NASDAQ:AVGO Analysis – Broadcom’s Strategic Growth Amid Market Volatility

Broadcom’s Dominance in Semiconductor and Software Markets

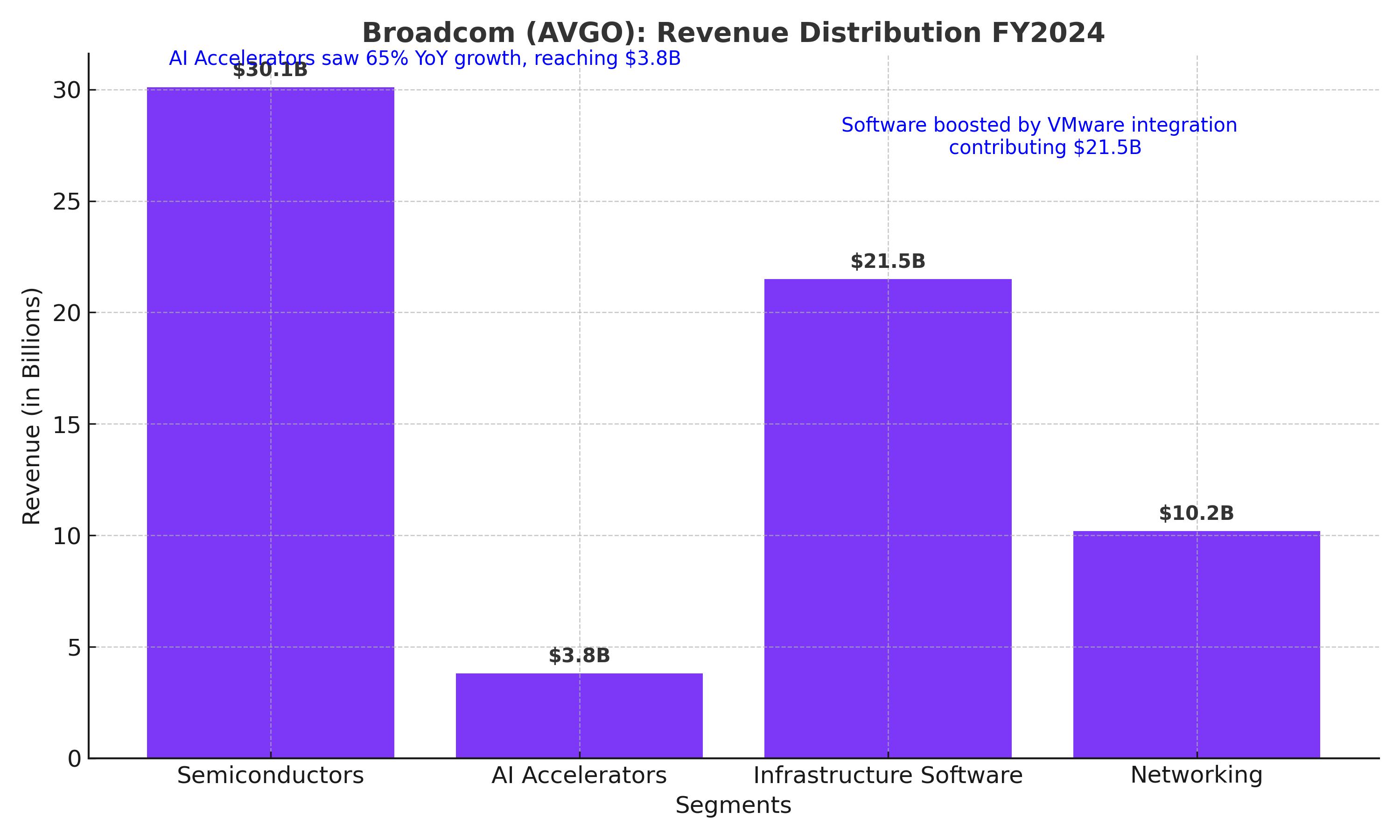

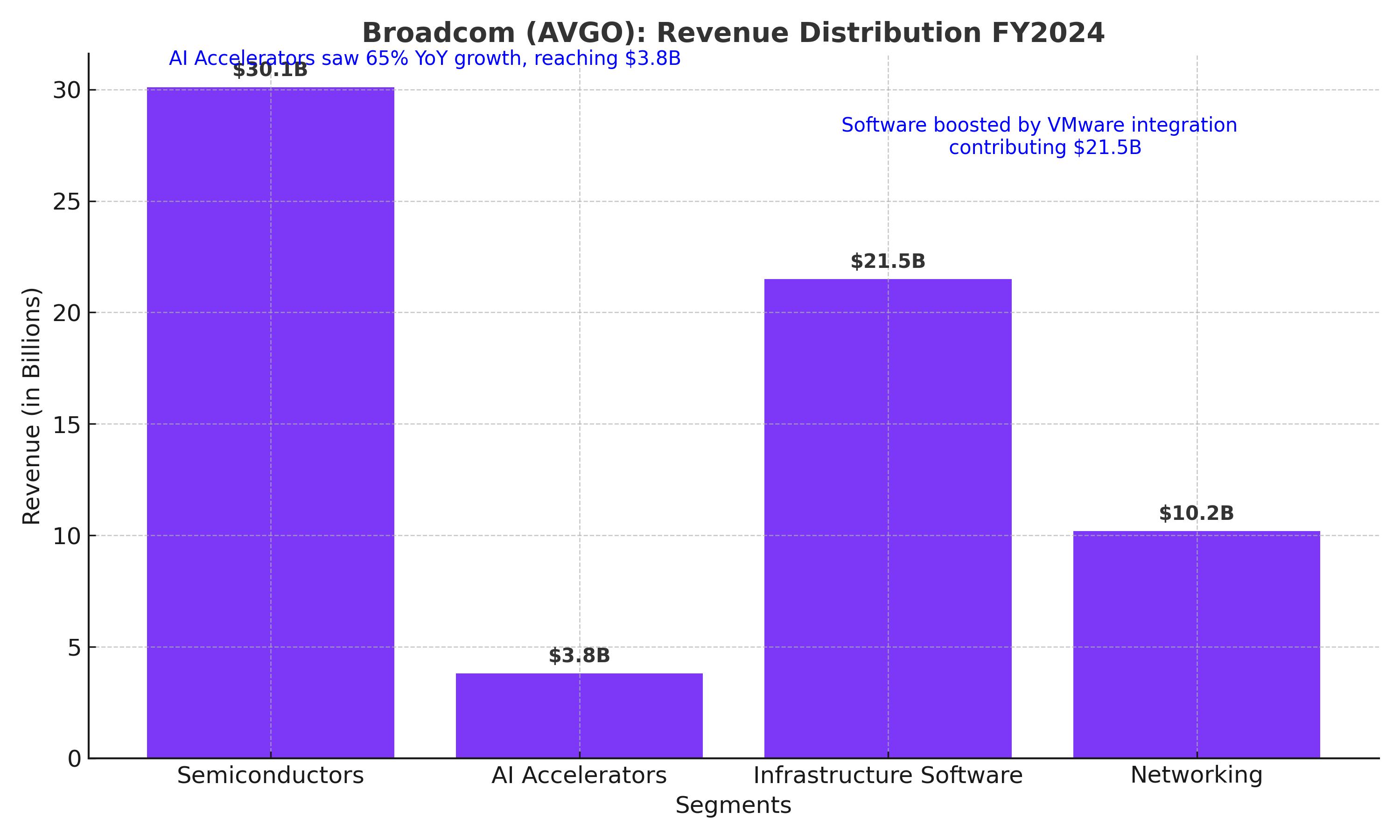

Broadcom Inc. (NASDAQ:AVGO) has solidified its position as a leader in the semiconductor and software infrastructure markets, boasting an impressive 1,450% stock gain over the past decade. Its exceptional performance is attributed to a blend of organic growth and strategic acquisitions. The company’s diversified revenue base includes advanced semiconductors, AI accelerators, and software solutions, providing resilience against industry-specific volatility. In fiscal 2024, Broadcom reported net revenues of $51.6 billion, reflecting a 44% YoY increase, driven primarily by the acquisition of VMware and sustained demand for AI-related infrastructure.

Broadcom’s semiconductor segment generated $30.1 billion in revenue, up 7% YoY, supported by the surging need for AI accelerators and networking solutions. The infrastructure software segment, bolstered by VMware, witnessed an astounding 181% YoY growth, contributing $21.5 billion. The company’s gross margins reached 66%, up from 60% in the prior year, further underscoring Broadcom’s operational efficiency.

Impact of VMware Integration on Growth Trajectory

The integration of VMware has been transformative for Broadcom, diversifying its portfolio and accelerating growth in software-driven revenue streams. VMware contributed significantly to infrastructure software revenues, which now account for 40% of total sales, up from 21% pre-acquisition. This acquisition aligns with Broadcom’s strategy to strengthen its position in high-growth, high-margin markets like cloud infrastructure and enterprise software.

VMware’s integration has also enhanced Broadcom’s capabilities in offering comprehensive solutions to hyperscalers like Google, Amazon, and Microsoft. These companies are increasingly reliant on custom silicon and advanced networking technologies for data centers, positioning Broadcom as a key partner in their AI-driven expansions.

AI Acceleration and Custom Silicon Demand

Broadcom’s leadership in AI hardware is evident from its robust performance in AI-related segments. In fiscal 2024, AI revenues grew 65% YoY, reaching $3.8 billion, and are projected to accelerate further in 2025. CEO Hock Tan highlighted that hyperscalers plan to deploy one million XPU clusters by 2027, creating a $60-$90 billion addressable market for Broadcom’s AI offerings.

Custom silicon remains a cornerstone of Broadcom’s AI strategy. The company collaborates with hyperscalers to design application-specific chips tailored to their unique workloads. Google’s Tensor Processing Units (TPUs), built in partnership with Broadcom, exemplify this synergy. Unlike off-the-shelf chips offered by competitors, Broadcom’s custom solutions provide cost efficiency and scalability, making them indispensable for large-scale AI deployments.

DeepSeek’s Influence on Market Sentiment

The recent selloff in Broadcom’s stock, triggered by DeepSeek’s claims of low-cost AI model development, reflects overblown market concerns. DeepSeek’s assertion that its models were built with minimal resources lacks verification and transparency. Industry experts question the feasibility of such claims, particularly given the reliance of advanced AI models on high-performance hardware like Broadcom’s AI accelerators.

While the DeepSeek narrative temporarily impacted market sentiment, it does not alter the fundamental demand drivers for Broadcom’s products. Hyperscalers remain committed to multi-year contracts for AI hardware, ensuring a stable revenue pipeline for Broadcom. The company’s ability to weather such market disruptions underscores its resilience and strategic importance in the global technology ecosystem.

Geopolitical Risks and Strategic Mitigation

Broadcom’s operations are not immune to geopolitical risks, particularly those arising from U.S.-China tensions. In fiscal 2023, Broadcom derived $11.5 billion in revenue from China, representing a significant portion of its global sales. Potential escalation in trade restrictions could pose challenges; however, Broadcom’s diversified revenue streams and strong presence in North America and Europe provide a buffer against regional volatility.

The company’s investments in U.S. manufacturing facilities, supported by the CHIPS Act, further mitigate geopolitical risks. These initiatives not only reduce dependence on Taiwan-based fabs but also strengthen Broadcom’s position as a key supplier to U.S. technology giants.

Financial Strength and Valuation

Broadcom’s financial performance remains robust, with adjusted EBITDA of $31.9 billion and free cash flow of $19.4 billion in fiscal 2024. The company’s commitment to shareholder returns is evident from its growing dividend, which has increased in tandem with its stock price. Broadcom’s forward P/E ratio of 21x and PEG ratio of 0.75 underscore its attractive valuation, particularly in light of its growth prospects.

The company’s projected CapEx of $63.5 billion for 2025 highlights its focus on innovation and capacity expansion. Investments in advanced packaging and next-generation chip technologies position Broadcom to capture emerging opportunities in AI, 5G, and cloud computing.