Brookfield Renewable (NYSE:BEP): A Must-Buy for Long-Term Investors with a 5.5% Yield

Tap into Brookfield Renewable's expansive portfolio, growth strategy, and solid financials as renewable energy demand surges globally | That's TradingNEWS

Brookfield Renewable Partners (NYSE:BEP) – A Comprehensive Dive into Renewable Energy Investment

Introduction: The Core Strength of Brookfield Renewable (NYSE: BEP)

Brookfield Renewable Partners (NYSE:BEP) is a leading name in the global renewable energy landscape, with one of the largest publicly traded portfolios in this space. Operating across North America, South America, Europe, and Asia, the company boasts over 34,000 megawatts (MW) of installed renewable capacity and has a staggering 200,000 MW in its development pipeline. These numbers are a testament to BEP's ambition to grow in the clean energy sector, solidifying its position as a dominant player. In this analysis, we will delve deeply into Brookfield Renewable's recent performance, its growth strategy, and the financial health of the company while covering every key aspect that investors need to consider.

Diversified Renewable Portfolio: Hydropower, Solar, Wind, and More

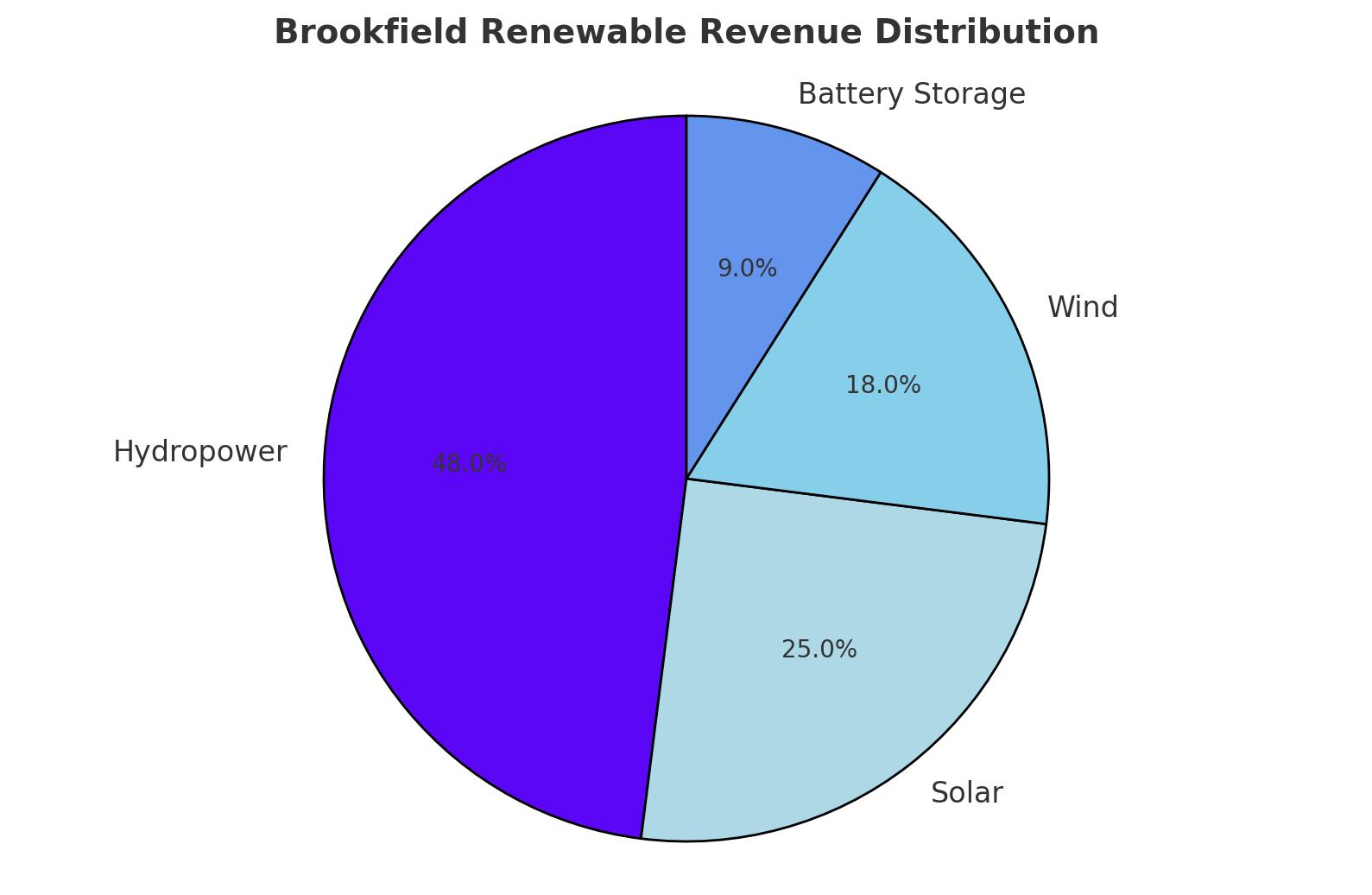

At the heart of Brookfield Renewable (NYSE: BEP) lies its diversified renewable energy portfolio. The company’s assets are spread across hydropower (which constitutes 48% of revenues), wind, utility-scale solar, and battery storage. This broad diversification not only ensures risk mitigation but also enables the company to tap into different sources of renewable energy depending on geographic advantages and market demand.

Brookfield's significant investments extend beyond traditional renewable sources. The firm is actively developing projects in carbon capture, renewable natural gas, sustainable aviation fuel, and nuclear services. Its investment in Westinghouse, a leading nuclear energy provider, reflects BEP’s commitment to leveraging multiple pathways to meet the growing demand for clean energy, particularly among corporate giants like Amazon (AMZN), Meta (META), and Microsoft (MSFT).

Growth and Financial Performance: Steady FFO Growth Backed by Strong Contracts

In the second quarter of 2024, Brookfield Renewable reported funds from operations (FFO) of $339 million, up 9% year-on-year. FFO per unit rose 6.3%, driven by the addition of 1.4 GW of new capacity from completed solar, wind, and battery projects. BEP’s ability to generate steady cash flows is further enhanced by its long-term power purchase agreements (PPAs), which cover 90% of its revenues. These contracts average 13 years in duration and provide a level of revenue certainty that mitigates risks from price volatility in energy markets.

What's more, 70% of BEP's contracts are indexed to inflation, providing the company with an additional layer of protection in the current economic environment. In a world of rising costs, inflation-indexed revenues are a valuable asset, ensuring that Brookfield Renewable (NYSE: BEP) continues to deliver steady, predictable income to its investors.

Key Strategic Partnerships and Corporate Agreements

The company’s growth strategy is bolstered by strategic partnerships with some of the largest tech companies in the world. Brookfield Renewable recently entered a significant agreement with Microsoft (MSFT) to supply over 10.5 GW of renewable energy between 2026 and 2030. This deal not only secures long-term demand but also highlights the rising importance of renewable energy in powering data centers and large-scale tech infrastructure, a sector expected to consume as much as 20% of global electricity by 2030.

Brookfield’s acquisition strategy, which includes the recent purchase of Neoen, further strengthens its position in core markets such as France, the Nordics, and Australia. Neoen's capabilities in battery storage and renewable project development perfectly complement BEP’s existing portfolio, providing the company with the flexibility to meet growing global energy needs.

Financial Strength and Liquidity: A Resilient Balance Sheet

Brookfield Renewable boasts a strong balance sheet, underpinned by a BBB+ credit rating and $4.4 billion in available liquidity. This financial strength enables the company to pursue growth opportunities without jeopardizing its long-term financial health. Approximately 96% of BEP’s debt is fixed-rate, reducing exposure to interest rate volatility, and the average debt maturity is 12 years, which ensures that the company is not vulnerable to near-term refinancing risks.

The company’s ability to raise capital through various means—such as asset-level financing, asset recycling, and partner capital—further reduces reliance on equity issuance, thereby protecting shareholder value.

Dividend Yield and Distribution Growth

For income investors, Brookfield Renewable (NYSE:BEP) offers an attractive dividend yield of 5.5%, well-covered by a 77% payout ratio. The company has a consistent track record of increasing distributions, with dividends growing at an annualized rate of 6% over the past two decades. The current quarterly distribution of $0.355 per unit represents a 5.2% increase compared to the previous year, demonstrating BEP's commitment to returning value to shareholders.

Investors seeking even higher yields might consider Brookfield’s preferred shares (NYSE:PR.A), which currently offer a 6.1% yield and are trading at a 14% discount to par value. This preferred issue provides a solid alternative for those looking to secure higher income with a lower risk profile, as the preferred dividends take precedence over common stock distributions.

Risks and Challenges: Weather Dependency and Market Competition

Despite its strong fundamentals, Brookfield Renewable faces certain risks. The company's heavy reliance on hydropower, which accounts for nearly half of its revenue, makes it susceptible to fluctuations in water availability due to weather patterns. Additionally, BEP operates in a highly competitive market where fossil fuels like natural gas remain cheaper alternatives in the absence of government subsidies for renewables.

Another potential risk is regulatory changes. BEP’s operations are highly dependent on favorable government policies, especially regarding subsidies and incentives for renewable energy. Any significant shift in policy, particularly in the United States or Canada, could impact the company’s growth trajectory.

Valuation: Is BEP a Buy After the Recent Dip?

Following a recent pullback in share price, Brookfield Renewable (NYSE: BEP) is trading at $25.92, which presents an appealing entry point for long-term investors. With a forward price-to-FFO ratio of 14.1 and a forecasted FFO growth rate of 10%, BEP offers a compelling mix of income and growth potential. The stock’s current valuation provides a solid margin of safety, especially considering its long-term contracts and inflation-linked revenues.

Furthermore, management’s guidance for double-digit FFO growth over the next five years is well-supported by its robust development pipeline and strategic acquisitions. This positions BEP as an attractive investment in the growing renewable energy space, with the potential for market-beating returns driven by both capital appreciation and dividend growth.

Final Thoughts: A Strong Buy in Renewable Energy

Brookfield Renewable Partners (NYSE:BEP) offers a unique opportunity for investors looking to gain exposure to a diversified, globally scaled portfolio of renewable energy assets. Its strong balance sheet, inflation-protected revenues, and strategic partnerships with some of the largest corporations in the world provide a solid foundation for future growth.

At the current valuation and with a well-covered 5.5% dividend yield, (NYSE:BEP)stands as a compelling buy for long-term investors who seek stable income alongside growth potential in the fast-expanding renewable energy sector.

That's TradingNEWS

NASDAQ:AMD Crashes to $89—But $2B Oracle AI Deal Hints at Massive Comeback