Bitcoin Market Analysis: Mt. Gox Liquidations and Political Shifts

Examining the Effects of Recent Mt. Gox Bitcoin Liquidations and Political Developments on BTC Market Trends and Future Outlook | That's TradingNEWS

Bitcoin: In-Depth Analysis of the Leading Cryptocurrency

Current Market Dynamics

Symbol: BTC

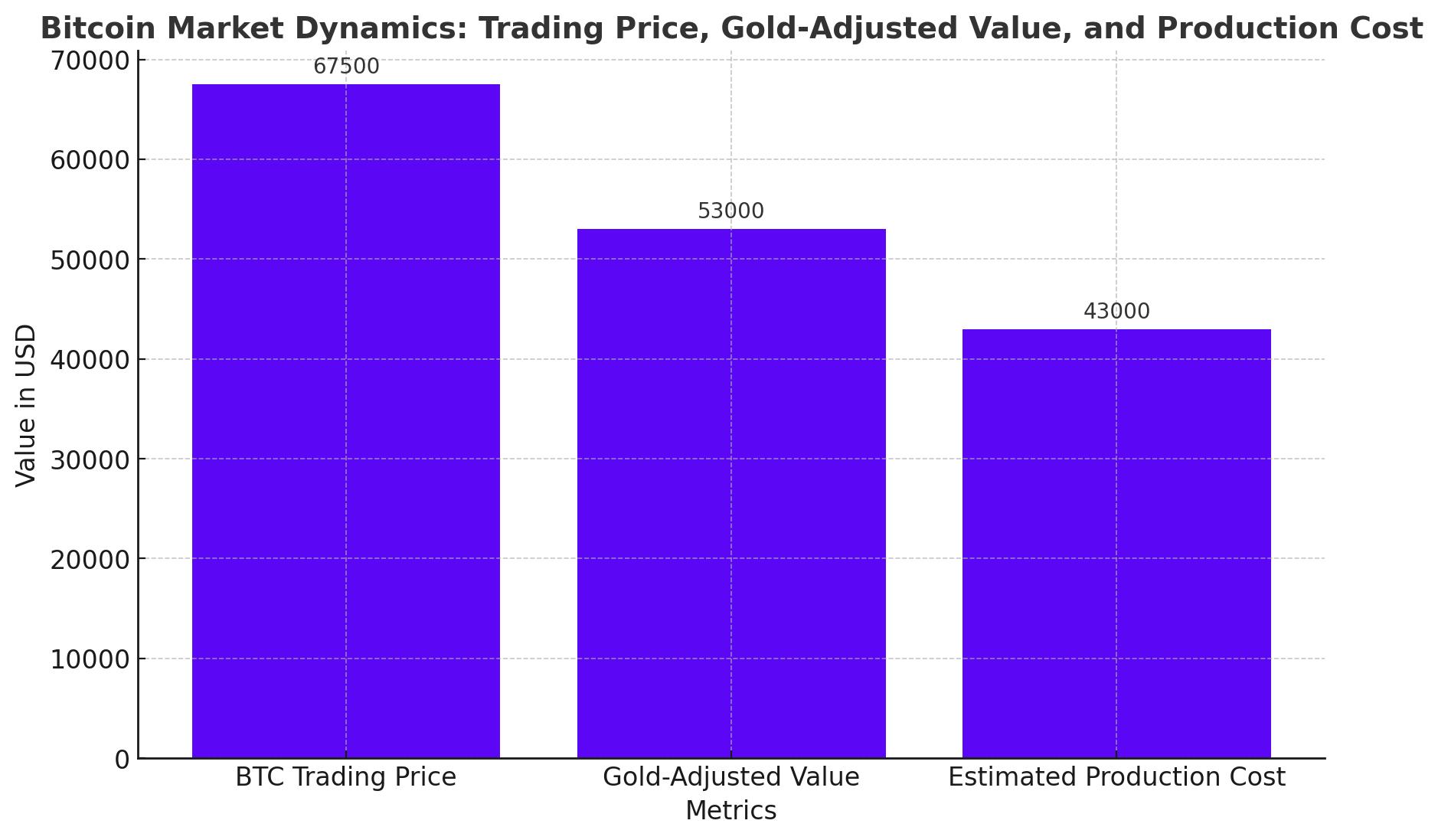

Bitcoin (BTC) is currently trading around $67,500, significantly higher than its estimated production cost of $43,000. This price is above the gold-adjusted value, which, considering volatility, would place BTC around $53,000. JPMorgan analysts suggest that while the current BTC price indicates a bullish trend, long-term significant price leaps might be limited, with stabilization likely around the volatility-adjusted gold comparison.

Impact of Market Liquidations and Political Landscape

Recent market dynamics have seen Bitcoin futures contracts weakened due to substantial liquidations by creditors of Gemini and Mt. Gox, along with the sale of BTC seized by the German government. These liquidations are expected to be temporary, with a recovery anticipated by August.

The political landscape, particularly the potential return of Donald Trump to the presidency, could favor crypto assets. Trump's trade policies may encourage central banks in emerging markets to diversify their reserves in gold, impacting future market trends.

Bitcoin Hash Ribbons Indicator

The Bitcoin hash ribbons, which track two moving averages of hashrate, have recently exited a "capitulation" phase for the first time in over two months. Historically, this exit has been a reliable buy signal, suggesting considerable BTC price upside. The last exit in August 2023 saw BTC/USD trading at under $30,000.

Expansion of Crypto Payments in the Luxury Sector

Luxury car manufacturer Ferrari is expanding its crypto payment options to its European dealer network, following a successful launch in the U.S. Ferrari partnered with BitPay to process these payments, accepting BTC, ETH, and USDC, with immediate conversion to fiat currency to mitigate price volatility.

Political Endorsements and Crypto Advocacy

Former U.S. President Donald Trump, now identifying as a "crypto candidate," is set to speak at the Bitcoin Conference in Nashville, Tennessee. His position marks a significant shift from his previous stance, where he denounced Bitcoin as a scam. Trump's campaign is now accepting donations in various cryptocurrencies, reflecting his new pro-crypto stance.

Other political figures, including independent presidential candidate Robert F. Kennedy Jr. and former Republican candidate Vivek Ramaswamy, will also attend the conference, highlighting the growing political interest in cryptocurrency.

Bitcoin Exchange-Traded Funds (ETFs) and Market Movements

The introduction of Bitcoin ETFs has significantly influenced market dynamics. Exchange-traded funds collectively hold 887,000 BTC on behalf of investors, creating substantial sell-side pressure during outflows. Recent significant sell-offs, such as the German government's disposal of 50,000 BTC, have challenged BTC's price stability.

Despite these sell-offs, the number of HODLers in profit has remained robust, even during price declines. The Bitcoin Fundamental Index (BFI) has shown stronger network fundamentals, indicating potential for price recovery.

Recent Price Movements and Future Outlook

Bitcoin's price recently dropped from over $67,000 to under $66,000, coinciding with the launch of several spot ETH ETFs. The German government's sell-off and Mt. Gox's repayment process have added downward pressure. However, analysts expect a potential rebound, driven by institutional inflows and positive network fundamentals.

Conclusion

Bitcoin remains a pivotal asset in the cryptocurrency market, influenced by a myriad of factors including market liquidations, political endorsements, and institutional activity. While short-term volatility may pose challenges, the long-term outlook for BTC remains bullish, supported by strong network fundamentals and increasing institutional interest.

Investment Decision: Bullish on Bitcoin.