Bitcoin (BTC-USD): Analyzing Price Momentum, Mining Trends, and Market Predictions

BTC Price Hits All-Time High, Tests Resistance

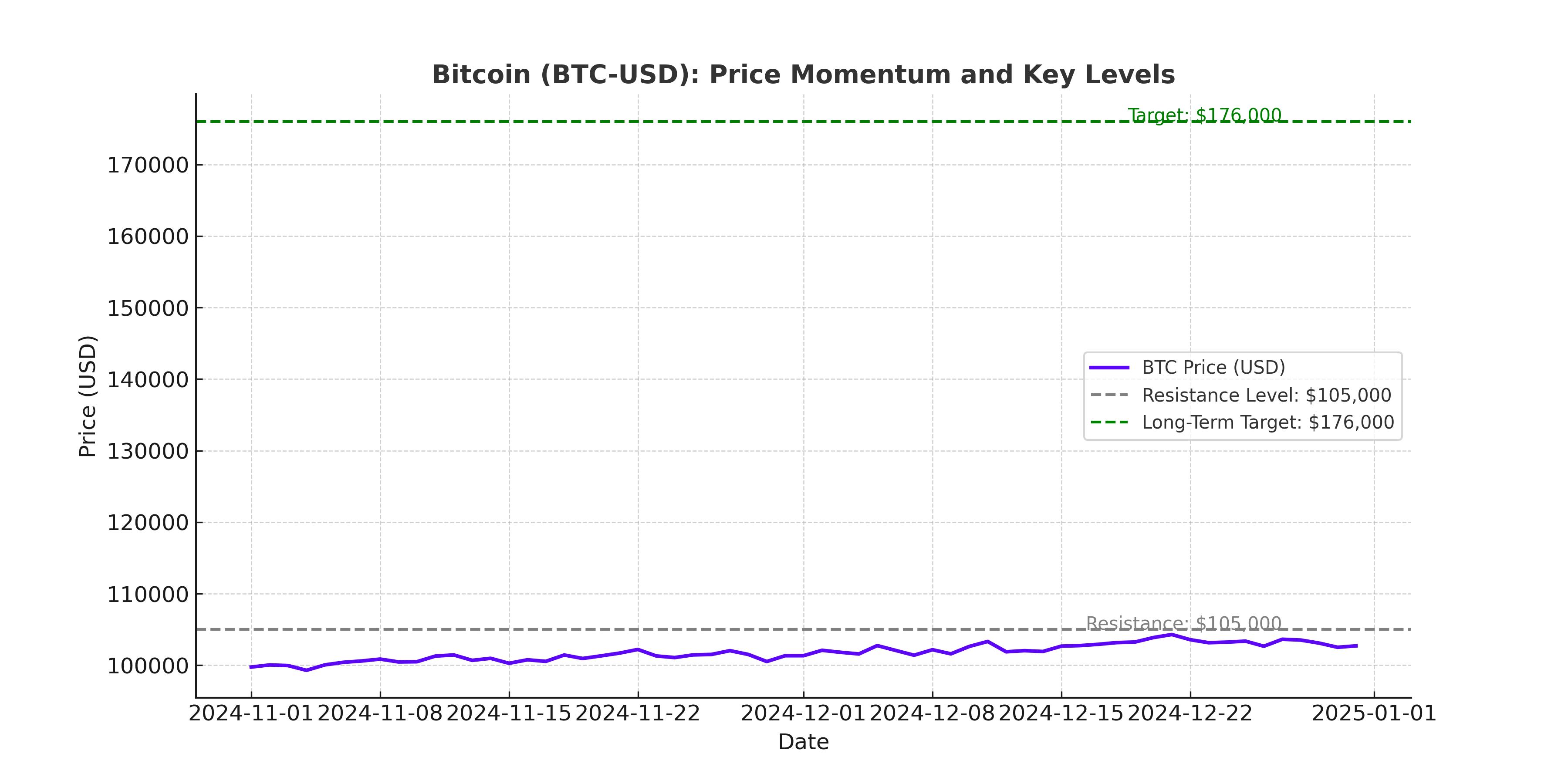

Bitcoin (BTC-USD) recently reached a record high of $103,647 on December 5, marking a significant milestone in its 2024 bull cycle. While the price temporarily dropped after hitting this level, it quickly recovered, maintaining support above $100,000. At the time of writing, Bitcoin is trading at $103,100, reflecting a 3% increase over the past week. The cryptocurrency remains in close range of its peak and continues to show resilience amid heightened market activity.

Market analysts are watching for Bitcoin's next breakout, with the $105,000 level highlighted as a critical resistance point. A successful push above this threshold could open the doors to higher targets, including $130,000 and $176,000 in the current cycle. This bullish momentum is fueled by growing institutional interest, favorable macroeconomic conditions, and the increasing adoption of Bitcoin as a hedge against inflation and currency devaluation.

Mining Dynamics: A Potential Warning Sign?

One notable development in December is the significant drop in Bitcoin miners’ holdings. Miners have sold over 140,000 BTC, worth approximately $13.72 billion, reducing their cumulative holdings from 2.08 million BTC to 1.95 million BTC. This marks one of the largest reductions in miner reserves in recent years.

Large-scale miner sales often signal financial stress or strategic repositioning within the mining sector. The sale of such a significant quantity of BTC could exert downward pressure on Bitcoin's price, especially if the supply released by miners outpaces market demand. While miners frequently liquidate holdings to cover operational costs, the scale of the sell-off has raised concerns about potential miner capitulation, which typically occurs during bear markets or periods of extreme price volatility.

Despite these sales, Bitcoin has demonstrated strong support near $100,000, with only brief pullbacks. This stability suggests robust underlying demand and continued investor confidence in the cryptocurrency's long-term growth potential.

Bullish Long-Term Predictions: $176,000 and Beyond

Looking ahead, prominent analysts are forecasting substantial price increases for Bitcoin. Using Fibonacci retracement levels and historical price patterns, one market strategist predicts BTC could reach $176,000 in this bull cycle, potentially forming the cycle's local peak. This target aligns with broader market expectations of Bitcoin's ability to act as a safe-haven asset amid global economic uncertainty.

Additionally, the highly regarded stock-to-flow model supports even more ambitious projections, suggesting Bitcoin could average $500,000 in 2025, with peak prices potentially exceeding $800,000. This model attributes its predictions to Bitcoin's fixed supply of 21 million coins and the anticipated acceleration of institutional and government adoption. For instance, the United States Treasury's rumored plans to accumulate 200,000 BTC annually could further tighten supply and drive prices higher.

Institutional Adoption and ETF Momentum

The introduction of spot Bitcoin ETFs has significantly enhanced accessibility for both retail and institutional investors. BlackRock's iShares Bitcoin Trust, in particular, has seen explosive growth, surpassing $35 billion in assets under management. This fund alone has outpaced the combined inflows of all other spot Bitcoin ETFs, demonstrating the strength of institutional demand.

The success of these ETFs is reshaping Bitcoin's investor base, attracting capital from traditional financial markets. With institutional investors managing over $120 trillion globally, even a modest allocation to Bitcoin could have a profound impact on its price. For example, a 2% allocation from global reserve assets, estimated at $900 trillion, could theoretically drive Bitcoin's price to $900,000 per coin.

On-Chain Metrics Signal Further Growth

Several on-chain indicators suggest Bitcoin's current bull cycle still has room to grow. The MVRV Z-Score, which compares market value to realized value, currently sits at 3.2, below the overbought threshold of 7. Historical trends indicate the indicator has further upside potential before reaching cycle highs. Similarly, the Puell Multiple, which measures miner revenue relative to its historical average, is currently at 1.22, well below previous cycle peaks, signaling potential for additional upward momentum.

The Pi Cycle Top indicator, which has accurately predicted past market tops, has yet to signal a peak in the current cycle. These metrics collectively point to the likelihood of further price appreciation in the months ahead.

Retail and Long-Term Holder Behavior

Retail investors, often represented by "shrimp wallets" holding less than one BTC, continue to accumulate despite high prices. The number of shrimp wallets is projected to rise by 8.67%, reaching 351,000. This trend reflects growing confidence among smaller investors in Bitcoin's long-term potential.

Conversely, long-term holders have reduced their positions, selling 827,783 BTC over the past 30 days. This shift may indicate that some investors believe the market is nearing a local top, although realized profit-taking and sell-side pressure have declined in recent weeks, suggesting less severe price corrections moving forward.

Macroeconomic and Regulatory Factors

Bitcoin's price trajectory is closely tied to macroeconomic conditions and regulatory developments. The incoming U.S. administration is expected to adopt a more pro-crypto stance, with potential executive actions to integrate Bitcoin into the U.S. reserve system. The proposed Bitcoin Act of 2024 aims to position the cryptocurrency as a strategic asset, further legitimizing its role in global financial markets.

Additionally, declining interest rates and potential tariffs under the new administration could spur renewed interest in alternative assets like Bitcoin. Historical data shows that Bitcoin performs well in low-rate environments, as investors seek higher-yielding opportunities.

Price Outlook and Investment Considerations

Bitcoin's journey beyond $100,000 marks a historic milestone, with projections ranging from $176,000 in the current cycle to $500,000 or more by 2025. These forecasts are underpinned by strong institutional demand, limited supply, and favorable macroeconomic conditions. While short-term volatility remains a risk, the long-term outlook for BTC-USD appears overwhelmingly bullish.

Investors should remain mindful of potential corrections and market dynamics, but Bitcoin's growing adoption and resilient market structure suggest it remains a compelling asset in diversified portfolios. Whether as a hedge against inflation or a high-growth investment, Bitcoin continues to redefine the financial landscape.