the blockchain space.

The Role of Trump’s Inauguration in Bitcoin’s Rally

Bitcoin's surge is strongly tied to President Trump's inauguration and his administration’s anticipated crypto-friendly policies. Trump has proposed integrating Bitcoin into a national reserve strategy, potentially legitimizing the digital asset as a long-term investment tool. Additionally, the introduction of executive orders to streamline crypto regulation and the establishment of a cryptocurrency advisory council signal a new era for digital assets in the United States.

Market participants are optimistic about Trump's focus on deregulation and innovation, which could enhance institutional adoption of Bitcoin. This aligns with record-breaking inflows into Bitcoin spot ETFs, which totaled $1.86 billion last week. Such inflows underscore the growing confidence of institutional investors in Bitcoin's potential as both a hedge against inflation and a strategic financial asset.

Technical Analysis: BTC in Price Discovery Mode

Bitcoin’s price chart reflects strong bullish momentum as it surpasses its previous high of $108,000. However, the psychological resistance at $110,000 remains a critical level for bulls to breach. Key support levels include $104,000 and $100,000, which have demonstrated resilience during recent market corrections. The Relative Strength Index (RSI) sits at 66, indicating robust buying interest, while the Moving Average Convergence Divergence (MACD) maintains a bullish crossover, signaling potential for continued upward movement.

Short-term projections suggest Bitcoin could rally toward $115,000 if it breaks above $111,000. On the downside, a drop below $100,000 might trigger a broader correction, with potential support around $92,300.

Institutional Demand and ETF Dynamics

Institutional demand for Bitcoin is at an all-time high, driven by spot ETF inflows and favorable macroeconomic conditions. ETFs have become a primary gateway for institutions to access Bitcoin, with total assets under management reaching $38.16 billion as of last week. Analysts at Standard Chartered and CryptoQuant predict that the growing adoption of Bitcoin ETFs could push prices to $200,000 or higher by 2025.

Moreover, the halving event in 2024 has reduced Bitcoin's supply on exchanges, further tightening the market and supporting higher price levels. These supply-demand dynamics are expected to play a pivotal role in Bitcoin’s trajectory throughout the year.

Impact of Meme Coins and Speculative Frenzy

Adding to the market's volatility is the emergence of new meme coins such as the "TRUMP" token, which reached a market capitalization of $10 billion shortly after its launch. This speculative asset, created on the Solana blockchain, highlights the blend of politics and crypto innovation under the Trump administration. While critics caution against the risks of speculative trading, the market’s enthusiasm underscores the broader shift toward mainstream crypto adoption.

Bitcoin’s Roadmap for 2025 and Beyond

Projections for Bitcoin’s price in 2025 range from $175,000 to $250,000, driven by factors such as institutional adoption, favorable regulations, and technological advancements in the blockchain space. Analysts highlight that Bitcoin's role as a hedge against traditional financial risks, coupled with increasing global demand for decentralized assets, positions it as a cornerstone of the digital economy.

As Bitcoin navigates the dynamics of market speculation, regulatory developments, and macroeconomic trends, its potential for growth remains robust. Investors are closely watching for further signals from the Trump administration and institutional players, as these factors could define the next phase of Bitcoin's historic bull run.

That's TradingNEWS

Read More

-

GPIX ETF At $52.52: 8% Yield And Dynamic S&P 500 Income Upside

13.12.2025 · TradingNEWS ArchiveStocks

-

XRP ETFs Surge Toward $1B As XRPI Hits $11.64 And XRPR $16.48 With XRP Near $2

13.12.2025 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Hovers Near $4.07 Support After 22% Weekly Slide

13.12.2025 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Dollar to Yen at 154–158 Range as BoJ 0.75% Hike and Fed Cut Debate

13.12.2025 · TradingNEWS ArchiveForex