Bitcoin’s Path to $100K: Market Trends, Predictions, and Critical Levels

Bitcoin (BTC-USD) has been on a rollercoaster ride, reflecting both resilience and volatility as it navigates critical price levels. The cryptocurrency, trading near $98,541 today with a market cap of $1.95 trillion, faces significant challenges and opportunities as it attempts to reclaim its all-time high (ATH) of $108,135. After briefly falling to $92,000, Bitcoin has rebounded, gaining 4.03% in the past 24 hours. This rebound raises the question: can Bitcoin maintain its upward trajectory, or will macroeconomic and technical factors send it lower?

Macroeconomic Factors Shaping Bitcoin’s Trajectory

Global macroeconomic conditions play a vital role in Bitcoin's price movements. The Federal Reserve's recent monetary policy decisions have significantly impacted risk assets, including cryptocurrencies. A 25 basis point rate cut brought the federal funds rate to 4.25%-4.50%, but Fed Chair Jerome Powell signaled fewer rate reductions in 2025 than previously expected. This hawkish tone contributed to a selloff in Bitcoin, which fell below $100,000 during the announcement.

Inflation data, however, provided a glimmer of hope. The November Personal Consumption Expenditures (PCE) index reported a 2.4% rise, just below expectations of 2.5%, helping Bitcoin recover from its lows. This inflation data aligns with Bitcoin's reputation as "digital gold," offering a hedge against the declining value of fiat currencies.

President-elect Donald Trump's pro-crypto administration adds another layer of intrigue. Proposals for a national Bitcoin reserve and policies aimed at fostering cryptocurrency adoption have fueled optimism. Trump's stance, coupled with legislative support from figures like Senator Cynthia Lummis, could position Bitcoin as a strategic asset for the U.S. economy.

Technical Analysis: Key Levels to Watch

From a technical perspective, Bitcoin's ability to hold above $97,000 is crucial. This level has served as a psychological and technical support, bolstered by significant buy orders within the $97,500-$99,800 range, where over 1.19 million BTC were previously purchased.

Should Bitcoin maintain this support, analysts predict a rally toward $103,000 and potentially new ATHs above $108,000. Failure to hold $97,000, however, could trigger a dip to $85,000, representing a 23.6% Fibonacci retracement level.

Elliott Wave analysis suggests that Bitcoin is currently in a corrective phase after reaching $107,000. If the cryptocurrency rebounds from its support levels, it may resume its bullish trajectory, targeting $178,000 based on historical patterns and Bollinger Band movements.

Institutional and Retail Dynamics

Institutional investors continue to play a pivotal role in Bitcoin's price dynamics. The entry of major players like BlackRock and Cathie Wood's Ark Invest has increased market legitimacy, tying Bitcoin's movements more closely to traditional financial indicators. Wood’s prediction of $1 million Bitcoin by 2030 underscores the long-term bullish sentiment among institutional investors.

Retail investors, meanwhile, are increasingly drawn to Bitcoin's deflationary nature. With a capped supply of 21 million coins, Bitcoin offers a scarcity-driven value proposition. This scarcity is further emphasized by its halving cycles, which reduce the rate of new Bitcoin creation every four years.

Regulatory Challenges and Geopolitical Risks

Despite its upward momentum, Bitcoin faces significant risks. Regulatory scrutiny remains a major hurdle, particularly as governments grapple with the implications of decentralized finance. The Federal Reserve has explicitly stated that it will not hold Bitcoin, leaving the question of a national Bitcoin reserve to Congress.

Geopolitical factors also weigh heavily on Bitcoin’s prospects. China's crackdown on cryptocurrency mining in 2021 highlighted the vulnerability of decentralized networks to regulatory pressures. Conversely, El Salvador's adoption of Bitcoin as legal tender demonstrates the asset's potential to disrupt traditional financial systems.

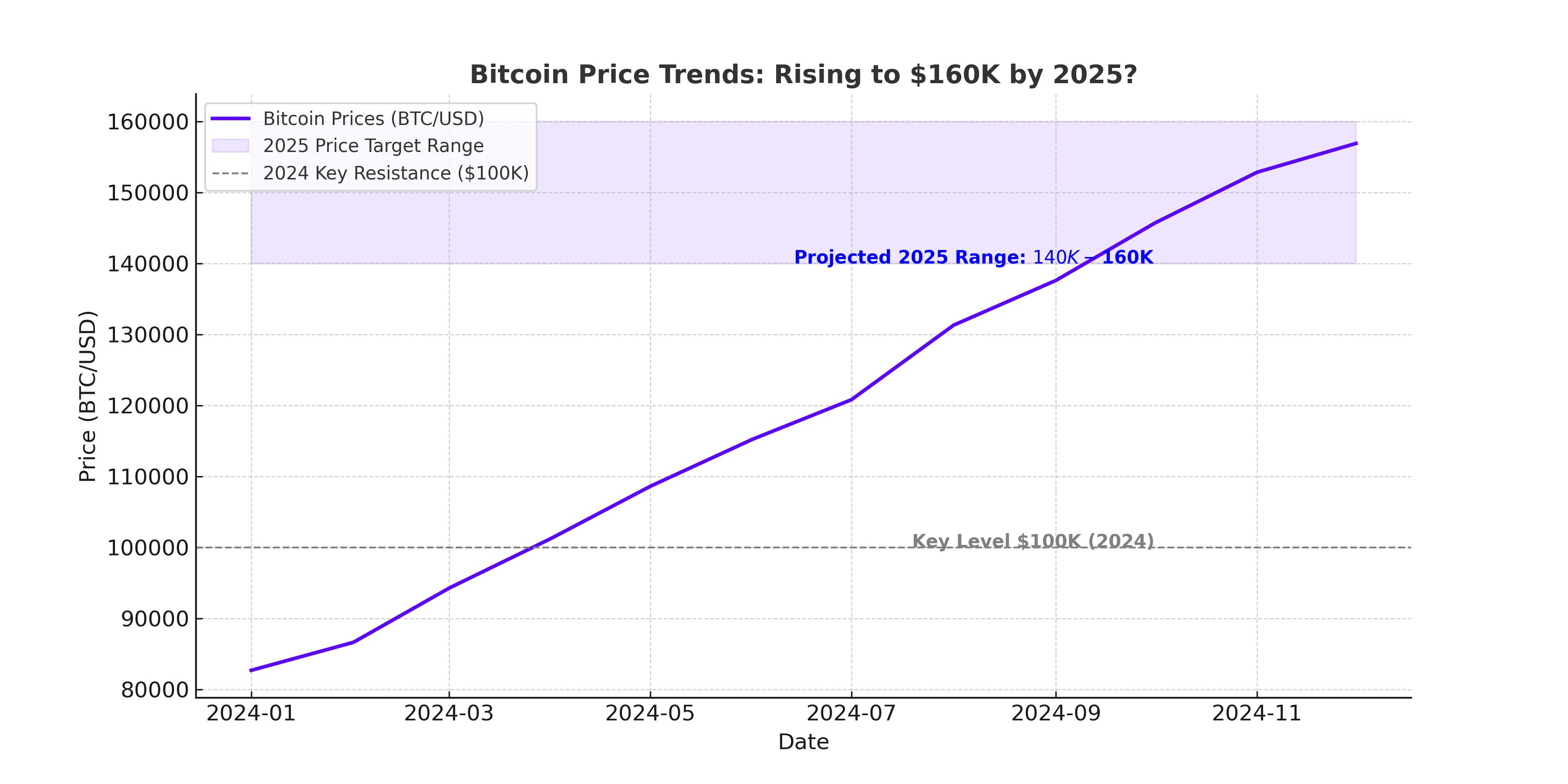

Price Predictions and Future Outlook

Market analysts offer varying predictions for Bitcoin's trajectory. VanEck forecasts a peak of $180,000 in Q1 2025, while Standard Chartered and Tim Draper set targets of $200,000 and $250,000, respectively. These projections are grounded in expectations of increased institutional adoption, regulatory clarity, and the impact of Bitcoin ETFs on mainstream acceptance.

As Bitcoin approaches key resistance levels, its price movement remains unpredictable. A breakout above $99,800 could pave the way for new ATHs, while a failure to hold $97,000 might signal a deeper correction. The interplay of macroeconomic factors, institutional dynamics, and technical levels will determine Bitcoin’s next major move. Investors should remain vigilant, as the cryptocurrency market continues to evolve in response to global economic and political developments.