Brent and WTI Oil Prices Surge as Sanctions and Supply Cuts Rock Global Markets

From U.S. sanctions on Russia to OPEC+ delaying production rollbacks, explore how oil prices are reacting to geopolitical chess moves, surging demand, and supply risks | That's TradingNEWS

Oil Market in Turmoil: Brent and WTI See Price Shifts Amid Global and Political Developments

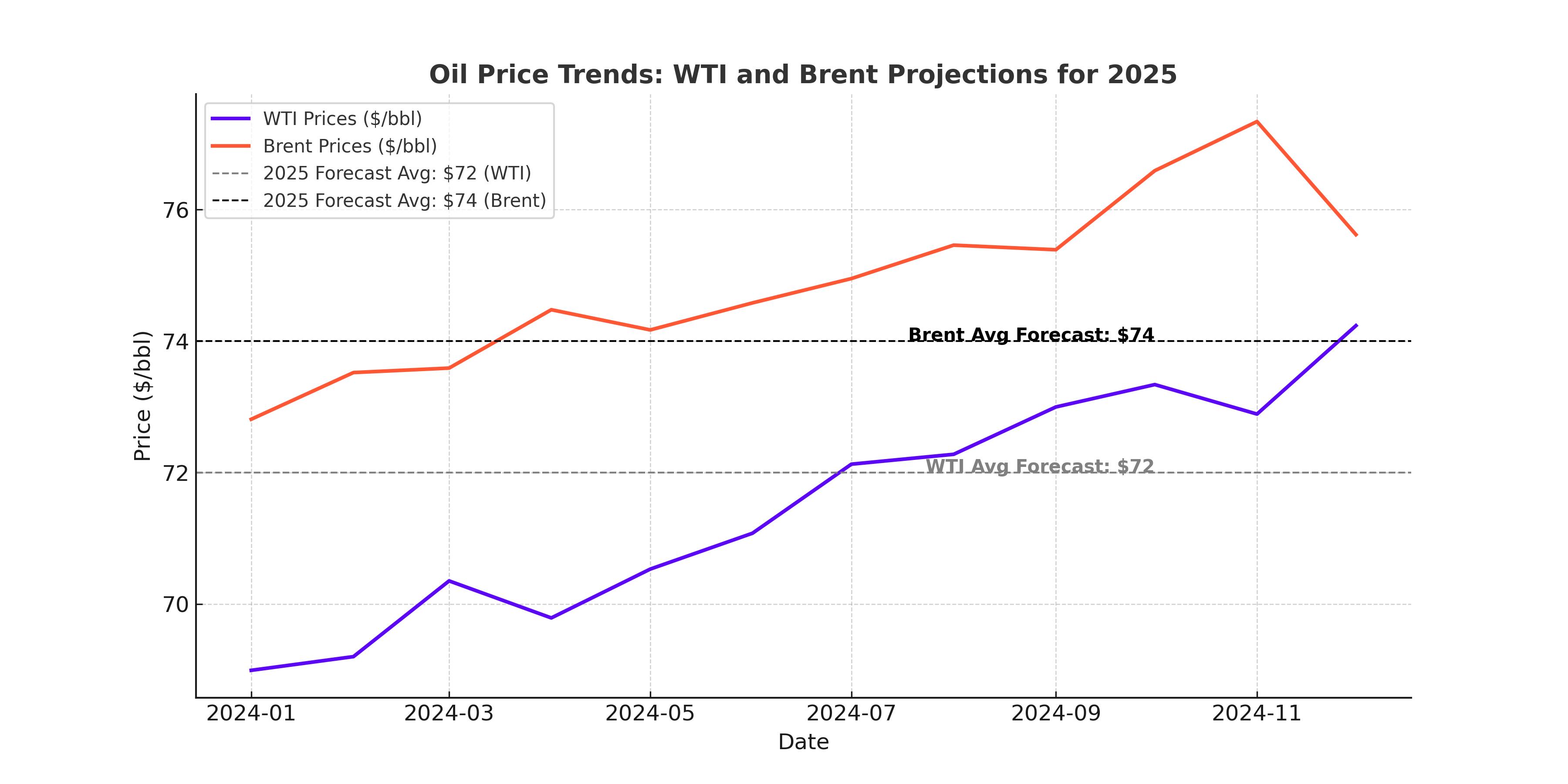

The oil market remains in flux, with Brent crude (BZ=F) trading at $73.67 per barrel and West Texas Intermediate (WTI or CL=F) at $70.34 per barrel as geopolitical and economic factors continue to dominate price movements. Fresh concerns about U.S. sanctions on Russia and Iran have contributed to market uncertainty, raising fears of disruptions in supply. The International Energy Agency (IEA) has also forecast a surplus in the oil market for 2025 due to increased production from non-OPEC countries such as Guyana, Brazil, and the United States. These factors have kept prices volatile, with traders closely watching upcoming policy announcements and economic data.

U.S. Sanctions and Russian Oil Exports

U.S. Treasury Secretary Janet Yellen’s recent remarks about potential new sanctions on Russia highlight a key factor in oil price dynamics. She noted that the current low prices and soft demand create an opportunity to further pressure Russian oil revenues. Simultaneously, Russia’s strategic pivot to India has resulted in a $13 billion annual crude supply deal with Reliance Industries, accounting for nearly 500,000 barrels per day. This agreement, while beneficial for India’s energy security, intensifies competition among OPEC+ members for market share in India, potentially affecting global supply dynamics.

OPEC+ Production Cuts and Supply Challenges

OPEC+ recently postponed its rollback of production cuts to April 2025, citing depressed prices and weak Chinese demand. The cartel’s decision to delay bringing back production to pre-agreement levels until 2027 reflects ongoing concerns about demand forecasts. OPEC has revised its global oil demand projections five times this year, with the latest estimate cut by 210,000 barrels per day to 1.6 million bpd. Despite this cautious outlook, supply constraints remain an issue, particularly with recovering output in Libya and limited growth elsewhere.

China’s Economic Stimulus and Import Patterns

China’s economic stimulus measures have been a significant factor influencing oil demand and prices. Although specific details of these measures remain vague, recent import figures from China indicate a modest recovery in demand. The country’s efforts to stabilize its economy could reinforce global oil demand, but skepticism persists about the speed and scale of this recovery.

Canadian Oil Expansion Amid Political Risks

Canada’s oil producers are ramping up production despite federal government pressure to cap emissions. Cenovus and Imperial Oil aim for output increases of 4.4% and 3.1%, respectively, buoyed by the expanded capacity of the Trans Mountain pipeline. However, U.S. President-elect Donald Trump’s threats of a 25% tariff on Canadian imports pose risks to these expansion plans. Analysts believe the likelihood of such tariffs being implemented is low, but the possibility adds a layer of uncertainty to the market.

Geopolitical Tensions and U.S. Energy Policy Shifts

President-elect Trump’s anticipated energy policies are likely to focus on increasing domestic oil and gas production while expediting LNG export permits. His administration’s plans to expand drilling on federal lands and offshore areas could significantly influence global supply dynamics. Additionally, Trump’s potential moves to bolster the Strategic Petroleum Reserve signal a commitment to energy security but could impact short-term supply and pricing strategies.

India’s Increasing Reliance on Russian Oil

India has emerged as Russia’s largest oil importer, overtaking China. July 2024 saw India importing 2.07 million barrels per day of Russian crude, a 12% year-over-year increase. This growing dependence on discounted Russian oil underscores India’s efforts to diversify its supply sources while managing geopolitical risks. Indian Prime Minister Narendra Modi has also emphasized the importance of Guyana in India’s energy strategy, though concrete agreements are still in the discussion phase.

Technological Advancements and Geothermal Energy

The oil and gas industry’s expertise in hydraulic fracturing and horizontal drilling is increasingly being applied to geothermal energy projects. The International Energy Agency suggests that this cross-industry collaboration could reduce geothermal costs by up to 80% by 2035, making it competitive with other renewable energy sources. These technological advancements highlight the evolving role of traditional energy sectors in the transition to cleaner energy solutions.

Russia-India Oil Cooperation Faces Sanction Risks

Russia’s recent agreements with India, such as the 500,000 bpd crude supply deal with Reliance Industries, face potential disruptions due to increasing Western sanctions. While these partnerships help Russia mitigate the impact of sanctions and find alternative markets, they may also strain relations within OPEC+ and complicate global supply strategies.

Conclusion

The oil market remains highly dynamic, influenced by geopolitical tensions, shifting production strategies, and evolving energy policies. With Brent crude trading at $73.67 and WTI at $70.34, the market faces a precarious balance between supply pressures and demand uncertainties. The interplay of sanctions, OPEC+ decisions, and economic recovery efforts will continue to shape oil prices in the coming months. For investors and market participants, monitoring these developments is crucial to understanding the trajectory of the global oil market.