Bitcoin Price: Exploring the Surge Above $100K and Future Outlook

Understanding Bitcoin’s (BTC-USD) Return to $100,000

Bitcoin's resurgence above $100,000 marks a significant milestone in its ongoing evolution as a financial asset. This recovery follows a sharp dip below $90,000 earlier in the week, driven by a mix of macroeconomic factors and regulatory optimism. The Consumer Price Index (CPI) report released on January 15, 2025, served as a critical catalyst. Inflation rose by 0.4% in December 2024, slightly exceeding expectations but sparking speculation about potential Federal Reserve rate cuts. Investors responded by pivoting toward riskier assets, pushing Bitcoin up 3.3% in 24 hours to $99,553, before crossing the $100,000 threshold.

The rally highlights Bitcoin's correlation with broader market sentiment. Lower interest rates make alternative assets like Bitcoin more attractive, while inflation concerns bolster its appeal as a hedge. The return above $100,000 reflects renewed investor confidence, spurred by economic conditions and optimism about the Trump administration's potential crypto-friendly policies.

Impact of CPI Data and Inflation Trends on Bitcoin

December's inflation data revealed an annual CPI increase of 2.9%, aligning with the Federal Reserve's stated 2% target but reflecting persistent upward pressure. Core CPI, excluding food and energy, rose 0.2%, dipping to 3.2% year-over-year. These trends sparked mixed reactions among investors. While headline inflation remains elevated, the decline in core inflation suggests the Federal Reserve could accelerate rate cuts in 2025.

This dynamic has profound implications for Bitcoin. Historically, periods of declining interest rates have coincided with strong crypto performance. As treasury yields fall, risk appetite increases, benefiting assets like Bitcoin. Following the inflation report, BTC surged to $98,500 and continued to climb, supported by its role as a speculative hedge against macroeconomic instability.

Regulatory Developments Boost Confidence in Bitcoin

Another driver of Bitcoin's rally is speculation about the U.S. Securities and Exchange Commission (SEC) potentially adopting more favorable cryptocurrency policies. A Reuters report hinted that the SEC could clarify when a crypto asset qualifies as a security and pause ongoing enforcement actions from the previous administration. Market participants view this as a significant step toward regulatory clarity, which could unlock institutional investment and boost Bitcoin’s legitimacy.

The Trump administration is expected to introduce policies favoring digital currencies, such as tax cuts for crypto transactions and a potential strategic Bitcoin reserve. Such developments could propel Bitcoin prices higher, with analysts forecasting a rally to $175,000 or even $400,000 by the end of 2025, depending on policy execution and adoption rates.

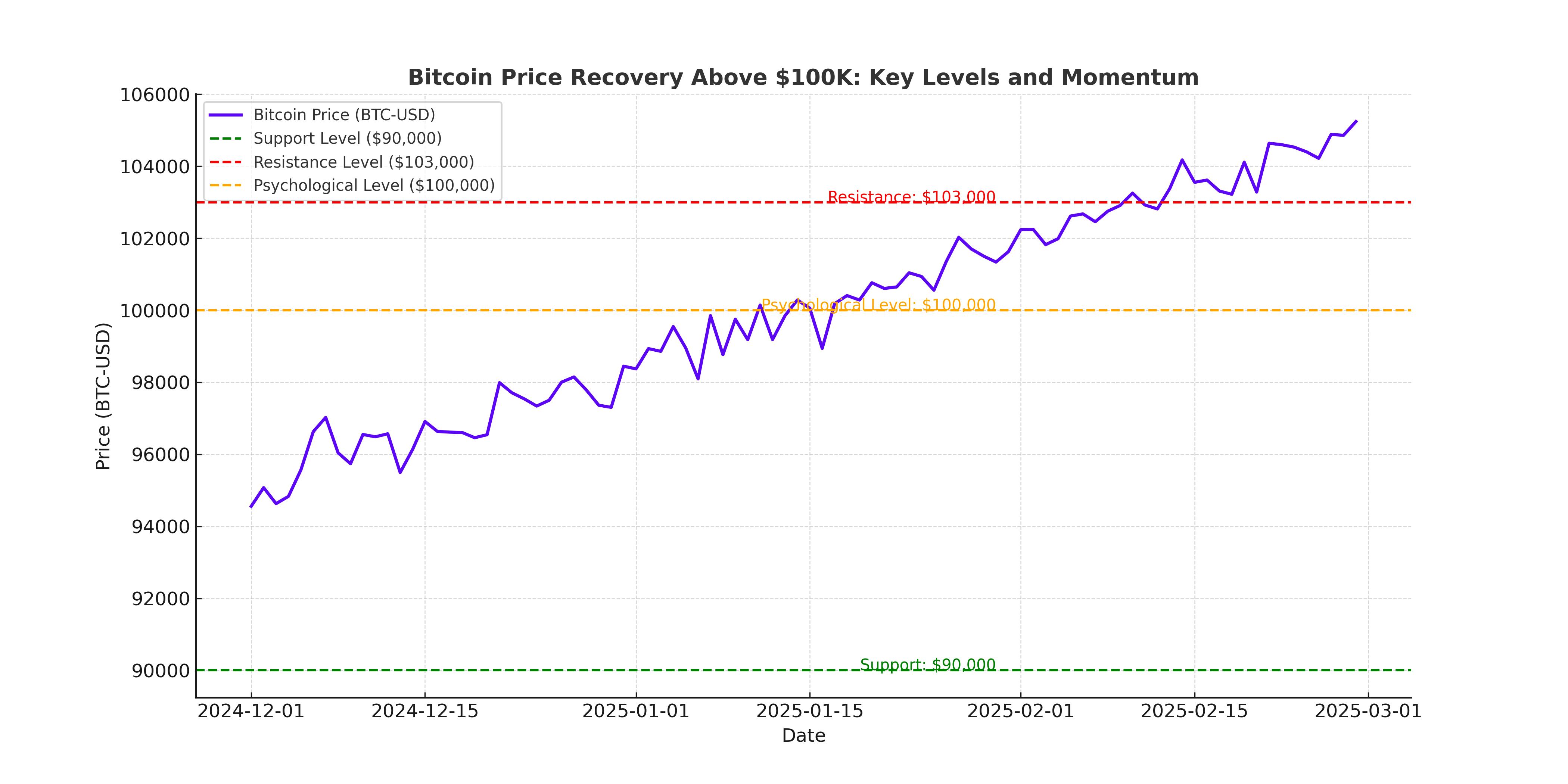

Bitcoin’s Technical Analysis: Can It Sustain Momentum?

From a technical perspective, Bitcoin’s recovery to $100,000 positions it for a retest of its December 2024 all-time high at $108,353. Key resistance lies at $103,000, with a potential breakout paving the way for further gains. Indicators such as the Relative Strength Index (RSI), which sits above its neutral level at 52, signal strengthening bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator is nearing a bullish crossover, which could confirm an upward trend.

However, downside risks persist. A failure to maintain support above $90,000 could lead to a retracement toward $85,000, especially if macroeconomic conditions worsen or regulatory changes disappoint. The interplay of technical and fundamental factors will be crucial in determining Bitcoin’s trajectory in the coming months.

Bitcoin and Its Correlation with the NASDAQ

Bitcoin’s price movements have increasingly mirrored the NASDAQ, with the 30-day correlation reaching a high for 2024. This linkage underscores Bitcoin’s evolving role as a risk asset, influenced by market liquidity and monetary policy expectations. Analysts note that favorable policies from the Trump administration could decouple Bitcoin from traditional markets, enhancing its appeal as a standalone asset class.

Whale Activity and On-Chain Metrics Support Bullish Sentiment

On-chain data reveals significant accumulation by Bitcoin whales. Holders with 10 to 10,000 BTC have added 2,997 BTC since January 1, 2025, signaling growing confidence in Bitcoin’s long-term potential. Whale activity often precedes major price movements, as these investors typically have access to superior market insights and a longer investment horizon.

The Role of Altcoins in the Broader Crypto Market Rally

Bitcoin’s rise has lifted the entire cryptocurrency market, with Ethereum (ETH) up 4.4% to $3,300 and Solana (SOL) climbing 5.4%. Total market capitalization has increased by 5.6% to $3.33 trillion, reflecting a broader bullish sentiment. Altcoins continue to benefit from Bitcoin's price leadership, with many tracking its performance closely.

Market Risks: Volatility and Potential Drawdowns

Despite the bullish outlook, Bitcoin remains susceptible to volatility. Standard Chartered recently warned of a potential dip to $80,000 if macroeconomic conditions deteriorate. Factors such as stronger-than-expected inflation, Federal Reserve hawkishness, and profit-taking by institutional investors could pressure prices. Traders must navigate these risks carefully, balancing short-term volatility with Bitcoin's long-term growth potential.

Conclusion

Bitcoin's recovery above $100,000 signals renewed investor confidence driven by favorable macroeconomic conditions, regulatory optimism, and technical momentum. While risks remain, the convergence of bullish factors points to further upside potential. As the cryptocurrency market evolves, Bitcoin’s resilience and its ability to navigate challenges will determine its role as a cornerstone of the digital economy. Investors should monitor key levels, policy developments, and whale activity to position effectively in this dynamic market.