Bitcoin Price Near $94,000: Institutional Inflows, Risks, and 2025’s $180K Potential

Bitcoin’s rally slows but institutional confidence and strategic reserve talks fuel optimism for unprecedented highs in 2025 | That's TradingNEWS

Bitcoin (BTC-USD): Navigating Price Consolidation Amid Mixed Market Sentiments

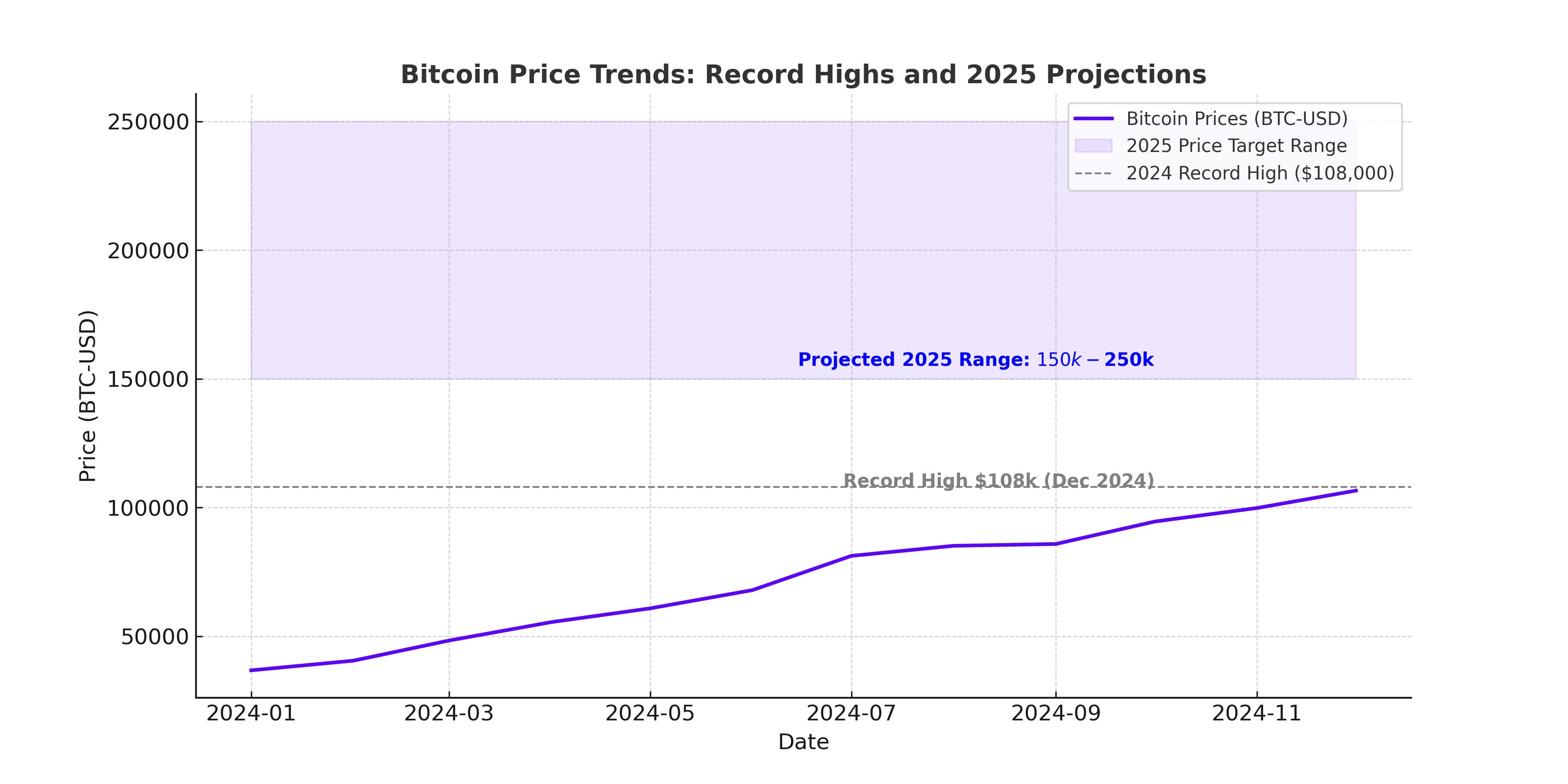

Bitcoin (BTC-USD), trading at approximately $94,000, has recently retreated from its 2024 peak of over $108,000. This pullback highlights the cryptocurrency’s inherent volatility, even after recording a robust 120% year-to-date increase. Several factors influence this decline, ranging from profit-taking and a strong dollar to the broader macroeconomic landscape, including shifts in bond yields and geopolitical uncertainties.

Institutional Influence and Strategic Reserves

The entrance of institutional players such as BlackRock and Fidelity via Bitcoin ETFs has significantly impacted the market. Over $36 billion in inflows through spot ETFs have brought unprecedented liquidity and institutional confidence to Bitcoin. However, the recent absence of a "Santa Rally" reflects year-end profit-taking and reduced liquidity. Despite this, the market anticipates renewed activity in early 2025, with predictions of Bitcoin regaining its $100,000 psychological threshold and possibly testing new highs.

One of the boldest projections for Bitcoin's trajectory stems from discussions about the potential establishment of a U.S. Strategic Bitcoin Reserve. Under proposals such as the Bitcoin Act of 2024, the U.S. government could acquire 1 million BTC over five years. Such a move, though speculative, could fundamentally reshape global cryptocurrency markets by intensifying demand and cementing Bitcoin’s role as a strategic digital asset.

Technical Analysis and Key Levels

From a technical standpoint, Bitcoin's price has consistently flirted with critical levels. The 50-day EMA, currently acting as a resistance, hovers around $92,500, while the support zone lies between $88,000 and $92,000. A break below this range could push BTC toward the $74,000 mark, a level that has historically served as a strong psychological barrier.

Chart patterns also point to potential risks. The emergence of a head-and-shoulders formation is a bearish indicator that could drive Bitcoin down to $78,000—a scenario representing a further 17% decline. However, should Bitcoin sustain its current levels, the market could see renewed bullish momentum, with a near-term target of $100,000 and a long-term projection of $180,000 by major analysts like VanEck.

Macro Drivers: Bond Yields, Dollar Strength, and Federal Policy

Bitcoin’s inverse relationship with the U.S. Dollar Index (DXY) has played a pivotal role in recent price movements. The DXY’s climb to 108.14 reflects a strong dollar environment driven by rising bond yields. The 30-year yield at 4.76% and the 5-year yield at 4.3% are near their yearly highs, creating headwinds for risk assets like Bitcoin.

Additionally, the Federal Reserve's monetary policy and the incoming Trump administration's crypto-friendly stance are anticipated to shape market dynamics. While Trump’s support for initiatives like a Strategic Bitcoin Reserve could boost long-term sentiment, immediate challenges such as reduced expectations for rate cuts and potential regulatory scrutiny remain.

Institutional Accumulation: MicroStrategy and Others

Institutional adoption continues to underwrite Bitcoin's growth narrative. MicroStrategy, led by Michael Saylor, has been a steadfast proponent, recently increasing its holdings to 446,400 BTC. Similarly, Tether expanded its Bitcoin reserves to over $7.7 billion, underscoring sustained demand from major market participants. This accumulation trend signals institutional confidence despite short-term market volatility.

Long-Term Projections: A Million-Dollar Bitcoin?

Bitcoin price forecasts for 2025 remain polarized but undeniably ambitious. Investment manager VanEck projects a price of $180,000, while Standard Chartered suggests $200,000. On the extreme end, Charles Schwab and Chamath Palihapitiya envision Bitcoin reaching $1 million, contingent on transformative factors like strategic government adoption and mainstream financial integration.

While such lofty predictions highlight Bitcoin's potential, they also emphasize its reliance on sentiment-driven demand rather than traditional valuation metrics. Bitcoin's finite supply of 21 million coins ensures scarcity, but its value hinges entirely on market enthusiasm and broader adoption.

Current Risks and Market Implications

Despite its strong performance in 2024, Bitcoin faces notable risks. The tightening dollar, rising yields, and potential liquidity challenges could dampen near-term performance. However, these risks are counterbalanced by long-term tailwinds, including institutional adoption, ETF-driven liquidity, and evolving global regulatory frameworks.

Bitcoin’s consolidation near $94,000 suggests a period of recalibration, setting the stage for renewed momentum as market conditions stabilize. With its role as a digital store of value solidified, Bitcoin remains a focal point for investors seeking exposure to the cryptocurrency sector’s transformative potential. The next move will likely depend on its ability to reclaim key levels and sustain the growing institutional interest that has fueled its 2024 rally.