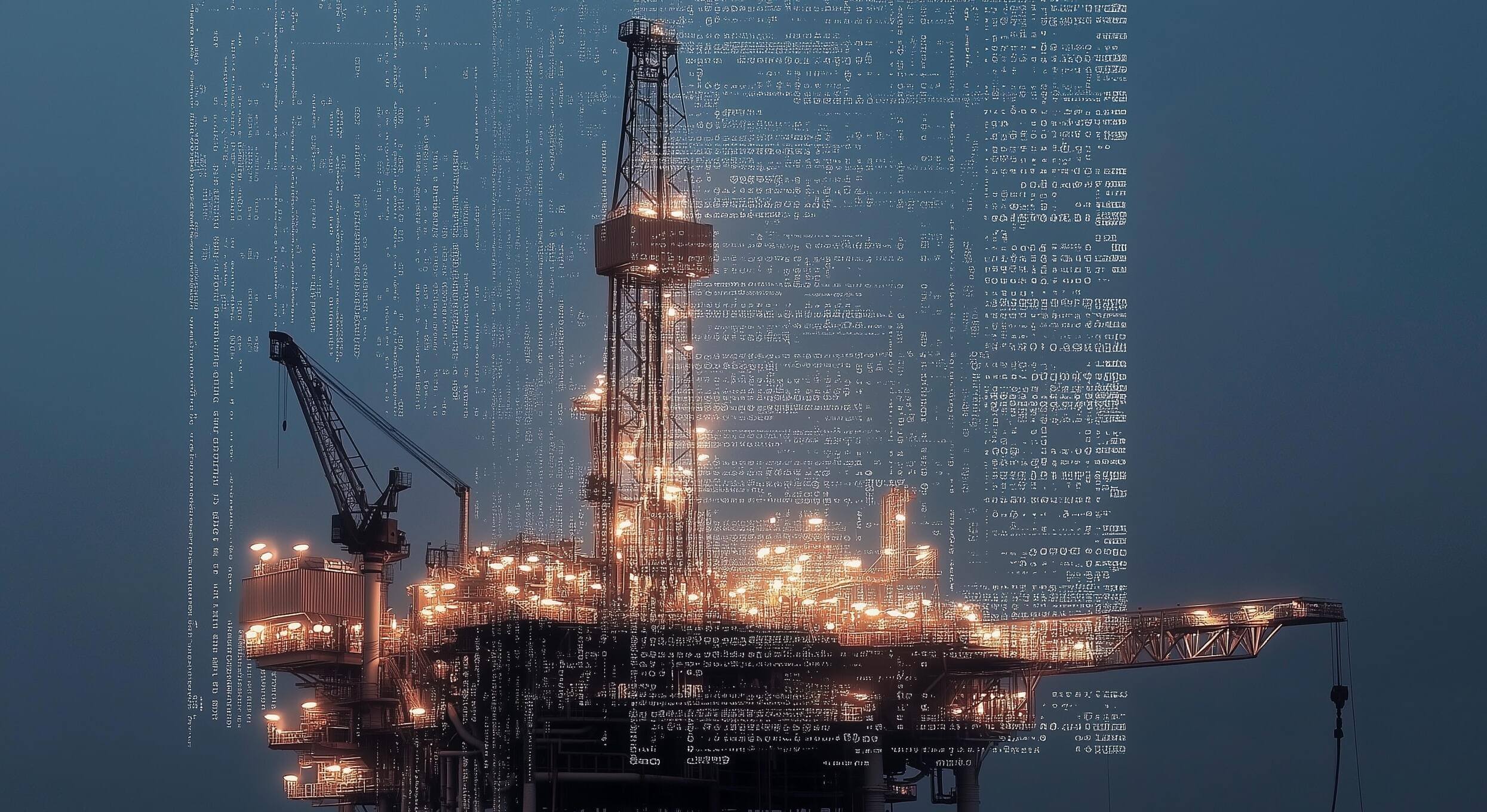

Brent Crude’s Path to $84: The Forces Fueling Oil’s 2024 Outlook

Brent crude targets $84.30/b for 2024 as U.S. output peaks, China rebounds, and OPEC+ maneuvers to stabilize supply | That's TradingNEWS

Oil Prices Face Critical Shifts: Analysis of Current Market Trends and Future Projections

Geopolitical Influence and Market Trends

Global oil prices are undergoing significant fluctuations, influenced heavily by geopolitical factors, production dynamics, and shifting demand. As of November 15, Brent crude was assessed at $73.49 per barrel, while projections for 2024 suggest an average of $84.30 per barrel, gradually decreasing to $78.70 per barrel in 2025. These predictions reflect expectations of a well-supplied market, particularly due to growth in production across the Americas.

OPEC+ Strategies and Challenges

OPEC+ continues to struggle with maintaining price stability amidst surplus concerns. Despite enacting a series of production cuts, the alliance faces headwinds from subdued Chinese demand and surging U.S. output. OPEC forecasts oil demand to rise by 18 million barrels per day (b/d) by 2050, reaching 120.1 million b/d, driven by growth in emerging markets like India and the Middle East. However, short-term pressures suggest oversupply risks extending through 2025, likely weighing on prices.

U.S. Dominance in Global Oil Production

Under the leadership of the world’s largest crude producer, the United States, oil output is forecasted to peak at 15.1 million b/d by 2030, representing 20% of the global total. The U.S. Energy Information Administration (EIA) highlights an increasingly aggressive production outlook, bolstered by advanced shale technologies and supportive policies from the incoming administration. President-elect Trump’s proposed energy policies further emphasize domestic dominance, potentially disrupting OPEC+ strategies.

China's Role in Global Oil Demand

China, the world's largest crude importer, continues to grapple with uneven economic recovery, with oil processing down 4.6% year-over-year (YoY). Recent months, however, have seen some demand recovery, with October data showing an 11.1% month-on-month (MoM) increase in EV sales and related energy needs. These trends underline China's dual role in stabilizing global demand while also accelerating its shift toward new energy vehicles (NEVs).

Price Projections and Realistic Benchmarks

Analysts argue that $75 per barrel, a target for Nigeria’s 2025 budget, may be overly ambitious given the current production and demand landscape. With Nigerian output hovering around 1.7 million b/d, falling short of its 2.06 million b/d target, revenue shortfalls and increased borrowing loom large. Experts suggest a more conservative benchmark of $70 per barrel to align with current market realities.

Emerging Technologies and Alternative Energy

The rise of AI-driven energy infrastructure and alternative fuels such as hydrogen may reshape the traditional oil market. For instance, partnerships like the Bloom Energy (NYSE:BE) and American Electric Power deal demonstrate a growing pivot towards innovative energy solutions, which could compete with traditional fossil fuel sources in the coming decades.

Investment Insights: Buy, Hold, or Sell?

Oil market investors face a mixed outlook. With Brent crude prices showing potential for moderate growth in 2024 but likely retreating in 2025, short-term opportunities may favor buy positions in energy infrastructure stocks or hedged oil futures. Long-term risks, particularly those tied to oversupply and global energy transitions, could warrant a cautious hold stance on oil-heavy portfolios.

Final Thoughts

Oil prices remain at the intersection of geopolitical uncertainty, technological innovation, and evolving consumer demands. With OPEC+, the U.S., and China playing pivotal roles, the market's direction hinges on managing surplus, addressing production constraints, and navigating the complexities of energy transitions.