Bullish Outlook - Why to Buy Formula One Group NASDAQ:FWONA ?

Robust Financial Performance and Strategic Acquisitions Make FWONA a Compelling Buy | That's TradingNEWS

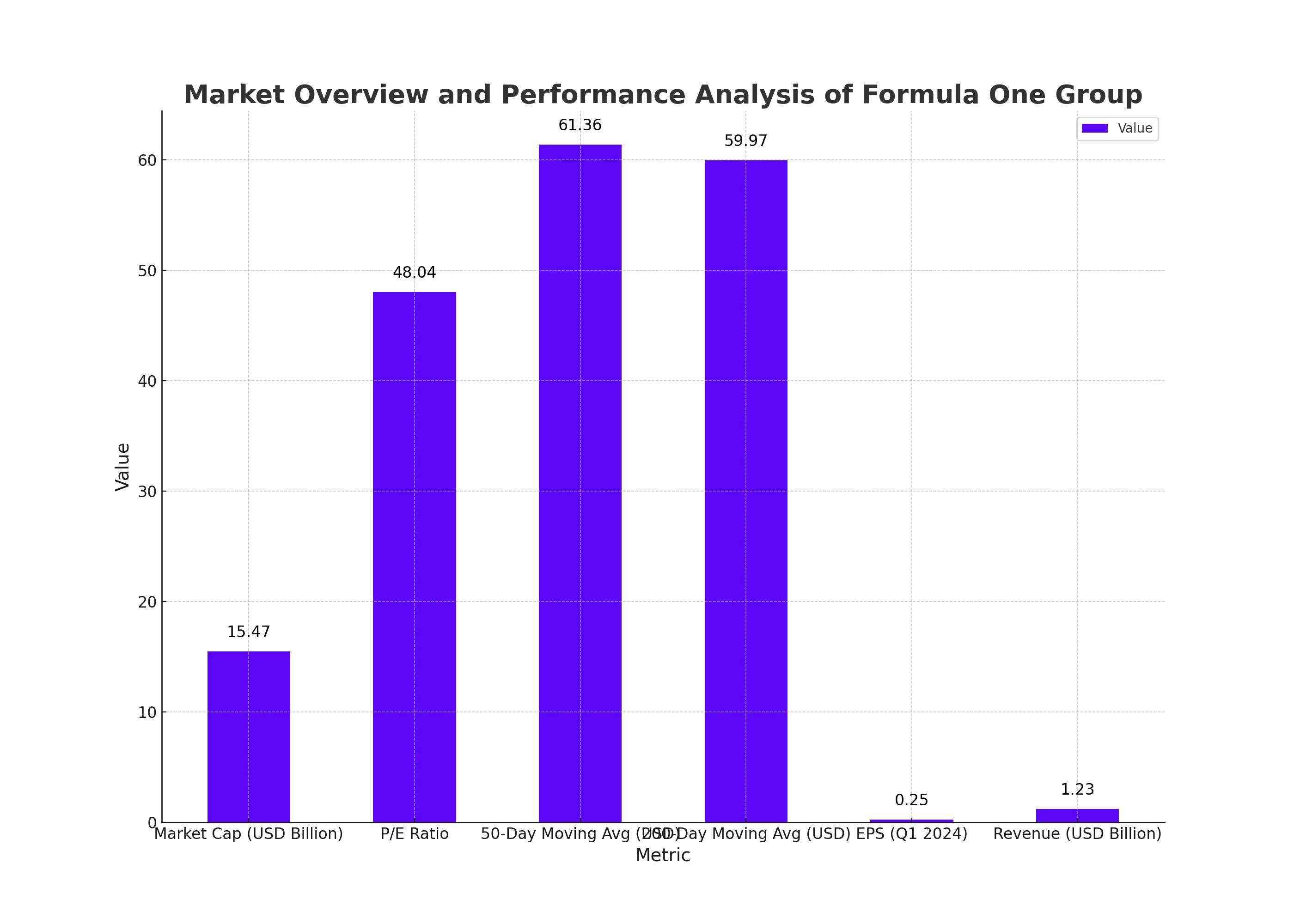

Market Overview and Performance Analysis

Formula One Group (NASDAQ:FWONA) experienced a notable trading session with its stock valued at $15.47 billion, showcasing a P/E ratio of 48.04. The stock’s 50-day moving average stands at $61.36, while its 200-day moving average is $59.97. Formula One Group reported its quarterly earnings on February 28th, where it posted an EPS of $0.25, falling short of the analysts' consensus estimate of $0.64 by $0.39. Revenue for the quarter was $1.23 billion, aligning with market expectations. Analysts forecast the company to post an EPS of 1.47 for the current year.

Insider Activity and Transactions

Insider transactions have been significant for Formula One Group. Major shareholder Berkshire Hathaway Inc purchased 20,609 shares on March 11th at an average price of $29.94 per share, totaling $617,033.46. Post-transaction, Berkshire Hathaway’s stake in the company is valued at approximately $771.67 million, holding 25,773,955 shares. Furthermore, Chairman John C. Malone sold 139,065 shares on May 13th at an average price of $68.98, amounting to $9,592,703.70. Malone’s current holdings after the transaction stand at 2,401,365 shares, worth approximately $165.65 million. Insiders collectively own 4.83% of the company’s stock. Detailed Insider Transactions

Institutional Inflows and Outflows

Institutional investment in Formula One Group has been dynamic. Kornitzer Capital Management Inc. KS increased its stake by 38.1% in the fourth quarter, acquiring 30,829 shares valued at $1,787,000. Institutional investors own 8.38% of Formula One Group’s stock.

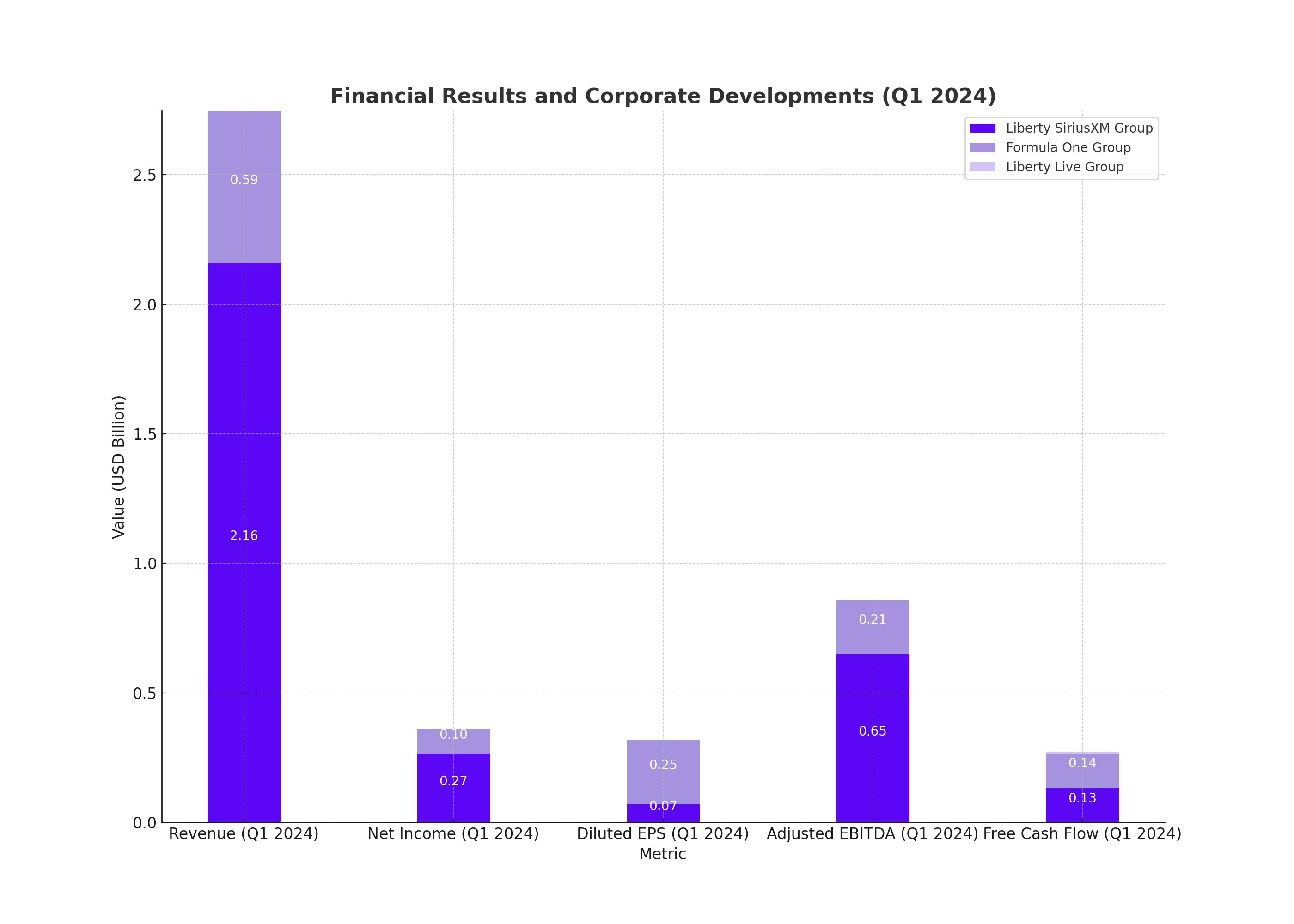

Financial Results and Corporate Developments

Liberty SiriusXM Group Financial Performance

Liberty SiriusXM Group reported a slight increase in revenue to $2.16 billion in Q1 2024, up 1% year-over-year. Advertising revenue saw a 7% increase, contributing to a net income of $265 million, with diluted EPS at $0.07. Adjusted EBITDA rose by 4% to $650 million, while free cash flow decreased by 8% to $132 million. Liberty Media holds an 83.3% ownership in SiriusXM as of April 26th and aims to complete its merger with SiriusXM by early Q3 2024. Real-time Stock Chart

Formula One Group Highlights

The Formula One Group announced plans to acquire MotoGP, aiming to finalize the transaction by the end of 2024. The group also revealed a 24-race calendar for 2025, marking the 75th anniversary of the FIA Formula One World Championship. Formula One has expanded its global partnerships, securing deals with DHL, Globant, and McDonald’s. New broadcast deals were secured with beIN SPORTS across the MENA region, extended partnerships with Viaplay in the Netherlands and Nordic countries, and a new partnership with FanCode in India.

Formula One Financial Results

In Q1 2024, Formula One Group's revenue surged by 45% to $587 million, with operating income soaring to $95 million from $16 million in the prior year. Adjusted OIBDA rose by 78% to $208 million. The increase in revenue is attributed to the addition of more races, contractual fee increases, and new sponsorship deals.

Corporate Updates and Strategic Moves

Liberty Media Corporate Activities

Liberty Media completed the acquisition of Quint for $205 million and agreed to purchase MotoGP for €3.5 billion, expecting to close the deal by year-end 2024. The acquisition includes 14% equity retention by MotoGP management, with the rest being a mix of cash and Series C Liberty Formula One common stock.

Liberty Live Group

The fair value of Liberty Media's investment in Live Nation was $7.4 billion as of March 31st. Liberty Live Group recorded an operating loss of $2 million in Q1 2024. The group’s strategy focuses on leveraging its investments in the live event and sports industries to enhance shareholder value.

Financial Statements and Outlook

Balance Sheet Information

As of March 31, 2024, Liberty SiriusXM Group had $135 million in cash and $11.07 billion in debt. Formula One Group held $1.23 billion in cash and $2.93 billion in debt. Liberty Live Group had $298 million in cash and $1.21 billion in debt. The consolidated total for Liberty Media’s cash and debt stood at $1.67 billion and $15.44 billion, respectively.

Cash Flow Analysis

Liberty SiriusXM Group generated $264 million from operating activities, while Formula One Group generated $140 million. Liberty Live Group's operations resulted in a cash outflow of $7 million. Investing activities led to significant outflows, with Liberty SiriusXM and Formula One Groups investing heavily in acquisitions and property, resulting in a net cash decrease across all segments.

Strategic and Market Implications

The strategic acquisition of MotoGP by Formula One Group is expected to enhance its portfolio in the premium live sports sector. The addition of new races and expanding sponsorship deals are likely to drive future revenue growth. The planned merger of Liberty SiriusXM with SiriusXM aims to streamline operations and improve financial performance, reflecting Liberty Media’s commitment to maximizing shareholder value.

Bullish Case for Formula One Group (NASDAQ:FWONA)

Formula One Group (NASDAQ:FWONA) reported impressive Q1 2024 results, with revenue soaring 45% to $587 million and operating income surging to $95 million from $16 million. The group's strategic acquisitions, including the planned MotoGP deal, and expanding global partnerships, signal strong future growth potential. With robust financial performance and an optimistic outlook, FWONA is poised to outperform, making it a compelling buy. Analysts predict the stock could reach new highs, driven by increased fan engagement and expanded sponsorship deals. Investors should consider buying FWONA now to capitalize on these bullish trends.

For detailed analysis and updates, visit Formula One Group Real-time Chart.