Brent Crude Prices Surge - Geopolitical and Market Dynamics

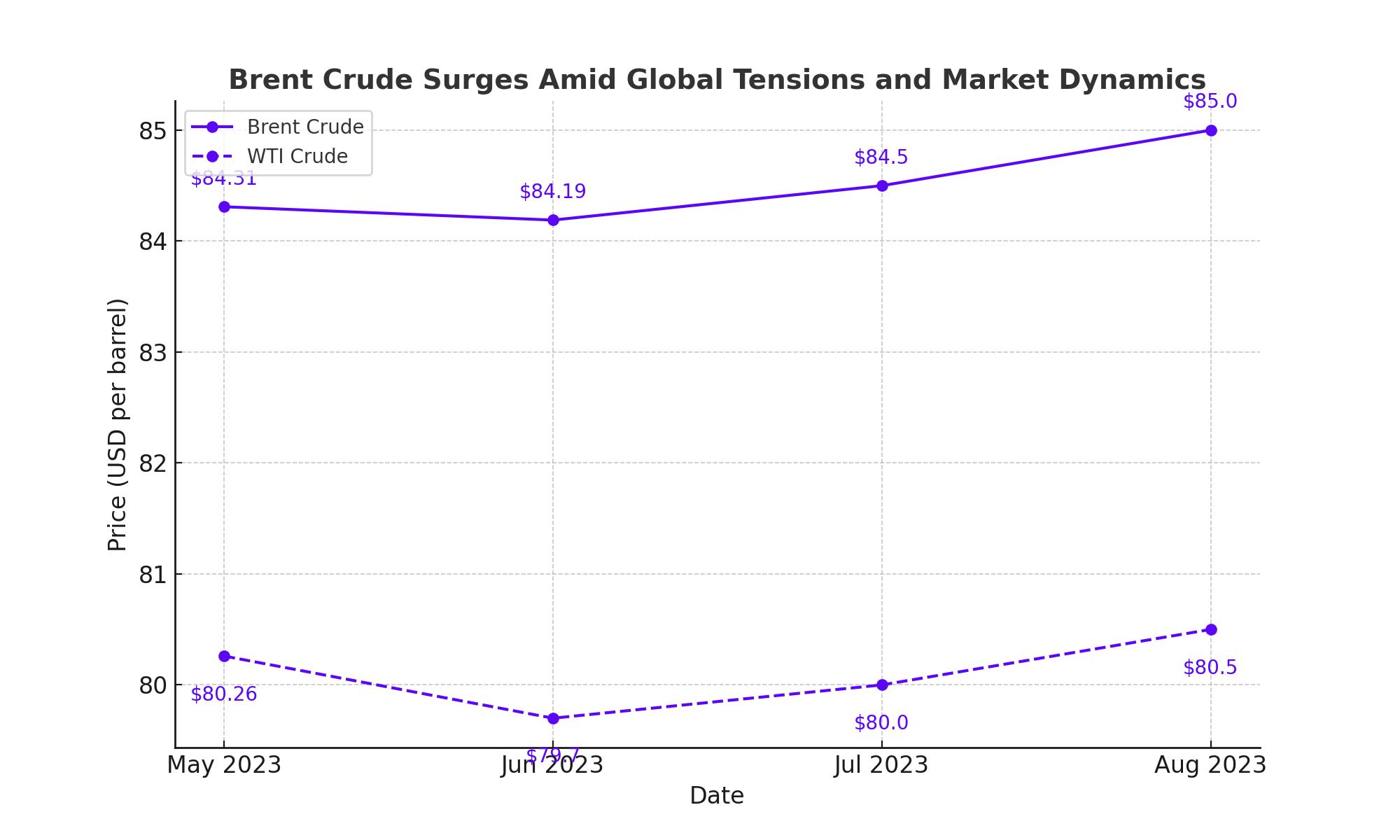

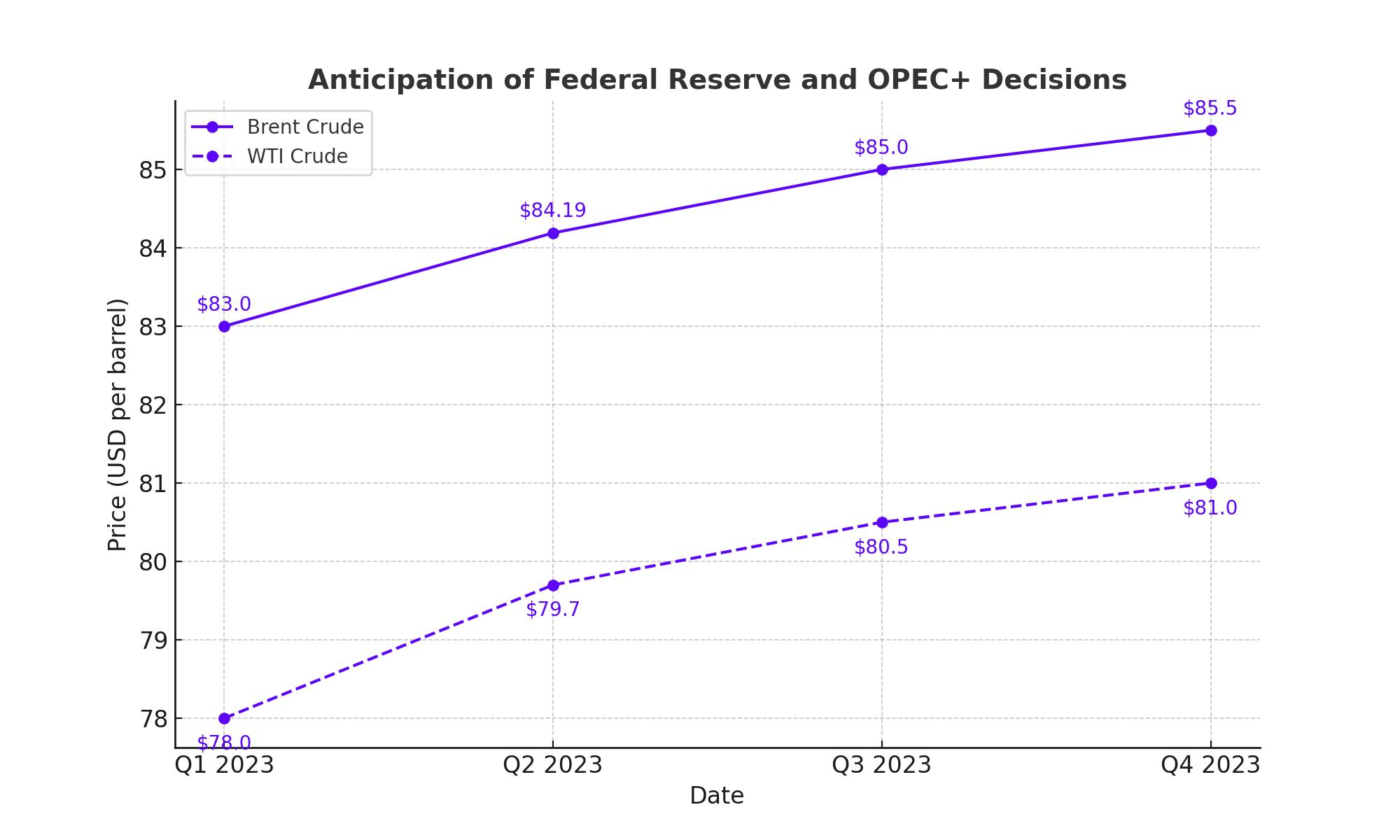

Global oil market sees tightening as Brent crude hits $84.31 per barrel, influenced by Middle East instability, U.S. interest rate prospects, and OPEC+ production decisions | That's TradingNEWS

5/20/2024 9:12:50 AM

That's TradingNEWS

Read More

-

AMLP ETF (NYSEARCA:AMLP): 8.29% Yield From America’s Midstream Toll Roads

06.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Lift XRPI to $13.12 and XRPR to $18.57 as XRP-USD Price Targets $2.40+

06.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Breaks Down as Henry Hub Spot Hits $2.86 and NG=F Slips Toward $3.00

06.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.70 While Markets Weigh Softer NFP Risk Against a Hawkish BoJ

06.01.2026 · TradingNEWS ArchiveForex