Bullish Investment Outlook on Oil Prices: OPEC+ and Saudi Strategies

Understanding the Factors Driving Higher Oil Prices and Strategic Investment Opportunities | That's TradingNEWS

In-Depth Analysis of OPEC+ Decision and Oil Market Dynamics

OPEC+ Production Cuts and Market Impact

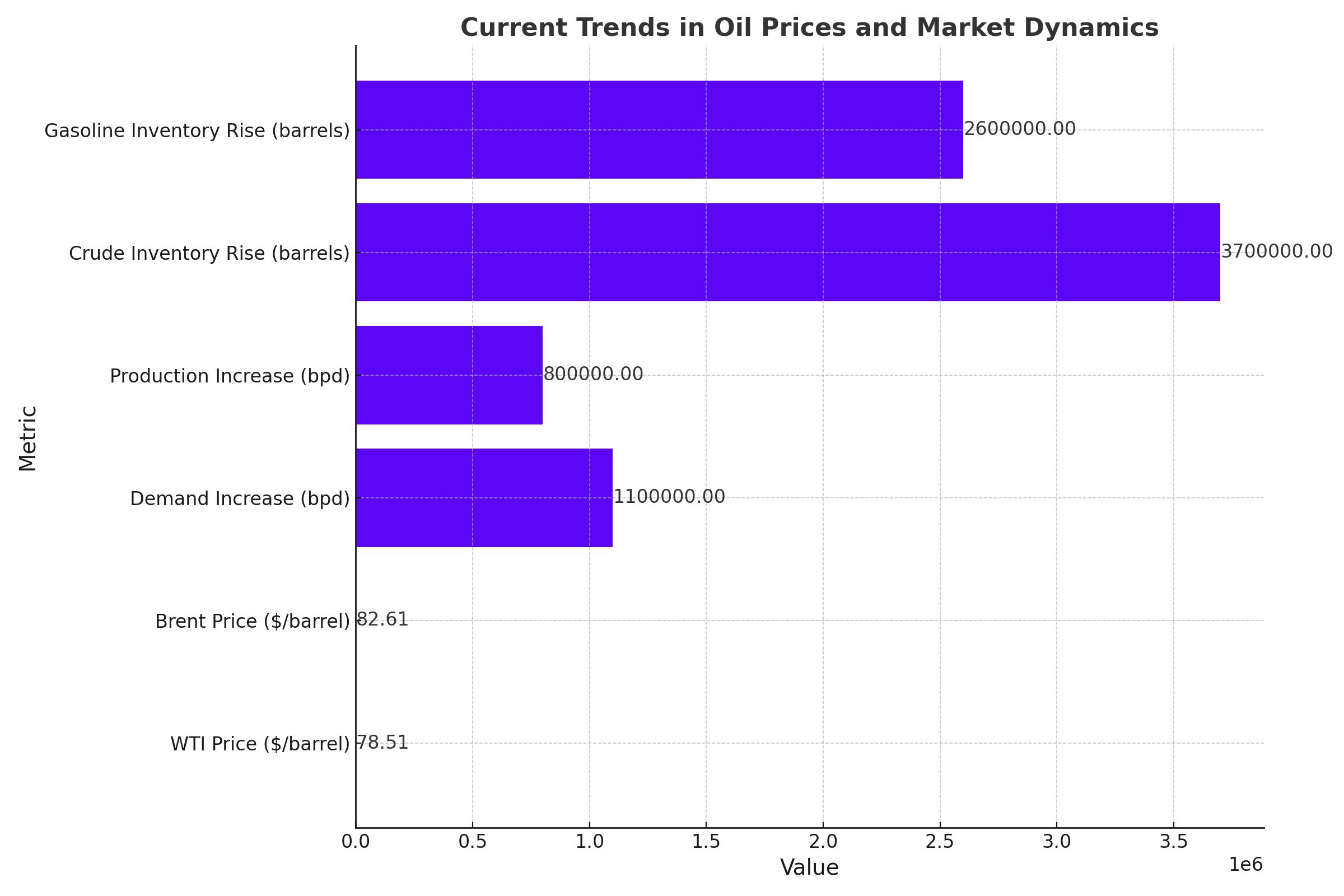

Brent crude oil prices fell below $80 a barrel on Monday for the first time since February, following an OPEC+ meeting where members agreed to phase out voluntary output cuts starting in October. The nearest Brent futures contract dropped 2.2% to $79.35 before recovering to around $80.32, while the American WTI contract declined by 1.0% to $76.19.

OPEC+ Agreement Details

OPEC+ agreed to extend all production curbs into next year, signaling that oil prices are likely to remain elevated through the U.S. presidential election. This decision aligns with Saudi Arabia's strategic sale of shares in its national oil company, Aramco, to fund economic transformation projects.

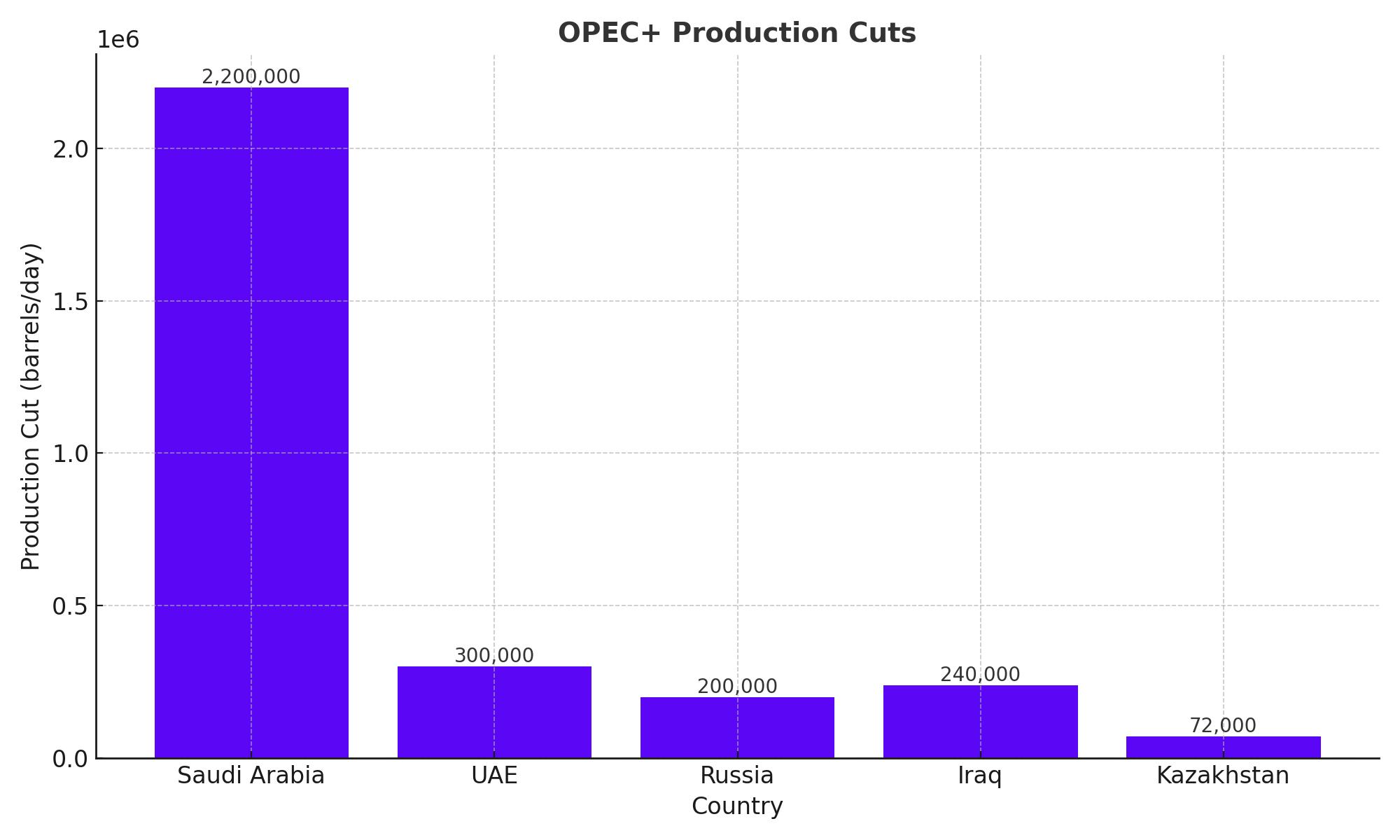

The agreement maintains longstanding official reductions of 3.66 million barrels a day. The UAE secured an upgrade to its production quota by 300,000 barrels a day, reaching 3.519 million barrels a day by September 2025. Additionally, eight top producers, including Saudi Arabia, agreed to continue voluntary cuts totaling around 2.2 million barrels a day until 2025.

Market Reactions and Future Projections

Price Trends and Compliance Issues

The curbs are aimed at bolstering prices and avoiding a global surplus amid rising output from non-OPEC producers like the U.S. and concerns over demand due to high interest rates and inflation. Brent crude currently trades around $83 a barrel, while WTI is at $79 a barrel. Both benchmarks gained some ground last week due to OPEC+ cut expectations and Middle East tensions but failed to gather significant momentum.

Saudi Arabia's Economic Strategies

Saudi Arabia's recent sale of less than 1% of Aramco aims to raise almost $12 billion, following its record $25.6 billion IPO in 2019. The kingdom needs oil prices in the high $90s to fund ambitious projects, including a megacity and a global airline. However, concerns arose about Wall Street traders' positions potentially leading to declining oil prices.

Futures trading suggests WTI will trade at $73 a barrel in a year, down over 5% from current levels. In April, money managers reduced net long positions in WTI by 20.6% and increased short positions by 97.5%, indicating bearish sentiment.

Production Cuts and Global Supply Dynamics

Compliance and Overproduction

OPEC+ faces challenges with compliance. Russia, Iraq, and Kazakhstan overproduced by 200,000, 240,000, and 72,000 barrels a day, respectively, in April. Additionally, Russia's crude flows increased by 400,000 barrels a day due to reduced domestic processing capacity from Ukrainian attacks. These flows are expected to decline as refineries restart.

Market Conditions and Adjustments

The agreement provides OPEC+ flexibility to adjust production based on market conditions. This is crucial to managing prices amid rising non-OPEC production and economic uncertainties. Despite the agreement, maintaining stable oil prices without causing market imbalance remains challenging.

European Gas Prices and Supply Concerns

Surge in European Gas Prices

European natural gas prices surged to a six-month high due to unplanned outages in Norway. The Dutch TTF Natural Gas Futures jumped 10.4% to $40.94 per megawatt-hour, while UK gas prices soared by 15%. The outages at Norway's Sleipner Riser platform and Nyhamna processing plant significantly reduced supply.

Vulnerability of European Gas Supply

Norway, now Europe's top gas supplier, faces challenges with unplanned outages. These events underscore the vulnerability of Europe's reliance on gas imports, especially with the ongoing conflict in Ukraine affecting Russian gas exports.

Technical Analysis of Oil Prices

WTI Crude Oil Chart Analysis

The WTI crude oil chart shows a break from the upward trend. Bulls attempted to revive the trend, leading to a false breakout at $80 per barrel. Bears subsequently drove the price below the channel's lower boundary, establishing a downward trend.

Key support lies at $75.75, a level held since late winter. If geopolitical stability persists, bears may push towards breaking this level, potentially slowing inflation and benefiting the current U.S. administration ahead of the presidential election.

OPEC+ Production Cut Extensions

OPEC+ members agreed to extend production cuts of 3.66 million barrels per day until the end of 2025. Eight nations plan to gradually reverse voluntary cuts of 2.2 million barrels per day from October 2024 to September 2025, indicating a desire to restore production amidst ample spare capacity.

Goldman Sachs analysts viewed the meeting's outcome as bearish, highlighting the desire among members to restore production. The next significant support level for WTI is $75.75, with a potential downward push if upcoming macroeconomic reports trigger negative market reactions.

Why to Invest In Oil ?

Despite the complexities of the global market, the extended OPEC+ production cuts, alongside Saudi Arabia’s strategic initiatives, hint at a bullish outlook for oil prices. Current agreements to restrict output are set to sustain high prices, with Brent crude trading around $83 per barrel and West Texas Intermediate (WTI) at $79 per barrel. Saudi Arabia’s economic strategies, including major asset sales and infrastructural projects, depend on maintaining oil prices well above $90 per barrel. For investors, this scenario underscores a promising opportunity to capitalize on rising oil prices amid a controlled supply environment.

That's TradingNEWS

Read More

-

SCHG ETF Near $33 High As AI Giants Drive 19% 2025 Rally

01.01.2026 · TradingNEWS ArchiveStocks

-

XRP-USD Stuck At $1.87 As XRPI Near $10.57 And XRPR Around $14.98 Despite $1.16B ETF Wave

01.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Slides Toward Key $3.57 Support As Ng=F Extends 33% Drop

01.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - Yen Near 156 As Fed Cuts Meet Boj Hawkish Turn

01.01.2026 · TradingNEWS ArchiveForex