Broadcom Inc. (NASDAQ:AVGO): AI-Driven Expansion and Strategic Acquisitions Fueling Growth

Broadcom Inc. (NASDAQ:AVGO) is emerging as a dominant force in the semiconductor industry, capitalizing on the AI boom and leveraging strategic acquisitions to solidify its position. With AI-related semiconductor revenue skyrocketing, strong financial performance, and the recent acquisition of VMware, Broadcom continues to expand its market reach. However, potential risks, including high debt levels and industry cyclicality, must be considered. The company's aggressive expansion strategy, combined with strong cash flow generation, suggests that AVGO is positioning itself as a long-term winner in the AI and cloud computing markets.

Broadcom (NASDAQ:AVGO) Smashes Revenue Records with AI-Powered Growth

Broadcom’s fiscal Q4 2024 results showcased a stellar performance, driven by the surging demand for AI chips. Revenue soared by 51% year-over-year to $14.05 billion, surpassing management’s guidance of $14 billion. Net income surged to $4.32 billion from $3.52 billion a year ago, reflecting strong profitability. AI-related semiconductor sales skyrocketed 224% YoY, reaching $12.2 billion, now accounting for 41% of the company’s semiconductor revenue. Networking revenue also surged by 44%, fueled by hyperscaler demand for AI-driven data centers. These figures highlight Broadcom’s dominance in the AI chip market and its ability to capitalize on the AI infrastructure buildout.

Despite these gains, Broadcom is facing declining growth in non-AI semiconductor revenue, which is projected to decline by mid-teens percentages year-over-year in FY2025. However, the company expects AI-driven semiconductor sales to surge by 65% YoY, mitigating losses in other areas. The continued expansion into AI accelerators and networking products puts Broadcom at the center of AI adoption, making it a crucial supplier to major cloud and AI companies.

Broadcom’s VMware Acquisition: The AI Edge in Enterprise Computing

Broadcom’s $69 billion acquisition of VMware in November 2023 has reshaped its business model, providing a strong foothold in enterprise software. The infrastructure software segment, now largely driven by VMware, saw a staggering 196% YoY revenue growth, contributing $3.77 billion in Q4 alone. VMware’s virtualization technology enhances Broadcom’s ability to serve AI workloads across hybrid cloud environments, making it an essential player in enterprise AI deployment.

The integration of VMware has also boosted Broadcom’s software margins, with the infrastructure software EBIT margin reaching an impressive 73%. CEO Hock Tan has emphasized that VMware is already accelerating growth and profitability, surpassing initial expectations. VMware’s contribution is expected to grow significantly as enterprises prioritize AI-powered cloud computing, security, and automation. This acquisition positions Broadcom as a hybrid infrastructure leader, enabling AI workloads across private and public cloud ecosystems.

However, there are risks associated with VMware’s transition to a subscription-based model. Some customers have expressed concerns over pricing changes and licensing structures, which could lead to churn. Nonetheless, Broadcom’s focus on high-margin enterprise clients and AI integration suggests that VMware will remain a critical growth engine.

Is Broadcom Targeting Intel’s Chip Business? A Game-Changing Move

Reports have surfaced that Broadcom is evaluating a potential acquisition of Intel’s chip design and marketing business, a move that could significantly bolster its semiconductor portfolio. If Broadcom proceeds with this acquisition, it would gain access to Intel’s advanced chip designs, further solidifying its position in the AI accelerator and networking space. Intel, which has struggled to compete with NVIDIA and TSMC, has been looking for strategic alternatives to offload certain assets.

Acquiring Intel’s chip business would provide Broadcom with additional intellectual property and allow it to integrate AI chips more seamlessly with its networking and data center solutions. However, such a move would also increase Broadcom’s debt burden, which has already risen following the VMware deal. Broadcom has managed to maintain a strong balance sheet, reducing its debt-to-equity ratio below 1x, but another major acquisition could raise concerns over leverage and integration risks.

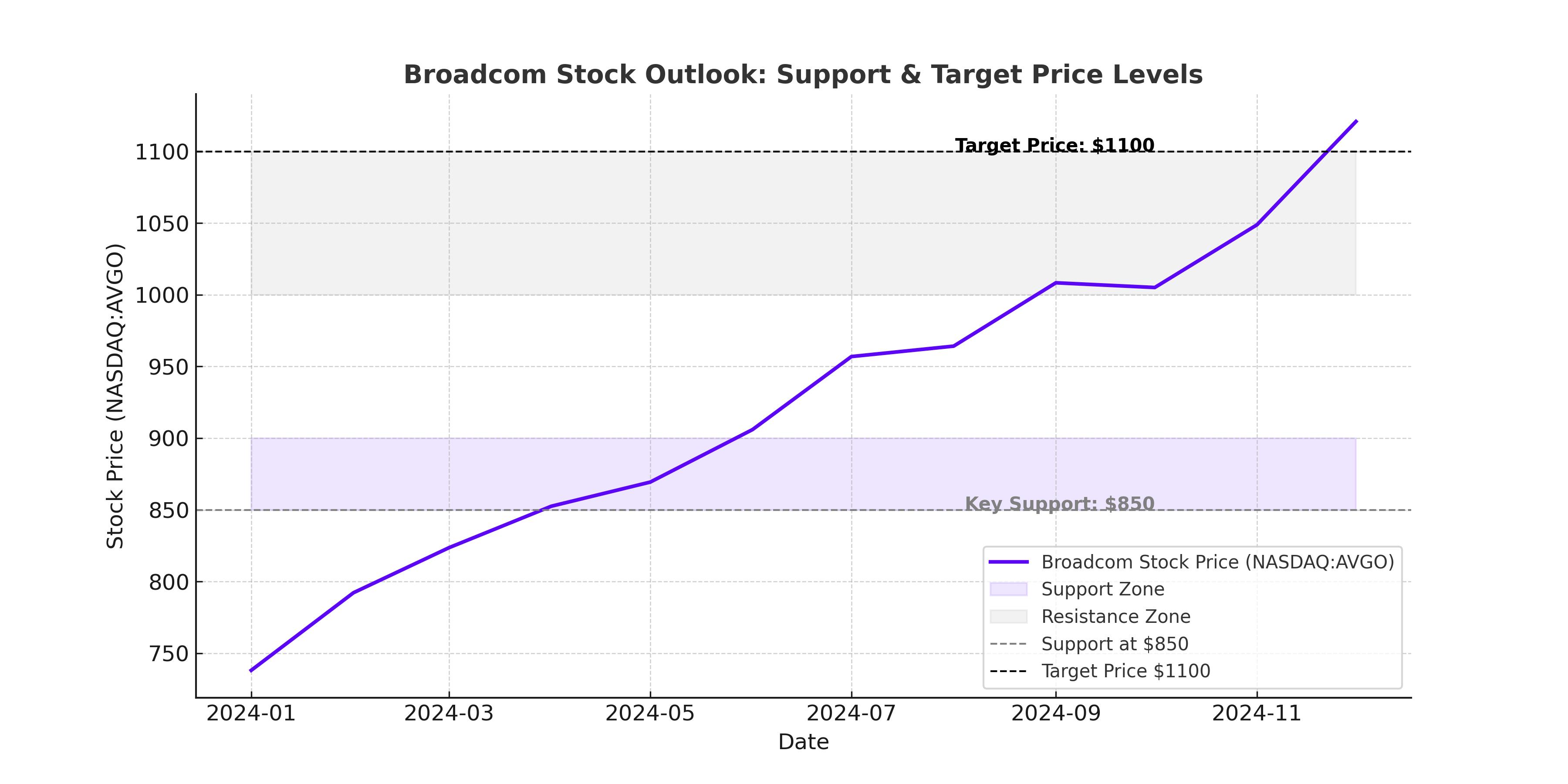

Broadcom’s Stock Performance: Riding the AI Wave

Broadcom’s stock has surged in response to its AI-driven growth strategy. As of February 20, 2025, AVGO is trading at $225.32, reflecting investor confidence in the company’s AI and cloud computing expansion. The forward P/E ratio of 35.98x suggests that the stock is trading at a premium compared to historical averages. However, given the company’s projected EPS growth of over 30% in FY2025, this valuation remains justified.

The stock's rally has been fueled by institutional investments, AI-driven demand, and strong execution by management. Broadcom’s financial health remains robust, with a 62.7% adjusted EBIT margin, reflecting operational efficiency. Free cash flow generation remains strong, enabling continued shareholder returns through dividends and buybacks. The company recently announced an 11% dividend increase to $0.59 per share, reinforcing its commitment to returning value to shareholders.

However, Broadcom’s reliance on AI growth presents some risks. The semiconductor industry is cyclical, and any slowdown in AI adoption could impact revenue projections. Additionally, increased competition from NVIDIA, AMD, and custom AI chipmakers could challenge Broadcom’s market dominance.

Should You Buy, Sell, or Hold NASDAQ:AVGO?

Broadcom’s AI-driven semiconductor dominance, VMware integration, and potential strategic acquisitions position it as a long-term winner in the AI and cloud computing space. The company is executing well on its growth strategy, maintaining high margins and generating strong cash flow. With AI-driven semiconductor revenue projected to grow 65% YoY in FY2025, Broadcom remains a top AI stock to watch.

However, investors should remain cautious about valuation risks and the cyclical nature of the semiconductor industry. While AVGO is trading at a premium, its strong earnings growth and AI market leadership justify the elevated valuation. The potential acquisition of Intel’s chip business could be a game-changer but also introduces integration and debt risks.

For investors with a long-term horizon, Broadcom is a solid buy, offering exposure to AI infrastructure, cloud computing, and enterprise software. Short-term volatility may persist, but the company’s fundamental strength and AI-driven momentum make it a compelling investment in the evolving semiconductor landscape. Investors should monitor upcoming earnings on March 6, 2025, as Broadcom provides further updates on AI growth, VMware integration, and potential acquisitions.

Final Verdict: Buy on Strength, Watch for AI Growth Updates

Broadcom remains one of the best-positioned AI stocks, benefiting from hyperscaler demand, enterprise cloud expansion, and AI-driven chip sales. While risks exist, the company’s execution under CEO Hock Tan has been exceptional. Investors should look for continued AI revenue growth, margin expansion, and insider confidence as key factors in determining the stock’s next move. Broadcom is a strong buy for AI-focused investors, with significant upside potential over the next several years.