Bitcoin Price Fluctuations Driven by Federal Reserve Rate Decisions

Analyzing Bitcoin's Response to Potential Rate Cuts and Market Sentiment | That's TradingNEWS

Bitcoin’s Seasonal Patterns and Market Dynamics

Seasonality and Historical Trends of Bitcoin (BTC)

Bitcoin (BTC) has historically shown distinct seasonal patterns. A statistical study from 2015 to 2023 indicates that July, August, and September are generally stagnant months for Bitcoin. However, a significant bullish phase often starts from late September to December, with Bitcoin prices rising 62% of the time during this period and an average increase of over 70%. This summer, Bitcoin's price behavior could be pivotal, potentially marking a turning point for a new bullish wave.

Recent Price Movements and Market Volatility

Current Bitcoin Price Analysis

Bitcoin has recently faced downward pressure, slipping below $64,000 and reaching an intra-day low of $63,580. This decline is attributed to escalating geopolitical tensions between Iran and Israel and a dovish outlook from the Federal Reserve. Despite this, Bitcoin’s long-term growth potential remains strong, with some economists predicting that BTC could surpass $500,000 by 2028.

Federal Reserve Policies and Their Impact on Bitcoin

Fed Hints at Rate Cuts and Bitcoin’s Reaction

The Federal Reserve has maintained interest rates at 5.25%-5.50% but hinted at a potential cut in September if inflation remains in check. This announcement briefly pushed Bitcoin below $65,000. Fed Chair Jerome Powell suggested that a rate reduction might be on the horizon, supported by weaker economic data. This potential easing of monetary policy could positively impact Bitcoin and other cryptocurrencies, creating a more favorable investment environment.

Technical Analysis of Bitcoin

Key Technical Levels and Market Sentiment

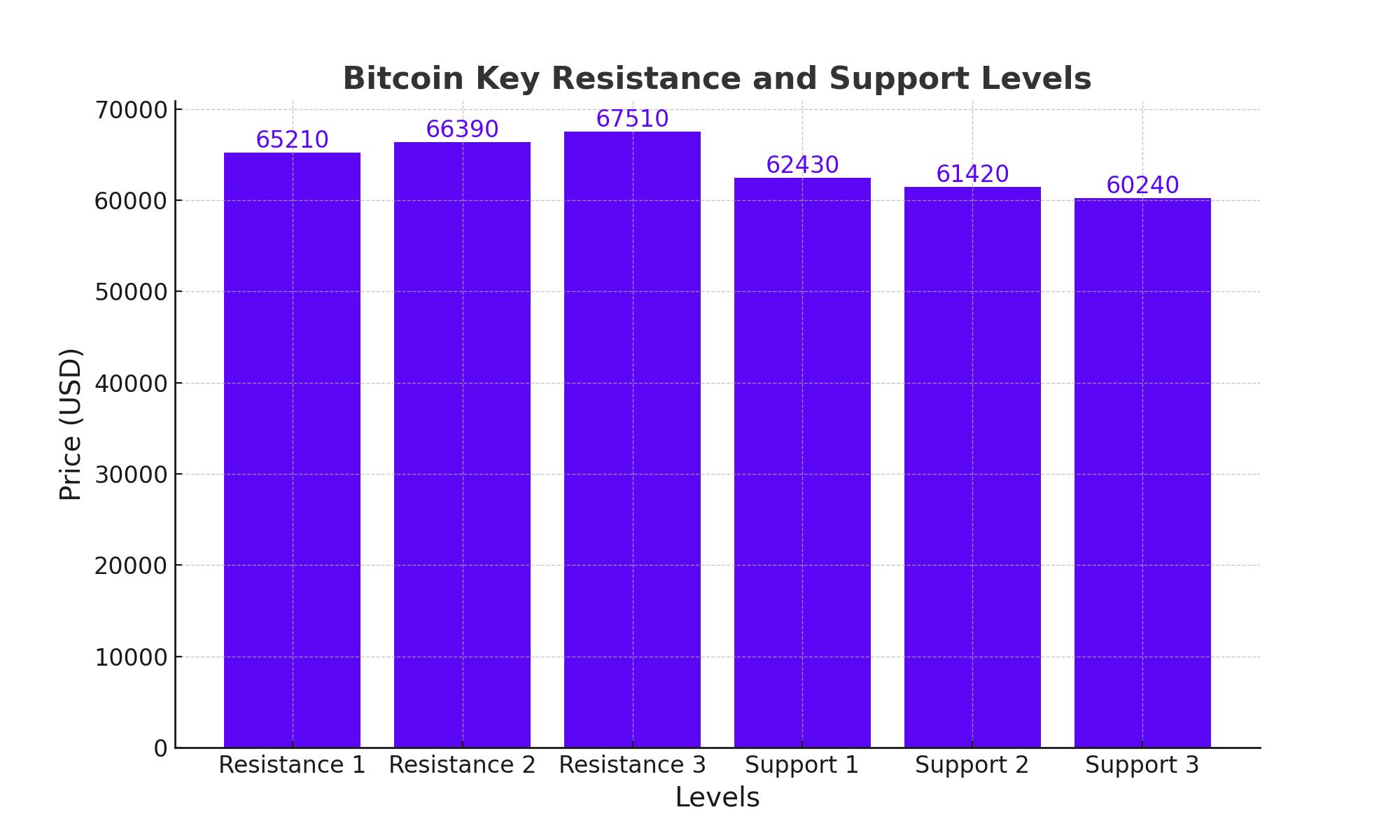

Bitcoin is currently trading at $64,360, reflecting a slight decrease of 0.40%. The 4-hour chart indicates a crucial pivot point at $63,450, determining the market’s next move. Immediate resistance levels are at $65,210, $66,390, and $67,510, while support is found at $62,430, $61,420, and $60,240. The Relative Strength Index (RSI) at 35 suggests oversold conditions, indicating potential for a rebound. The 50-day Exponential Moving Average (EMA) at $66,350 highlights resistance to upward movement.

Future Outlook for Bitcoin

Bullish Sentiment and Long-Term Potential

Despite current market pressures, the outlook for Bitcoin remains bullish. Seasonal patterns suggest that the end of summer could mark the beginning of a strong bullish phase. Additionally, Federal Reserve policies and ongoing geopolitical tensions are likely to continue influencing Bitcoin prices. Economists like Timothy Peterson forecast that Bitcoin’s price could surpass $500,000 by 2028, driven by historical trends and increasing adoption.

Investors should closely monitor key technical levels and market developments, as these factors will play crucial roles in Bitcoin’s price trajectory in the coming months.

Thta's TradingNEWS

Read More

-

FDVV ETF at $57.41 — 22% Discount to SPY, Why the Barbell of Nvidia and Coca-Cola Makes This a Buy

06.03.2026 · TradingNEWS ArchiveStocks

-

XRP ETF (NASDAQ:XRPI) at $7.76, XRPR at $11.12 — $153M Institutional Buying Into a 25% Decline, 7B Tokens Off Exchanges

06.03.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Futures Price at $2.97 — Qatar's 77M Ton LNG Halt and Why $2.90 Is the Most Dangerous Floor in Energy Markets Right Now

06.03.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price at 157 — Fed Cut Odds at 50%, and Why the Dollar Climbs Despite the Worst Jobs Miss in Years

06.03.2026 · TradingNEWS ArchiveForex