Bitcoin Price Drops to $94,300: Can BTC Break $100K Again?

BTC at a Crossroads: Will Strengthening Support or Market Pressure Define the Next Move? | That's TradingNEWS

Bitcoin Price Analysis: Will BTC Reclaim Its Momentum?

Bitcoin (BTC-USD) has recently experienced significant price volatility, with its value dropping below the key psychological $100,000 level and trading at $94,300 at the time of writing. The cryptocurrency's struggle to maintain higher levels has sparked discussions across markets about its next move. This analysis dives deep into Bitcoin's recent performance, market influences, and technical trends, offering a comprehensive outlook on its future trajectory.

Macroeconomic Pressures Weigh on BTC-USD Performance

Bitcoin's decline to $91,200 earlier this week reflects the broader impact of macroeconomic conditions. Stronger-than-expected U.S. economic data, particularly in the labor and services sectors, has reduced market expectations for aggressive Federal Reserve rate cuts in 2025. This development has strengthened the U.S. dollar, increased Treasury yields, and pressured high-risk assets like Bitcoin.

The cryptocurrency market also faced an estimated $390 million in liquidations within a single day, with $54 million directly tied to Bitcoin positions. This wave of liquidations highlights the vulnerability of overleveraged positions in volatile markets.

Adding to the bearish sentiment is the U.S. government's planned liquidation of 69,370 Bitcoins seized from the Silk Road case. Valued at over $6.5 billion, this massive sale, managed by the U.S. Marshals Service, has introduced further uncertainty into the market.

Institutional Sentiment and ETF Flows

Institutional activity has also played a pivotal role in shaping Bitcoin's current price trends. Despite a challenging market environment, Bitcoin spot ETFs have recorded notable inflows, suggesting continued interest among institutional investors. For instance, the iShares Bitcoin Trust (IBIT) saw net inflows of $497.6 million in the first week of January 2025. However, this optimism is counterbalanced by outflows in other funds, such as ARK 21Shares Bitcoin ETF, which reported a $202.3 million net withdrawal.

These mixed signals from ETF flows underscore a cautious yet opportunistic approach among institutional players. The growing discourse around Bitcoin becoming a strategic reserve asset, as proposed by several U.S. states and corporate shareholders like Meta Platforms, reflects the cryptocurrency's evolving role in mainstream financial markets.

Technical Analysis: Support and Resistance Levels

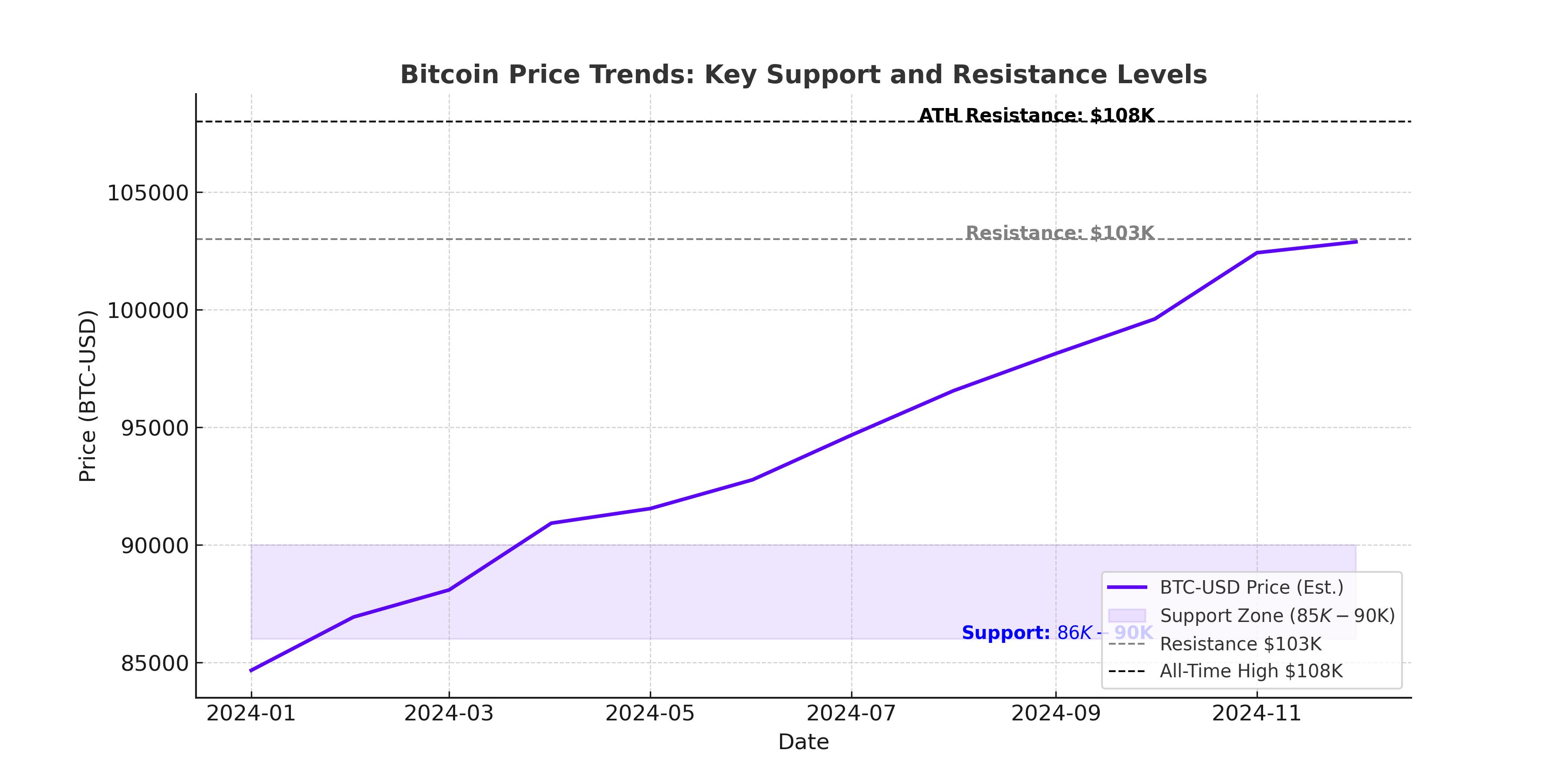

From a technical perspective, Bitcoin's price action remains within a critical consolidation channel between $91,000 and $108,000. The lower boundary at $91,000 has acted as a robust support level, preventing deeper declines. However, a break below this level could push the price toward the next significant support zones at $80,500 and $73,000, representing prior consolidation areas and local highs.

Resistance remains formidable at $100,000, which aligns with peaks from late 2024, and at $102,700, reflecting recent highs. Surpassing these levels could pave the way for a retest of Bitcoin's all-time high of $108,231.

Indicators like the Relative Strength Index (RSI) signal caution, with Bitcoin's RSI hovering near neutral levels, suggesting neither oversold nor overbought conditions. This technical setup implies that Bitcoin's price could swing either way, depending on external market catalysts and sentiment shifts.

Long-Term Price Projections for Bitcoin

Despite short-term setbacks, Bitcoin's long-term outlook remains bullish, supported by predictions from leading analysts and institutions. Standard Chartered forecasts a price of $200,000 by the end of 2025, driven by increased institutional adoption and the rollout of Bitcoin ETFs. Fundstrat Global Advisors anticipates an even more ambitious target of $250,000 within the same timeframe, highlighting the cryptocurrency's potential to capitalize on macroeconomic and technological trends.

These optimistic projections are grounded in factors such as the anticipated halving event in 2024, which will reduce Bitcoin's mining rewards and tighten its supply. Historical data suggests that post-halving periods often trigger significant price rallies, with some analysts drawing parallels to Bitcoin's meteoric rise in prior cycles.

Short-Term Volatility: Opportunity or Risk?

Market veterans like Peter Brandt and Willy Woo have emphasized the importance of navigating short-term volatility with caution. Brandt's suggestion of a potential "final dump" or prolonged consolidation phase before a significant rally underscores the market's unpredictable nature. Woo echoes this sentiment, advising traders to adopt a cautious approach amidst heightened profit-taking activity.

While such volatility may test the patience of retail investors, it also creates opportunities for strategic accumulation. Buyers aiming for long-term gains may find attractive entry points near critical support levels, provided they manage risk effectively.

Corporate and Governmental Influence on BTC

The proposal by Meta shareholders to adopt Bitcoin as a treasury asset marks a significant development in corporate adoption. If approved, this move could signal a broader trend among corporations seeking inflation-resistant assets to protect shareholder value. Similarly, the introduction of Bitcoin Strategic Reserve bills in states like Texas and Pennsylvania reflects growing governmental interest in leveraging Bitcoin's potential as a national asset.

These developments, coupled with the growing influence of Bitcoin ETFs, could catalyze a renewed wave of adoption, further solidifying Bitcoin's status as a global financial asset.

Conclusion: Navigating Bitcoin's Dynamic Landscape

Bitcoin's current price of $94,300 reflects the delicate balance between bullish long-term fundamentals and bearish short-term pressures. With robust support at $91,000 and critical resistance at $100,000, the cryptocurrency's next move will likely depend on macroeconomic developments, institutional behavior, and broader market sentiment.

For investors, Bitcoin presents both opportunities and risks. While short-term volatility remains a challenge, the long-term growth narrative—fueled by adoption, innovation, and supply dynamics—positions BTC-USD as a compelling asset for those with a high risk tolerance and a long-term investment horizon.