Bitcoin Market Analysis: Historical Trends, Institutional & Economic Factors Impact

Evaluating Bitcoin's Performance Through Historical Data, Institutional Movements, and Economic Indicators for Future Insights | That's TradingNEWs

Bitcoin Market Analysis: Navigating Volatility and Future Prospects

Historical Performance and July Prospects

Bitcoin (BTC) has experienced significant volatility in June, leaving investors to speculate on July's direction. Historically, July has been a bullish month for Bitcoin, with price increases in seven of the past eleven Julys. Analysts are examining historical data and technical indicators to predict whether this trend will continue or if the current bull run is nearing its peak.

Key Indicators and Historical Trends

Bitcoin’s Post-Halving Surge

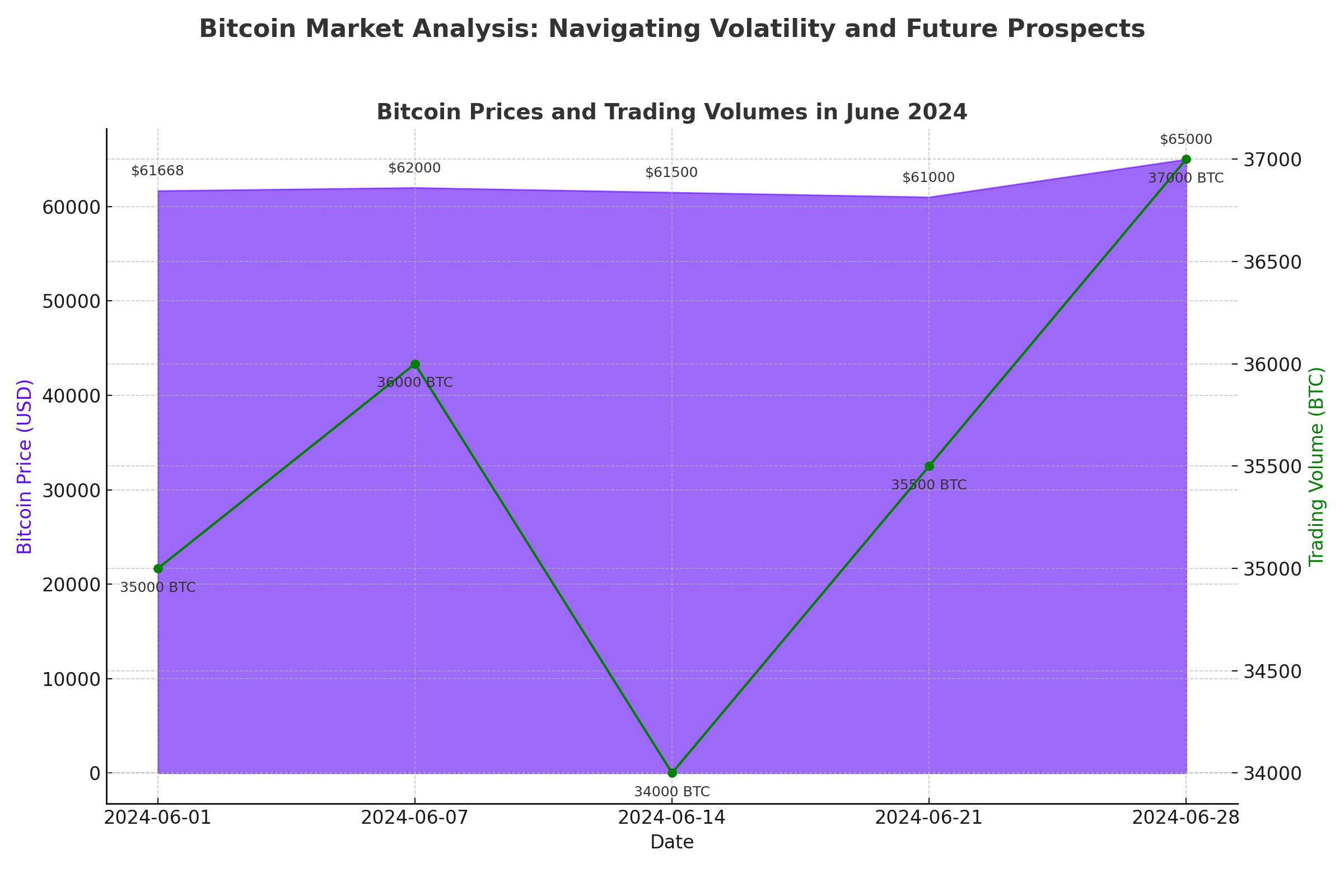

Bitcoin’s price behavior following past halving cycles provides valuable insights. After the 2017 halving, Bitcoin saw an eight-month upward trajectory before hitting a peak of $19,783 in December 2017. Similarly, the 2021 cycle exhibited three months of growth, with Bitcoin reaching a high of $64,863 in April 2021, followed by a pullback and a final peak of $69,000 in November 2021. The current market, trading around $61,668 as of the latest data, has yet to close a post-halving trading period at an all-time high, a potential indicator for future bullish movements if achieved in July.

Current Market Dynamics

Bitcoin is trading slightly lower around the $65,000 level as the second quarter ends. Demand from spot ETF buyers, counterbalanced by selling from cash holders, has led to relatively subdued price movements. However, expectations of increasing institutional adoption could drive Bitcoin’s price higher over the next three months. Spot Bitcoin ETFs have attracted over $60 billion in inflows, demonstrating strong institutional interest.

Institutional Adoption and ETF Influence

Spot Bitcoin ETFs

Since the launch of various spot Bitcoin ETFs, over $60 billion has flowed into these products. Spot Bitcoin ETFs allow mainstream investors to gain exposure to Bitcoin through their brokerage accounts, providing a regulated and convenient investment vehicle. These ETFs directly invest in Bitcoin, significantly impacting market supply and demand dynamics.

Bitcoin Halving and Mining Rewards

The recent Bitcoin halving event on April 20th reduced mining rewards from 6.25 to 3.125 Bitcoins per block. With approximately 450 new Bitcoins entering the market daily, the accumulation of nearly 15,000 Bitcoins by spot ETFs as of mid-June highlights a significant supply constraint. This supply-demand imbalance could drive prices higher if demand remains constant or increases.

Market Sentiment and Technical Analysis

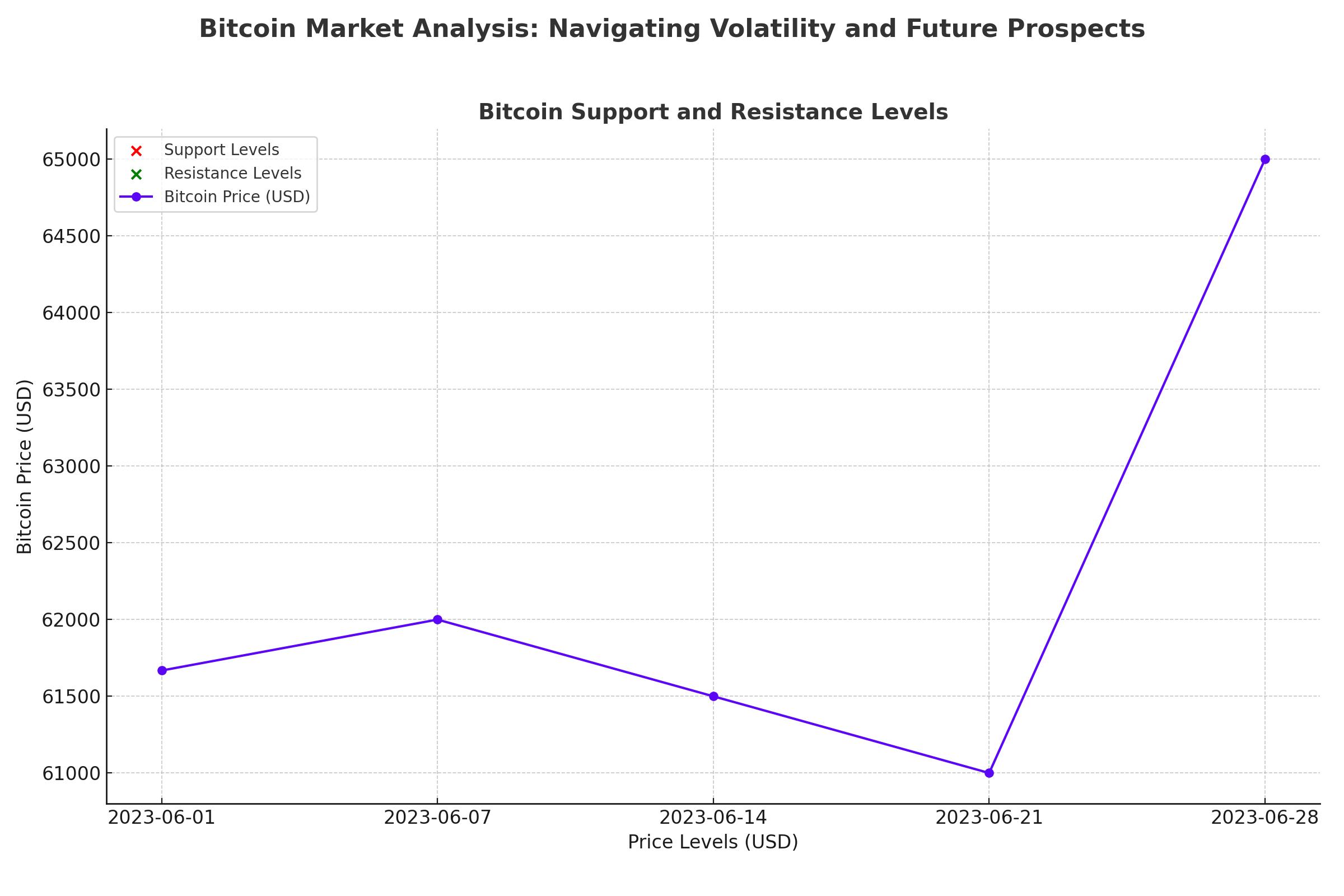

Key Support and Resistance Levels

Bitcoin’s price has been whipsawed by recent volatility, hitting intraday highs of $61,668 and recovering from lows of $59,950. Key support levels to watch are $60,000, with significant bids appearing below this mark. Resistance levels are around $64,000 and $67,000. The Relative Strength Index (RSI) currently sits at 36, suggesting Bitcoin is nearing oversold territory, which could indicate a potential buying opportunity if it dips further.

Market Dynamics and Price Movements

Volatility and Institutional Sentiment

June saw significant volatility in the EUR/USD pair, with Bitcoin experiencing a range between $58,554 and $71,907. This volatility reflects speculative positioning and reactions to geopolitical and economic uncertainties. The speculative price range for July is expected to be between $61,100 and $92,000, considering historical trends and current market conditions.

Institutional Investors and Their Impact

Institutional Positions

Institutional investors have shown varied confidence in Bitcoin’s long-term potential:

- Grayscale Investment: Continues to bridge the supply gap by holding a significant amount of Bitcoin.

- MicroStrategy: Increased its Bitcoin holdings to over 100,000 BTC, demonstrating strong institutional support.

- ARK Invest: Recently acquired additional Bitcoin, reflecting a strategic move to capitalize on potential future gains.

Geopolitical Tensions and Economic Indicators

Geopolitical Influences

Tensions in the Middle East and the ongoing Russia-Ukraine conflict add layers of complexity to the Bitcoin analysis. These geopolitical factors can drive safe-haven flows into the US Dollar, impacting Bitcoin negatively. However, if geopolitical tensions ease, Bitcoin could benefit from increased risk appetite among investors.

Economic Indicators

US Inflation Data

The US Personal Consumption Expenditures (PCE) index, the Federal Reserve's preferred inflation gauge, showed a year-over-year increase of 2.6% in the latest report, the lowest since March 2021. This cooling inflation could influence the Federal Reserve’s decision on interest rates, with market expectations of a rate cut in September showing a 68% probability according to the CME FedWatch Tool.

Non-Farm Payrolls (NFP)

The upcoming NFP report is another critical indicator. A robust NFP could strengthen the US Dollar, adding downward pressure on Bitcoin, while weaker data could provide some relief to the cryptocurrency.

Strategic Outlook and Trade Recommendations

Short-Term Strategy

- Monitor Support Levels: Watch closely at $60,000 and $59,950. A break below these levels could signal further downside.

- Watch for Resistance: Resistance around $64,000 and $67,000 could indicate bullish momentum if breached.

Long-Term Strategy for Bitcoin

- Monitor Institutional Investor Moves and Geopolitical Developments: Stay vigilant about institutional investor moves and geopolitical events, such as ongoing tensions in the Middle East and the Russia-Ukraine conflict. These factors can impact market stability and drive safe-haven flows into or out of Bitcoin.

- Stay Updated on Key Economic Indicators: Regularly review reports from the US Bureau of Labor Statistics for CPI and PCE data, and monitor announcements from the Federal Reserve. These indicators will provide insights into potential interest rate changes that could affect Bitcoin’s price.

Conclusion

Bitcoin (BTC) is navigating a complex landscape of economic data, geopolitical tensions, and institutional sentiment. By integrating technical analysis with a keen understanding of macroeconomic factors, investors can effectively navigate the challenges and opportunities in the Bitcoin market. As July approaches, key support and resistance levels, institutional adoption, and economic indicators will play crucial roles in shaping Bitcoin’s price trajectory.