Bitcoin Market Analysis: Regulatory Pressures & Technical Indicators

Unpacking Bitcoin's Recent Price Movements, Market Sentiment, and Future Projections Amid Regulatory Concerns and Economic Uncertainties | That's TradingNEWS

Bitcoin Market Analysis: Current Trends and Future Projections

Bitcoin's Recent Price Movement

Bitcoin (BTC) has experienced significant volatility recently, with its price remaining relatively flat at $61,212.1 as of 08:30 ET (12:30 GMT) on Tuesday. This follows a drop to $59,215 in overnight trade. Various factors, including regulatory concerns and broader risk aversion among investors, have driven this fluctuation.

Regulatory Fears and Market Sentiment

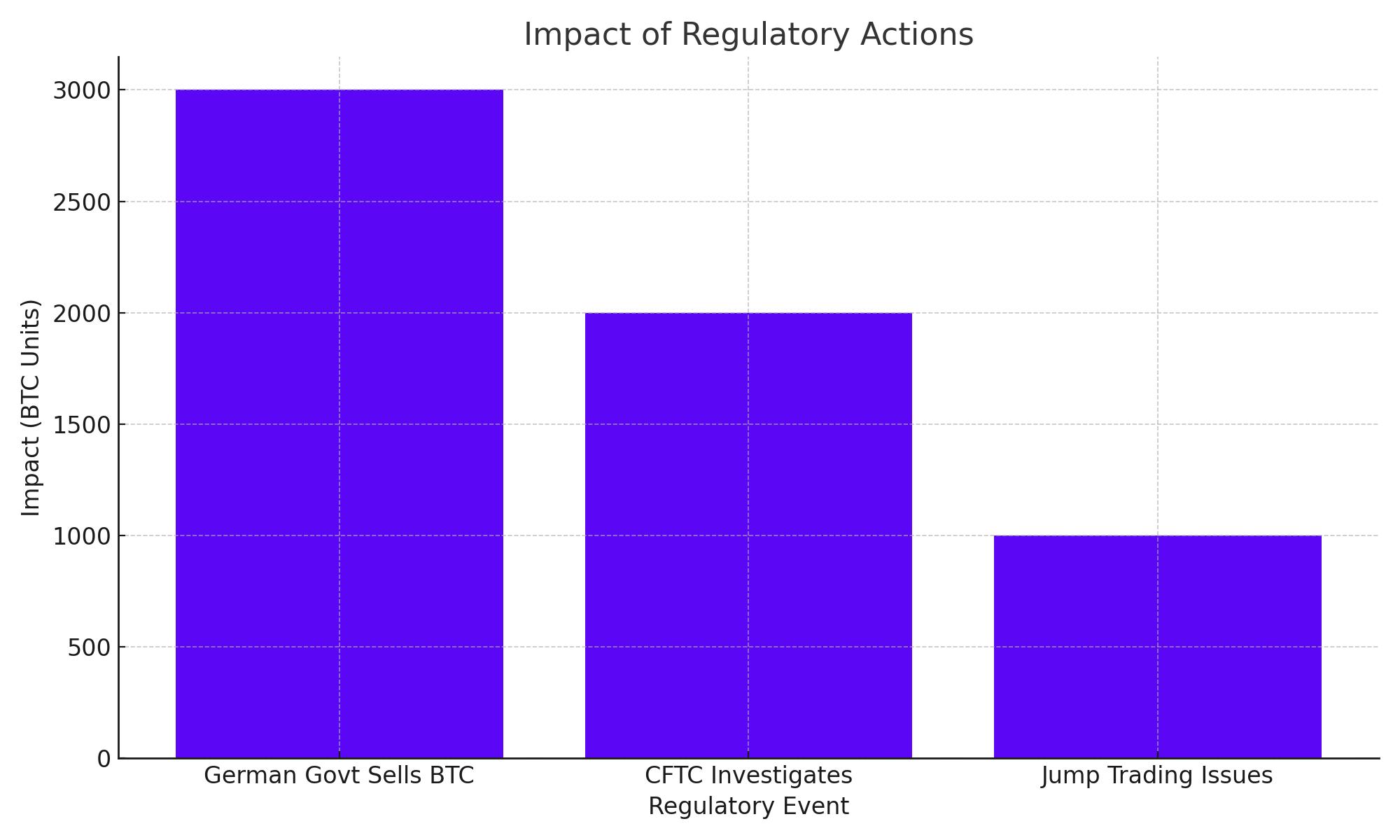

Impact of Regulatory Actions

The cryptocurrency market faced pressure due to a mix of regulatory fears. Reports that the German government was selling Bitcoin confiscated from a piracy website contributed significantly to the bearish sentiment. Approximately 3,000 Bitcoins out of 50,000 confiscated were reportedly sold by German authorities, causing anxiety among investors.

Furthermore, the U.S. Commodity Futures Trading Commission (CFTC) is investigating market maker Jump Trading over its crypto trading activities, adding to the negative sentiment. The departure of Jump President Kanav Kariya also raised concerns about the stability of crypto trading activities.

Inflation Concerns and Dollar Strength

Economic Indicators and Inflation Data

Traders are also eyeing the upcoming U.S. inflation data, specifically the PCE price index, which is the Federal Reserve's preferred gauge of inflation. Rising fears of high interest rates have already battered crypto markets, and any indication of persistent inflation could lead to further selling pressure.

Crypto Investment Product Outflows

Investment Trends

According to digital asset manager CoinShares, crypto investment products saw outflows totaling approximately $584 million recently. Bitcoin products alone accounted for $630 million in outflows, while altcoin products saw mild inflows as some investors viewed the price slumps as buying opportunities.

Performance of Major Altcoins

Altcoin Rebound

Despite the broader market downturn, some major altcoins have shown resilience. Ether (ETH) rose 1.6% to $3,372.49, recovering from losses incurred due to the hype over a spot Ether ETF. Other altcoins like ADA and SOL climbed 5% and 7%, respectively, while XRP slipped by around 0.1%. Meme tokens such as SHIB and DOGE added 3% and 4.5%, respectively.

Ether ETFs vs. Bitcoin Funds

Market Dynamics

Bernstein analysts noted that Ether ETFs are expected to attract similar demand sources as Bitcoin ETFs, though on a smaller scale due to the lack of an ETH staking feature. The basis trade involving spot ETF purchases and futures contract sales is likely to gain traction, contributing to healthy liquidity in the ETF market.

Structural Adoption and Regulatory Environment

Long-term Adoption

Despite recent market declines, the structural adoption cycle for digital assets like Bitcoin and Ether remains intact. Bernstein analysts anticipate that the regulatory narrative will improve closer to the U.S. elections, especially with the increasing odds of a Republican victory and former President Trump's pro-crypto stance.

Fixed Supply and Price Volatility

Bitcoin's Unique Supply Dynamics

Unlike traditional commodities, Bitcoin's supply is fixed and issued on a predictable schedule. Even though increased demand can lead to higher prices, the supply curve remains unchanged due to the Bitcoin protocol's automatic adjustment of mining difficulty. This fixed supply mechanism contributes to greater price volatility compared to other goods and commodities.

Potential Market Scenarios

Critical Support and Resistance Levels

Bitcoin's recent plunge towards $57,000 highlighted key technical levels. The 200 EMA, a critical support level, would be invalidated if Bitcoin falls below this threshold, potentially worsening the sell-off. A drop below $57,000 could trigger more liquidations as buyers' stop-loss orders are hit, leading to additional selling pressure.

Institutional Selling and Market Stalemate

If Bitcoin falls below $57,000, it could result in a market stalemate with prices trading between $55,000 and $60,000. However, continued institutional selling might push the price down to $50,000, extending the bear market.

Market Performance and Strategic Insights

Short-term and Long-term Drivers

Bitcoin's price settled at $59,191.39 on Monday, its lowest since early May. The cryptocurrency is down 12% so far this month but remains significantly higher for the year after ending last year below $43,000. Short-term drivers include the German authorities' Bitcoin sales and the potential release of more Bitcoins from defunct exchange Mt. Gox.

Conclusion: Bitcoin's Future Outlook

Investment Recommendation

Given the current regulatory environment, inflation concerns, and market dynamics, Bitcoin's price is likely to remain volatile in the short term. Investors should monitor regulatory developments and economic indicators closely. The recommendation is to hold Bitcoin, waiting for clearer signs of market stabilization before making further investment decisions.

For more details on Bitcoin's real-time performance, click here.