Bitcoin's Volatility - Regulatory and Economic Uncertainties

Analyzing Bitcoin's Price Dynamics and the Influence of SEC Decisions and U.S. Interest Rates on Crypto Investments | That's TradingNEWS

Analyzing the Fluctuations in Bitcoin's Market Amidst Regulatory Challenges

Market Dynamics and Bitcoin's Recent Price Actions

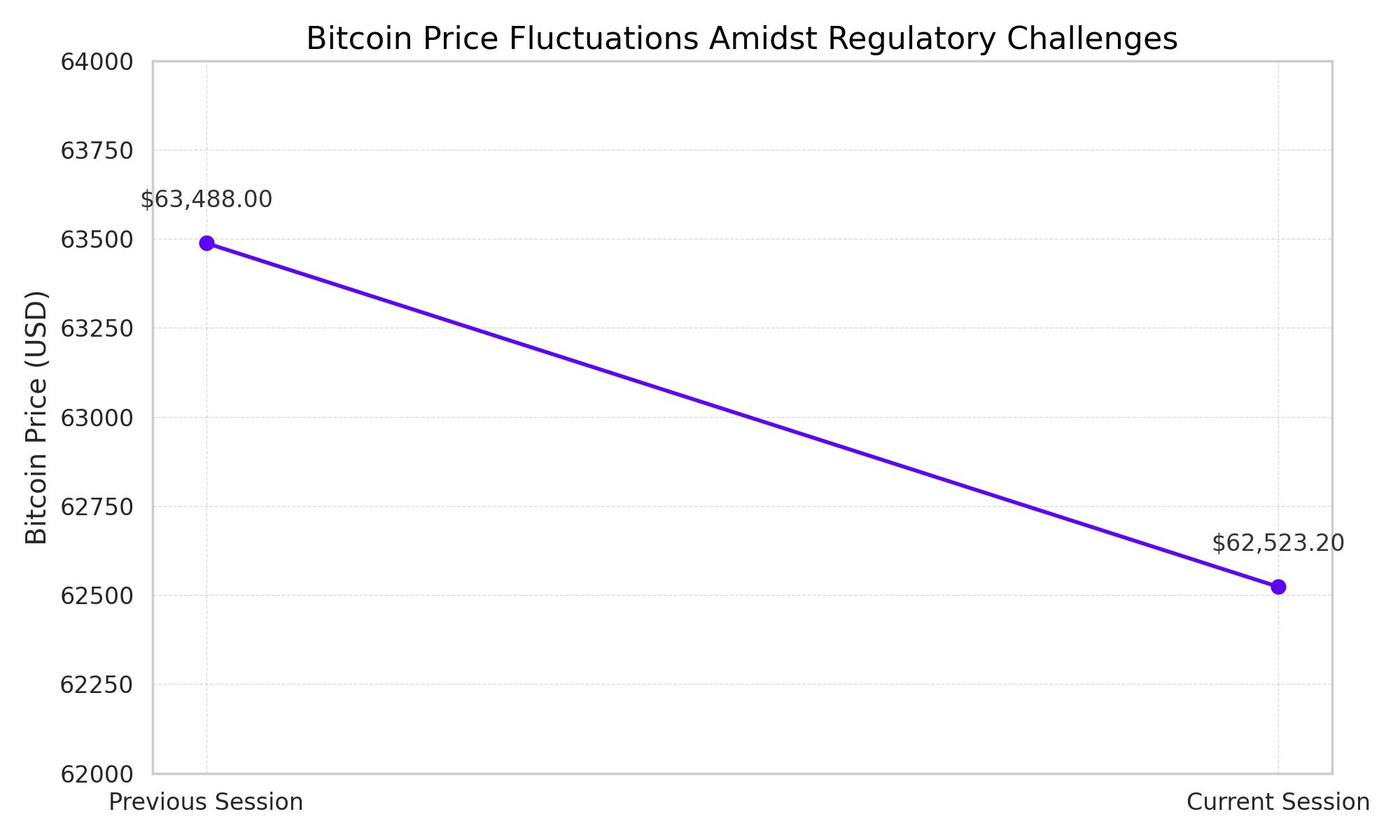

Bitcoin's price trajectory has experienced significant fluctuations, reflecting a broader uncertainty in the cryptocurrency market. Recent trading sessions have seen Bitcoin decline by 1.5% to a value of $62,523.20. This downturn aligns with a broader hesitance among traders, attributable to heightened regulatory scrutiny and a tentative stance on U.S. interest rates by Federal Reserve officials, hinting at a likelihood of rates remaining unchanged through 2024. This macroeconomic backdrop has influenced a rebound in the U.S. dollar, adding pressure to Bitcoin and broader cryptocurrency valuations.

Regulatory Impacts and Investor Sentiment

The investment climate for Bitcoin has been further complicated by substantial capital outflows, marking a third consecutive week of declines, particularly highlighted by fading enthusiasm in crypto-related exchange-traded funds (ETFs). These outflows coincide with growing regulatory concerns, particularly a critical report suggesting that over 90% of stablecoin transactions lack organic user activity, casting shadows over the real demand within the crypto market.

The SEC's Tightening Grip

Amid these market movements, the Securities and Exchange Commission (SEC) remains a pivotal figure, with ongoing deliberations over the classification of cryptocurrencies like Ethereum as securities, potentially reshaping the regulatory landscape. Notably, the SEC has delayed its decision on approving spot-traded Ethereum ETFs, with prevailing expectations leaning towards a rejection. These regulatory uncertainties are pivotal, influencing both market sentiment and the strategic positioning of investors.

Economic and Regulatory Influences on Bitcoin Prices

Investors in the cryptocurrency market are currently contending with a volatile environment influenced by a mix of regulatory developments and shifting economic indicators. As of recent trading sessions, Bitcoin has adjusted to a price level of $62,523.20, reflecting a 1.5% decline within 24 hours. This movement is indicative of broader market uncertainties, influenced heavily by speculative reactions to potential U.S. monetary policy adjustments.

Strategic Market Positioning Amidst Uncertainty

The importance of vigilant monitoring of U.S. Federal Reserve communications cannot be overstated, as their indications towards interest rate policies directly impact investment strategies in the crypto sector. The current market scenario suggests an urgency for investors to employ a cautious strategy, particularly focusing on strategic market entries and exits. This approach is essential in a landscape where unexpected regulatory announcements and economic data releases can trigger significant price fluctuations.

Bullish Factors and Strategic Entry Points

Understanding the influence of regulatory news on market dynamics is essential for making informed investment decisions. For example, Bitcoin’s resilience in maintaining a price above $62,000 despite regulatory pressures and market fluctuations indicates strong underlying market confidence. This resilience provides a bullish outlook for Bitcoin as it continues to demonstrate strength amid regulatory uncertainties.

Implementing Robust Risk Management

Investors should employ robust risk management strategies, including setting precise entry and exit points to capitalize on market movements influenced by regulatory announcements. For instance, placing strategic buy orders following a dip caused by regulatory fears can be beneficial if the market’s reaction is exaggerated. Moreover, setting stop-loss orders can protect investments from sudden downturns in a market known for its high volatility.

Proactive and Flexible Portfolio Management

Staying updated with the latest regulatory developments and their potential impacts allows investors to adjust their portfolios proactively. This could mean reallocating investments towards cryptocurrencies that might benefit from new regulations or reducing exposure to those likely to be negatively impacted. Such a proactive approach not only mitigates risks but also positions investors to take advantage of positive shifts in the market landscape.