The Impact of Regulatory Shifts and Political Developments on Bitcoin’s Price

The recent election of Donald Trump, coupled with his pro-crypto stance, has had an immediate and profound effect on Bitcoin’s market performance. Trump’s campaign promises, including replacing the Securities and Exchange Commission Chair and creating a strategic Bitcoin reserve, have bolstered investor confidence. Market analysts anticipate these moves to lead to reduced regulatory uncertainty, thereby attracting institutional capital and facilitating broader adoption.

The SEC's approval of spot Bitcoin ETFs in late 2024 was another watershed moment, making Bitcoin accessible to a larger pool of mainstream investors. Funds like Galaxy Digital and Matrixport have highlighted the significant uptick in institutional inflows following this decision. According to Matrixport, these developments could push Bitcoin to $160,000 by year-end 2025, driven by increased demand for regulated financial products.

Bitcoin Halving Event: A Critical Catalyst for Price Momentum

Bitcoin's halving event, a scheduled reduction in mining rewards, has historically acted as a major price catalyst. The 2024 halving reduced the rate of new Bitcoin entering circulation, creating supply scarcity amidst rising demand. Historically, halving events have led to substantial price gains in the following 12-18 months. Analysts point out that 2025 could mirror this trend, with prices projected to climb as high as $200,000, as indicated by Standard Chartered’s forecasts. Their analysis emphasizes the pivotal role of the halving in driving long-term value appreciation for Bitcoin.

Institutional and Nation-State Adoption Driving Momentum

Institutional adoption remains a significant growth driver for Bitcoin. Galaxy Digital projects Bitcoin to cross $185,000 by Q4 2025, citing increasing adoption by both corporate and governmental entities. Notably, several Nasdaq 100 companies and global sovereign wealth funds are expected to add Bitcoin to their balance sheets. This shift underscores the growing recognition of Bitcoin as a legitimate reserve asset.

The strategic entry of nation-states into the Bitcoin ecosystem further solidifies its bullish outlook. Trump’s proposed Bitcoin strategic reserve plan, which mirrors the U.S. oil reserve, has sparked optimism about broader governmental involvement. Standard Chartered estimates even a modest allocation of U.S. retirement funds to Bitcoin could significantly impact prices, further validating its role as a store of value.

Market Analysis and Near-Term Risks

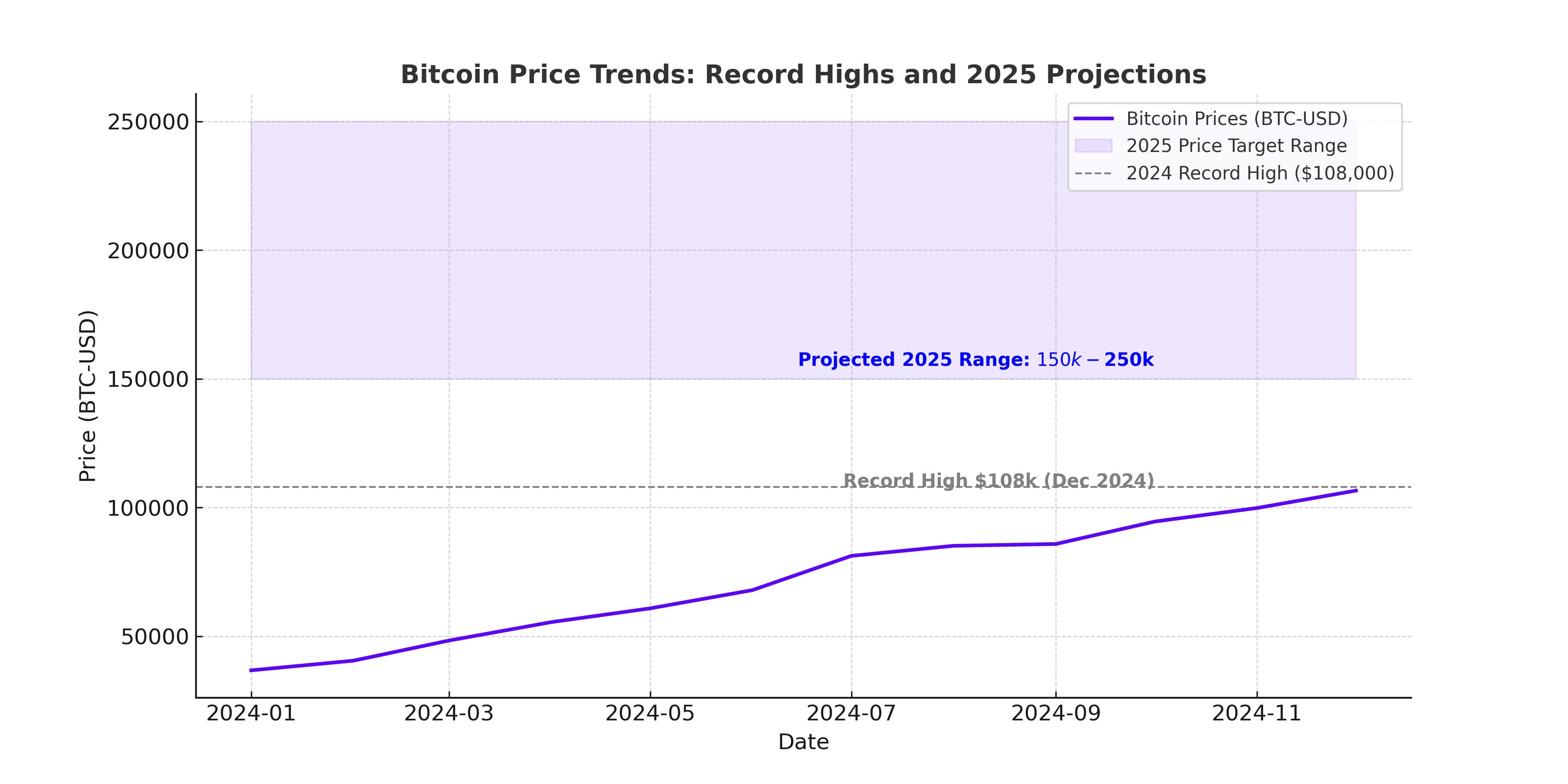

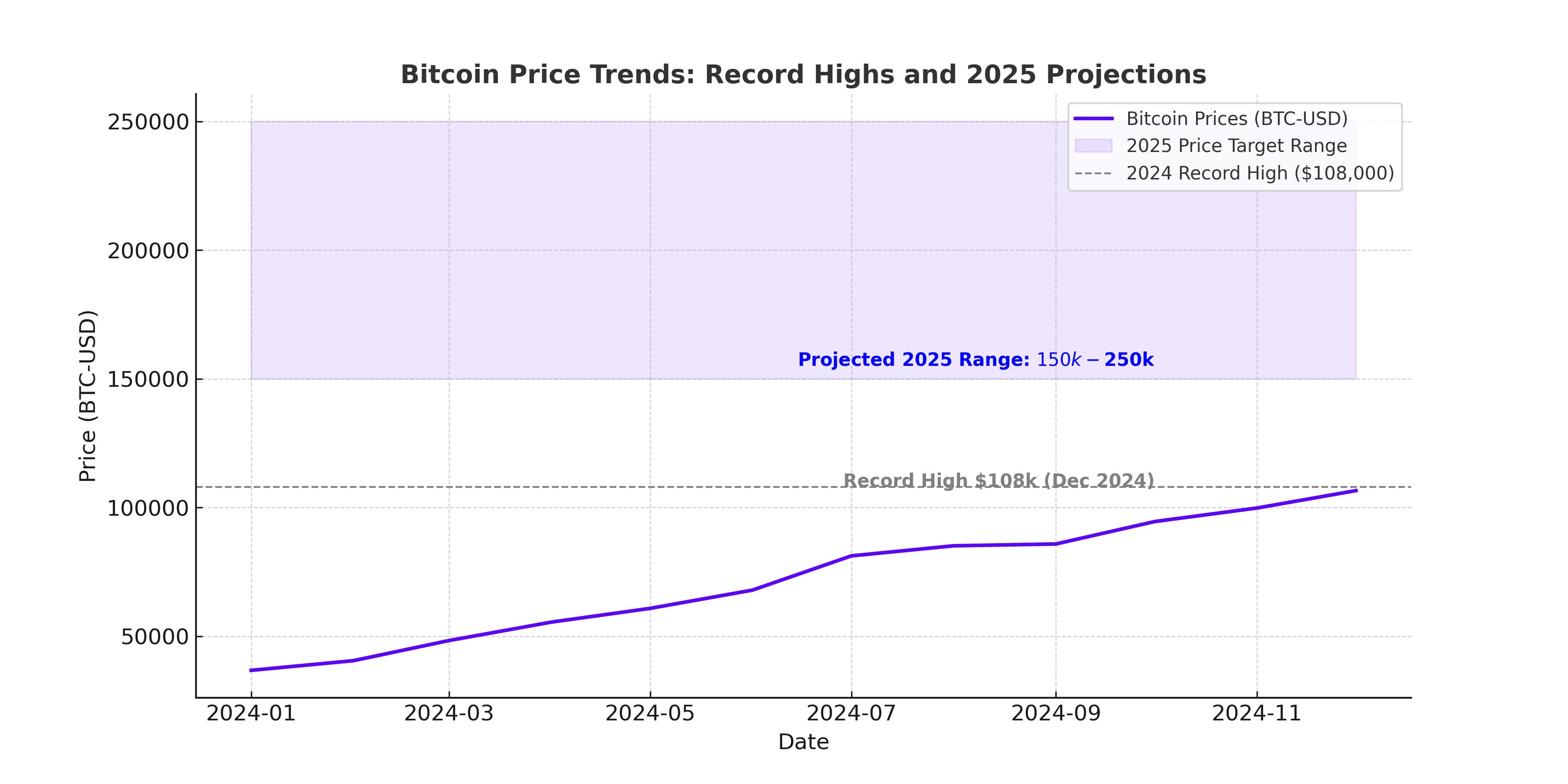

Despite the bullish projections, Bitcoin faces potential pullbacks, which are inherent in its volatile nature. Current support levels hover around $93,000 to $95,000, while major downside risks could push the price to $81,000. These risks are exacerbated by global macroeconomic uncertainties, such as U.S.-China tensions and potential delays in the Federal Reserve’s anticipated rate cuts. Short-term technical indicators, including the Moving Average Convergence Divergence (MACD) and 50-day moving averages, also suggest the possibility of minor corrections.

Carol Alexander of the University of Sussex anticipates Bitcoin could reach $200,000 in 2025 but warns that high volatility, fueled by leveraged trading and unregulated exchanges, may continue to create abrupt price swings. On-chain data points to robust institutional support, with realized price levels at $81,000 acting as a critical floor for buyers. These dynamics suggest that while short-term corrections may occur, they are unlikely to derail Bitcoin’s broader upward trajectory.

Price Projections for 2025: A Divergence of Opinions

Market participants remain optimistic about Bitcoin’s future, though price forecasts vary widely. CoinShares predicts a trading range of $80,000 to $150,000, citing the influence of Trump’s regulatory policies and broader market sentiment. Meanwhile, Matrixport and Galaxy Digital project higher targets of $160,000 and $185,000, respectively, attributing their bullish stance to the growing demand for Bitcoin ETFs and increasing adoption by global institutions. Standard Chartered and Maple Finance both foresee Bitcoin reaching $200,000 by late 2025, fueled by strategic institutional inflows and macroeconomic tailwinds.

Some analysts, such as Nexo’s Elitsa Taskova, offer even more aggressive targets, predicting Bitcoin to surpass $250,000 within the next year. This ambitious outlook aligns with the anticipated easing of monetary policies by major central banks and the growing perception of Bitcoin as a hedge against inflation.

Conclusion: A Pivotal Year for Bitcoin

Bitcoin’s trajectory in 2025 is poised to break new ground, driven by regulatory clarity, institutional adoption, and pivotal market catalysts like the halving. While risks remain, including market corrections and geopolitical tensions, the overall outlook remains optimistic. As Bitcoin continues to assert its position as a digital reserve asset, its price movement will likely mirror its growing significance in the global financial ecosystem. With projections ranging from $150,000 to $250,000, Bitcoin remains a compelling asset for both retail and institutional investors navigating the evolving cryptocurrency landscape.

That's TradingNEWS

Adobe (NASDAQ:ADBE): Redefining Growth and 52% Potential Upside

Adobe (NASDAQ:ADBE): Redefining Growth and 52% Potential Upside

Is SoundHound AI (NASDAQ:SOUN) the Next Big AI Disruptor?

Is SoundHound AI (NASDAQ:SOUN) the Next Big AI Disruptor?

Can Alphabet (GOOGL) Deliver Over 20% Upside by 2025?

Can Alphabet (GOOGL) Deliver Over 20% Upside by 2025?

Can NVIDIA (NASDAQ:NVDA) Reach $350 Amid Soaring AI Demand?

Can NVIDIA (NASDAQ:NVDA) Reach $350 Amid Soaring AI Demand?

Will Micron Technology (NASDAQ:MU) Regain Momentum and Hit $115?

Will Micron Technology (NASDAQ:MU) Regain Momentum and Hit $115?