Bitcoin’s Road to $200,000: Is $96,000 Just the Beginning?

BTC-USD surges with regulatory breakthroughs, institutional inflows, and pro-crypto policies, setting the stage for a potentially record-breaking 2025 | That's TradingNEWS

Bitcoin Price Analysis: A Closer Look at BTC-USD and its Trajectory in 2025

Bitcoin (BTC-USD) has experienced a turbulent yet extraordinary year, cementing its position as the largest cryptocurrency by market capitalization and a staple in global financial systems. Trading at approximately $96,000, Bitcoin continues to exhibit strong resilience despite recent corrections. The cryptocurrency’s price journey in 2024 has been shaped by bullish macroeconomic trends, regulatory breakthroughs, and institutional adoption, paving the way for what analysts predict could be an even more momentous 2025.

Bitcoin’s Rally in 2024: A Foundation for Growth

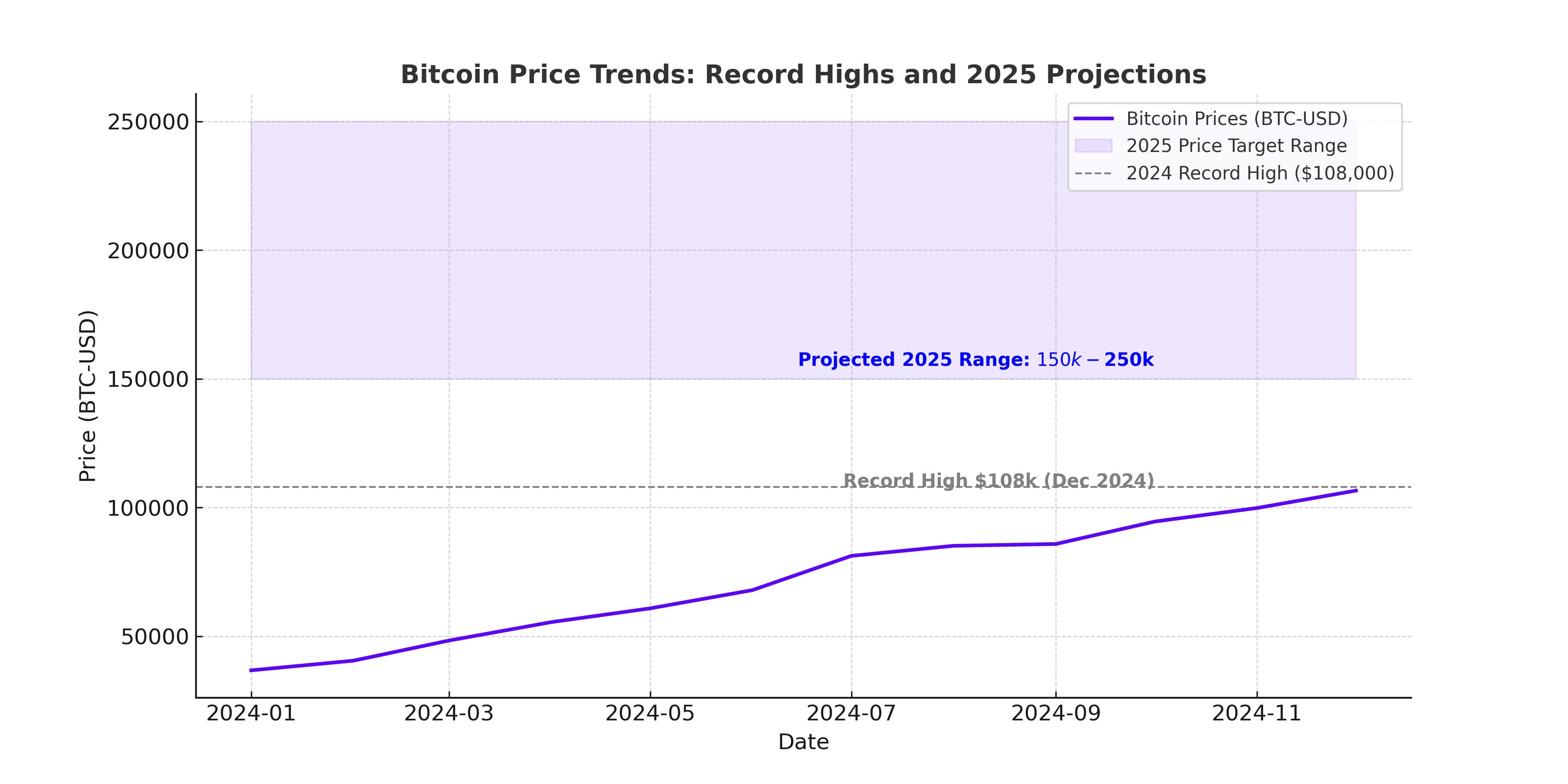

2024 was a landmark year for Bitcoin, with the asset rallying over 150% from its lows of $38,000 in late 2023 to a December high of $108,000. This extraordinary performance was fueled by several critical catalysts, including the approval of U.S.-based spot Bitcoin ETFs, a mid-year halving event, and increased institutional interest. Notably, BlackRock's iShares Bitcoin Trust (IBIT) surpassed $50 billion in assets under management within 228 days of its launch, highlighting surging institutional demand.

These developments coincided with significant regulatory clarity, particularly after the U.S. Securities and Exchange Commission (SEC) approved Bitcoin ETFs in early 2024. President-elect Donald Trump’s pro-crypto policies further buoyed sentiment, with promises of favorable regulations and the potential inclusion of Bitcoin in U.S. strategic reserves driving optimism.

Projections for 2025: Could Bitcoin Reach $200,000?

Analysts are bullish on Bitcoin's prospects for 2025, with price targets ranging from $150,000 to $250,000. Key drivers for this optimism include Bitcoin’s unique supply constraints, enhanced regulatory clarity, and its increasing role as a hedge against macroeconomic uncertainties.

H.C. Wainwright has revised its price target for Bitcoin to $225,000, citing factors such as the maturation of the U.S. regulatory environment, institutional adoption through ETFs, and the digital asset's growing perception as "digital gold." The 2024 halving event further amplified Bitcoin’s deflationary characteristics, reducing block rewards to 3.125 BTC per block and intensifying scarcity.

Institutional and Retail Demand Strengthening

The ongoing shift toward institutional adoption is a critical factor underpinning Bitcoin's growth. U.S. spot ETFs alone brought in billions in inflows, solidifying Bitcoin’s legitimacy as an investable asset class. Beyond ETFs, firms like Tesla and MicroStrategy continue to hold substantial Bitcoin reserves, while the inclusion of Bitcoin in corporate treasuries is becoming more common.

Retail demand remains robust as well, with the Coinbase Premium Index—a measure of retail demand—indicating consistent activity despite some profit-taking at the end of 2024. This dynamic reflects a healthy balance between institutional and retail market participation, bolstered by global acceptance of Bitcoin payments and technological advancements.

Trump Administration Policies: A Catalyst for Crypto Markets

The incoming Trump administration has pledged significant support for cryptocurrencies, with initiatives aimed at positioning the U.S. as a global leader in digital assets. Plans to integrate Bitcoin into national reserves and nominate crypto-friendly figures like Paul Atkins as SEC chair could further legitimize the sector. Trump’s administration has also proposed that the U.S. government purchase Bitcoin annually, which could provide a sustained upward pressure on prices.

If executed, these policies would not only drive Bitcoin’s adoption but could also set a precedent for other nations to incorporate cryptocurrencies into their financial frameworks. Analysts from Charles Schwab even suggest that such moves could propel Bitcoin’s price to $1 million in the longer term, though this remains speculative.

Challenges and Near-Term Risks

Despite the bullish outlook, Bitcoin faces several near-term challenges. Profit-taking by investors following the December peak of $108,000 has contributed to a pullback, with the cryptocurrency currently trading around $96,000. Analysts note that $94,000 serves as a critical support level, with a breach potentially pushing Bitcoin toward the $73,000 range.

Macroeconomic factors also pose risks. Although the Federal Reserve has signaled slower interest rate cuts in 2025, lingering inflation and tightening liquidity could dampen speculative asset demand. Additionally, Bitcoin’s volatility remains a double-edged sword; while it attracts traders, sharp corrections could deter long-term investors.

Market Sentiment and Technical Analysis

Technical indicators suggest Bitcoin remains in a bullish cycle, with its 600% surge since the 2022 lows providing a strong foundation for further gains. Key resistance levels are identified around $100,000 and $108,000, while support remains firm at $90,000 and $94,000. Analysts predict heightened volatility in the coming months, but the overall sentiment leans positive, supported by ongoing institutional flows and macroeconomic tailwinds.

The introduction of AI-driven trading strategies and real-world asset (RWA) tokenization is also expected to enhance liquidity and adoption. These innovations, combined with Bitcoin’s finite supply of 21 million tokens, continue to attract a diverse range of investors.

Broader Crypto Market Dynamics

Bitcoin’s performance has significantly influenced the broader cryptocurrency market, with the global market cap reaching $3.5 trillion as of January 2025. Altcoins like Ethereum (ETH), XRP, and Solana (SOL) have mirrored Bitcoin’s gains, posting double-digit increases in recent weeks. However, Bitcoin’s dominance remains robust at 53.8%, underscoring its role as the market leader.

Emerging sectors such as decentralized finance (DeFi) and non-fungible tokens (NFTs) have also benefited from Bitcoin’s resurgence, creating a positive feedback loop that supports the entire ecosystem.

Final Thoughts on Bitcoin’s Outlook

Bitcoin’s trajectory in 2025 appears promising, with a convergence of regulatory clarity, institutional adoption, and favorable macroeconomic conditions driving its growth. While short-term corrections are inevitable, the long-term outlook suggests substantial upside potential. At its current price of $96,000, Bitcoin represents both a store of value and a high-growth asset, appealing to a wide range of investors.