Can Bitcoin Break $150,000 in 2025?

With BTC hovering around $100,000, rising whale activity and economic shifts suggest a potential breakthrough. Dive into the analysis of Bitcoin's trajectory and price forecasts | That's TradingNEWS

Bitcoin Price Analysis: Can BTC Break $150,000 and Beyond?

Bitcoin (BTC-USD) has defied expectations in 2024, surging past $100,000 and setting a new high at $108,200. With less than a week left in the year, speculation is rampant about whether Bitcoin can achieve $150,000 in the near term. The cryptocurrency’s current price of $98,148 reflects a 150% increase since the year began, driven by strong institutional interest, macroeconomic shifts, and a favorable regulatory environment.

Institutional Interest and Whale Activity

Institutional investors and large-scale market participants have been instrumental in Bitcoin's bullish momentum. On-chain data reveals an unprecedented increase in whale activity. Average transaction sizes reached a two-year high of $306,101, indicating significant sell-offs by large holders. However, this spike in activity has also contributed to liquidity and price consolidation, with Bitcoin finding support at $95,000. Whale wallets holding over 100 BTC have surged since October, reflecting growing confidence in Bitcoin’s long-term potential.

MicroStrategy and Metaplanet Inc., among other institutional players, have bolstered Bitcoin’s standing with significant purchases. MicroStrategy added $516 million worth of BTC to its holdings, signaling confidence in a long-term price trajectory. Yet, despite these bullish moves, the market remains cautious, with many whales rebalancing portfolios in response to Federal Reserve policy and global economic uncertainties.

Macroeconomic Factors Driving Momentum

Bitcoin’s meteoric rise in 2024 was fueled by macroeconomic conditions, including rising inflation and shifting central bank policies. The Federal Reserve’s dovish stance on rate hikes catalyzed renewed interest in risk assets like cryptocurrencies. Meanwhile, China’s $411 billion fiscal stimulus aimed at economic recovery has further supported global markets, including Bitcoin.

BTC’s correlation with traditional markets has softened, showcasing its resilience as a hedge against inflation and economic instability. This divergence has made Bitcoin an attractive option for institutional and retail investors alike, with trading volumes and market capitalization approaching record highs.

Key Technical Levels and Predictions

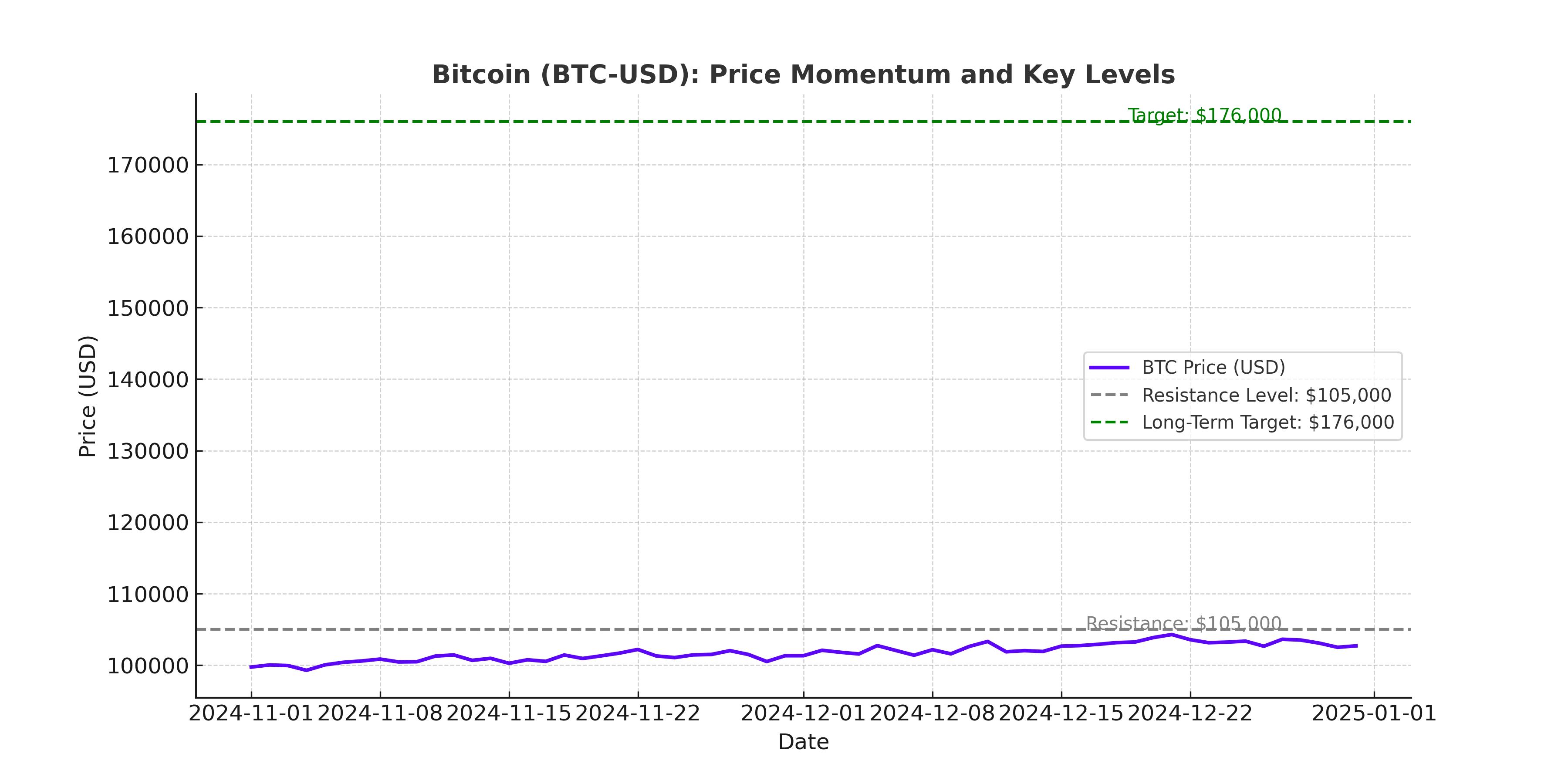

Bitcoin’s price action has been shaped by crucial technical levels. After breaking out of a rising wedge pattern earlier in December, BTC faced resistance near $100,000 but managed to stabilize above $95,000. Technical indicators like the Relative Strength Index (RSI) show a gradual recovery, pointing to a potential bullish breakout if BTC reclaims $100,000 as support.

Analysts project a short-term price target of $107,000, with Fibonacci retracement levels at $98,000 and $94,000 serving as critical support zones. A sustained push above $99,426, the neckline of a double-bottom reversal pattern, could pave the way for Bitcoin to test $110,000. However, failure to maintain momentum may result in a retest of lower levels, including $90,500.

Long-Term Outlook and Price Predictions

Market experts remain divided on Bitcoin’s trajectory. Prominent figures like Tim Draper and Tom Lee have revised their forecasts, with expectations ranging from $120,000 to $150,000 in 2025. Cathie Wood of ARK Invest remains a long-term bull, projecting Bitcoin to reach $500,000 by 2026 and $1 million by 2030. Michael Saylor, known for his aggressive Bitcoin advocacy, sees the cryptocurrency as a treasury reserve asset capable of hitting $13 million by 2045.

While these predictions highlight Bitcoin’s immense potential, the path forward is fraught with challenges. Regulatory clarity, liquidity dynamics, and global economic trends will play pivotal roles in shaping BTC’s future.

Market Sentiment and ETF Trends

Bitcoin ETFs, once hailed as a game-changer, have experienced mixed fortunes. Spot Bitcoin ETFs in the U.S. recorded net outflows of $338.38 million on December 24, with leading players like BlackRock and Fidelity witnessing significant withdrawals. Despite this, the broader market sentiment remains optimistic, supported by Bitcoin’s resilience and growing adoption.

Conclusion: Is $150,000 Within Reach?

Bitcoin’s journey in 2024 underscores its evolving role as a financial asset. From institutional adoption to macroeconomic influences, BTC has demonstrated remarkable adaptability. While the $150,000 milestone may not materialize immediately, Bitcoin’s current price near $100,000 lays the foundation for future growth. As the market navigates short-term volatility, long-term prospects remain bullish, with Bitcoin poised to redefine its all-time highs in the years to come.