Bitcoin’s $58K Resistance Battle: A Prelude to a Potential Bull Run?

As Bitcoin hovers around $58,000, it faces a crucial resistance level. This battle could determine the next move, with historical patterns suggesting that a breakthrough might ignite a significant rally. Are we on the brink of a new bullish wave? | That's TradingNEWS

Bitcoin Faces a Critical Juncture: Price Action, On-Chain Metrics, and Market Sentiment Analysis

Testing Key Levels: Bitcoin's Technical Landscape

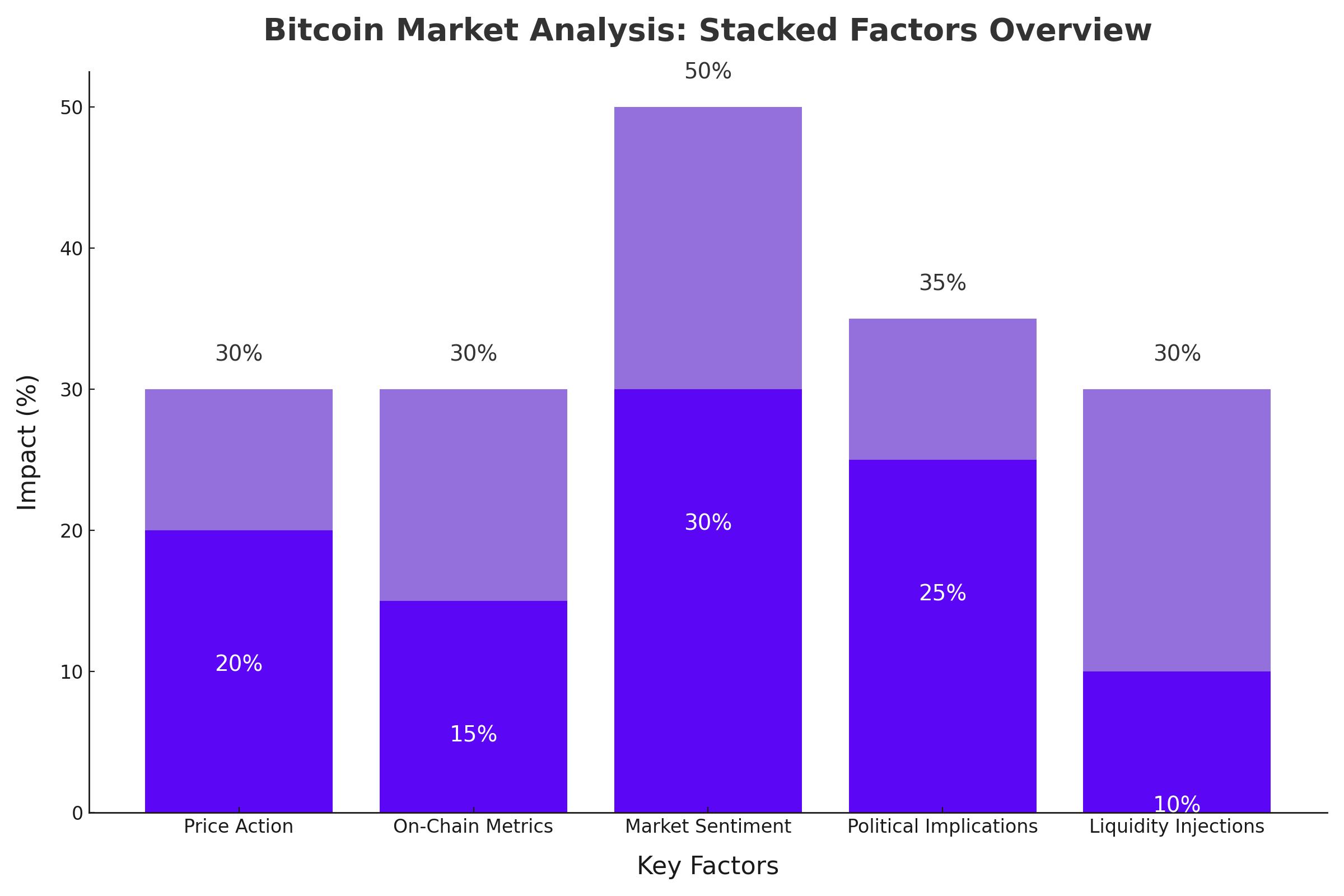

Bitcoin (BTC) has been navigating a turbulent market environment, with its price action reflecting the broader uncertainty in the financial landscape. The cryptocurrency recently broke below the critical 200-day moving average, situated around the $63,000 mark, which has historically served as a significant support and resistance level.

After plunging to a low of $50,000, Bitcoin managed to stage a recovery, briefly retesting the 200-day moving average. However, this recovery was short-lived as the market rejected the rally, pushing BTC back down. Currently, Bitcoin is eyeing the $56,000 support level, a crucial juncture that could dictate its next move. Should this level hold, it might pave the way for a renewed attempt to breach the 200-day moving average, potentially sparking the beginning of a new bullish phase.

In a shorter timeframe, particularly on the 4-hour chart, Bitcoin's price has shown signs of resilience, bouncing back rapidly from the $52,000 support following a recent drop. However, the market is encountering stiff resistance at the $61,000 level, creating a bullish flag pattern. A successful breakout from this pattern could propel Bitcoin towards the $64,000 level in the near term. Conversely, failure to breach this resistance could see the market retesting the $52,000 support, posing further challenges.

Bitcoin Exchange Reserves Signal Potential Supply Shock

While Bitcoin’s price action remains under pressure, fundamental network metrics suggest a different story. One key metric, the Bitcoin exchange reserve, has been steadily declining since the beginning of 2024. This metric, which tracks the amount of BTC held in exchange wallets, serves as a proxy for potential selling pressure. A decreasing reserve indicates that investors are withdrawing their Bitcoin from exchanges, typically a sign of accumulation and long-term holding.

The significant reduction in exchange reserves points to a potential supply shock on the horizon. If this trend continues, it could lead to a scarcity of Bitcoin available for sale, potentially driving prices higher in the coming months. This accumulation behavior is a positive indicator, reflecting growing investor confidence in Bitcoin's long-term prospects.

Market Sentiment and Reaction to Economic Data

Bitcoin’s price movements have also been influenced by broader economic indicators, particularly the latest U.S. Consumer Price Index (CPI) data. The CPI print, which came in below expectations, initially provided a boost to risk assets, including cryptocurrencies. Bitcoin briefly spiked to nearly $62,000 following the release of the data, but the rally was short-lived, with the price falling by more than 3% within an hour.

This volatility underscores the sensitive nature of the cryptocurrency market to macroeconomic data. As markets now see a 41% chance of a 50 basis point rate cut by the Federal Reserve in September, down from 50% before the CPI release, the reduced likelihood of aggressive monetary easing has tempered bullish sentiment in the Bitcoin market. Lower interest rates typically increase the attractiveness of riskier assets like Bitcoin by reducing the opportunity cost of holding non-yielding assets.

Political Implications and Bitcoin’s Market Dynamics

The intersection of politics and cryptocurrency has become increasingly apparent, particularly in the lead-up to the 2024 U.S. presidential election. Bitcoin and crypto have emerged as partisan issues, with significant implications depending on the outcome. The potential for a crypto crackdown under a Kamala Harris administration, as speculated by market observers, could weigh heavily on Bitcoin’s future.

On the other hand, prominent figures like former President Donald Trump have hinted at a major Bitcoin-related announcement, which could have a substantial impact on market sentiment. The political landscape is likely to play a crucial role in shaping the regulatory environment for cryptocurrencies in the United States, further adding to the uncertainty.

Liquidity Injections and Market Implications

Looking ahead, macroeconomic analysts like Arthur Hayes, co-founder of BitMEX, have speculated that the U.S. Treasury might inject significant liquidity into the financial system before the end of 2024. This move, potentially driven by political motivations to support the economy ahead of the election, could be a major catalyst for Bitcoin.

Hayes argues that such a liquidity injection could push Bitcoin past its all-time high, with targets of $100,000 being floated. The Treasury’s actions, whether through emptying the Reverse Repo Program or spending from the Treasury general account, could create a bullish environment for risk assets, including Bitcoin, as liquidity conditions improve.

On-Chain Metrics and Long-Term Holder Activity

On-chain data provides further insights into Bitcoin’s current market dynamics. Long-term holders, who had been distributing their coins during the earlier part of the year, are now showing signs of renewed accumulation. This shift in behavior indicates growing confidence in Bitcoin’s future prospects, as these holders are less likely to sell in the short term, reducing overall selling pressure in the market.

This accumulation trend, particularly among large wallets often associated with institutional investors, suggests that Bitcoin could be poised for a recovery, provided external conditions remain favorable. The reduction in selling pressure from long-term holders could support a price rally, especially if accompanied by positive macroeconomic developments.

Technical Outlook and Key Levels to Watch

From a technical perspective, Bitcoin’s price action is currently pressured below the 50-3D exponential moving average (EMA), a critical level that has often dictated market direction. A breakout above this level could see Bitcoin targeting the $66,900 resistance, which aligns with the upper trendline of the prevailing descending channel pattern.

However, failure to break above the 50-3D EMA could result in a decline towards the lower trendline, around $54,800. This level, which corresponds with the 0.236 Fibonacci retracement line, will be crucial in determining Bitcoin’s next move. The market’s response to these key technical levels will likely set the tone for Bitcoin’s performance in the coming weeks.

Conclusion

As Bitcoin navigates through a complex landscape of technical levels, on-chain metrics, and macroeconomic factors, the market remains at a critical juncture. The interplay between support and resistance levels, coupled with broader market sentiment and political developments, will be key in shaping Bitcoin’s trajectory. Investors should closely monitor these factors, as the cryptocurrency could be poised for significant moves in the near future. Whether Bitcoin can sustain its recovery and break above key resistance levels or faces further downside will depend on a confluence of technical, fundamental, and macroeconomic drivers.

That's TradingNEWS

Bitcoin Price Outlook: Can BTC-USD Break Past $90,000 in 2025?

Bitcoin Price Drops Below $82K: Is BTC Poised for a Rebound or Heading Toward $78K?