Bitcoin Rockets Beyond $101,000: Is $275K Within Reach?

With Bitcoin trading at $101,074 and a $2 trillion market cap in sight, investors are eyeing explosive growth. Institutional demand, ETF inflows, and shrinking supply could push BTC to $275,000 | That's TradingNEWS

Bitcoin Rally Pushes Toward $101,074: Momentum Builds Amid High Demand

Bitcoin, trading at $101,074, has surged past the critical $100,000 milestone, marking a 5.4% increase in the last 24 hours. The cryptocurrency’s market cap now nears a staggering $2 trillion, sitting at $1.998 trillion, with daily trading volume soaring to $129.39 billion. This upward momentum reflects robust institutional and retail demand and positions Bitcoin as a leading hedge against economic uncertainties. Analysts are now forecasting bullish price targets, with some speculating Bitcoin could reach $275,000 in the coming cycles.

Supply Dynamics: A Key Driver of Bitcoin’s Price

Bitcoin’s capped supply of 21 million coins remains a fundamental factor driving its value. With 19.7 million BTC already mined, only 1.3 million coins are left to be produced. The scarcity is further amplified by lost coins, many of which are irrecoverable, reducing the actual circulating supply significantly. The amount of Bitcoin on exchanges has plummeted to 2.24 million BTC, down from 2.7 million BTC earlier this year, signaling long-term holders are increasingly reluctant to sell. Companies like MicroStrategy, which holds 423,650 BTC, exemplify the growing institutional grip on the crypto market.

Institutional Inflows and ETF Momentum

The ETF market continues to be a catalyst for Bitcoin’s price surge, with inflows surpassing $34 billion. These ETFs now collectively manage assets worth over $107 billion, reflecting growing investor interest. Analysts at Bitwise predict Bitcoin could reach $200,000 by 2025, driven by sustained ETF demand and increased adoption. If Bitcoin’s market cap surpasses gold’s $18 trillion benchmark by 2029, it will redefine its role in global financial markets.

Technical Indicators Signal Strong Bullish Momentum

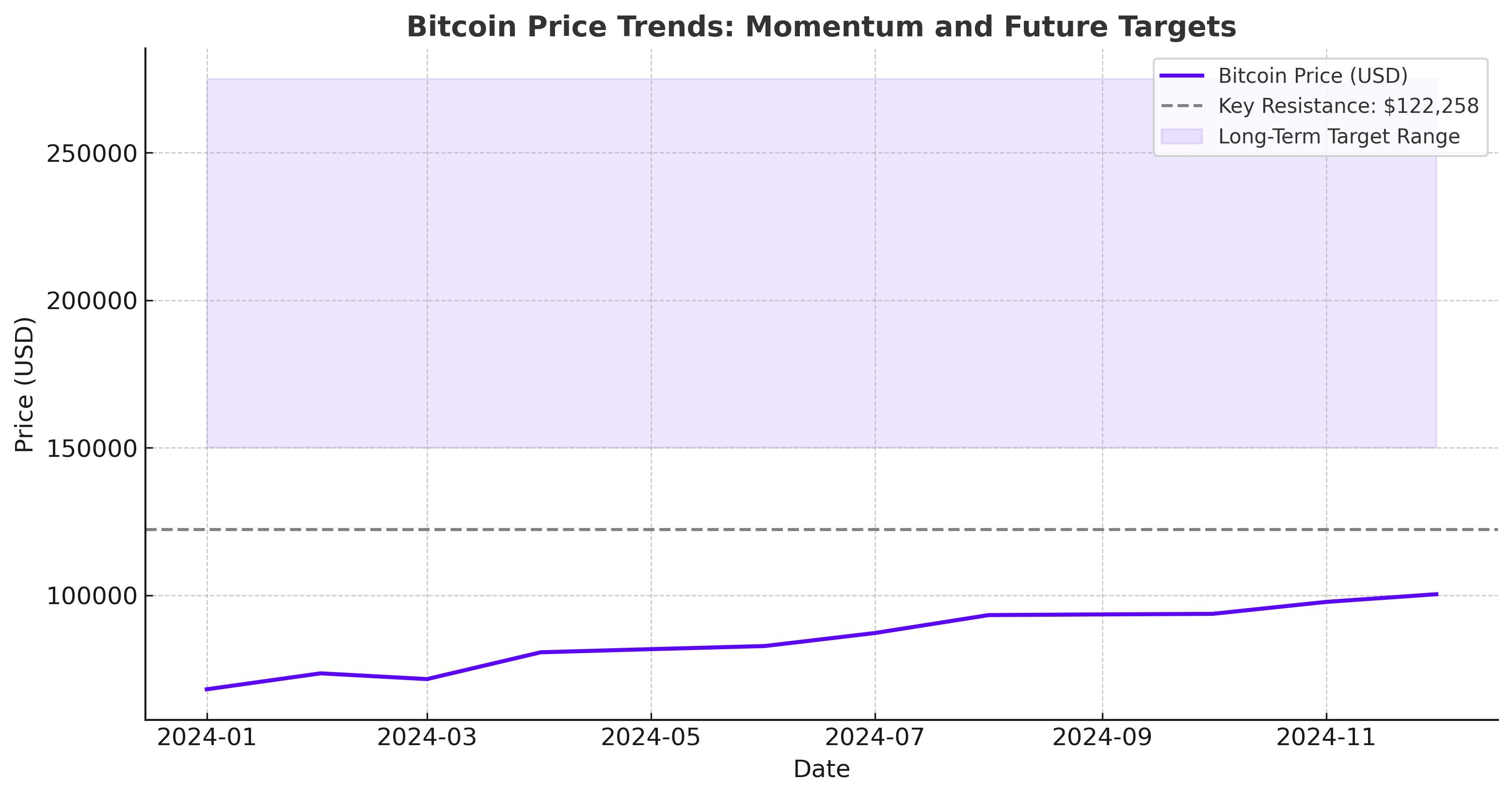

Bitcoin’s price recently broke above the significant $69,210 resistance, supported by bullish technical signals. The weekly chart reveals Bitcoin is trading above the 50-week and 200-week Exponential Moving Averages, with a golden cross formed in April 2023. These indicators suggest further upside potential, with the next key resistance level identified at $122,258. Analysts highlight that breaking this level could open the path toward the ambitious $150,000 mark.

Conversely, a failure to maintain momentum could trigger a pullback to $90,000, the lower bound of Bitcoin’s recent consolidation range. However, the market structure remains overwhelmingly bullish, supported by strong buying interest at lower levels.

On-Chain Metrics Support Bullish Outlook

On-chain data also supports Bitcoin’s bullish case. The Coinbase Premium Index, a measure of price differences between Coinbase and Binance, has surged into positive territory, reflecting renewed buying interest from U.S.-based institutions. Historically, spikes in this index have preceded significant price rallies, and the current trend suggests that institutional demand is driving the current uptrend.

Additionally, Bitcoin futures markets have stabilized after recent volatility, with funding rates normalizing. This shift indicates a healthier market structure, reducing the likelihood of speculative liquidations and creating a more sustainable rally environment.

Potential Risks: Overbought Signals and Historical Patterns

Despite the optimistic outlook, some analysts warn of a potential correction. The Bitcoin-to-Gold ratio has reached a key resistance level between 34 and 37, historically associated with local market tops. The 14-week RSI has also entered overbought territory at 73 points, raising the likelihood of a pullback. If Bitcoin mirrors past patterns, a retracement to the $65,000-$69,000 range could occur, representing a 30-35% decline.

Price Target and Market Sentiment

Bitcoin’s current price of $101,074 has reignited bullish sentiment, with analysts setting ambitious price targets. Near-term resistance is pegged at $122,258, while longer-term projections place Bitcoin’s potential high at $275,000. Even with potential short-term corrections, the overall trend remains upward, bolstered by institutional adoption, decreasing supply, and favorable macroeconomic conditions.

Final Assessment

Bitcoin’s recent performance highlights its resilience and growing appeal as a digital asset. Trading at $101,074 with a price target of $122,258 in the short term and $150,000 to $275,000 in the long term, Bitcoin offers a compelling investment opportunity. While short-term volatility may persist, the underlying fundamentals and increasing adoption suggest that the crypto asset is well-positioned for sustained growth in the years ahead.