Bloom Energy (NYSE:BE) Stock Analysis: Surging on Landmark AEP Deal

Fuel Cell Revolution: A Game-Changing Moment for Bloom Energy (NYSE:BE)

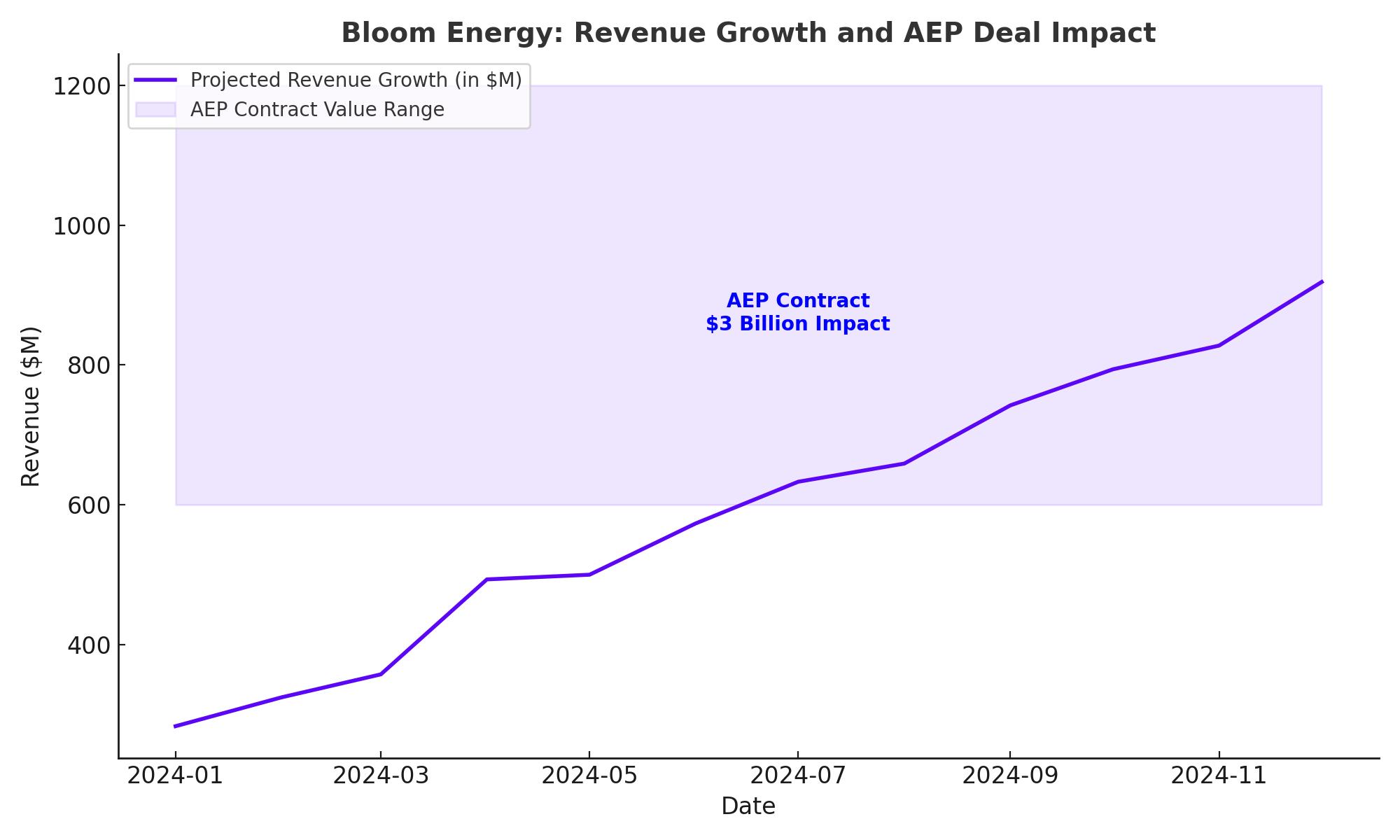

Bloom Energy (NYSE:BE) has made headlines with an extraordinary surge of nearly 59%, propelling its stock price to a 20-month high. This surge followed the announcement of a monumental deal with American Electric Power (NASDAQ:AEP) to supply up to 1 gigawatt (GW) of solid oxide fuel cells, marking the largest commercial fuel cell procurement in history. By the end of trading, Bloom’s stock was valued at $21.19, climbing from an intraday low of $14.35, and smashing past its 30-day average volume of 6.5 million shares to reach a staggering 55.8 million shares traded.

Bloom Energy's Record-Breaking Partnership with AEP

The agreement with AEP is a transformative milestone. It includes an initial order of 100 megawatts (MW) of fuel cells, with further orders of 900 MW anticipated in 2025. These fuel cells will be co-located at customer facilities, specifically targeting AI data centers, which demand high-density, efficient, and reliable energy solutions. With Bloom’s technology capable of delivering 100 MW per acre, this deal underscores its ability to cater to the rapidly expanding power needs of AI-driven infrastructure.

Key Metrics and Financial Highlights

Bloom Energy reported Q3 revenue of $330.4 million, a decline of 18.5% year-over-year, missing analysts’ expectations of $382.2 million. Despite the revenue dip, the company demonstrated significant improvement in profitability metrics:

- Gross profit margins: Increased to 23.8%, a dramatic turnaround from negative margins in the prior year.

- Operating margin: Improved to -2.9%, showcasing better cost management.

- Year-over-year net losses: Reduced from $0.80 per share in Q3 2023 to $0.06 per share in Q3 2024.

The AEP deal, estimated to generate over $3 billion in revenue, could finally push Bloom Energy into sustained profitability, with analysts projecting positive net income by 2025.

Strategic Implications of the AEP Deal

Bloom’s partnership with AEP repositions the company as a major player in the artificial intelligence energy space. By integrating its solid oxide fuel cells (SOFCs) into critical infrastructure like AI data centers, Bloom is expanding beyond traditional hydrogen energy applications. AEP’s forecasted 20% annual growth in commercial load over the next three years ensures robust demand for Bloom’s solutions, making this partnership a long-term growth driver.

Sustainability and Flexibility:

Bloom’s fuel cells, currently powered by natural gas, offer the flexibility to transition to hydrogen as a cleaner energy source becomes more accessible. This aligns with global sustainability trends and makes Bloom a viable partner for companies prioritizing net-zero targets.

Operational Efficiency:

The modular design of Bloom’s fuel cells facilitates rapid deployment, bypassing delays associated with traditional grid upgrades. This operational efficiency is crucial for high-growth sectors like AI and cloud computing, where power needs are both immediate and scalable.

Analyst Upgrades Reflect Renewed Optimism

The AEP deal has spurred significant upgrades from analysts, signaling broad confidence in Bloom Energy’s future prospects:

- Piper Sandler: Upgraded the stock from "Neutral" to "Overweight" with a price target increase from $10 to $20.

- Susquehanna Financial Group: Described the deal as a “massive win” and raised its price target to $20, citing the partnership as proof of Bloom’s viability in powering large-scale infrastructure.

- BMO Capital: Increased its price target from $12 to $19.50, emphasizing the transformative potential of the agreement.

Challenges and Path to Profitability

While the AEP deal highlights Bloom’s growth potential, challenges remain. The company continues to operate at a loss, with net losses of $0.06 per share in Q3. Scaling production to meet the demands of the AEP contract and future deals will require strategic investments. Moreover, uncertainties around the timeline for delivering the additional 900 MW of fuel cells could introduce volatility.

However, with over 1.3 GW of fuel cells already deployed globally and a factory capable of producing gigawatts of products annually, Bloom is well-positioned to scale operations efficiently.

Investment Decision: Buy or Hold?

Bloom Energy’s stock is an attractive Buy for investors seeking exposure to the renewable energy and AI infrastructure sectors. The AEP deal validates Bloom’s technology and opens doors to partnerships with other utilities and data center operators. With analysts projecting significant revenue growth and the potential to turn profitable by 2025, Bloom Energy offers substantial upside.

For real-time updates on Bloom Energy’s stock performance, visit Bloom Energy Real-Time Chart.