Bitcoin Market Volatility: Institutional Inflows vs. Government Sell-offs

BTC Price Faces Resistance at $59,000 as Whales Accumulate and Institutional Investments Surge | That's TradingNEWS

Bitcoin Faces Pivotal Moment Amidst Market Volatility and Institutional Activity

Bitcoin’s Price Struggles and Potential Downtrend

Bitcoin (BTC) has been experiencing significant market fluctuations, with its price currently trading around $58,000. After reaching a two-month low of $53,500 on July 5, the cryptocurrency managed to rebound above $57,000. However, the downtrend from its all-time high in March has resulted in lower highs and lower lows, indicating a bearish market sentiment. Despite this recovery, the ongoing Bitcoin sell-off by the German government and Mt. Gox repayments threaten further declines.

According to CryptoQuant, the profit and loss (P&L) index is hovering around its 365-day moving average (MA). If this index drops below its 365-day MA, Bitcoin could face a major correction similar to previous drawdowns. CryptoQuant’s bull-bear market cycle indicator also suggests that Bitcoin is nearing a critical level, which could signal a switch to a bear market if prices decline further.

Whale Accumulation and Institutional Inflows

Despite the bearish sentiment, Bitcoin whales have been accumulating at the fastest rate in over a year. Over the past month, large holders have increased their Bitcoin holdings by 6.3%, indicating rising demand for Bitcoin at lower levels. This accumulation is corroborated by increased inflows into US-based spot Bitcoin exchange-traded funds (ETFs).

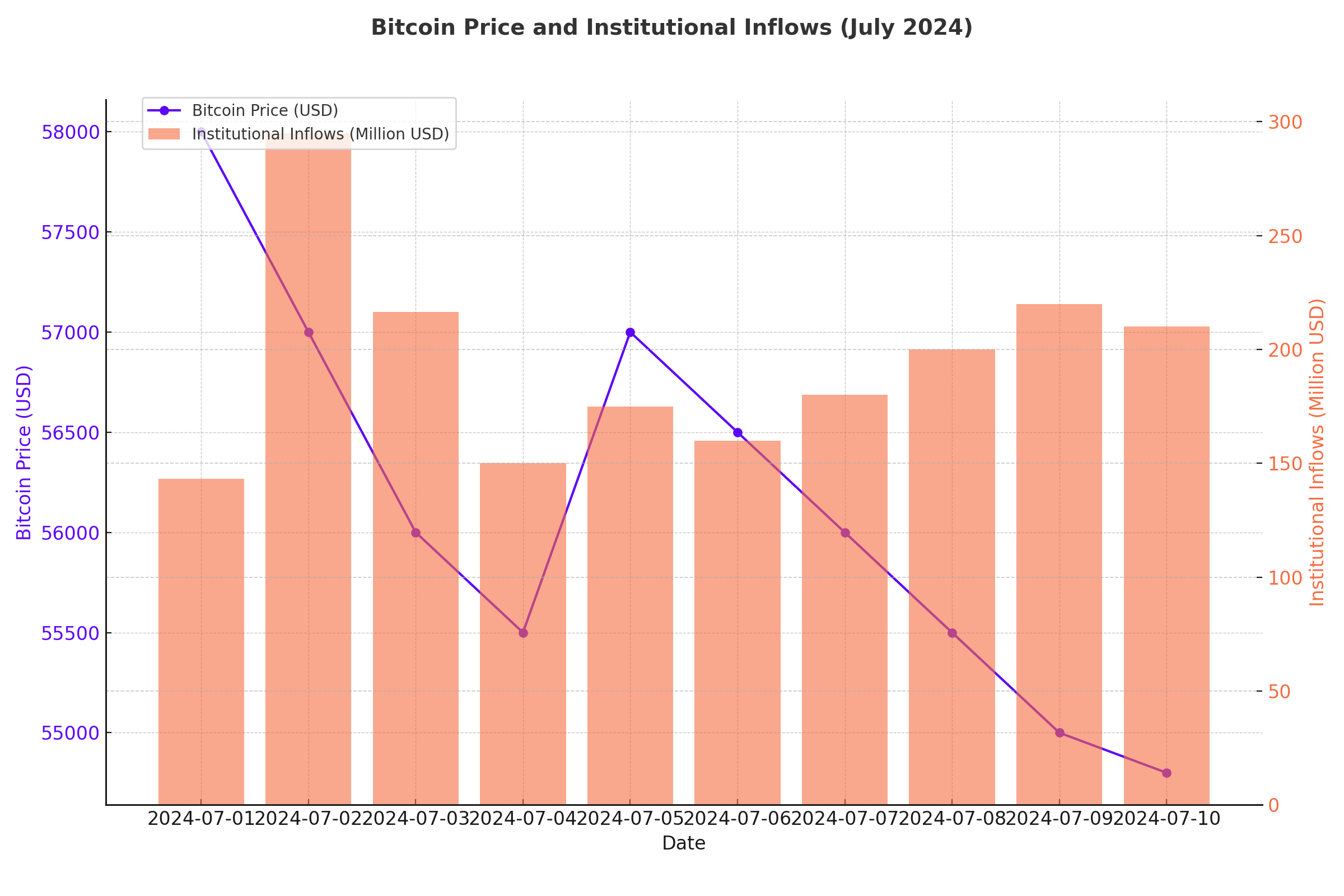

Data from SoSo Value shows that institutional investors poured $143.1 million into spot Bitcoin ETFs on July 5, followed by $294.9 million and $216.4 million on July 8 and July 9, respectively. This institutional support has helped counterbalance the selling pressure and demonstrates Bitcoin’s acceptance within the financial mainstream.

Technical Analysis and Resistance Levels

From a technical perspective, Bitcoin faces short-term resistance at $59,000, as observed by Benjamin Cowen, founder of "Into The Cryptoverse." The price has been sealed below this level since breaching it on July 4, and bulls need to flip it back into support to avoid further losses. Immediate resistance is near the $58,200 level, with the first major resistance at $58,500. A move above this level could trigger a fresh increase, potentially targeting the next key resistance at $59,200.

If Bitcoin fails to climb above the $58,500 resistance, it could face another decline. The first major support level is $57,200, with the next significant support at $56,200. A break below this level could lead to a further drop towards the $55,000 support zone.

Impact of Government Sell-offs and Market Reactions

The German government's continued liquidation of its Bitcoin holdings has exerted downward pressure on the market. The Bundeskriminalamt (BKA) has been actively selling Bitcoin, with its holdings now valued at less than $1 billion for the first time. Despite market concerns, these sales represent a small fraction of Germany's total holdings, leaving 40,359 Bitcoins still in reserve.

Market analysts view these sales as an opportunity to capitalize on the dip. The ongoing sales by the German government are being closely monitored, with analysts predicting short-term market volatility. This selling spree, combined with the initiation of Mt. Gox creditor repayments involving 47,228 BTC, has created a buying opportunity for investors who believe the market has overreacted to these developments.

Bitcoin’s Future Outlook

The recent market dynamics suggest that Bitcoin is poised for a recovery, driven by both technical indicators and market fundamentals. The substantial inflows from institutional investors and aggressive whale accumulation indicate a bullish demand for Bitcoin. However, the market must navigate the selling pressure from government liquidations and significant sell-offs like those from Mt. Gox.

If Bitcoin can surpass the critical resistance levels and maintain its current upward trajectory, it could target the $60,000 mark, a psychologically significant level for investors. On the downside, failing to overcome resistance levels could result in further declines, with support levels at $57,200 and $56,200 being crucial to watch.