Bitcoin Set for Massive Growth as Economic and Political Forces Align

Inflation concerns, U.S. rate cuts, and growing institutional interest are fueling Bitcoin’s rise. Could BTC hit $100,000 sooner than expected? | That's TradingNEWS

Bitcoin’s Bullish Momentum Intensifies: Will It Surpass $100,000?

Institutional Interest and ETF Flows Surge BTC Prices

The rise of Bitcoin (BTC) has been nothing short of remarkable, with current prices hovering around $68,400. With Bitcoin Exchange-Traded Funds (ETFs) attracting over $1.5 billion in inflows in the past week, institutional demand is playing a pivotal role in BTC's ascent. Collectively, these ETFs now manage assets worth more than $65 billion, a milestone that took gold ETFs five years to achieve. Notably, BlackRock's iShares Bitcoin Trust leads with $22.4 billion in inflows, signaling that institutional investors view Bitcoin as a valuable hedge against economic instability and inflation.

Moreover, as global economic policies shift, particularly in the U.S., where Federal Reserve rate cuts have bolstered confidence, Bitcoin remains the go-to asset for many investors. In Japan, Metaplanet, a publicly traded firm, recently increased its BTC options strike price from $62,000 to $66,000, reflecting optimism for even higher future prices.

Rising Whale Activity and Halving's Impact

Large-scale investors, often referred to as "whales," have increased their BTC holdings, adding weight to the bullish outlook. Bitcoin's fixed supply, with only 21 million coins ever in circulation, coupled with the upcoming halving in 2024, creates a scarcity factor that will likely drive prices higher. Historically, halving events have reduced new BTC issuance, pushing demand even further, and experts predict that Bitcoin could hit $100,000 within the next year.

Bitcoin’s Price Targets: $70,000 and Beyond

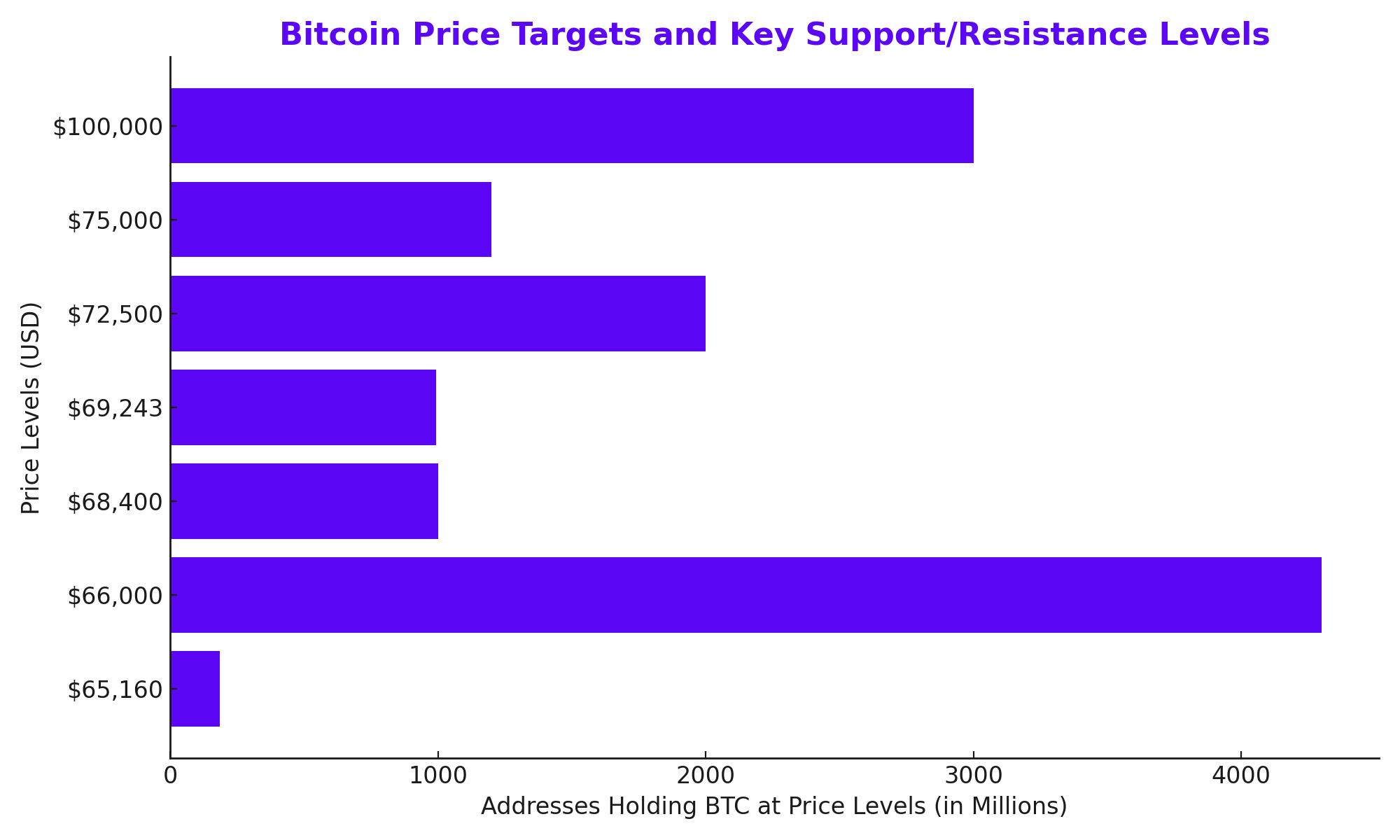

Bitcoin’s next key resistance level lies between $69,243 and $72,500. Over 994,000 addresses purchased BTC at this level during its previous high, presenting a potential sell-wall. However, analysts believe that if Bitcoin breaches this barrier, it could quickly rise to $75,000, with further upside momentum pushing it toward new all-time highs of $80,000 or more before year-end.

The $66,000 mark serves as a solid support level, with over 4.3 million BTC held at that price, keeping downward volatility in check. Should Bitcoin close above $72,500, it will likely signal the start of a new bullish phase, potentially reaching $100,000 by mid-2025.

Economic Shifts and Political Influences Favor Bitcoin

Key Drivers of BTC’s Price Surge

The convergence of key political and economic factors is creating an environment that could significantly propel Bitcoin (BTC) to new highs. One of the most critical drivers of this growth is the upcoming U.S. presidential election. With GOP candidates like Donald Trump openly supporting cryptocurrencies, the market is anticipating a more favorable regulatory landscape for Bitcoin. A win for Trump or any pro-crypto candidate could bring much-needed regulatory clarity, which is expected to attract substantial institutional investments into BTC.

This political alignment comes at a time when inflation concerns and mounting U.S. debt are undermining confidence in traditional fiat currencies. The U.S. national debt is now over $33 trillion, and the government’s growing deficit is causing investors to seek alternatives like Bitcoin to preserve their wealth. As inflation eats away at the purchasing power of fiat currencies, Bitcoin’s fixed supply of 21 million coins becomes increasingly attractive as a hedge. With current Bitcoin prices hovering around $68,400, many see this as a buying opportunity before the cryptocurrency heads toward $75,000 and beyond.

Rate Cuts and Global Economic Trends

Global monetary policy is also playing a significant role in Bitcoin's rise. Both the U.S. Federal Reserve and the European Central Bank (ECB) are cutting interest rates to stimulate their respective economies, creating a more bullish environment for BTC. Lower interest rates generally make riskier assets more appealing, as the opportunity cost of holding non-yielding assets like Bitcoin decreases. This shift is already evident, with Bitcoin ETFs seeing inflows of over $1.5 billion last week alone, signaling robust demand from institutional investors.

In addition to the West, China is implementing its own economic stimulus measures, including rate cuts and fiscal policies aimed at boosting domestic growth. These actions are further increasing demand for assets like Bitcoin that are seen as stores of value in an inflationary environment. As central banks worldwide adopt dovish policies, Bitcoin is benefiting from the global liquidity influx. This is pushing BTC toward key resistance levels, and analysts are increasingly confident that Bitcoin will soon test the $70,000 mark. If economic conditions continue to favor alternative assets, BTC could surge past its previous all-time high of $73,000, with a new target set for $100,000 in 2024.

Conclusion: Bitcoin Set for Explosive Growth

Bitcoin’s market dynamics are currently supported by a perfect storm of favorable political, economic, and institutional factors. Institutional investors are pouring money into Bitcoin ETFs, and whales are accumulating BTC, signaling strong confidence in the asset’s long-term potential. The Federal Reserve's rate cuts, alongside China's economic stimulus and the ECB's monetary easing, create a backdrop where Bitcoin is primed to rise further.

As the global economic environment remains uncertain, Bitcoin is increasingly viewed as a hedge against inflation and currency devaluation. With institutional demand surging, Bitcoin’s price could soon break past $72,500, setting the stage for a run toward $100,000 in the next 12 months. As regulatory clarity improves and more capital flows into BTC, the cryptocurrency is poised to solidify its position as a premier asset class in the global financial system.

Bitcoin's current price of around $68,400 could soon seem like a distant memory as it tests new highs. The $70,000 resistance level is within reach, and once breached, could pave the way for even greater gains. Given the current political and economic landscape, Bitcoin’s path to six figures is looking increasingly inevitable.