Bitcoin's Bullish Surge: Why Experts Predict a $150K Target

Analyzing Key Factors Driving Bitcoin's Recent Price Jump and Optimistic Forecasts | That's TradingNEWS

Bitcoin's Price Surge: An Optimistic Forecast

Bullish Impact of Consumer Price Index

Bitcoin's impressive 7.5% price jump is directly tied to recent economic indicators, particularly the Consumer Price Index (CPI). April's CPI narrowly exceeded expectations, registering a 0.3% increase compared to March's 0.4%. This slight decrease has buoyed market sentiment, suggesting potentially easier monetary policies ahead. Such conditions are favorable for risk assets, including Bitcoin.

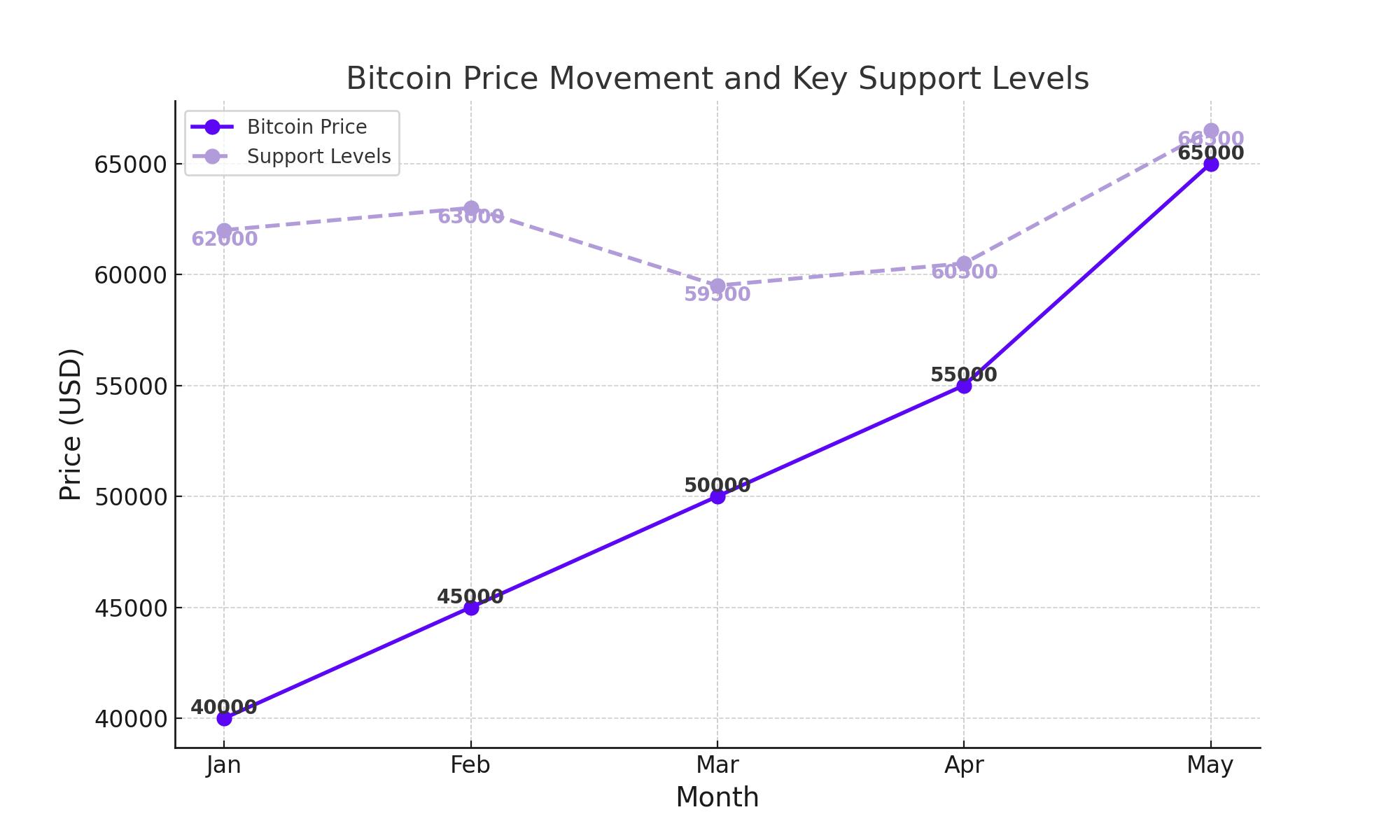

Market Sentiments and Key Support Levels

While the initial response to Bitcoin's price rise is positive, some market analysts express caution. The rapid increase in open interest could hint at an unsustainable price move. However, critical support levels identified by traders like Credible Crypto underscore the importance of the $62,000 to $63,000 range. Maintaining this support could prevent a dip back to $59,000-$60,000, setting the stage for further gains.

Daan Crypto Trades has highlighted significant ask liquidity above the current price, with orders exceeding $400 million between $66,000 and $67,000. Should Bitcoin breach these levels, it could trigger a rapid price increase, further reinforcing the bullish trend.

Optimistic Projections from Veteran Traders

Veteran traders like Peter Brandt and Michaël van de Poppe are optimistic about Bitcoin's long-term potential. Brandt maintains that Bitcoin's trajectory points towards continued growth, potentially reaching new all-time highs. Van de Poppe predicts a steady upward movement, with altcoins likely to outperform as market confidence strengthens. He notes the robust support at $60,500, suggesting that this level could act as a launchpad for further price increases.

Institutional Adoption and Future Growth

QCP Capital forecasts a return to Bitcoin's all-time highs of $74,000, driven by sovereign and institutional adoption, easing inflation, and the upcoming U.S. elections. These factors collectively create a favorable environment for Bitcoin's continued appreciation.

Federal Reserve's Influence and Market Potential

Recent U.S. inflation data has propelled Bitcoin's price above $65,000 for the first time since early May. Market participants are increasingly betting that the Federal Reserve might soon declare victory over inflation and cut interest rates. Fundstrat's Tom Lee projects Bitcoin could reach $150,000 this year, citing the $6 trillion in sidelined cash poised to enter the market.

Regulatory Landscape and Market Accessibility

Regulatory developments play a crucial role in Bitcoin's market dynamics. While the U.S. lags behind Europe in regulatory clarity, the approval of Bitcoin ETFs by the SEC has significantly expanded market access for retail and institutional investors. Vanguard's appointment of Salim Ramji, a known crypto advocate, as Chief Executive, signals a potential shift in institutional attitudes towards cryptocurrencies.

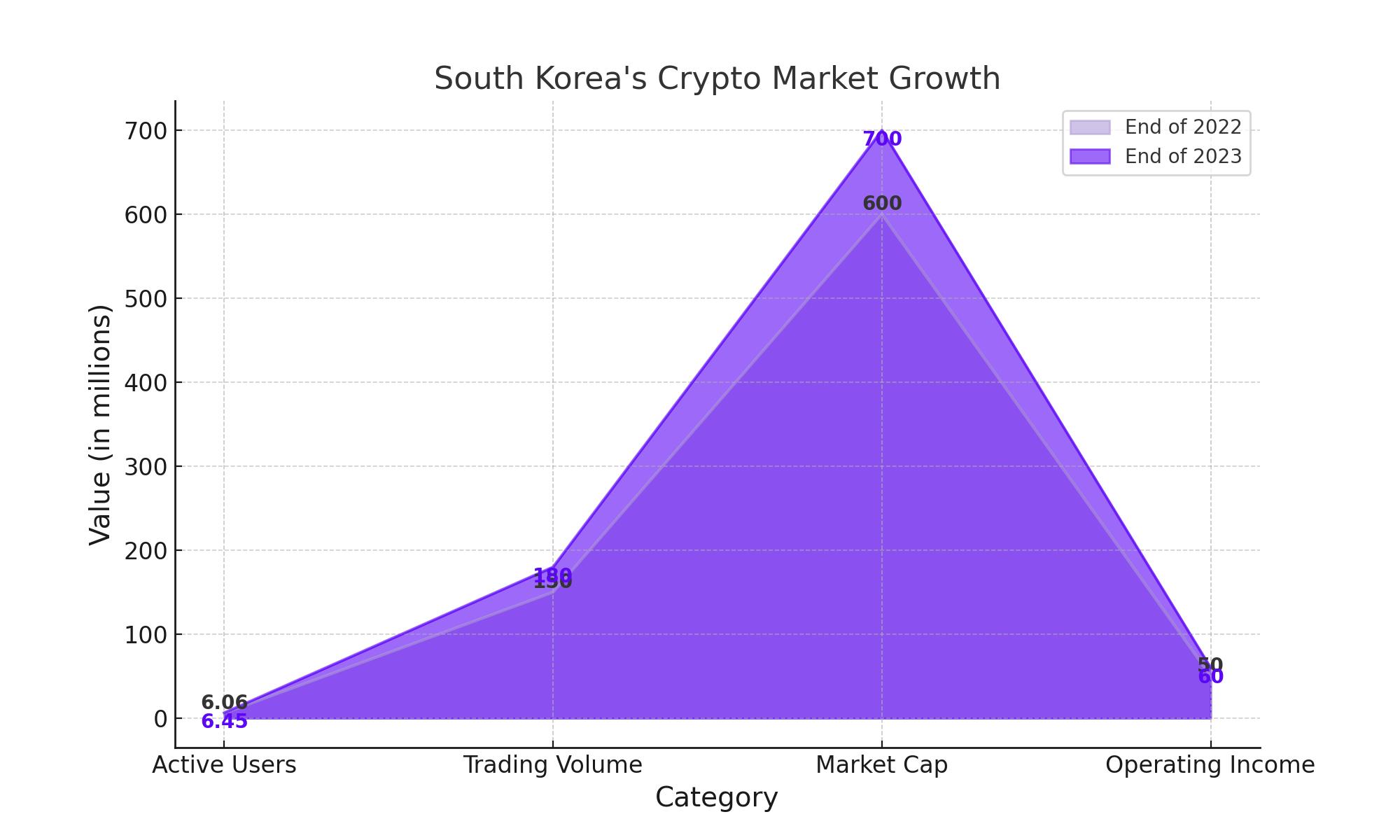

South Korea's Crypto Surge

South Korea's crypto market is booming, with active users on local exchanges increasing by 390,000 to 6.45 million by the end of 2023. This growth reflects a broader recovery in investor sentiment and an increase in trading volumes, market capitalization, and operating income of exchanges. The upcoming Virtual Asset User Protection Act will further bolster this market by introducing stricter regulations and penalties for misconduct.

CME's Expansion into Spot Bitcoin Trading

The Chicago Mercantile Exchange (CME) is reportedly planning to offer spot Bitcoin trading, catering to the rising demand among Wall Street money managers. This move would complement CME's existing cryptocurrency futures offerings, enhancing market accessibility and sophistication. Basis trades, which involve profiting from price gaps between futures and the underlying asset, will become more straightforward, attracting more professional traders.

Institutional Interest and Market Dynamics

Major players like Deutsche Börse and CBOE Global Markets are making significant moves in the crypto space, despite regulatory uncertainties in the U.S. The approval of Bitcoin ETFs and increased institutional participation signal a robust future for Bitcoin and other cryptocurrencies.

Conclusion

Bitcoin's recent price movements are driven by a mix of economic indicators, regulatory developments, and growing institutional adoption. Despite short-term uncertainties, the long-term outlook for Bitcoin remains bullish. Strong market fundamentals, increasing investor interest, and evolving regulatory landscapes suggest that Bitcoin is poised for significant growth, with projections of reaching $150,000 within the year. As the market continues to mature, Bitcoin's trajectory will be shaped by macroeconomic trends and regulatory advancements, solidifying its position as a leading asset in the financial world.