BlackRock (NYSE:BLK) Breaks $1,000 – Is the Stock Still a Buy or Has It Peaked?

With assets surpassing $11.6 trillion, record Q4 profits, and aggressive private market expansion, BlackRock is cementing its dominance. But at $1,000 per share, is BLK still a smart investment, or is the stock overpriced? | That's TradingNEWS

BlackRock (NYSE:BLK) Analysis: Dominating Asset Management While Expanding Beyond Traditional Investments

Is BlackRock (NYSE:BLK) an Undervalued Powerhouse or a Stagnant Giant?

BlackRock (NYSE:BLK) continues to solidify its dominance in the asset management industry, recently surpassing $11.6 trillion in assets under management (AUM). The company’s Q4 2024 earnings report revealed a 21% jump in profit, fueled by robust equity markets and growing demand for its exchange-traded funds (ETFs). Despite some concerns about CEO succession and regulatory scrutiny over its exposure to China, BlackRock remains a financial titan with an expanding global footprint, aggressive acquisitions, and a strong dividend growth profile. With shares trading at $1,000, is BlackRock a buy, hold, or sell at this valuation?

BlackRock’s Market Leadership and Record-Breaking Asset Growth

BlackRock’s financial dominance is unparalleled. The firm saw its AUM surge from $10.01 trillion in Q4 2023 to $11.55 trillion in Q4 2024, reflecting continued investor confidence. A major contributor to this expansion has been the strong performance of U.S. equity markets, particularly the post-election rally that has driven increased institutional and retail capital inflows into risk assets.

BlackRock’s Q4 2024 net inflows reached an impressive $281.4 billion, up from $95.6 billion a year ago. A staggering $142.6 billion flowed into BlackRock ETFs alone, underscoring the growing demand for passive investment vehicles. Fixed-income products also performed well, attracting $23.8 billion in client capital, highlighting BlackRock’s ability to capitalize on shifting investor sentiment and macroeconomic conditions.

Despite economic uncertainties, BlackRock’s investment strategies have continued to outperform, leading to record-high earnings of $1.67 billion in Q4, translating to $10.63 per share, up from $9.15 per share a year earlier. With strong profitability metrics and a diversified revenue stream, BlackRock remains the undisputed leader in asset management.

🔗 Check BlackRock’s Real-Time Stock Performance

Strategic Acquisitions and Expansion into Private Markets

BlackRock has aggressively expanded beyond traditional asset management. In 2024, the firm completed two major acquisitions totaling $25 billion, solidifying its position in private markets and alternative investments. The $12.5 billion purchase of Global Infrastructure Partners and the $12.5 billion acquisition of HPS Investment Partners underscore BlackRock’s long-term vision to dominate private equity, infrastructure, and credit markets.

This shift into private markets is strategic. Institutional investors are increasingly allocating capital to private equity, infrastructure, and alternative investments to seek higher returns in a low-yield environment. By expanding its private market presence, BlackRock can capture a larger share of institutional capital, driving higher revenue growth and fee generation compared to traditional ETFs and mutual funds.

Is BlackRock’s Dividend Growth Sustainable?

BlackRock has one of the most attractive dividend growth profiles in the financial sector. The company raised its quarterly dividend to $5.10 per share, representing a 10.2% annualized growth rate over the past decade. The current dividend yield of 1.9% may seem modest, but BlackRock’s ability to sustain double-digit dividend growth makes it an attractive choice for long-term income investors.

The firm’s payout ratio remains conservative at 46.8%, leaving plenty of room for future dividend increases. Given BlackRock’s strong free cash flow generation, dividend hikes are expected to continue for years to come.

Regulatory Concerns and Exposure to China—A Potential Headwind?

Despite its financial strength, BlackRock has faced regulatory scrutiny, particularly regarding its investments in China. A coalition of 17 U.S. state attorneys general has accused BlackRock of downplaying the risks of investing in China, raising concerns about geopolitical tensions and potential sanctions.

This criticism comes amid growing concerns about China’s economic slowdown, regulatory crackdowns, and tensions over Taiwan. Some U.S. policymakers argue that BlackRock has not been transparent enough about the risks associated with Chinese investments, particularly regarding state-controlled enterprises and regulatory unpredictability.

While China remains a key growth market for BlackRock, potential restrictions on U.S. firms investing in China could pose a long-term risk to its emerging market strategies. However, BlackRock has responded by diversifying its investment offerings, particularly through increased exposure to India and other Asian markets, mitigating some of the China-specific risks.

Valuation—Is BlackRock Fairly Priced or Overvalued?

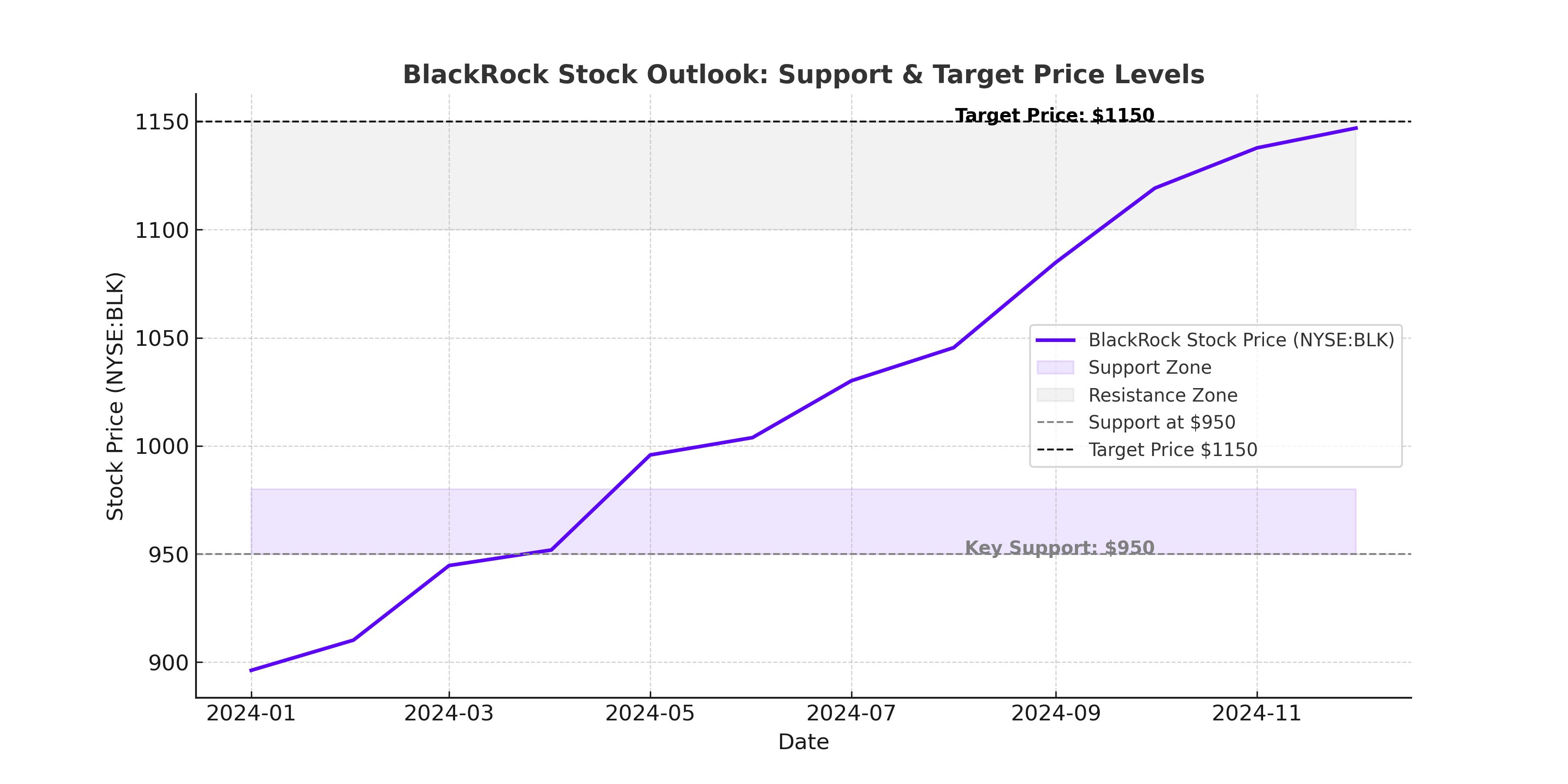

BlackRock currently trades at a forward P/E ratio of 24.16, which is reasonable given its growth trajectory. Despite its strong earnings growth and robust AUM expansion, some investors may question whether the stock is fully valued at $1,000 per share.

Compared to other asset management firms, BlackRock’s valuation is slightly elevated, but this premium is justified due to its dominant market position, strong profitability metrics, and expanding private market footprint. Analysts estimate that BlackRock’s fair value should be around $1,150 per share, suggesting a 15% upside from current levels.

Is BlackRock a Buy, Hold, or Sell?

BlackRock’s strong earnings growth, aggressive expansion into private markets, and commitment to dividend increases make it a compelling long-term investment. While concerns about China exposure and CEO succession remain, the company’s financial strength and market leadership position offset these risks.

With record-high AUM, accelerating ETF inflows, and strategic acquisitions boosting its private market exposure, BlackRock appears undervalued relative to its long-term growth potential.