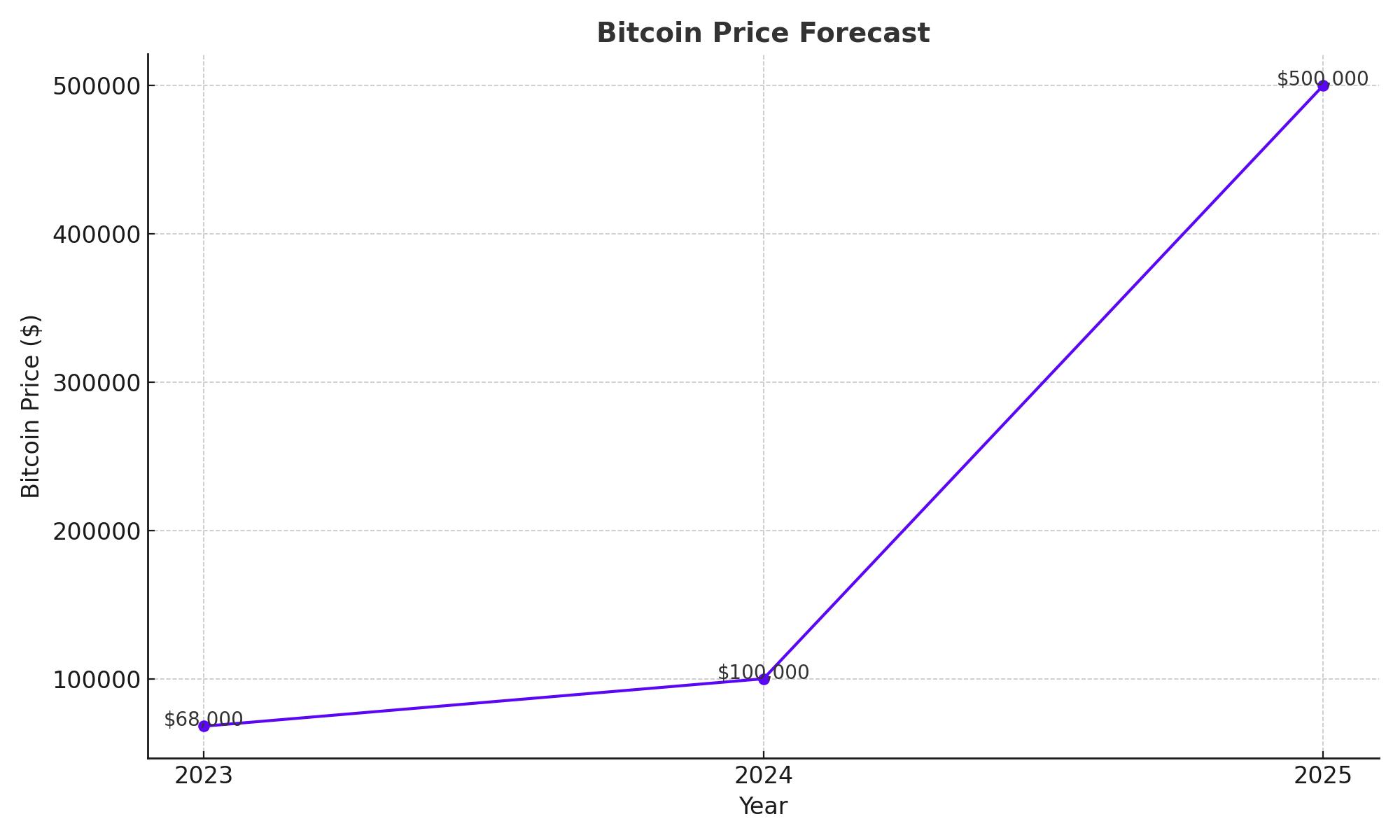

Bitcoin Price Forecast: Could BTC Reach $100k by June 2024?

Analyzing Market Trends, Expert Predictions, and Key Economic Indicators Driving Bitcoin's Potential Surge | That's TradingNEWS

Bitcoin Price Forecast: Path to $100,000 in June 2024

Market Dynamics and Current Trends

Bitcoin price remains relatively stable, trading around $69,000. The cryptocurrency has been consolidating between $60,000 and $72,000, indicating market indecision. Swing traders might find opportunities to trade within this range, buying near $60,000 and selling around $72,000. The MACD and RSI indicators suggest bullish momentum, with the nearest support at $60,000 and potential resistance at $73,000.

Bullish Sentiment and Influences

Crypto analyst Crypto Rover predicts a breakout for Bitcoin's Ascending Broadening Wedge pattern, potentially pushing BTC to $100,000. Institutional investments and favorable regulatory environments contribute to this optimism. ClayBro, a popular YouTuber, highlights Dogeverse as a promising altcoin, emphasizing its long-term potential and strong community support.

Global Bitcoin Price Projections

A Finder survey involving 31 fintech experts suggests Bitcoin could reach $122,000 by the end of 2024 and $155,000 by 2025. AllianceBernstein forecasts a bullish trajectory post-halving, with Bitcoin possibly touching $150,000 by 2025. Analyst Captain Faibik anticipates a 15-20% surge soon, driven by an upside breakout within the Falling Wedge pattern.

Contrasting Bearish Views

Not all analysts share the bullish sentiment. Markus Thielen of 10X Research expresses concern over persistent inflation and high bond yields, suggesting potential corrections for risk assets like Bitcoin. Goldman Sachs and economist Peter Schiff remain skeptical, viewing Bitcoin as speculative and not suitable for investment portfolios.

Regional Perspectives and Insights

Middle Eastern crypto experts maintain a bullish outlook. Talal Tabbaa of CoinMENA believes Bitcoin hitting $100,000 is inevitable, driven by global liquidity and reduced BTC supply. Vineet Budki of Cypher Capital predicts Bitcoin could reach $150,000-$200,000, emphasizing increasing global crypto adoption.

Technical Analysis and Price Movements

Bitcoin's technical indicators show potential for further gains. RSI and MACD readings support a bullish outlook, with key support levels at $60,000 and $55,800. A breakout above $73,000 could pave the way for $100,000. However, if Bitcoin closes below $58,271, it may signal a bearish reversal, potentially leading to a drop to $52,400.

Impact of U.S. Economic Indicators

U.S. economic data, including the PCE Price Index and GDP figures, will influence Bitcoin's price. Persistent inflation and high interest rates could weigh on crypto markets, while positive economic indicators may provide a boost. The Federal Reserve's stance on interest rates remains crucial for Bitcoin's near-term outlook.

Global Geopolitical Developments

Geopolitical tensions, such as the conflict between Israel and Hamas, can impact Bitcoin's safe-haven appeal. Additionally, the World Gold Council reports a decrease in gold ETFs, reflecting shifting investor sentiment. Central bank actions and global economic conditions will continue to play a significant role in shaping Bitcoin's trajectory.

Conclusion

Bitcoin's path to $100,000 by June 2024 appears promising, supported by technical indicators, institutional investments, and favorable economic conditions. However, traders should remain cautious of potential bearish signals and macroeconomic factors that could influence market dynamics. For a detailed and real-time analysis of Bitcoin's price movements, refer to TradingNews.