Brent Crude Near $75: Oil Markets Brace for Volatility

Geopolitical Risks and OPEC+ Decisions Shape the Future of Global Oil Prices | That's TradingNEWS

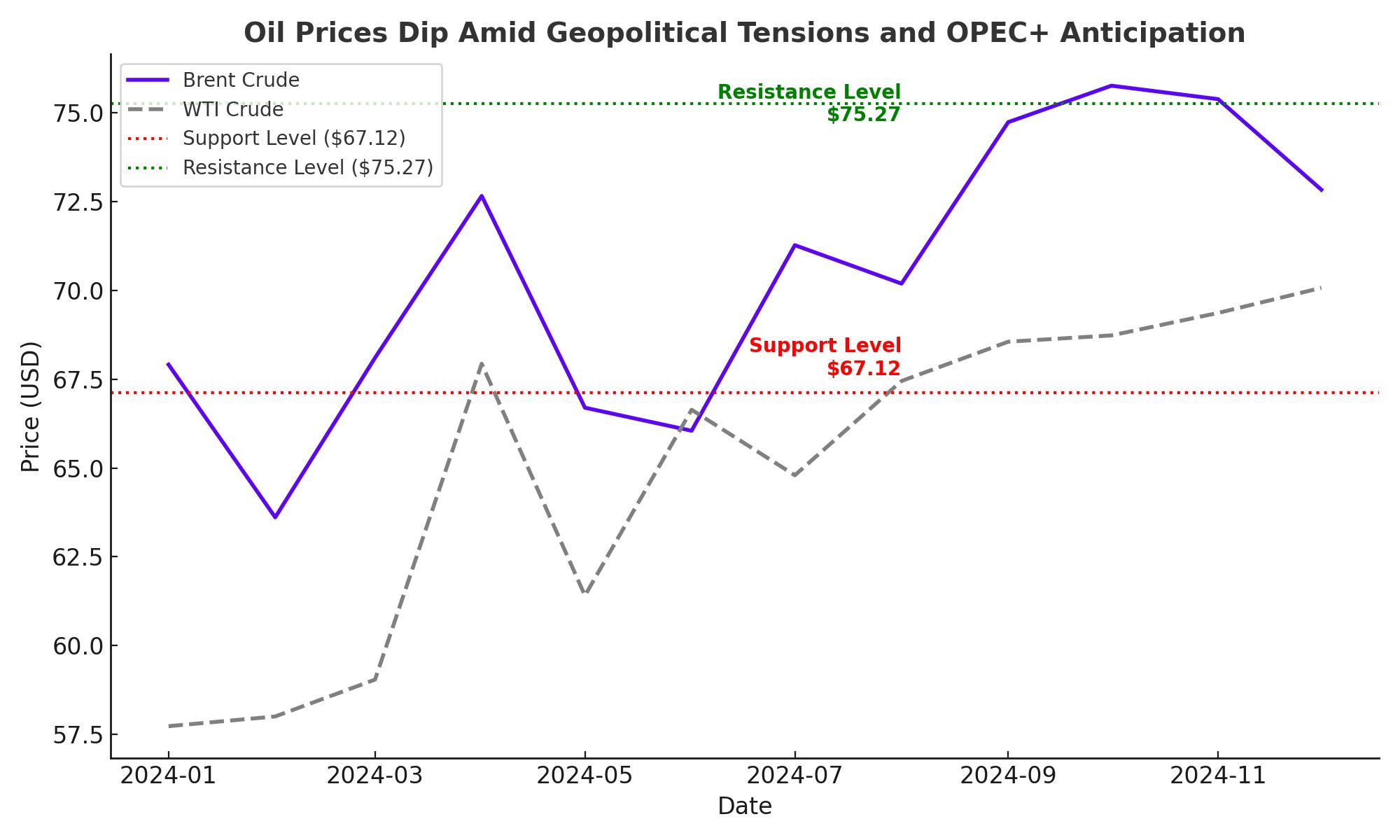

Oil Prices Dip Amid Geopolitical Tensions and OPEC+ Anticipation

Brent Crude and WTI at Critical Levels

Crude oil markets began the week with slight declines after last week’s substantial 6% gains, driven by geopolitical developments. Brent crude is trading at $74.58 per barrel, while West Texas Intermediate (WTI) stands at $70.65 per barrel. These levels highlight an oil market bracing for the implications of geopolitical tensions and upcoming OPEC+ decisions.

Geopolitical Risks Intensify: Russia-Ukraine Conflict and Iranian Tensions

The Russia-Ukraine war remains a significant factor in driving volatility in oil prices. Russia’s recent use of hypersonic missiles, in response to strikes involving U.S. and British weapons, added a layer of geopolitical uncertainty. Such events have elevated concerns about supply disruptions, particularly as markets assess potential ripple effects beyond the immediate conflict zones.

Simultaneously, Iran's nuclear ambitions are under scrutiny after the International Atomic Energy Agency (IAEA) passed a resolution urging Tehran to increase cooperation. In response, Iran announced measures to ramp up uranium enrichment, heightening fears of tightened U.S. sanctions under the incoming Trump administration. Analysts estimate that up to 1 million barrels per day of Iranian oil supply could be at risk, a scenario that could drastically impact global supply dynamics.

OPEC+ Meeting Looms Large on Market Sentiment

The upcoming OPEC+ meeting on December 1 is critical, with expectations that the group may extend production cuts into 2025. Recent reports suggest the potential delay of planned production increases, possibly until the second quarter of 2025. Such a move would add further support to prices by curbing supply.

Independent energy analysts have noted that OPEC+ may use the meeting to address weak global demand, aligning their output strategy accordingly. Key levels to watch include Brent’s 100-day moving average at $72.67, with resistance expected near $75.27.

China’s Crude Imports Surge Amid Strategic Stockpiling

China’s crude imports rebounded in November, driven by stockpiling at lower price levels. Analysts anticipate further increases, supported by an additional import quota of 5.84 million metric tons issued to independent refiners. This uptick in demand highlights China’s strategic approach to securing oil supplies amidst global uncertainties.

Iran’s Oil Supply Faces Increasing Pressure

Iran’s nuclear standoff has reemerged as a focal point for oil markets. The potential removal of Iranian oil from global markets, estimated at around 1 million barrels per day, adds a layer of complexity. Tehran is set to hold talks with European powers on November 29, but optimism for a quick resolution remains muted.

If sanctions intensify, the disruption to Iranian oil flows could push Brent prices above Goldman Sachs’ projected range of $70–$85 per barrel for 2025. However, the investment bank emphasizes the mitigating role of OPEC’s spare production capacity, a factor that has historically helped balance markets during supply shocks.

U.S. Energy Sector Sees Strategic Consolidation

In the United States, midstream operators continue to consolidate, with ONEOK recently acquiring EnLink Midstream’s remaining Permian assets for $4.3 billion in stock. This acquisition aligns with growing expectations of a surge in natural gas demand. It follows a broader trend of mergers and acquisitions in the sector, with players like Energy Transfer and Occidental also engaging in strategic divestments and expansions.

Technical Analysis: Volatility Expected Ahead of OPEC+ Decisions

Oil markets are poised for heightened volatility as traders prepare for the December 1 OPEC+ meeting. Key resistance levels include Brent’s pivotal $75.27 and the 200-day moving average at $76.42. On the downside, support is expected near $67.12, with a break below potentially testing the year-to-date low of $64.75.

Market Sentiment Influenced by Broader Macroeconomic Trends

Oil prices are also influenced by movements in the U.S. Dollar Index (DXY), which retreated after hitting a two-year high last week. President-elect Trump’s nomination of Scott Bessent as Treasury Secretary, perceived as a fiscal hawk, has introduced new variables into market sentiment. Bessent’s support for tighter fiscal policies and trade reforms may indirectly impact energy markets by influencing global economic growth trajectories.

Global Spare Capacity: A Double-Edged Sword

OPEC’s spare production capacity continues to play a dual role in market dynamics. While it provides a cushion during supply disruptions, its presence has been a bearish factor in pricing discussions. However, tapping into this capacity requires deliberate action, which OPEC+ has shown reluctance to undertake amid concerns about long-term demand trends.

Conclusion

The oil market’s direction hinges on multiple variables, from geopolitical developments to OPEC+ decisions. Brent and WTI prices are navigating a tight range, reflecting cautious optimism tempered by supply-side risks. The December 1 OPEC+ meeting, alongside macroeconomic signals, will likely set the tone for oil markets heading into 2025.