Oil Market Dynamics: Analyzing WTI and Brent Performance Amid Key Global Trends

Short-Term Recovery and Geopolitical Tensions Drive WTI (CL=F) and Brent (BZ=F) Prices

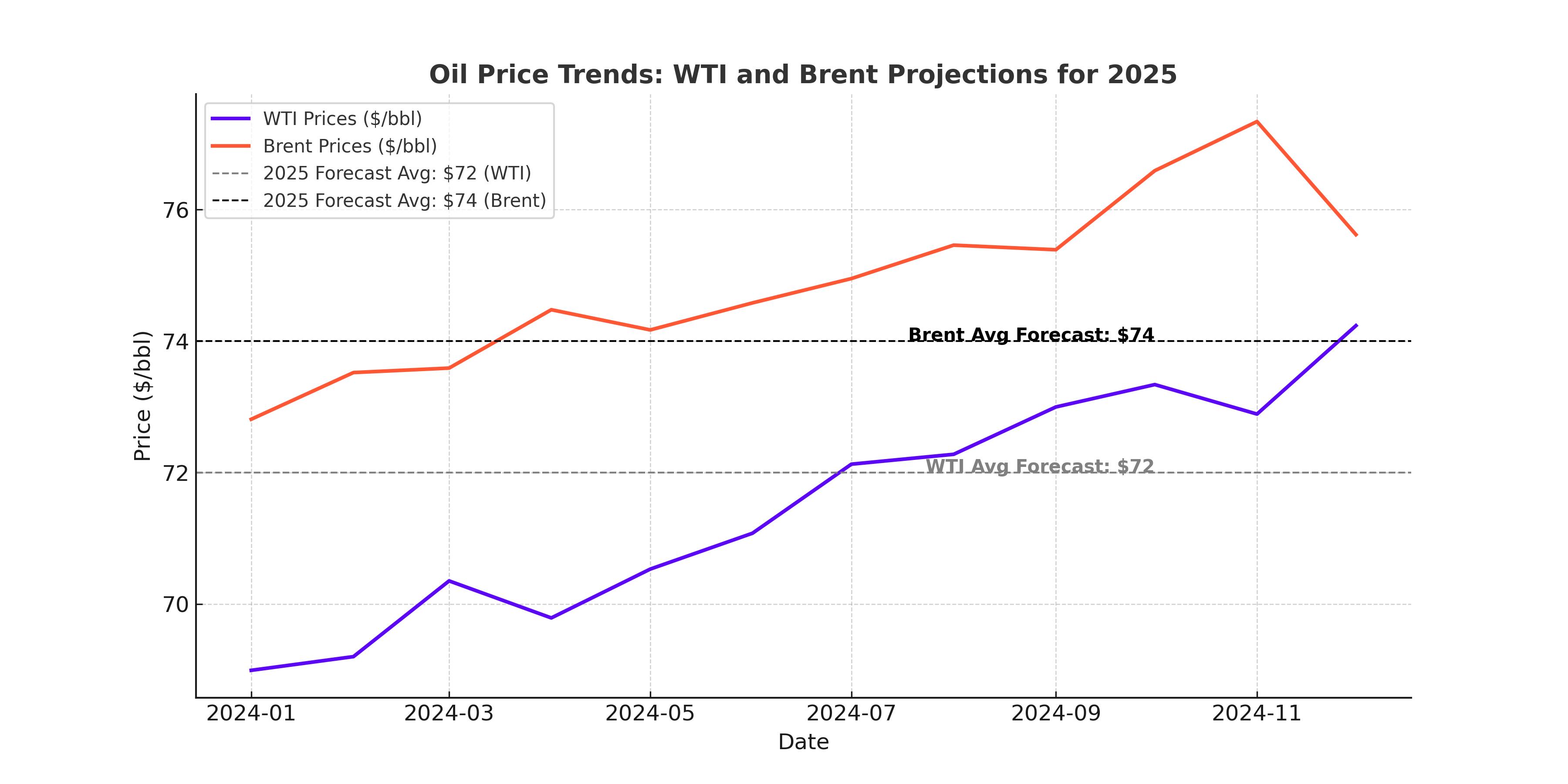

Oil prices have regained momentum in the final quarter of 2024, with WTI crude oil (CL=F) rising 0.90% to $70.14 per barrel and Brent crude oil (BZ=F) trading at $73.61, a 1.3% increase. This resurgence follows a turbulent year marked by production cuts, geopolitical tensions, and fluctuating demand across key markets. While WTI hovers above the critical pivot point of $69.51, Brent's support lies firmly at $73.33, signaling potential bullish trends if momentum holds.

OPEC+ Actions and Production Adjustments

OPEC+ continues to influence oil markets with delayed production increases. The group’s cautious approach aims to maintain price stability, countering competitive pressures from non-member producers. These strategic delays come as the global oil supply landscape remains uncertain, compounded by sanctions on Russian and Iranian exports. Analysts predict OPEC+ adjustments could provide support for WTI around $67 and Brent near $72.68 in the event of bearish swings.

China's Economic Stimulus and Demand Outlook

China’s announcement of 3 trillion yuan ($411 billion) in special Treasury bonds signals a renewed commitment to bolstering its economy, the world's largest oil importer. This fiscal stimulus is expected to support WTI crude at $67 and Brent prices at $73. However, subdued Chinese demand earlier in the year dampened overall consumption growth, leaving analysts cautious about sustained upward price trajectories. Notably, the Energy Information Administration (EIA) recently shifted its 2025 forecast for liquids balances toward a draw, suggesting a tightening supply outlook next year.

U.S. Oil Production and Market Trends

The U.S., the world's largest oil producer, achieved record-high output of 13.2 million barrels per day in 2024. Despite this, WTI prices fell to a yearly low of $65.48 in September before recovering. Strong demand for machinery and a rebound in new home sales have supported economic stability, with consumer confidence remaining a pivotal factor. This backdrop places WTI in a consolidation phase, with resistance at $71.46 and support around $68.42.

Key Technical Levels and Moving Averages

For WTI, the 50-day Exponential Moving Average (EMA) at $69.56 and the 200-day EMA at $69.44 indicate a robust consolidation range. Similarly, Brent’s 50-day EMA at $73.01 aligns with its current trading price of $73.61, reinforcing short-term stability. Analysts identify resistance for Brent at $74.55, with a break beyond this level likely propelling prices toward $75.27.

Market Sentiment and Speculative Positions

Futures market activity reflects heightened speculative interest as traders navigate holiday-thinned volumes. The "short paper market" positioning poses a risk of upward price spikes should supply disruptions arise. The FGE predicts near-term price stability, though sudden geopolitical shifts could unsettle the balance.

Geopolitical Risks and Energy Security

Uncertainty surrounding the Middle East and Eastern Europe remains a key driver of oil price volatility. With Israel dismantling Hamas leadership and potential negotiations between Ukraine and Russia on the horizon, these developments could stabilize global energy markets in 2025. However, further sanctions or conflicts could sharply impact supply chains.

2025 Outlook: Bullish or Bearish?

While analysts remain divided, the consensus leans toward moderate price gains in 2025, contingent on geopolitical stability and economic recovery in major markets. Brent is expected to average around $72, with WTI slightly trailing at $68. Risks include weakened demand due to global economic slowdowns and oversupply scenarios if OPEC+ fails to maintain discipline.

The interplay of fiscal policies, production adjustments, and geopolitical events will likely dictate oil price trajectories in the coming months. Investors should monitor critical support and resistance levels while staying attuned to macroeconomic developments shaping supply and demand dynamics.