Bitcoin Soars Toward $100,000: A Bold Move to $118K in Sight

Bitcoin Breaks $98,000: A Pennant Pattern Signals $118K Potential | That's TradingNEWS

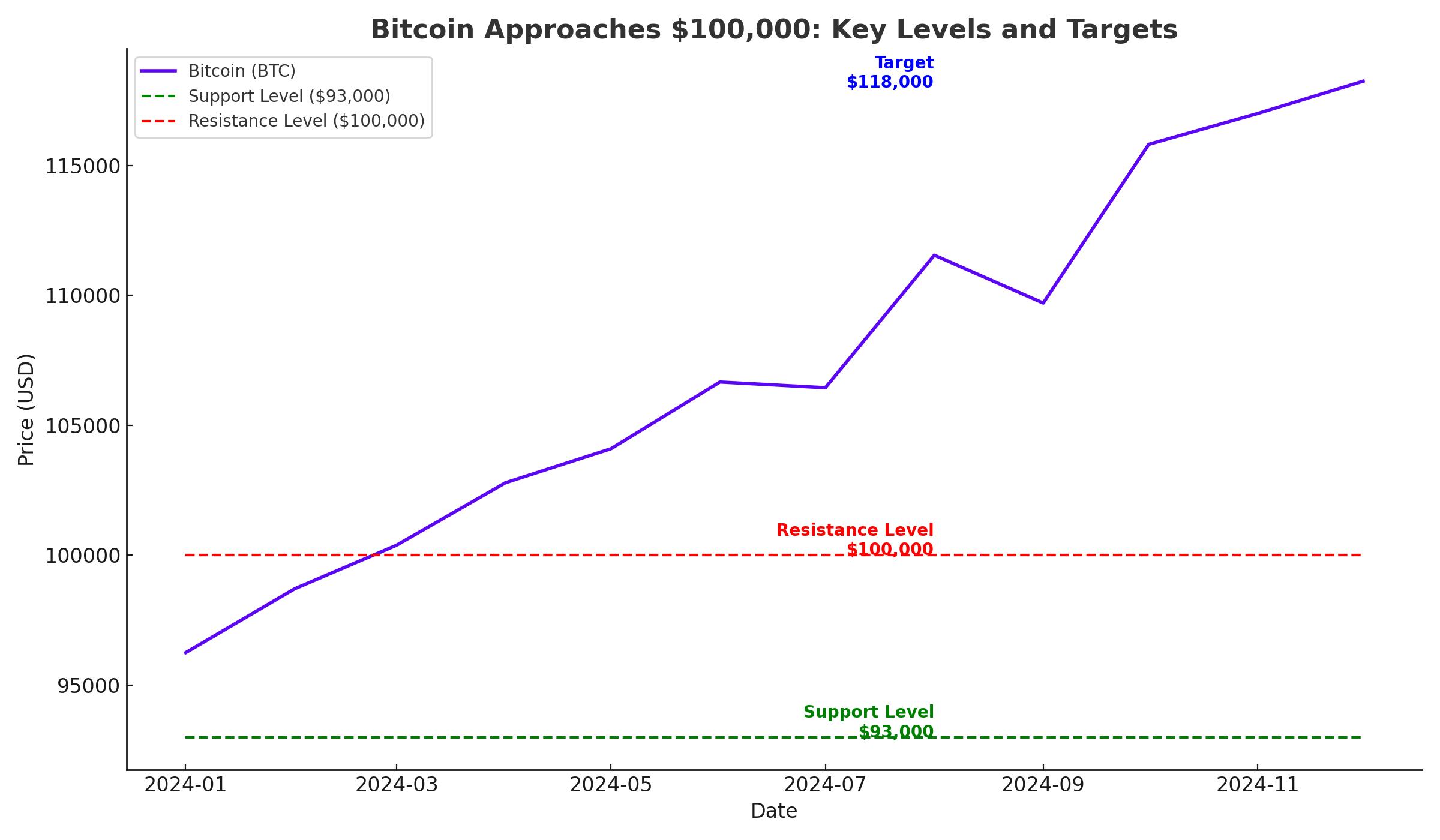

Bitcoin Approaches $100,000: A Turning Point for Cryptocurrency Markets

Bitcoin (BTCUSD) is poised on the brink of a historic milestone, with its price nearing the highly anticipated $100,000 level. This explosive growth follows a series of bullish catalysts, including increased institutional adoption, renewed regulatory optimism, and heightened interest fueled by the recent presidential election. Below, we delve into the critical drivers of Bitcoin’s rally, analyze its technical landscape, and assess its implications for the broader cryptocurrency market.

Technical Breakout Signals Continued Momentum for Bitcoin (BTCUSD)

Bitcoin’s recent breakout above an eight-month consolidation range signals robust bullish momentum. The cryptocurrency surged past $97,700 over the weekend, touching an all-time high of $99,800. A golden cross in late October—when the 50-day moving average surpassed the 200-day moving average—validated this uptrend, attracting both institutional and retail investors.

Adding to the bullish case, Bitcoin recently broke out of a pennant pattern, a continuation chart formation. Using a bars pattern projection technique, analysts estimate Bitcoin’s next target could reach $118,000, representing a significant upside from current levels.

Key Support and Resistance Levels to Watch

Amid its meteoric rise, Bitcoin has established critical support zones at $93,000 and $70,000. The $93,000 level aligns with the top of the pennant pattern and serves as a key point for dip buyers. Should the price face further corrections, $70,000—a region near the 200-day moving average—could attract substantial buying interest, preventing deeper pullbacks.

Resistance at the $100,000 psychological level remains formidable. However, strong trading volumes and heightened market liquidity suggest that a sustained breakout could drive Bitcoin higher, potentially testing the $118,000 mark in the coming months.

Institutional Adoption Propels Bitcoin’s Growth

The surge in Bitcoin’s price is not merely a retail phenomenon; institutional interest is playing a pivotal role. Trading volumes have reached their highest levels since March, as asset managers and hedge funds increasingly view Bitcoin as a strategic allocation in diversified portfolios. The U.S. Securities and Exchange Commission’s approval of Bitcoin ETFs has further broadened access, allowing investors to bypass traditional crypto exchanges and participate through brokerage accounts.

MicroStrategy’s (NASDAQ:MSTR) aggressive Bitcoin accumulation strategy exemplifies this trend. The company, holding over 279,420 BTC—approximately 1.3% of all circulating supply—continues to bridge the gap between traditional finance and cryptocurrency markets. MicroStrategy’s innovative financial engineering, including issuing convertible bonds backed by Bitcoin, underscores the increasing sophistication of institutional Bitcoin adoption.

Regulatory Landscape Favors Bitcoin

The regulatory environment for cryptocurrencies has taken a more optimistic turn following the recent U.S. presidential election. Donald Trump’s administration has demonstrated a pro-crypto stance, with plans to make America a “world capital for Bitcoin.” Key appointments, such as Scott Bessent as Treasury Secretary and Howard Lutnick as Commerce Secretary, highlight a concerted effort to integrate crypto into the broader financial framework.

Moreover, the announcement of crypto-based initiatives, including government-backed lending programs and Bitcoin-backed financial instruments, reflects a policy shift toward fostering innovation in the sector. This regulatory clarity is expected to drive further institutional adoption and solidify Bitcoin’s status as a mainstream asset.

Market Fundamentals: Supply, Demand, and Halving Dynamics

Bitcoin’s fixed supply of 21 million coins continues to underpin its scarcity-driven value proposition. With 19 million BTC already in circulation and a recent halving event reducing the issuance rate, demand dynamics favor price appreciation. The halving mechanism, which occurs approximately every four years, decreases the reward for mining new Bitcoin, creating upward price pressure as the total supply dwindles.

In addition to scarcity, demand for Bitcoin is buoyed by its use as a hedge against inflation. As global economies grapple with rising inflation rates and monetary policy uncertainty, Bitcoin’s decentralized nature and limited supply make it an attractive alternative to fiat currencies and traditional assets like gold.

The Role of Retail Investors and FOMO

While institutional participation has garnered headlines, retail investors remain a driving force behind Bitcoin’s rally. The fear of missing out (FOMO) is palpable as the cryptocurrency nears the $100,000 threshold. Platforms like Binance, Coinbase, and Robinhood have reported surging activity, with millions of new accounts created in recent months. Social media buzz and endorsements from high-profile figures like Elon Musk have further amplified retail enthusiasm.

Risks to Consider: Overbought Signals and Market Volatility

Despite its strong momentum, Bitcoin faces near-term risks. The Relative Strength Index (RSI) currently stands at 77, signaling overbought conditions. This technical indicator suggests the potential for a short-term correction, which could test support levels at $93,000 or lower.

Additionally, market volatility remains a hallmark of the cryptocurrency space. Events such as regulatory shifts, macroeconomic uncertainty, or large-scale profit-taking could trigger sharp price swings. Investors should exercise caution and consider employing risk management strategies, such as stop-loss orders or diversified portfolios, to mitigate potential downside risks.

Bitcoin’s Broader Implications for the Crypto Ecosystem

Bitcoin’s rally has had a cascading effect on the broader cryptocurrency market. Ethereum (ETH), Ripple (XRP), and other altcoins have posted significant gains, benefiting from increased investor interest in digital assets. Ethereum, for instance, is nearing its key resistance level of $3,454, while Ripple has found strong support around $1.40, hinting at further upside potential.

Moreover, Bitcoin’s price action influences the performance of crypto-related equities. Companies like Coinbase (NASDAQ:COIN) and Marathon Digital (NASDAQ:MARA) have seen their stock prices closely track Bitcoin’s movements, offering additional avenues for investors to gain exposure to the sector.

The Path Ahead: Is Bitcoin a Buy, Hold, or Sell?

Given its robust technical setup, favorable regulatory environment, and strong institutional backing, Bitcoin appears well-positioned for continued growth. The cryptocurrency’s potential to breach the $100,000 mark and target $118,000 underscores its appeal as both a speculative investment and a long-term store of value.

For risk-tolerant investors, Bitcoin remains a compelling buy. However, those with a lower risk appetite may consider holding existing positions or waiting for a pullback to key support levels before adding to their exposure. As always, diversification and disciplined portfolio management are essential when navigating the volatile cryptocurrency market.