Bitcoin Soars Beyond $93K: Could Trump’s Crypto Policies Propel It to $100,000?

Record ETF Inflows and Pro-Crypto Sentiment Drive Bitcoin to Historic Levels — Here’s What’s Next for BTC | That's TradingNEWS

Bitcoin’s Record-Breaking Surge: Analysis of Market Drivers, Political Influence, and ETF Impact

Trump’s Pro-Crypto Policies Fuel Bitcoin’s Rally

In a historic rally that has the financial world abuzz, Bitcoin (BTC) recently soared to unprecedented heights, crossing the $93,000 mark for the first time. This remarkable surge comes on the heels of Donald Trump’s presidential victory, where he outlined a series of pro-crypto policies during his campaign. The impact of Trump’s proposed crypto-friendly measures, including establishing a national Bitcoin stockpile and incentivizing U.S.-based mining, has ignited a wave of optimism throughout the cryptocurrency market, sending Bitcoin and other digital assets into a price frenzy.

In the days following the election, Bitcoin’s price has more than doubled, with analysts noting a seismic shift in investor sentiment toward the flagship cryptocurrency. A significant element driving this growth is the recent approval and success of spot Bitcoin ETFs, which have provided a regulated avenue for both institutional and retail investors to enter the market.

The Impact of Spot Bitcoin ETFs: Record Inflows and Market Transformation

The recent launch of spot Bitcoin exchange-traded funds (ETFs) has dramatically transformed the landscape for BTC. Since the approval of BlackRock’s iShares Bitcoin Trust (IBIT) in January, ETF inflows have set new records, further intensifying Bitcoin’s bull run. According to Farside Investors, the two largest inflows into Bitcoin ETFs occurred within days of Trump’s victory, with nearly $2 billion pouring into these funds in a single 48-hour period. This momentum pushed BlackRock's iShares Bitcoin Trust (IBIT) past $40 billion in inflows, an unprecedented achievement for any ETF in history. Surpassing its own Gold Trust, BlackRock's BTC ETF reflects a shift where Bitcoin is increasingly seen as a potential "digital gold."

This ETF boom is a game-changer for Bitcoin, providing easier access to cryptocurrency for traditional investors who may have been hesitant due to regulatory concerns or market volatility. The explosive growth in ETF inflows has been instrumental in propelling Bitcoin's price, offering a level of legitimacy and accessibility that could sustain the rally and attract more institutional players.

Bitcoin’s Market Reaction: Price Surge and the Path to $100,000

Bitcoin’s meteoric rise post-election is more than just a knee-jerk reaction; it represents a fundamental shift in the market’s perception of the cryptocurrency. Trump’s campaign pledges to create a favorable regulatory framework for Bitcoin, coupled with the launch of ETFs, have provided investors with both confidence and an easy entry point into the market. Bitcoin’s price, which hovered below $70,000 on election night, now trades above $90,000, signaling a shift in sentiment where BTC is not only seen as a speculative asset but as a hedge against economic uncertainty.

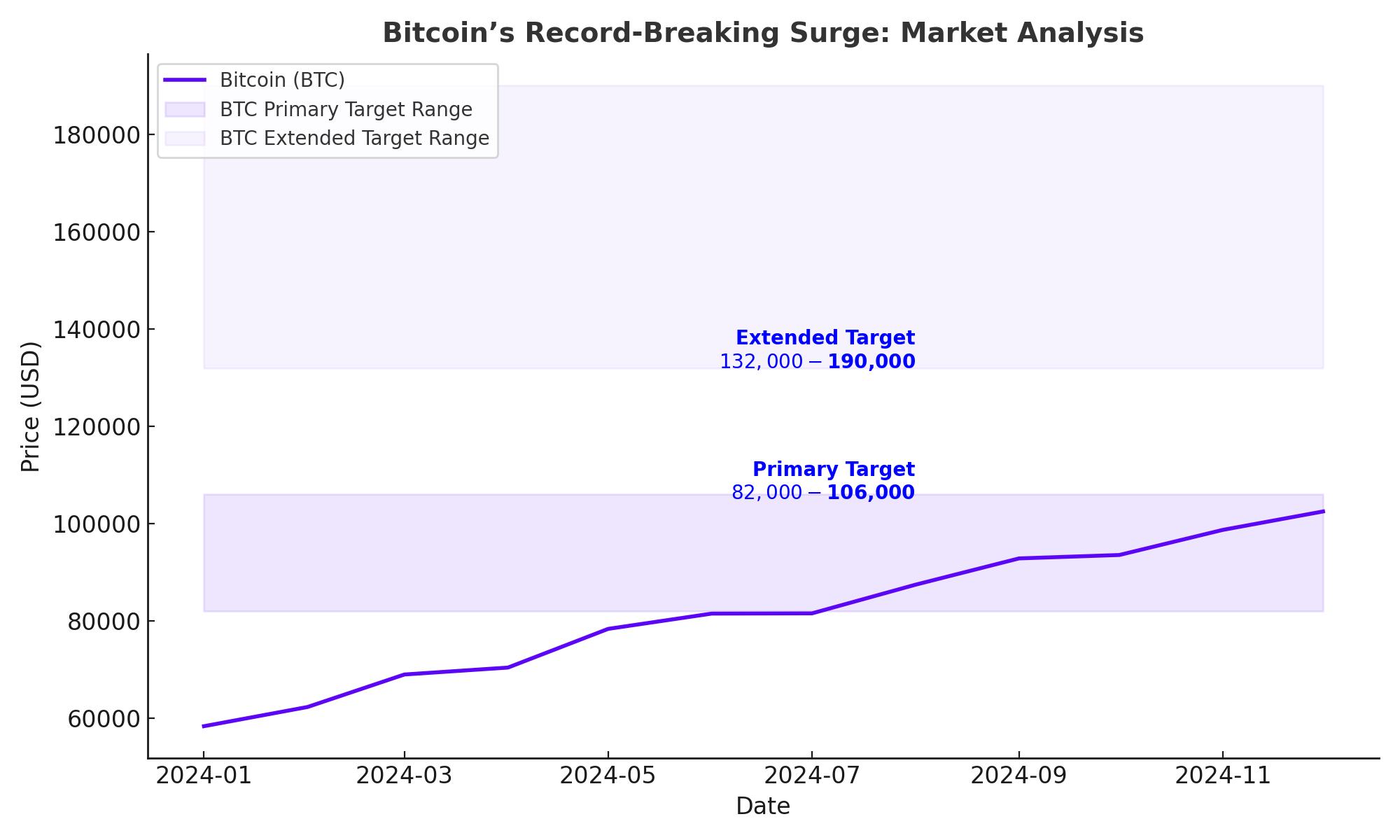

Technically, Bitcoin has broken through major resistance levels, and analysts now believe that the $100,000 mark could be within reach if the current trajectory continues. Factors such as increased ETF inflows, Trump's commitment to pro-crypto policies, and broader market sentiment are aligning to create a favorable environment for Bitcoin’s continued growth. However, this upward momentum is also creating pressure on resistance levels around the $93,000 mark. If BTC manages to break and sustain above this level, the psychological $100,000 threshold may soon be tested.

Rising Institutional Interest and Broader Market Sentiment

One of the most significant shifts in Bitcoin's current rally is the level of institutional interest. Major investment firms and traditional financial players are increasingly turning toward Bitcoin as a hedge and diversification asset. BlackRock's rapid inflows into its iShares Bitcoin Trust (IBIT) signal that institutional players are beginning to see BTC as a viable addition to their portfolios. The spot ETF market alone has reached over $94 billion in assets under management, accounting for around 5.3% of the total BTC market cap, underscoring a substantial reallocation of capital toward the cryptocurrency sector.

This institutional support marks a pivotal moment for Bitcoin, as major hedge funds and investment managers signal their confidence in BTC's long-term value. The inflows into ETFs are expected to provide a steady stream of capital that could help stabilize Bitcoin’s price, reducing volatility and attracting more conservative investors who previously viewed the cryptocurrency as too risky.

Market Indicators: RSI, Volume, and Technical Levels

Bitcoin’s recent price action has also attracted attention from a technical perspective. The Relative Strength Index (RSI), a common indicator of overbought or oversold conditions, has moved closer to overbought territory but still shows room for upward movement. With the RSI approaching 68, BTC is riding a wave of bullish sentiment without yet hitting the extremes that often precede corrections.

Additionally, trading volume has surged, with the Volume Price Trend (VPT) indicating strong buying interest as BTC climbs. This rise in volume, alongside record ETF inflows, shows that Bitcoin’s rally is underpinned by substantial market support rather than short-term speculation. Should Bitcoin maintain its momentum, the next significant resistance lies near the $100,000 psychological level, which would represent a major milestone and could trigger even more buying activity.

Long-Term Outlook: Will Bitcoin Maintain Momentum?

Looking further ahead, Trump’s pro-crypto administration is expected to roll out additional measures that could bolster Bitcoin’s standing in the financial ecosystem. Among his proposed initiatives are the establishment of a national Bitcoin reserve, the creation of crypto-friendly regulations, and support for U.S.-based mining operations. These measures could pave the way for further adoption, especially if federal guidelines make it easier for institutions to include BTC in their portfolios.

Some analysts, including those from Bernstein, have even suggested that Bitcoin’s price could reach as high as $200,000 by 2025 if Trump’s policies take root and drive broader adoption. A $500,000 target has also been floated by certain bullish advocates, who argue that as Bitcoin becomes more widely accepted as a store of value, it will rival gold’s market cap.

Final Take: Is Bitcoin a Buy, Hold, or Sell?

Given the current political climate, regulatory shifts, and market dynamics, Bitcoin appears to be in a strong position. The confluence of Trump’s pro-crypto policies, robust ETF inflows, and rising institutional interest suggests a positive outlook for BTC. For investors looking to capitalize on Bitcoin's momentum, the data points to a continued uptrend. While some caution may be warranted given Bitcoin's volatility, the overarching indicators suggest that BTC could soon reach the six-figure milestone. For those willing to weather short-term fluctuations, Bitcoin’s current trajectory may offer substantial long-term returns.

Verdict: Strong buy