Bitcoin Set for Massive Surge as $100K Target Comes Into Focus

Fractal Pattern, Whale Accumulation, and Market Momentum Signal Big Gains Ahead | That's TradingNEWS

Bitcoin Price Action Mirrors October 2023 Fractal, Bulls Eye $100,000 Target Before 2024

Fractal Repeats: Bitcoin Chart Shows Bullish Pattern

Bitcoin (BTC) has caught the attention of analysts, with recent patterns drawing strong comparisons to its October 2023 performance. According to analyst TradingShot, the flagship cryptocurrency is currently trading in a similar manner to last year, and the implications are undeniably bullish. The key comparison lies in Bitcoin’s movement within its 1D 50-day and 1D 200-day moving averages, echoing a setup from last October when BTC began its aggressive rally.

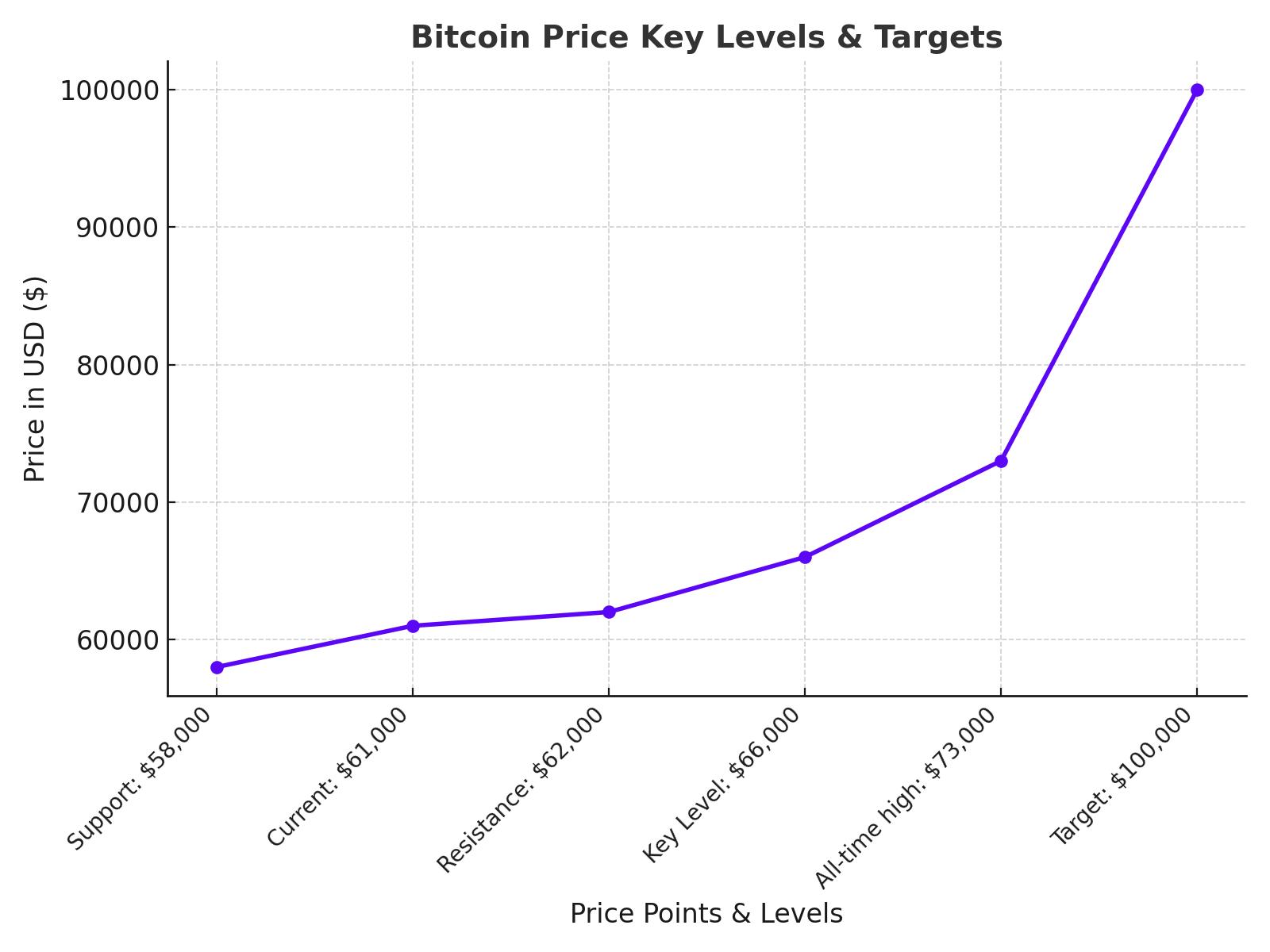

In October 2023, Bitcoin briefly crossed above the 1D 200-day MA before retracing, and this pattern triggered a rally that saw prices climb to new all-time highs by March. Currently trading near $61,000, Bitcoin recently tested its 1D 50 MA, signaling potential upward momentum once again. If the pattern holds true, analysts predict a significant rally, with some forecasting that BTC could push past $100,000 before the end of 2024.

Institutional Predictions Align With $100K Bitcoin Target

From a broader market perspective, institutions like Standard Chartered have predicted a $100,000 Bitcoin price before the U.S. presidential elections in November. If this prediction plays out, Bitcoin will see one of its most aggressive rallies in history. In contrast, Bernstein analysts remain more cautious, suggesting that BTC may approach $90,000 should former president Donald Trump win the election, leveraging his crypto-friendly stance.

However, it’s not all clear skies. Rising geopolitical tensions and uncertain macroeconomic factors have led to periods of volatility, leaving traders uncertain about Bitcoin’s immediate trajectory. For instance, recent U.S. inflation data and the upcoming elections have resulted in sideways trading, with BTC holding steady near $61,000.

Macroeconomic Data Continues to Weigh Heavily on Bitcoin

The economic backdrop remains crucial for Bitcoin’s price movements. The most recent U.S. Consumer Price Index (CPI) report indicated inflation rising by 0.2%, creating anxiety around potential Federal Reserve policy shifts. In response, Bitcoin briefly fell below the $59,000 level before rebounding. The CPI report has fueled fears that the Fed may pause its planned interest rate cuts, leading to potential economic stagflation—a scenario where inflation persists in a stagnant economy.

Adding further pressure, the U.S. jobless claims surged to a 14-month high, with 258,000 filings by October 5. This added another layer of concern, causing Bitcoin to struggle with sustained upward momentum. Despite these setbacks, whales—those holding more than 1,000 BTC—continue to accumulate, signaling confidence in Bitcoin’s long-term trajectory.

Whales Accumulate, Betting on Future Bitcoin Surge

On-chain analytics indicate that whales are increasing their Bitcoin holdings, with 1.5 million BTC accumulated over the past six months. These large-volume investors seem unfazed by the recent market dip, positioning themselves for a potential bullish breakout.

Interestingly, smaller holders—those with less than 1,000 BTC—have been offloading, taking profits from earlier surges. Data from CryptoQuant shows that while short-term traders have been selling at a loss, larger investors continue to buy in. Analysts predict that these accumulations could precede another upward movement, which aligns with broader market expectations for a Bitcoin surge.

Bitcoin Futures and Options Show Reduced Trader Confidence

While long-term holders remain bullish, futures and options data indicate reduced confidence among traders in the short term. Bitcoin futures have fallen below their neutral 3% threshold, signaling that traders are cautious about leveraged long positions. Historically, when Bitcoin futures metrics fall, prices tend to follow. The futures premium dropped to 5%, a sign that traders may expect further declines in the near term.

Similarly, Bitcoin options markets are showing signs of indecision. The 25% delta skew, which reveals when traders are overcharging for downside protection, remained neutral. This signals that whales and market makers have yet to position themselves aggressively for further price declines.

Market Sentiment: Bullish Long-Term, Bearish Short-Term

Despite the short-term market volatility, experts remain optimistic about Bitcoin’s long-term trajectory. Some analysts, like Peter Brandt, have gone so far as to predict a Bitcoin price of $135,000 within a year, provided key support levels hold. On the other hand, shorter-term forecasts paint a more cautious picture. If Bitcoin falls below the $58,000 level, further declines could lead to a testing of the $52,000 support level, according to crypto analyst Ali Martinez.

At present, Bitcoin is hovering around $61,000, a far cry from its all-time high of $73,000 set earlier this year. Traders are closely monitoring the $66,000 resistance level, which could trigger another rally if breached. However, a failure to hold current support levels may result in a deeper retracement.

Bitcoin’s Reaction to Regulatory Pressures and Legal Battles

Adding to Bitcoin’s challenges are regulatory pressures. The U.S. Securities and Exchange Commission (SEC) recently sued Cumberland DRW, a prominent market maker, for operating as an unregistered dealer in cryptocurrency transactions. While this news didn’t dramatically impact Bitcoin’s price, it raised concerns about regulatory crackdowns, which could further dampen investor sentiment.

In contrast, Bitcoin ETFs have seen consecutive days of net outflows, with traders pulling $59 million from these instruments. This has led to a bearish sentiment, further fueled by macroeconomic uncertainty and regulatory pressures. While some major institutional investors like Metaplanet Inc. have added to their Bitcoin holdings, boosting their assets to over 748 BTC, the broader market remains cautious.

Conclusion: Bitcoin Stands at a Crossroads

Bitcoin’s future remains uncertain, with both bullish and bearish signals competing for dominance. On the one hand, whale accumulation, institutional optimism, and long-term technical patterns suggest Bitcoin could soon resume its upward trajectory, potentially breaking through the $100,000 barrier. On the other hand, macroeconomic headwinds, regulatory pressures, and declining futures and options sentiment may keep Bitcoin range-bound in the short term.

As traders and investors navigate these complex signals, the coming months will be crucial in determining whether Bitcoin can reclaim its bullish momentum or whether a deeper correction is on the horizon.