Bitcoin Shatters Records: The $100K Milestone Is Just a Breath Away!

From Trump’s Crypto Revolution to ETF Frenzy—Unveiling the Forces Propelling Bitcoin’s Unstoppable Rise | That's TradingNEWS

Bitcoin Surges Toward $100,000: The Driving Forces Behind the Historic Rally

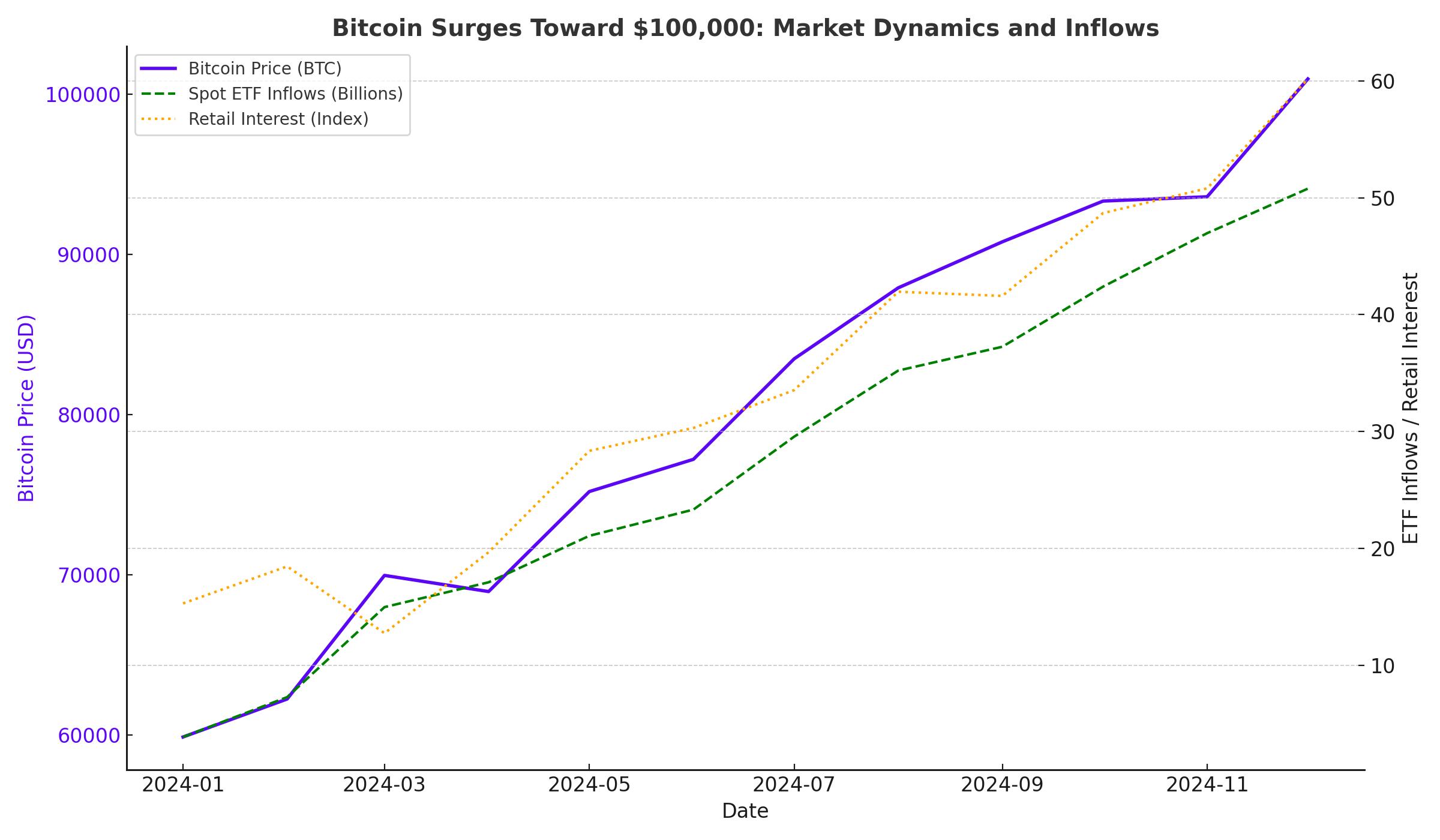

Bitcoin has skyrocketed to unprecedented levels, reaching $99,299 on Friday and leaving investors eager for the next move. This rally, fueled by institutional adoption, regulatory optimism, and shifting market dynamics, marks a pivotal moment in cryptocurrency history. Let’s dive deep into the forces propelling Bitcoin (BTCUSD) toward the coveted six-figure milestone and examine the implications for investors.

Bitcoin Breaks Records, Inches Closer to $100,000

Bitcoin’s year-to-date gains now stand at over 130%, with the cryptocurrency surging 46% since Donald Trump’s presidential victory on November 5th. The $100,000 psychological milestone is within striking distance, driven by strong retail and institutional demand, bolstered by Trump’s pro-crypto stance and promises to deregulate the crypto industry.

The price surge also coincided with the announcement of SEC Chair Gary Gensler's upcoming resignation, a development widely celebrated by crypto enthusiasts who have long criticized his enforcement-heavy approach. This regulatory shift is being hailed as a game-changer for the industry, with potential implications for Bitcoin ETFs and broader market participation.

Spot Bitcoin ETFs Ignite Institutional Demand

The approval and trading of spot Bitcoin exchange-traded funds (ETFs) have provided a significant catalyst for the current rally. BlackRock’s iShares Bitcoin Trust (NASDAQ:IBIT) launched options trading earlier this week, sparking a wave of investor activity. The ETF has already attracted billions in inflows, with a record-breaking $50 billion in trading volume for Bitcoin-related assets on Wednesday alone.

Institutional investors have played a critical role in this surge. Data from Coinbase shows that more hedge funds and financial advisors bought into spot Bitcoin ETFs in Q3 than in any previous quarter. MicroStrategy (NASDAQ:MSTR), one of the largest corporate holders of Bitcoin with 331,200 BTC worth over $32 billion, exemplifies the trend. Its stock has soared more than 500% this year, demonstrating the power of Bitcoin as a treasury asset.

Retail and Corporate Adoption on the Rise

Retail interest remains strong, but the corporate world is also taking note. Following MicroStrategy’s lead, companies like Cosmos Health (NASDAQ:COSM), LQR House (NASDAQ:LQR), and Acurx Pharmaceuticals (NASDAQ:ACXP) announced Bitcoin purchases this week, signaling a broader acceptance of cryptocurrency as a strategic reserve.

This surge in corporate adoption underscores Bitcoin’s growing appeal as a hedge against traditional market volatility and a tool for long-term value preservation. The narrative of Bitcoin as "digital gold" has gained further traction, even as its correlation with traditional safe-haven assets like gold weakens.

Bitcoin's Decoupling From Gold and Correlation with Equities

Interestingly, Bitcoin's 30-day correlation with gold has shifted dramatically—from a high of 0.82 in early November to an inverse correlation of -0.66. This divergence reflects a significant change in investor behavior, as capital flows appear to be rotating out of gold and into Bitcoin.

Meanwhile, Bitcoin maintains a strong correlation with equity markets, particularly the S&P 500 and Nasdaq, with correlation scores of 0.7 and 0.76, respectively. This dual dynamic highlights Bitcoin’s evolving role in the broader financial ecosystem, straddling the line between a speculative asset and a store of value.

Market Signals Suggest a Correction May Be Looming

While optimism reigns, some analysts caution that Bitcoin’s meteoric rise may not be sustainable in the short term. Galaxy Digital CEO Mike Novogratz has warned of a potential correction, suggesting Bitcoin could retrace to $80,000 after breaching $100,000. Indicators like the Relative Strength Index (RSI), which currently reads 82 (indicating overbought conditions), support this view.

Traders are advised to exercise caution, as high leverage across the crypto ecosystem could amplify volatility. Short liquidations have already totaled $115 million this week, and further squeezes could result in sharp price swings.

Altcoins Follow Bitcoin’s Lead

Bitcoin’s rally has lifted the broader cryptocurrency market, with major altcoins like Ethereum (ETH) and Ripple (XRP) posting significant gains. Ethereum is trading above $3,400, with analysts eyeing a move toward $4,000 if it breaks key resistance at $3,454. Meanwhile, XRP has surged over 25%, fueled by optimism surrounding Gensler’s resignation and potential regulatory relief under the incoming Trump administration.

The Road Ahead: Bitcoin’s $100,000 Milestone

Bitcoin’s path to $100,000 seems increasingly plausible, with Trump’s crypto-friendly policies, institutional inflows, and expanding ETF options providing a solid foundation for continued growth. However, traders should remain vigilant, as market dynamics could shift quickly.

For now, Bitcoin’s rally represents a pivotal moment for the crypto industry, showcasing its resilience and growing mainstream acceptance. Whether it sustains these levels or faces a near-term correction, one thing is clear: Bitcoin’s role in the global financial system is stronger than ever.