Bitcoin's Price Momentum: Navigating Opportunities and Risks in 2025

Bitcoin's recent price performance, trading at approximately $96,700, remains a focal point of the financial markets. After reaching an all-time high of $108,000 in December 2024, BTC-USD has shown resilience despite recent pullbacks. Analysts continue to predict significant growth, with some forecasts suggesting Bitcoin could hit $225,000 by the end of 2025. The cryptocurrency has been buoyed by institutional adoption, favorable market conditions, and regulatory advancements under the Trump administration, presenting both opportunities and risks for investors.

Key Factors Driving Bitcoin's Price

Bitcoin's ascent has been fueled by a combination of factors, including the increasing adoption of Bitcoin ETFs, such as BlackRock’s iShares Bitcoin Trust (IBIT), which has attracted over $60 billion in assets. The emergence of ETFs tailored to corporations adopting Bitcoin standards has bolstered institutional confidence. The ETF market's expansion underscores the growing mainstream acceptance of Bitcoin as a viable investment asset.

Mining dynamics further support Bitcoin’s upward trajectory. Record-high mining difficulty and hash rates, coupled with diminishing exchange balances, have created favorable supply-demand conditions. Institutional players like MicroStrategy have doubled down on Bitcoin, holding nearly 450,000 BTC, and continue to influence market sentiment. This strategic accumulation by major entities demonstrates the strengthening role of Bitcoin as a digital treasury asset.

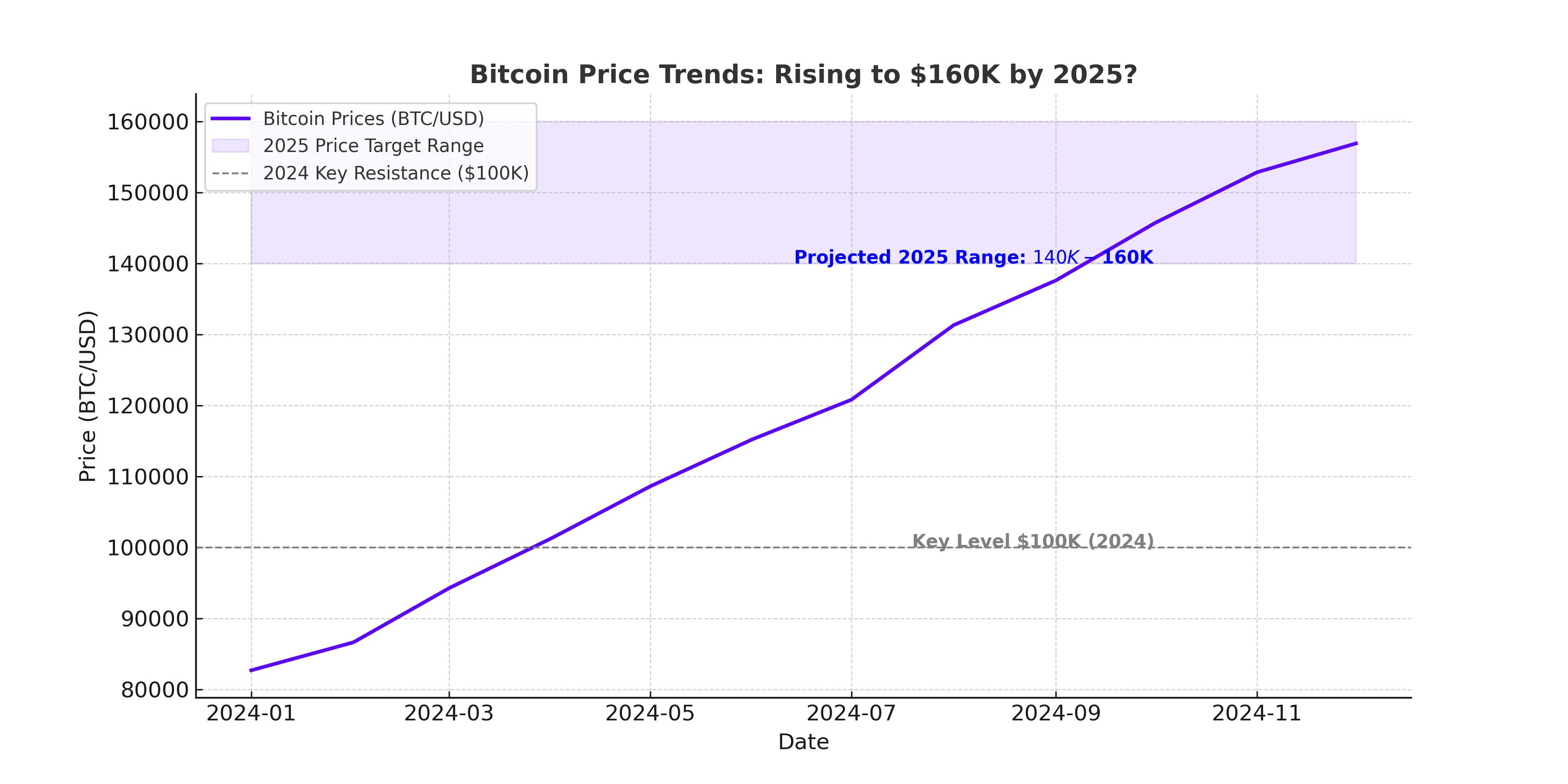

Bitcoin's technical indicators suggest potential bullish momentum. Support levels at $90,000 and resistance at $100,000 mark critical thresholds. Recent RSI readings hovering above 50 indicate a bullish sentiment, with the potential for BTC-USD to breach $120,000 in the near term. The $92,000 support zone has repeatedly withstood selling pressure, providing a robust base for upward price movements.

Macro Risks and Regulatory Considerations

Despite its bullish outlook, Bitcoin is not without risks. Macroeconomic factors, including rising U.S. Treasury yields and the Federal Reserve's rate policies, could weigh on risky assets like Bitcoin. Although the Fed implemented a 0.25% rate cut recently, it signaled fewer cuts than anticipated, which could dampen bullish momentum in the short term.

Regulatory developments also pose uncertainties. While the Trump administration’s pro-crypto stance has brought optimism, the market awaits concrete policy implementations. The evolving regulatory landscape could either propel Bitcoin’s adoption or introduce hurdles that impact its valuation.

Investor Sentiment and Market Behavior

The current market sentiment reflects cautious optimism. Bitcoin’s price consolidation near key levels like $100,000 suggests a pause as traders assess broader economic and policy signals. Analysts warn of potential corrections, citing historical patterns such as the “shooting star” candlestick formations observed in prior market cycles.

However, the long-term outlook remains positive. Cathie Wood of Ark Invest projects Bitcoin to reach $500,000 by 2026, citing its growing role in portfolios and increasing utility. Michael Saylor envisions a $13 million price point by 2045, emphasizing Bitcoin's potential as a transformative asset class.

Strategic Implications for 2025

Bitcoin’s trajectory in 2025 appears poised for further growth, driven by its expanding role in institutional portfolios and supportive macroeconomic trends. Analysts at H.C. Wainwright anticipate Bitcoin reaching $225,000, with the cryptocurrency capturing 25% of gold's market cap. The introduction of Bitcoin bond ETFs and other innovative financial products indicates a maturing market that could sustain long-term growth.

The cryptocurrency market's volatility, however, calls for measured strategies. While Bitcoin has outperformed traditional assets like gold, its price sensitivity to economic and regulatory changes underscores the need for diversification. Investors should monitor key price levels, macro indicators, and institutional flows to capitalize on Bitcoin's potential while mitigating downside risks.

Bitcoin's price outlook for 2025 highlights its dual nature as both an opportunity and a challenge. With prices holding firm above $90,000 and forecasts pointing toward new highs, Bitcoin remains a compelling asset for those seeking exposure to the evolving digital economy. Investors must navigate its volatility carefully, balancing bullish optimism with prudent risk management.