Can Broadcom NASDAQ:AVGO Stock Deliver a 37% Upside?

Broadcom (NASDAQ:AVGO) targets $75B in AI revenue by FY2027. At $218, is the stock poised for a 37% climb? | That's TradingNEWS

Broadcom’s AI Growth and Long-Term Outlook: A Comprehensive Analysis of NASDAQ:AVGO

Broadcom’s Strategic Growth in AI Custom ASIC Market

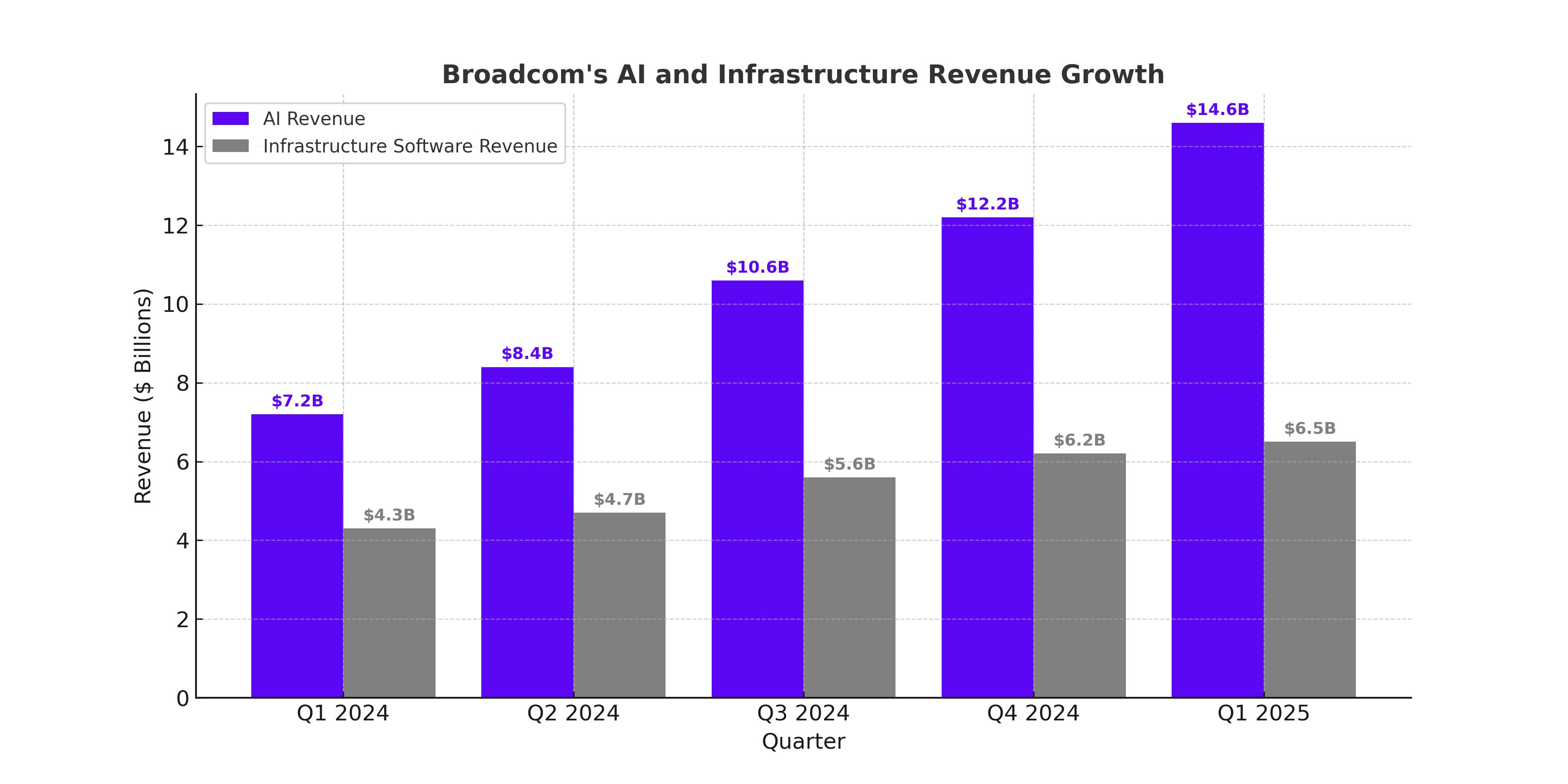

Broadcom Inc. (NASDAQ:AVGO) has positioned itself as a key player in the burgeoning AI infrastructure market, leveraging its expertise in custom application-specific integrated circuits (ASICs) to secure a competitive edge. Broadcom’s AI-related revenues, which include AI accelerators (XPUs) and networking products, surged to $12.2 billion in fiscal 2024, reflecting an extraordinary 220% year-over-year growth. This accounted for 41% of its semiconductor revenue, a clear indication of the company’s strategic pivot toward high-growth AI opportunities.

Broadcom’s management projects its AI serviceable addressable market (SAM) to expand from $15–$20 billion in 2024 to an impressive $60–$90 billion by 2027, fueled by deployments from three core hyperscale customers, rumored to include Alphabet (GOOG, GOOGL), Meta Platforms (META), and potentially Apple (AAPL). CEO Hock Tan has highlighted that each hyperscaler plans to deploy 1 million XPU clusters by 2027, underlining the massive potential revenue streams Broadcom can capture.

Revenue Breakdown and Financial Strength

Broadcom reported $51.6 billion in fiscal 2024 revenue, a 44% year-over-year increase, with the semiconductor segment contributing $30.1 billion. AI networking revenue alone soared by 158% year-over-year in Q4 FY2024, reaching $3.42 billion, supported by robust demand for AI accelerators and networking ICs.

The company’s adjusted EBITDA margin reached 61.8% in FY2024, underscoring its ability to maintain profitability amid rapid growth. For Q1 FY2025, management forecasts revenue of $14.6 billion, a 22% year-over-year increase, with semiconductor revenue expected to grow by 10% year-over-year to $8.1 billion.

Navigating the VMware Acquisition and Debt Management

The completion of Broadcom’s acquisition of VMware has reshaped its revenue mix, increasing its infrastructure software revenue to $6.5 billion in Q1 FY2025, up by 41% year-over-year. While the acquisition bolstered Broadcom’s long-term growth prospects, it also increased the company’s debt to $69.8 billion. However, Broadcom has made strides in debt reduction, cutting $2.5 billion in Q4 FY2024 and refinancing $5 billion of floating-rate debt with fixed-rate senior notes, stabilizing its interest expenses.

Broadcom’s financial discipline is evident in its free cash flow (FCF), which reached $19.41 billion in FY2024 despite integration costs. Management has committed to shareholder returns, announcing a 14th consecutive annual dividend increase to $2.36 per share for FY2025, representing a 12% year-over-year increase.

Valuation and Competitive Position

Broadcom currently trades at a forward P/E of 36x, higher than its historical averages but still competitive compared to peers like NVIDIA (NVDA) at 45.46x. Despite concerns about overvaluation, Broadcom’s forward PEG ratio of 1.69x aligns well with its 22.2% projected EPS growth through FY2027. Analysts have revised their expectations upward, forecasting FY2027 revenue of $79.94 billion, with a CAGR of 16% from FY2024 to FY2027.

Broadcom’s valuation is further supported by its unique position in the AI custom ASIC market, where it competes effectively with NVIDIA and Advanced Micro Devices (AMD). Its focused approach on hyperscale customers and tailored solutions differentiates it from competitors, giving it a stable foothold in a rapidly evolving industry.

Risks and Challenges

While Broadcom’s AI growth story is compelling, risks remain. The potential loss of Apple’s business, which accounts for 20% of Broadcom’s revenue, could weigh heavily on future performance. Apple’s transition to in-house Bluetooth and Wi-Fi chips poses a significant risk starting with the iPhone SE and possibly extending to the iPhone 17.

Additionally, Broadcom’s reliance on a small group of hyperscale customers heightens concentration risk. Any delay or reduction in AI deployments from these customers could lead to revenue shortfalls. Furthermore, geopolitical tensions and potential U.S. export restrictions to China—Broadcom’s third-largest market—represent ongoing uncertainties.

Technical Analysis and Entry Points

Broadcom’s stock has experienced substantial gains, rising to $218 per share after its Q4 FY2024 earnings report. However, technical indicators suggest potential resistance near $250 and support around $180–$190, creating opportunities for opportunistic investors. The recent Relative Strength Index (RSI) of 63 indicates that the stock is nearing overbought territory, making a pullback likely.

Strategic Outlook and Recommendation

Broadcom’s leadership in AI custom ASICs, robust financial performance, and strategic partnerships position it as a strong player in the AI revolution. With management targeting $75 billion in AI revenue by FY2027, the stock’s long-term potential is undeniable. For investors with a high-risk tolerance, NASDAQ:AVGO remains a Buy at current levels, with a projected fair value of $267 and a bull-case target of $300. However, those seeking improved margins of safety should watch for a pullback to the $190 range as an ideal entry point.