Bitcoin Market Analysis: Navigating Volatility and Anticipating Market Moves

Assessing the Impact of U.S. Inflation Data, Federal Reserve Policies, and Geopolitical Tensions on Bitcoin Prices | That's TradingNEWS

Bitcoin Market Analysis: Navigating Volatility and Anticipating Market Moves

Impact of U.S. Inflation Data on Bitcoin Prices

Bitcoin (BTC) remained relatively stable as the U.S. Personal Consumption Expenditures (PCE) Price Index for May aligned with expectations. The core PCE showed a year-over-year increase of 2.6%, marking the lowest reading since March 2021. This data point, closely watched by the Federal Reserve, suggested cooling inflation and raised hopes for potential interest rate cuts later this year, impacting the broader market sentiment and Bitcoin's trajectory.

Data from Cointelegraph Markets Pro and TradingView indicated that BTC price action hovered around the lower $61,000 range following the release of the PCE data. Despite the stable price movement, market participants are keenly observing the Federal Reserve's policy decisions, which could significantly influence Bitcoin's future performance.

Bitcoin Price Movement and Support Levels

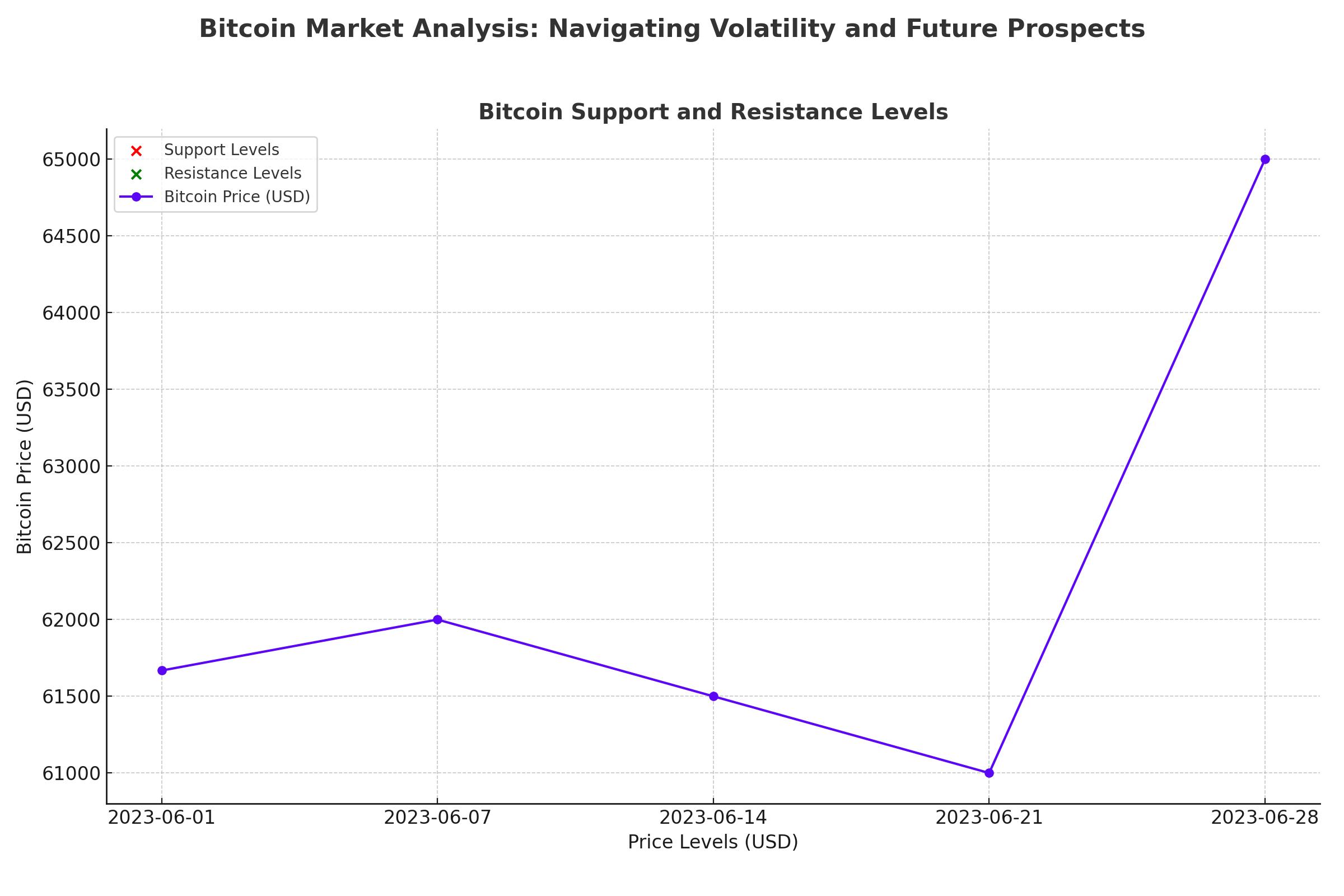

Bitcoin's price has faced resistance around the $62,400 mark, failing to maintain a rise above this level. Recently, BTC/USD saw a decline below $62,000, though support around $60,550 has been maintained. The recent high was recorded at $62,297, with Bitcoin now consolidating above the $61,500 level and the 100-hourly Simple Moving Average (SMA).

On the technical front, a significant trend line break above $61,250 resistance suggests a potential bullish movement. However, the $62,400 resistance remains a critical hurdle. A clear move above $62,500 could pave the way for further gains, targeting $63,500 and possibly $64,400.

Conversely, failure to break past the $62,400 resistance could result in another decline, with immediate support at $61,450 and more substantial support at $60,550. Any significant breach below this could drive prices down towards the $58,500 support zone.

Bitcoin's Long-Term Holders and Market Sentiment

Long-term Bitcoin holders sold off approximately $10 billion worth of BTC in May 2024, translating to around 160,000 BTC, highlighting a significant trend in investor behavior. The put-call ratio for Bitcoin options on Deribit rose to 1.66, indicating a bearish sentiment among investors hedging against price declines. With 107,000 Bitcoin options expiring and a max pain point at $61,500, traders are positioning themselves to benefit from this alignment, potentially reducing volatility around the expiry.

Market Reaction to Mt Gox Liquidation Fears

The anticipated distribution of tokens from the defunct Mt Gox exchange has weighed heavily on Bitcoin prices. Liquidators are set to begin distributions in early July, potentially leading to a significant sell-off as recipients might liquidate their holdings. This has created a cautious market environment, with Bitcoin on track for a nearly 9% decline in June.

Influence of Broader Crypto Market Trends

The broader crypto market has seen mixed performances, with Ethereum (ETH) and other altcoins experiencing varying degrees of gains and losses. Ether rose slightly by 0.1%, driven by speculation around the potential approval of a spot Ether exchange-traded fund (ETF) by the Securities and Exchange Commission (SEC). However, Ether has also faced a nearly 9% decline in June, mirroring Bitcoin's challenges.

Other altcoins like SOL, XRP, and ADA have also seen modest gains, but the overall market sentiment remains cautious. The strength of the U.S. dollar, reaching a two-month high, has pressured crypto prices as traders shift towards the greenback ahead of critical inflation data releases.

Geopolitical Tensions and Their Impact on Bitcoin

Geopolitical tensions, particularly in the Middle East, have added to the market's volatility. Escalating conflicts between Israel and Hezbollah pose a significant risk to regional stability and global energy supplies. Such geopolitical risks tend to drive investors towards safe-haven assets like Bitcoin, influencing its price dynamics.

Technical Analysis and Future Projections

Bitcoin's price is currently consolidating, with critical resistance at $62,400 and support at $60,550. The 50-day moving average at $61,500 serves as a pivotal point for potential upside movements. Maintaining stability above key support levels is crucial to avoid further declines.

Market sentiment, as indicated by the CME FedWatch tool, shows a 68% probability of a rate cut by the Federal Reserve in September. This potential easing could provide a bullish impetus for Bitcoin, making it a favorable investment amid a low-interest-rate environment.

ETF Market Developments

The demand for Bitcoin spot investment products has cooled, with significant outflows observed in recent weeks. This trend suggests that while institutional interest surged initially, the road to widespread adoption remains uneven. Additionally, the upcoming launch of spot Ether ETFs could shift investor focus, potentially triggering a rally in Ethereum and influencing Bitcoin's market dynamics.

Conclusion

Bitcoin's market dynamics are influenced by a myriad of factors, including U.S. inflation data, Federal Reserve policies, geopolitical tensions, and market sentiment towards ETFs. While the current environment presents challenges, the long-term prospects for Bitcoin remain positive, driven by its resilience and growing institutional adoption. Investors should closely monitor technical levels, market trends, and geopolitical developments to navigate the evolving landscape effectively.