Bitcoin's $102,000 Momentum: Could 2025 See BTC Hit $160,000?

Exploring Price Drivers: ETFs, Institutional Interest, and the 2024 Halving's Impact | That's TradingNEWS

Bitcoin (BTC-USD) Soars Past $100,000: Analyzing the Milestones and Future Potential

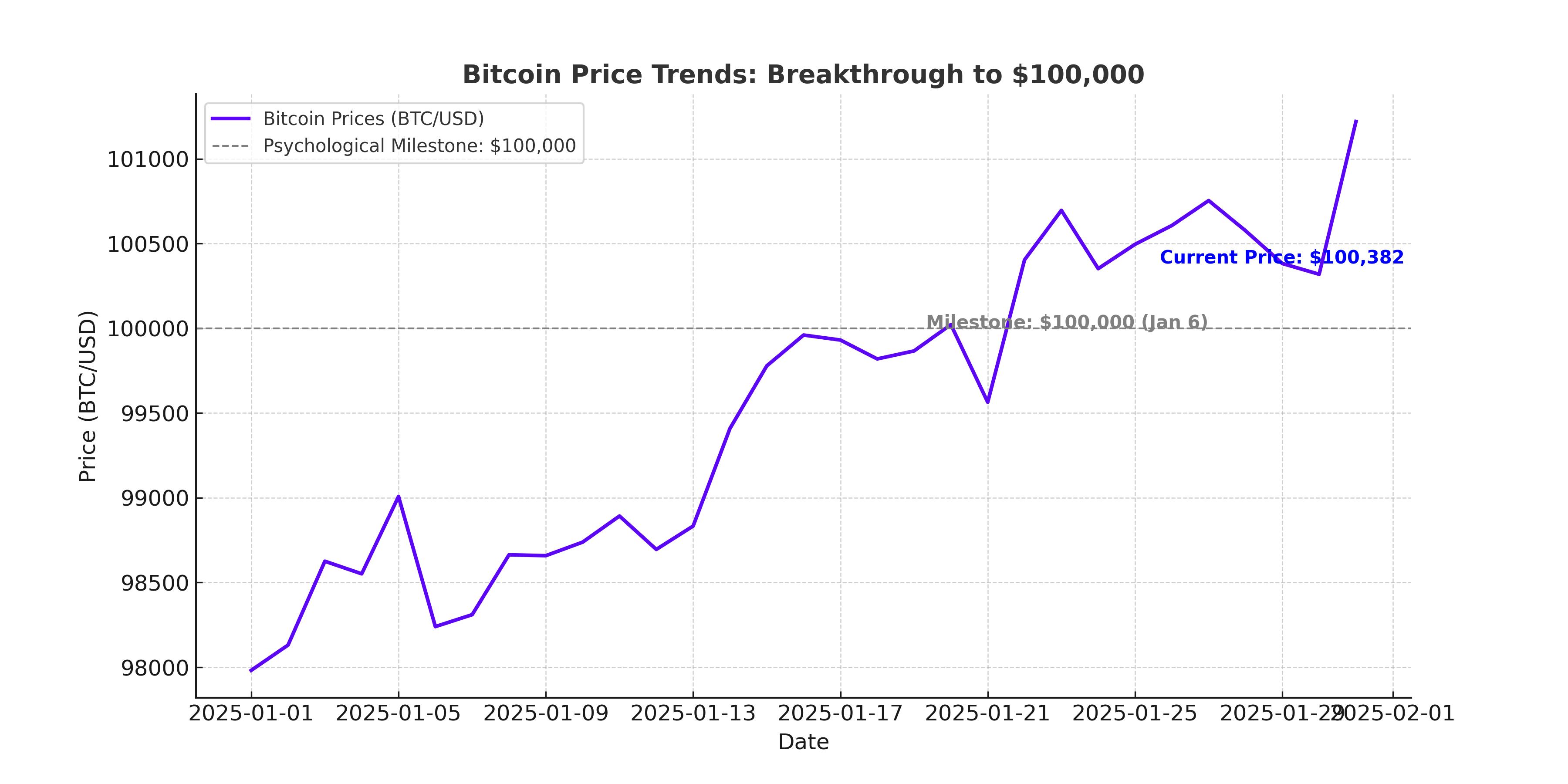

Bitcoin (BTC-USD) has entered 2025 with unparalleled momentum, surging past the $100,000 mark for the first time on Monday, January 6. The milestone signifies a pivotal moment for the cryptocurrency market, driven by institutional interest, reduced exchange supplies, and renewed optimism around pro-crypto regulatory developments under the new U.S. administration. Trading at $101,184, Bitcoin's performance highlights key market catalysts and future projections that demand closer scrutiny.

Institutional Inflows and ETF Momentum Bolster Bitcoin’s Rally

One of the primary drivers behind Bitcoin's recent surge is the resurgence of institutional inflows. After a subdued December, Bitcoin-based spot ETFs witnessed net inflows of $908.1 million on January 3, marking the largest single-day volume since mid-December 2024. These inflows, predominantly from U.S.-based ETFs, including Fidelity and BlackRock funds, have significantly boosted market liquidity and fueled the price surge.

MicroStrategy (NASDAQ: MSTR), a corporate giant known for its aggressive Bitcoin acquisitions, recently purchased 1,070 BTC for $101 million at an average price of $94,004 per Bitcoin. This move brings MicroStrategy’s total Bitcoin holdings to 447,470 BTC, valued at approximately $44.4 billion. The company's sustained commitment to Bitcoin further underscores the increasing role of corporate treasuries in driving market demand.

Shrinking Exchange Supply Points to Long-Term Holder Confidence

Data from on-chain metrics reveals a significant decline in Bitcoin held on exchanges, a strong indicator of long-term holder confidence. Platforms such as Coinbase, Binance, and Bitfinex experienced notable outflows, collectively reducing the available BTC supply. Coinbase alone saw a 30-day outflow of 48,000 BTC, reflecting a growing trend of investors moving assets to private wallets for long-term storage.

With fewer Bitcoins available for trading, the market experiences reduced selling pressure, creating an environment conducive to price growth. Over-the-counter (OTC) desk holdings are also at historic lows, tightening supply further and reinforcing a bullish outlook.

Pro-Crypto Policies Under Trump Administration Fuel Optimism

The anticipation of pro-crypto policies under President-elect Donald Trump has ignited renewed enthusiasm among investors. Trump's campaign promises included the establishment of a strategic Bitcoin reserve for the U.S., aiming to acquire up to 1 million BTC over five years. This bold move signals a potential shift in how governments view cryptocurrencies, positioning Bitcoin as a critical asset in global financial strategies.

The appointment of pro-crypto officials to key regulatory positions, including the SEC and AI & Crypto Czar, is expected to foster a favorable environment for blockchain innovation. Regulatory clarity could drive further adoption, attracting institutional and retail investors alike.

Technical Analysis: Resistance Levels and Market Indicators

Bitcoin’s upward trajectory positions it to challenge resistance at $102,800, a critical level on the BTC/USDT daily chart. If successfully breached, the path toward the all-time high of $108,353 becomes viable. Key support zones between $95,151 and $96,100 provide a cushion against potential corrections.

Technical indicators reinforce the bullish momentum. The Relative Strength Index (RSI) currently reads 56 and is trending upward, signaling strength in market sentiment. Meanwhile, the Moving Average Convergence Divergence (MACD) continues to flash green histogram bars, indicating sustained positive momentum.

Cathie Wood’s $1 Million Price Target Gains Traction

Cathie Wood, CEO of ARK Invest, has doubled down on her prediction that Bitcoin could reach $1 million by 2030. This projection is based on Bitcoin’s inherent scarcity and increasing demand from institutional investors, nation-states, and retail holders. Wood's model assumes a 2.5% to 6.5% portfolio allocation to Bitcoin by institutional investors and growing recognition of BTC as a hedge against inflation.

Where is Bitcoin Headed Next?

Analysts are divided on Bitcoin’s short-term trajectory but largely bullish in the medium to long term. Bernstein projects a $200,000 price target by the end of 2025, driven by ETF inflows exceeding $70 billion and corporate treasury adoption surpassing $50 billion. Meanwhile, Javon Marks forecasts a 14% rise to $113,386 in the coming months, supported by historical trends and growing investor optimism.

MicroStrategy's ongoing plans to raise $2 billion for further Bitcoin purchases could provide additional upward pressure on prices. However, market watchers caution that Bitcoin must maintain its support above $97,000 to avoid a reversal that could test lower levels.

Final Thoughts

Bitcoin’s historic rise above $100,000 represents more than a price milestone—it underscores the cryptocurrency's evolving role in institutional portfolios, corporate strategies, and even national reserves. While challenges such as regulatory uncertainty and potential volatility remain, Bitcoin’s strong fundamentals and growing adoption signal a promising future. Investors eyeing BTC must weigh these dynamics carefully, as the digital asset market enters a transformative phase in 2025.