Bitcoin Holds Steady Above $102,000: Will BTC-USD Retest $109,000 Soon?

Examining Bitcoin’s Resilience Amid Trump’s Crypto Policies, Institutional Moves, and Key Market Levels | That's TradingNEWS

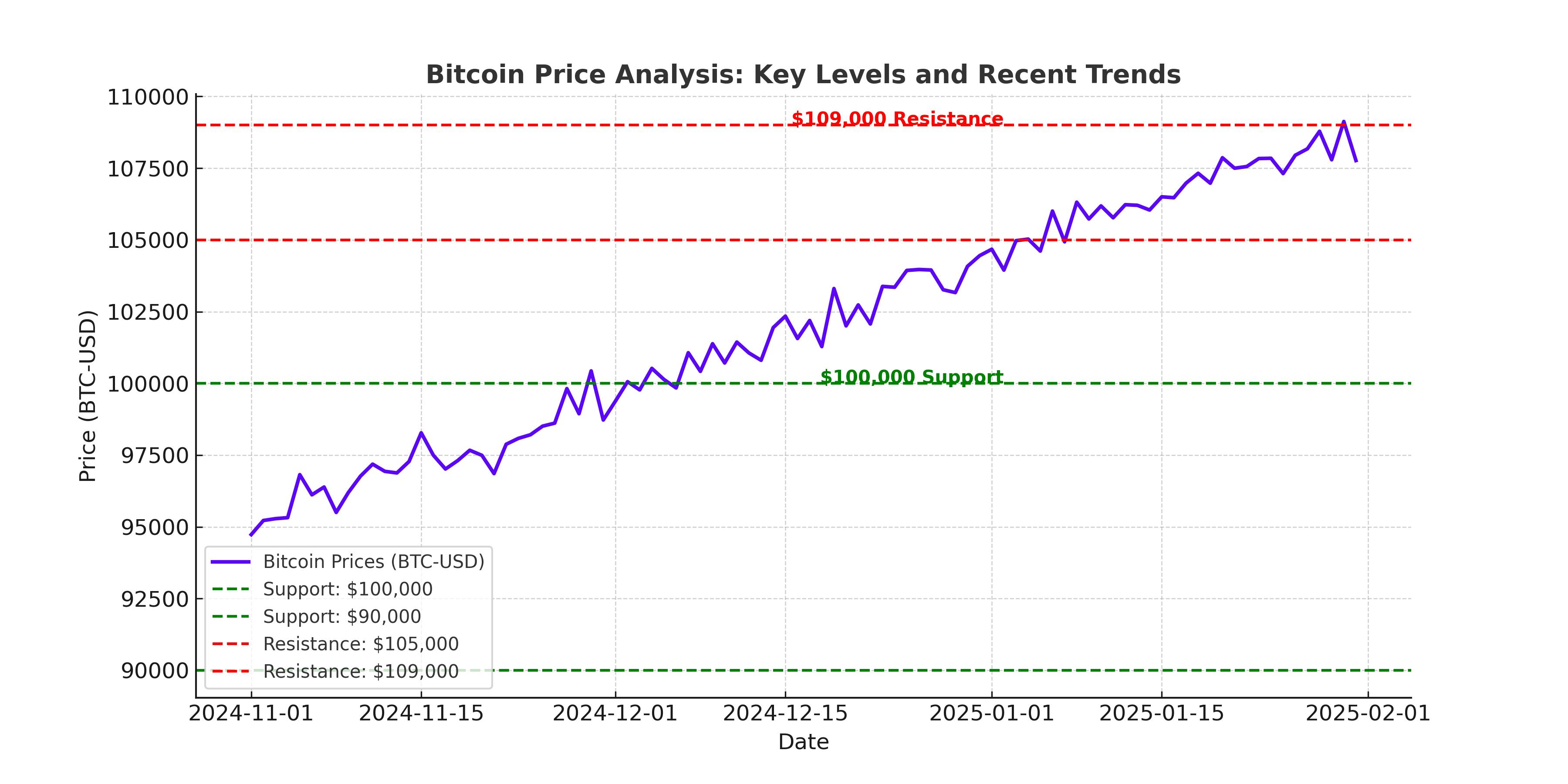

Bitcoin Price Analysis: BTC-USD Holds Above $100,000 with Volatility Ahead

BTC-USD Surges Above $100,000 But Faces Key Resistance

Bitcoin (BTC-USD) is trading at $102,530 as of January 23, 2025, after peaking at $109,588 on January 20th. This represents a 2% decline over the last 24 hours, as profit-taking and market uncertainty weigh on short-term momentum. Despite this, Bitcoin remains above the psychologically significant $100,000 level, a zone that has acted as critical support. Analysts note that BTC’s performance is tied to broader market volatility, geopolitical events, and expectations surrounding U.S. monetary policy under President Trump.

The cryptocurrency's surge to its recent all-time high was fueled by bullish market sentiment, optimism about Trump’s crypto-friendly stance, and increased whale activity. However, the pullback suggests profit-taking by short-term investors and concerns over Trump's tariff threats, which could impact broader risk appetite.

Trump’s Pro-Crypto Policies: Strategic Reserve and SEC Reforms

President Donald Trump’s return to the White House has reignited interest in Bitcoin, particularly after his announcement of plans to establish a U.S. Bitcoin Strategic Reserve, akin to the nation’s gold and oil reserves. Trump has stated his intention to position the U.S. as a leader in cryptocurrency adoption to counterbalance China's dominance in blockchain technology. This policy, if implemented, could provide significant institutional support for Bitcoin, potentially pushing its price toward $120,000 and beyond.

Trump’s administration has also introduced a "crypto task force" under the Securities and Exchange Commission (SEC) to develop clear regulations for digital assets. While this move signals progress, the lack of immediate executive orders has tempered market enthusiasm, leading to the current consolidation phase in Bitcoin prices.

BlackRock’s Bitcoin Adoption Push and $700,000 Forecast

BlackRock CEO Larry Fink has predicted that Bitcoin could reach $700,000 if sovereign wealth funds, pensions, and other institutional investors continue to adopt the cryptocurrency as a hedge against inflation. BlackRock’s iShares Bitcoin Trust (IBIT), which launched in 2024, has already amassed over $60 billion in assets under management, demonstrating robust institutional interest.

The push for Bitcoin ETFs has further legitimized the asset class, with total spot Bitcoin ETF assets surpassing $100 billion in late 2024. Analysts believe this wave of institutional adoption is a key driver of Bitcoin’s current bullish trajectory and long-term potential.

Technical Analysis: Key Levels to Watch for BTC-USD

From a technical perspective, Bitcoin’s price action is consolidating within a broad range between $100,000 and $109,000. Immediate support lies at $100,000, a critical psychological level reinforced by the 50-day exponential moving average (EMA) at $99,750. A breach below this level could trigger a deeper correction toward $90,000, where long-term buyers are likely to step in.

On the upside, resistance is seen at $105,000 and $109,000. A breakout above $109,000 would signal a resumption of the bullish trend, with potential targets at $115,000 and $120,000. The Relative Strength Index (RSI) on the daily chart remains neutral, indicating that Bitcoin could continue to consolidate before making a decisive move.

Whale Activity and On-Chain Metrics

Recent data shows significant whale accumulation, with large investors purchasing over 22,000 BTC, worth approximately $2.24 billion, in the past three days. This suggests strong confidence among major holders and could provide the liquidity needed for Bitcoin to challenge new highs.

On-chain metrics also indicate that short-term holders have largely completed their profit-taking, reducing selling pressure in the market. The Short-Term Holder SOPR (Spent Output Profit Ratio) has been declining, signaling a potential supply squeeze that could drive prices higher in the coming weeks.

Volatility Measures and Upcoming Catalysts

Bitcoin’s historical volatility remains elevated, with the 60-day price range narrowing significantly in recent weeks. This tightening often precedes major price moves, either to the upside or downside. The Federal Reserve's upcoming FOMC meeting on January 29th could act as a catalyst, especially if monetary policy signals shift market sentiment.

Trump’s tariff threats and geopolitical developments, including tensions with China and Russia, also contribute to market uncertainty. Bitcoin’s role as a hedge against such risks could attract additional capital, particularly from retail and institutional investors seeking alternative assets.

Bitcoin’s Role as Digital Gold

Bitcoin’s narrative as “digital gold” has gained traction, especially in the context of global inflation concerns and economic instability. With traditional safe-haven assets like gold trading at elevated levels, Bitcoin offers a decentralized alternative that appeals to a younger, tech-savvy demographic. BlackRock’s Fink highlighted this point, emphasizing Bitcoin’s potential as a global hedge against currency debasement.

Market Sentiment and Broader Crypto Trends

Broader cryptocurrency markets have mirrored Bitcoin’s recent price action, with major altcoins like Ethereum (ETH) and Ripple (XRP) experiencing declines of 1.8% and 2.4%, respectively. However, Bitcoin remains the dominant force, with a market capitalization exceeding $2 trillion.

The launch of Trump’s memecoin, $TRUMP, has added to market volatility, raising ethical questions about the intersection of politics and cryptocurrency. While $TRUMP saw an initial surge, its recent decline highlights the speculative nature of such tokens.

Conclusion: Is Bitcoin a Buy, Sell, or Hold?

Bitcoin’s current price level of $102,530 offers a compelling entry point for long-term investors, particularly given its resilience above $100,000. However, traders should be cautious of short-term volatility and closely monitor key resistance levels at $105,000 and $109,000.

For those with a long-term horizon, Bitcoin remains a strong buy, supported by institutional adoption, favorable regulatory developments, and its role as a hedge against macroeconomic risks. Short-term traders may prefer to wait for a breakout above $109,000 or a pullback to stronger support levels before entering new positions.

That's TradingNEWS

Bitcoin's Meteoric Rise: What’s Driving the Surge?

Bitcoin Price: Is $85,000 Resistance Holding BTC Back or Is a Bullish Breakout Imminent?