Bitcoin Smashes $75,000 Milestone as Trump’s Election Lead Ignites Crypto Surge

Historic Highs in Bitcoin as Election Unfolds – Here’s Why BTC’s Bull Run Might Just Be Getting Started! | That's TradingNEWS

Bitcoin Rockets Past $75,000: Election Volatility and Pro-Crypto Sentiment Drive Unprecedented Highs

The Rise of Bitcoin Amid Election Uncertainty

As early results show Donald Trump leading in the 2024 U.S. presidential race, Bitcoin (BTC-USD) has surged to a record high of $75,000, surpassing its previous peak of $73,800 reached in March. The digital asset, now up over 8% in the past 24 hours, reflects investor confidence in Trump’s pro-crypto stance, which has gained momentum in recent weeks. With both institutional investors and retail traders anticipating a regulatory environment more favorable to digital assets under Trump, Bitcoin has once again become a focus in the market.

Trump’s Edge and Market Sentiment

Election Impact on Bitcoin

According to the Associated Press, Trump holds an electoral college lead over Kamala Harris, with 198 votes to her 112. Market sentiment is clearly swayed by this development, with betting markets like Polymarket showing Trump’s odds of victory rising to 88%, up from 58% earlier on election day. This surge in odds has corresponded with Bitcoin’s price ascent, highlighting the perceived positive impact a Trump administration might have on the crypto sector.

Trump’s Pro-Crypto Agenda

Trump’s recent pivot to a pro-crypto stance has played a substantial role in market optimism. During his campaign, he announced intentions to remove Securities and Exchange Commission (SEC) Chair Gary Gensler, whom the industry widely views as a roadblock to crypto-friendly policies. Trump has also proposed the creation of a strategic Bitcoin reserve, positioning BTC as a legitimate asset in the U.S. financial ecosystem. This has rallied investors who are betting on an environment that could provide fewer regulatory restrictions and bolster institutional support for cryptocurrencies.

Institutional Inflows and Bitcoin ETF Impact

Bitcoin ETF Boost

The approval of multiple Bitcoin ETFs earlier this year, including BlackRock’s iShares Bitcoin Trust, has fundamentally altered Bitcoin’s market dynamics. With over $20 billion in ETF inflows, institutional players have unprecedented access to Bitcoin exposure without the direct purchase of the asset. This influx of capital from institutional investors, traditionally cautious toward cryptocurrency, has been a key driver behind Bitcoin’s record-breaking performance. BlackRock’s continued inflows, in particular, stand out, with $38.3 million added this week, defying a broader trend of outflows from other providers.

Broadening Institutional Adoption

Funds from major institutions such as Fidelity, Ark Invest, and Bitwise have propelled Bitcoin’s liquidity and credibility. The U.S. election results have only amplified the appeal for institutional investment in Bitcoin, as the prospect of a pro-crypto administration under Trump adds an additional layer of potential market stability and growth for institutional participants. The combined effect of ETF inflows and Trump’s pro-Bitcoin stance has created a powerful upward pressure on BTC.

Bitcoin Technical Analysis and Key Levels

Breakthrough of Key Resistance Levels

From a technical perspective, Bitcoin’s recent price movement marks a significant breakout. The cryptocurrency has moved well above the $68,450 resistance level, shattering the 100-hour Simple Moving Average (SMA) and the critical 76.4% Fibonacci retracement level, signaling continued bullish momentum. As of the latest trading session, Bitcoin has tested resistance levels at $72,800 and $73,200, with immediate support now forming at $72,000.

MACD and RSI Indicators

The Moving Average Convergence Divergence (MACD) indicator shows a strong bullish trend, while the Relative Strength Index (RSI) remains above 50, indicating positive momentum. Technical analysts are watching a critical pattern—the “Descending Broadening Wedge”—on the weekly chart, which suggests a potential rally towards $88,000 by year-end if the bullish trend persists. This upward trajectory aligns with a historical pattern observed in previous Bitcoin cycles, especially those driven by significant geopolitical or economic events.

Long-Term Price Predictions: Beyond the Election

Short-Term Targets Based on Election Outcome

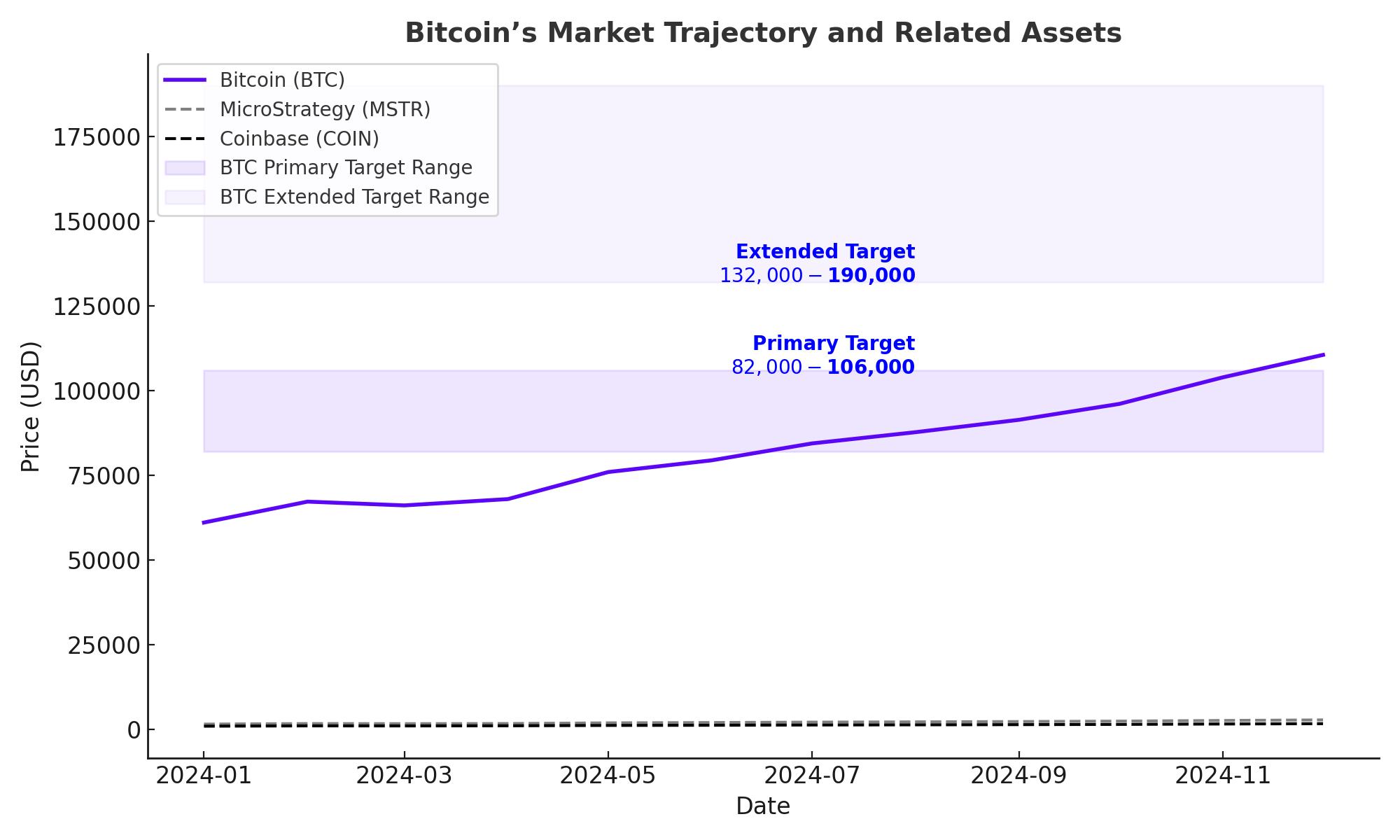

Analysts have set differentiated short-term price targets based on the election outcome. In the event of a Trump victory, some projections see BTC reaching $80,000 to $90,000 in the near term. Conversely, a Harris win could introduce regulatory uncertainty, with analysts forecasting a potential drop to $50,000 as the market reassesses the regulatory landscape. However, most forecasts suggest that any election-driven volatility will be temporary, with Bitcoin poised for a long-term bullish trajectory.

Bernstein’s $200,000 Prediction by 2025

Bernstein Research has an ambitious projection, estimating Bitcoin could reach $200,000 by 2025, driven by a combination of structural market shifts, growing institutional adoption, and increased concerns over the U.S. national debt. The success of Bitcoin ETFs has opened a floodgate for retail and institutional investors alike, offering robust access points that could sustain Bitcoin’s price growth well into the future.

Broader Market Impact and Risk Factors

Options Market Sentiment

Options data shows increased buying interest in calls at $72,000-$75,000 strike prices, suggesting that traders remain optimistic about Bitcoin’s near-term upside. However, there has also been protective put buying at $64,000, indicating caution and hedging behavior among institutional participants, who are wary of election-related volatility. This mixed positioning reflects a market that is optimistic yet prepared for potential downside risks.

Election and Economic Factors in Focus

In the broader economic landscape, factors such as interest rates, U.S. debt levels, and economic policy remain central to Bitcoin’s appeal as an alternative store of value. If Trump’s policies include further inflationary spending or dovish monetary stances, Bitcoin could see heightened demand as a hedge against potential fiat currency devaluation.

Key Takeaways and Levels to Watch

- Immediate Resistance: $75,000

- Key Support: $70,000

- Secondary Support: $68,000

- Election Scenario Targets:

- Trump Victory: Short-term target of $80,000-$90,000

- Harris Victory: Potential pullback to $50,000

Conclusion

Bitcoin’s record surge past $75,000 is not only a result of election-induced volatility but also reflects an evolving landscape in digital assets, with significant institutional backing and an increasingly favorable policy outlook. As markets remain glued to election results, BTC’s movement highlights the asset’s unique positioning as both a risk asset and a hedge. With critical technical levels broken and institutional interest surging, Bitcoin’s path forward looks robust, regardless of immediate election results. For traders and investors, the next few days will be pivotal in setting the tone for Bitcoin’s long-term trajectory.