Bitcoin's Unstoppable Ascent: ETF Influence, Halving Impact, and Future Outlook

Diving deep into Bitcoin's market resilience, the strategic influence of ETFs, the anticipated halving event, and speculative price trajectories shaping the cryptocurrency's future in the financial landscape | That's TradingNEWS

The Bitcoin Phenomenon: Navigating Through Volatility Towards Unprecedented Highs

In the ever-evolving landscape of cryptocurrencies, Bitcoin (BTC) continues to command attention with its remarkable price movements and the underlying technology that offers a glimpse into the future of finance. This comprehensive analysis delves into Bitcoin's recent performance, the strategic milestones affecting its valuation, and the speculative yet intriguing projections that captivate investors and analysts alike.

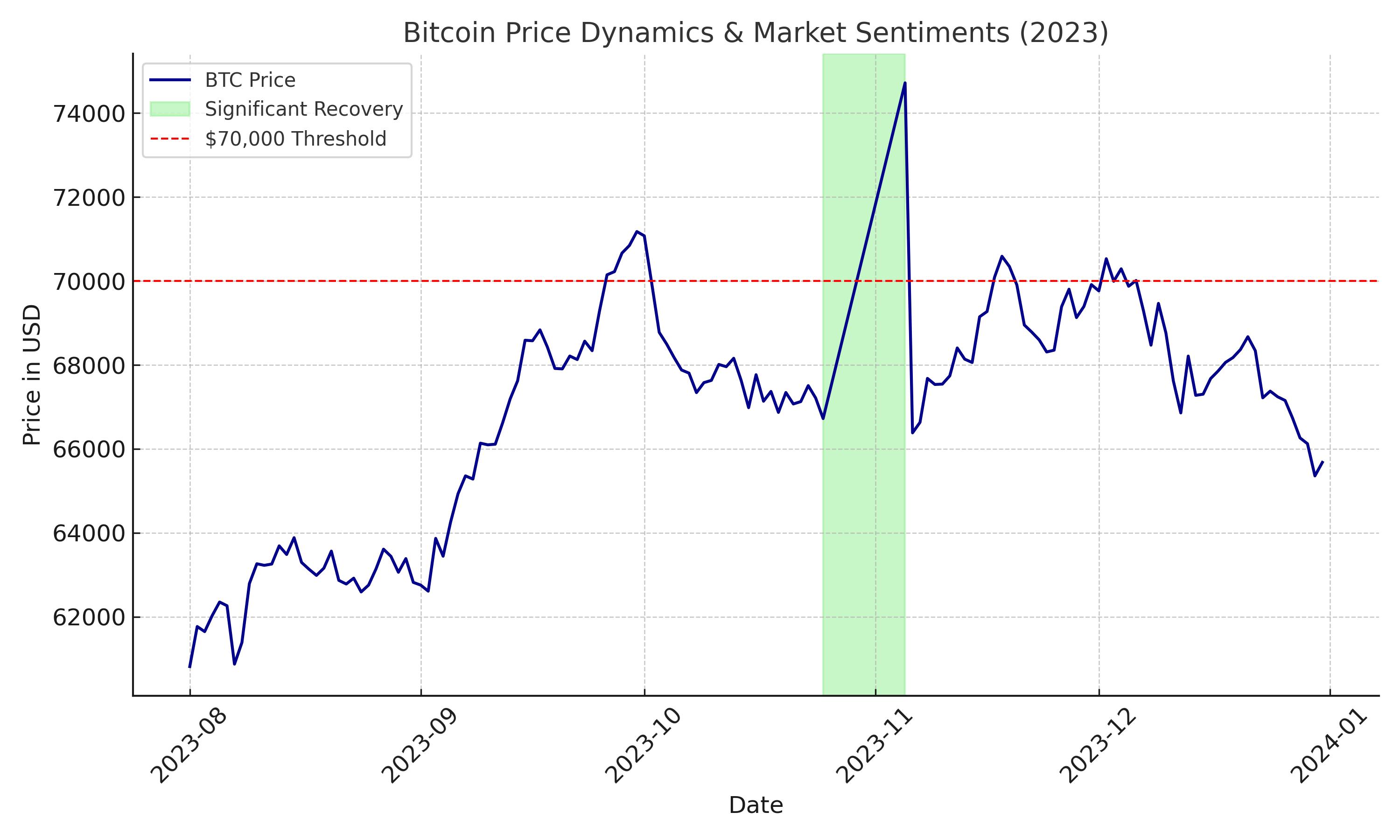

Recent Price Dynamics and Market Sentiments

Bitcoin recently showcased a significant recovery, momentarily breaching the $70,000 threshold after a dip to the $62,000 range, highlighting the cryptocurrency's resilience and the robust demand driving its recovery. This rebound was notably influenced by increased outflows from spot Bitcoin exchange-traded funds (ETFs), signaling a shifting investor sentiment.

The anticipation surrounding the introduction of Bitcoin and Ethereum Exchange-Traded Notes (ETNs) on the London Stock Exchange further buoyed the market, presenting a potential for increased mainstream adoption and investment. However, the allure of profit-taking by long-term holders, amid rising realized profits, poses a delicate balance for Bitcoin's trajectory.

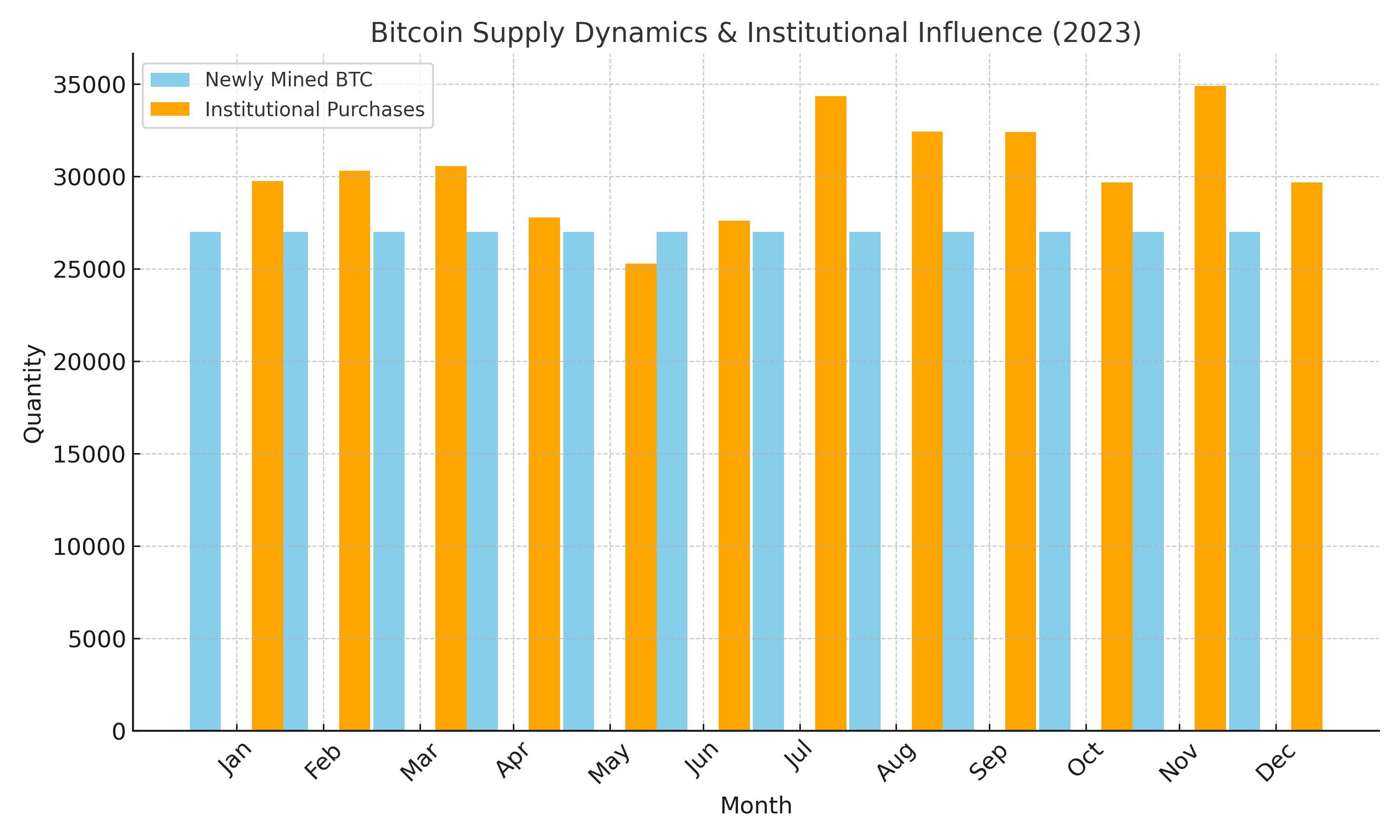

Insights into Bitcoin's Supply Dynamics and Institutional Influence

An analysis of Bitcoin's supply dynamics reveals a telling trend where the aggregate purchases by various Bitcoin cohorts consistently outstrip the newly mined supply. This scenario indicates a bullish sentiment across the investor spectrum, from individual enthusiasts to institutional behemoths, as they collectively absorb more than the monthly issuance of approximately 27,000 BTC.

The introduction and approval of spot Bitcoin ETFs in the U.S. have catalyzed this demand, leading to record inflows and tightening the available supply. This dynamic is particularly noteworthy as we approach the anticipated Bitcoin halving event, slated to reduce the block reward from 6.25 to 3.125 BTC, historically a precursor to significant price rallies.

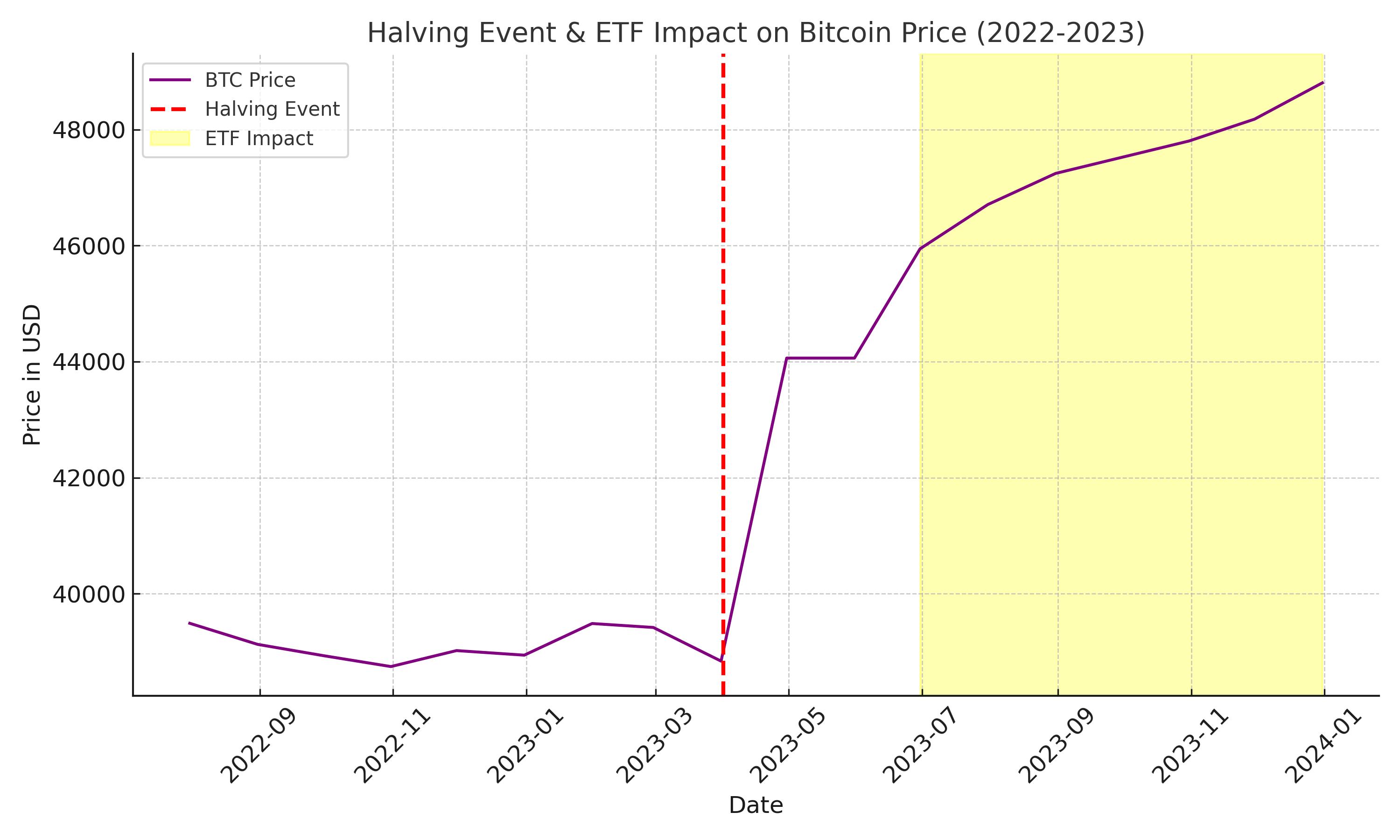

Analyzing the Halving Event and ETF Impact

The halving event, a programmed reduction in Bitcoin's new supply, has historically been a catalyst for substantial price appreciation. As the mining reward halves, the reduced supply, coupled with sustained or increasing demand, tends to drive the price upwards. The upcoming halving, expected to occur around April with the generation of the 740,000th block, has already sparked speculation and bullish forecasts.

Concurrently, the proliferation of Bitcoin ETFs introduces a new layer of institutional participation, potentially exacerbating the supply crunch. This institutional endorsement not only legitimizes Bitcoin as an investment vehicle but also amplifies the effects of the halving by locking away significant portions of the circulating supply.

Projected Price Trajectories: Optimism Amid Speculation

Amid the optimistic market trends and institutional embrace, projections about Bitcoin's price have reached new heights of speculation. Figures ranging from $1.5 million to an eye-watering $3.8 million per BTC by 2030 underscore the massive potential seen by some analysts. These projections rest on assumptions about increasing institutional adoption, portfolio allocations, and the evolving financial ecosystem surrounding Bitcoin.

Navigating the Future: Volatility, Regulation, and Adoption

As Bitcoin continues its journey through price recoveries, halving events, and increased institutional involvement, the road ahead remains fraught with volatility and regulatory uncertainties. The interplay of market dynamics, technological advancements, and macroeconomic factors will shape Bitcoin's future.

Investors and enthusiasts alike are tasked with navigating this complex landscape, balancing the lure of speculative gains with the realities of a market still in its infancy. The potential for growth is undeniable, but it comes with the need for diligence, research, and a preparedness for the volatility inherent in the cryptocurrency market.

Conclusion: A Cautious Optimism

In conclusion, Bitcoin stands at a crossroads, bolstered by institutional interest and upcoming supply constraints, yet tempered by the realities of market volatility and regulatory scrutiny. The speculative projections offer a tantalizing glimpse into a future where Bitcoin could redefine wealth and investment. However, these forecasts should be approached with caution, grounded in a comprehensive understanding of the market's complexities and the technological underpinnings of cryptocurrencies.