Bitcoin Price Crashes Below $92K as Trump's Tariffs Shake Global Markets – Will BTC Recover?

Bitcoin (BTC-USD) Drops 14% in Four Days – Can Support Hold at $92K?

Bitcoin is under intense selling pressure, plummeting 14% in just four days, as Donald Trump’s aggressive tariffs on Canada, Mexico, and China trigger market-wide panic. The cryptocurrency fell to $91,281 before staging a modest recovery to $95,700, still down over 5% intraday. The broader crypto market is feeling the shockwaves, with Ethereum (ETH) collapsing 20% to $2,150, XRP plunging 30% to $1.80, and Dogecoin (DOGE) losing 25%.

Bitcoin’s recent slump comes amid a broader selloff in risk assets, as Wall Street futures nosedived. The Dow Jones shed 1.4% (600+ points), the S&P 500 lost 1.9%, and the Nasdaq tumbled 2.4%. Meanwhile, the U.S. Dollar Index (DXY) surged past 109.90, strengthening against major currencies and further weighing on BTC. With economic uncertainty gripping global markets, investors are now questioning whether Bitcoin can hold its key $92,000 support level or whether deeper losses are ahead.

Trump Tariffs Cause Havoc – What’s Next for Bitcoin?

Trump’s 25% tariff on Canadian and Mexican imports and 10% on Chinese goods has triggered a major liquidity squeeze across all asset classes, hitting Bitcoin particularly hard. The risk-off sentiment has forced institutional investors to cut exposure to volatile assets, causing mass liquidations in Bitcoin and altcoins.

Data from CoinGlass shows that in the last 24 hours alone, $2.3 billion worth of leveraged crypto positions were liquidated, with Bitcoin accounting for $411.8 million and Ethereum losing $611.6 million. The sharp decline wiped out short-term bullish sentiment and raised fears of a prolonged correction.

Adding to the pressure, macro factors are turning more bearish for Bitcoin. The Federal Reserve’s reluctance to cut interest rates due to rising inflation expectations is keeping bond yields elevated, making non-yielding assets like BTC less attractive. Bitcoin’s correlation with traditional markets remains strong, meaning any further equity selloffs could drag BTC even lower.

Technical Breakdown – Will Bitcoin Hold $92K or Crash to $83K?

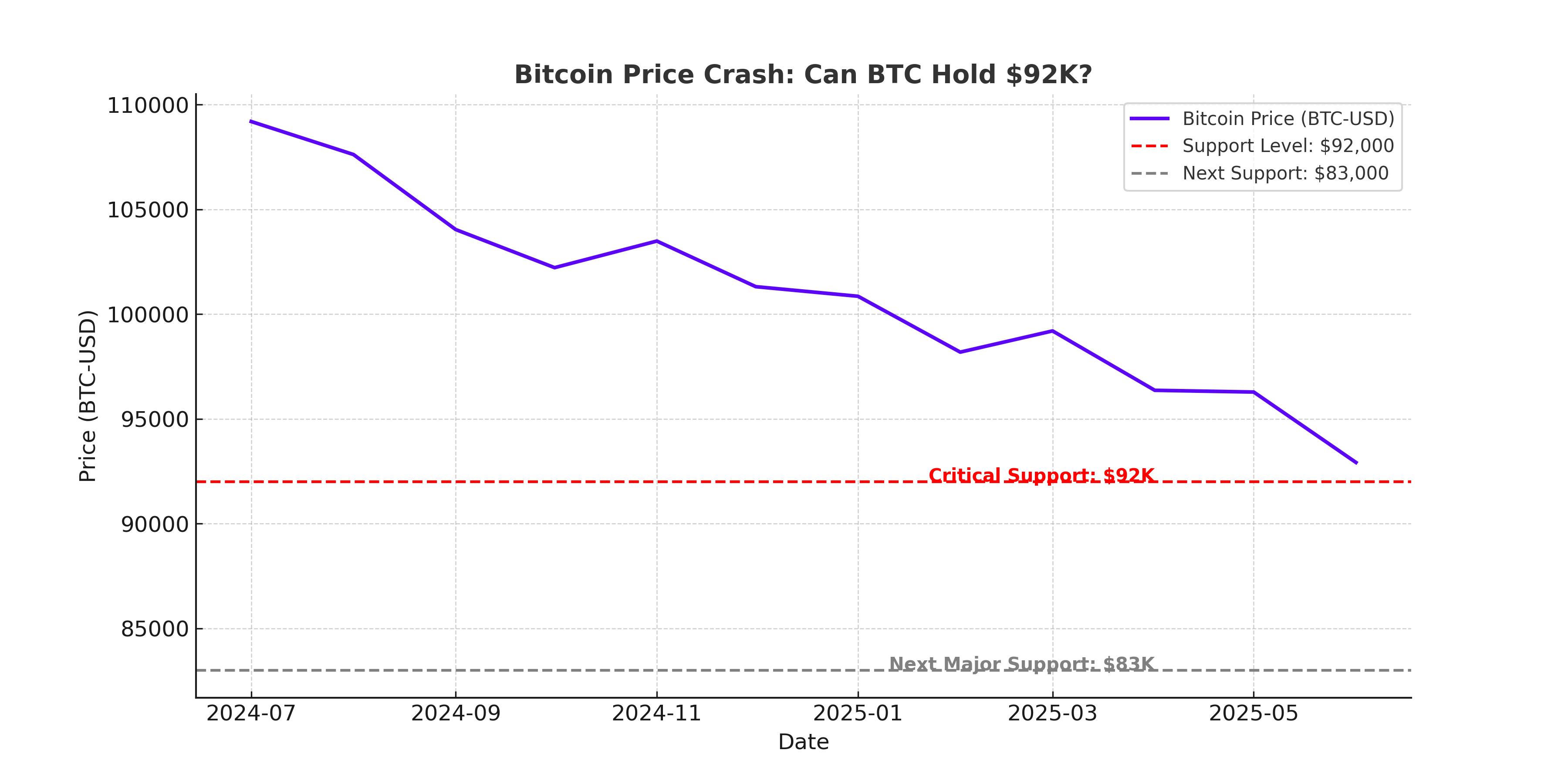

Despite the sharp correction, technical support at $92,000 remains a critical line of defense. This level has been tested multiple times in the past two months, and bounced back strongly each time, including during the January 13 drop. A sustained hold above $92K could provide a base for a recovery toward $98,000.

However, if Bitcoin breaks below $92,000, the next major support lies at $83,000, aligning with the 200-day EMA. A breach of this level would signal a deeper correction, potentially leading BTC toward $74,000, a key psychological level dating back to October 2024.

The Relative Strength Index (RSI) is nearing oversold territory at 38, suggesting that a short-term rebound is possible. However, the MACD indicator remains in bearish alignment, meaning that downside risks persist unless BTC can reclaim $98,000 quickly.

Bitcoin ETFs and Institutional Flows – Will They Save BTC?

One of Bitcoin’s biggest price drivers in 2025 has been the massive inflows into spot Bitcoin ETFs, led by BlackRock’s IBIT and Fidelity’s FBTC. These funds saw record demand in January, with total inflows exceeding $5 billion, a pace that could push 2025 ETF inflows past $50 billion.

However, ETF inflows slowed drastically last week, with net flows dropping to just $527 million compared to $1.9 billion the week before. The sharp decline coincided with Trump’s tariff announcement, suggesting that institutional buyers are pausing amid heightened uncertainty.

If Bitcoin ETFs resume strong inflows, it could provide the catalyst for BTC to rebound. However, if institutional demand weakens further, BTC could struggle to hold critical support levels at $92K and $83K.

Altcoin Bloodbath – Ethereum, XRP, and Solana Crushed by Market Panic

Bitcoin’s selloff has caused even greater damage to altcoins. Ethereum (ETH) dropped 20%, testing $2,150, while XRP crashed 30% to $1.80. Dogecoin (DOGE) and Solana (SOL) both lost over 25%, reflecting extreme liquidation pressure across the market.

The fear and greed index plunged to 39, signaling rising panic among investors. Total crypto market capitalization fell to $3.11 trillion, marking its lowest level since November 2024.

With altcoins facing extreme volatility, BTC dominance is expected to rise as traders rotate back into Bitcoin for relative safety. However, if BTC continues to decline, the broader market could face even sharper losses.

Bitcoin’s Next Move – Will BTC Rebound or Drop Below $90K?

Bitcoin’s fate in the short term depends on how it reacts to the $92,000 support level. A strong bounce from here could see BTC retest $98,000, and if it breaks above $100,000, it could signal the end of the correction. However, if BTC fails to hold $92,000, it could trigger a cascading selloff, pushing prices down toward $83,000 or lower.

Investors should closely watch institutional flows into Bitcoin ETFs, macroeconomic developments, and Federal Reserve policy signals. If spot Bitcoin ETF demand picks up again, BTC could recover quickly. However, if inflation concerns and rate hike fears persist, Bitcoin could struggle to regain bullish momentum.

With volatility at extreme levels, Bitcoin traders should brace for wild price swings in the coming days. The key question now is whether BTC can hold the line at $92K, or if deeper losses are still ahead.